Zweig Group recently released the 2017 Recruitment & Retention Survey of Architecture, Engineering, Planning and Environmental Consulting Firms. The survey found that the average firm is spending a significant amount on new hires, even at average turnover rates, yet may not be budgeting appropriately.

Only 30 percent of firms who responded to the survey have an HR/Recruiting budget. Sixty-five percent of industry firms have in-house hiring/recruitment staff, with 25 percent reporting their hiring needs are beyond the scope of this staff.

Zweig Group’s director of executive search, Randy Wilburn, says firms can determine how much to budget for recruiting based on their needs, staff turnover rates, and growth projections.

“For instance, if a company currently has 200 people and an average turnover rate of 8-10 percent (industry average), it can expect to lose 16-20 people each year. If that firm wants to grow by 15 percent annually, it will need to hire 30 people, plus make up for the 16-20 that will likely be lost through attrition. This equates to a total of 46-50 people the firm needs to hire over a 12-month period,” he says.

Hiring in this industry takes on average between 30 and 60 days, and firms spend on average $4,454 on each new hire.

Using the numbers above, that 200-person firm is probably spending around $200,000 per year on new hires alone (not including salaries or bonuses)!

Firms are not spending significantly on the search phase of hiring, with word of mouth/referrals reported as the greatest source of new hires for the industry and internet advertising following closely behind (24 percent).

For more information on this survey visit: zweiggroup.com/surveys.

Related Stories

Designers | Oct 12, 2016

Perkins Eastman and EwingCole co-publish new white paper examining the benefits and challenges of design research

The survey’s findings, combined with input from the EDRA conference, informed the content produced for “Where Are We Now?”

Market Data | Oct 11, 2016

Building design revenue topped $28 billion in 2015

Growing profitability at architecture firms has led to reinvestment and expansion

Market Data | Oct 4, 2016

Nonresidential spending slips in August

Public sector spending is declining faster than the private sector.

Industry Research | Oct 3, 2016

Structure Tone survey shows cost is still a major barrier to building green

Climate change, resilience and wellness are also growing concerns.

Industry Research | Sep 28, 2016

Worldwide hotel construction shows modest year-over-year growth

Overall construction for hotel projects is up, but the current number of hotels currently being built has dipped slightly from one year ago.

Industry Research | Sep 27, 2016

Sterling Risk Sentiment Index indicates risk exposure perception remains stable in construction industry

Nearly half (45%) of those polled say election year uncertainty has a negative effect on risk perception in the construction market.

Industry Research | Sep 21, 2016

The global penetration of smart meters is expected to reach approximately 53% by the end of 2025

Large-scale smart meter deployments are underway across Western Europe, while new deployments continue among later adopters in the United States.

Industry Research | Sep 12, 2016

Evidence linking classroom design to improved learning mounts

A study finds the impact can be as much as 25% per year.

Healthcare Facilities | Sep 6, 2016

Chicago Faucets releases white paper: Reducing the risk of HAIs in healthcare facilities

The white paper discusses in detail four options used to mitigate transmission of waterborne bacteria

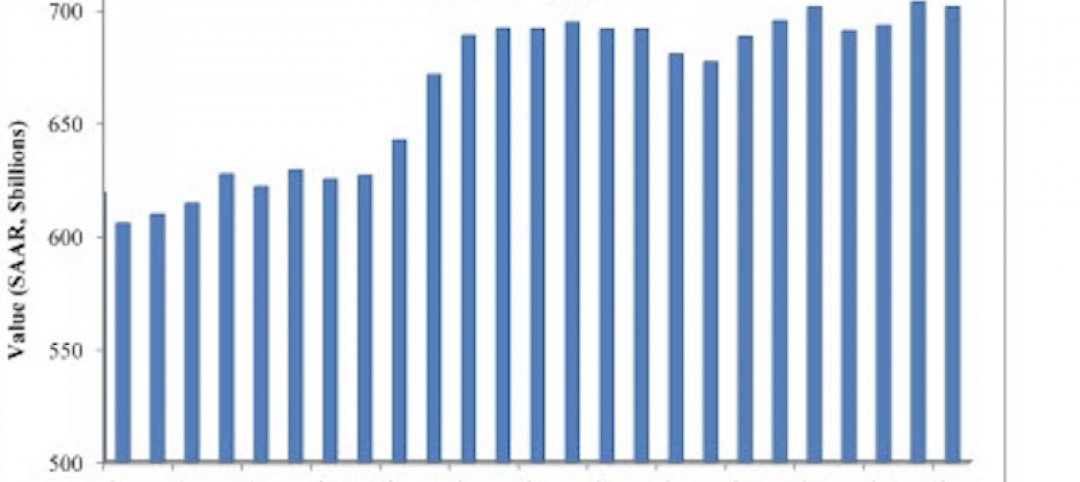

Market Data | Sep 2, 2016

Nonresidential spending inches lower in July while June data is upwardly revised to eight-year record

Nonresidential construction spending has been suppressed over the last year or so with the primary factor being the lack of momentum in public spending.