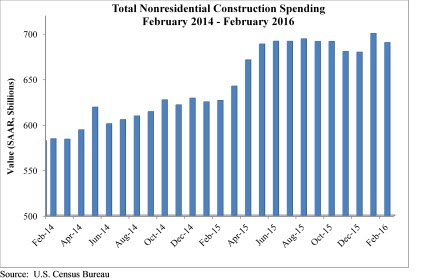

Nonresidential construction spending dipped in February, falling 1.4% on a monthly basis according to analysis of U.S. Census Bureau data released by Associated Builders and Contractors (ABC).

Spending in the nonresidential sector totaled $690.3 billion on a seasonally adjusted, annualized basis in February. While this represents a step back from January's figure of $700.3 billion (revised down from $701.9 billion), it is still 1.5% higher than the level of spending registered in December 2015 and 10.1% higher than February 2015.

"February's weather was particularly harsh in certain parts of the country, including in the economic activity-rich Mid-Atlantic region, and that appears to have had an undue effect on construction spending data," ABC Chief Economist Anirban Basu said. "February data are always difficult to interpret, and the latest nonresidential construction spending figures are no different. Seasonal factors have also made state-level data very difficult to interpret.

"Beyond meteorological considerations, there are other reasons not to be alarmed by February's decline in nonresidential construction spending," Basu said. "Today's positive construction employment report indicates continued economic growth. Moreover, much of the decline in volume was attributable to manufacturing, but the ISM manufacturing index recently crossed the threshold 50 level, indicating that domestic manufacturing is now expanding for the first time in seven months."

Eight of the 16 nonresidential subsectors experienced spending decreases in February, though almost half of the total decline in spending is attributable to the 5.9% decline in manufacturing-related spending.

The following 16 nonresidential construction sectors experienced spending increases in February on a monthly basis:

- Spending in the amusement and recreation category climbed 0.4% from January and is up 13.7% from February 2015.

- Lodging-related spending is up 0.4% for the month and is up 30.1% on a year-ago basis.

- Water supply-related spending expanded 1.9% on a monthly basis and 3.2% on a yearly basis.

- Spending in the office category grew 3.8% from January and is up 25.3% on a year-ago basis.

- Transportation-related spending expanded 0.5% month-over-month and 5.8% year-over-year.

- Health care-related spending expanded 2% from January and is up 3.3% from February 2015.

- Public safety-related spending is up 1.8% for the month, but is down 5.3% for the year.

- Commercial-related construction spending inched 0.1% higher for the month and grew 11% for the year.

Spending in eight of the nonresidential construction subsectors fell in February on a monthly basis:

- Educational-related construction spending fell 2.4% from January, but has expanded 8.5% on a yearly basis.

- Communication-related spending fell 15% month-over-month, but expanded 11.8% year-over-year.

- Spending in the highway and street category fell 2% from January, but is 24.5 higher than one year ago.

- Sewage and waste disposal-related spending fell 2.4% for the month, but is up 2.3% for the year.

- Conservation and development-related spending is 4.6% lower on a monthly basis and 16.8% lower on a year-over-year basis.

- Spending in the religious category fell 4% for the month and is up just 0.7% for the year.

- Manufacturing-related spending fell 5.9% on a monthly basis and is up only 0.8% on a yearly basis.

- Spending in the power category fell 0.6% from January, but is 4.8% higher than one year ago.

Related Stories

Market Data | Aug 16, 2016

Leading economists predict construction industry growth through 2017

The Chief Economists for ABC, AIA, and NAHB all see the construction industry continuing to expand over the next year and a half.

Multifamily Housing | Aug 12, 2016

Apartment completions in largest metros on pace to increase by 50% in 2016

Texas is leading this multifamily construction boom, according to latest RENTCafé estimates.

Market Data | Jul 29, 2016

ABC: Output expands, but nonresidential fixed investment falters

Nonresidential fixed investment fell for a third consecutive quarter, as indicated by Bureau of Economic Analysis data.

Industry Research | Jul 26, 2016

AIA consensus forecast sees construction spending on rise through next year

But several factors could make the industry downshift.

Architects | Jul 20, 2016

AIA: Architecture Billings Index remains on solid footing

The June ABI score was down from May, but the figure was positive for the fifth consecutive month.

Market Data | Jul 7, 2016

Airbnb alleged to worsen housing crunch in New York City

Allegedly removing thousands of housing units from market, driving up rents.

Market Data | Jul 6, 2016

Construction spending falls 0.8% from April to May

The private and public sectors have a combined estimated seasonally adjusted annual rate of $1.14 trillion.

Market Data | Jul 6, 2016

A thriving economy and influx of businesses spur construction in downtown Seattle

Development investment is twice what it was five years ago.

Multifamily Housing | Jul 5, 2016

Apartments continue to shrink, rents continue to rise

Latest survey by RENTCafé tracks size changes in 95 metros.

Multifamily Housing | Jun 22, 2016

Can multifamily construction keep up with projected demand?

The Joint Center for Housing Studies’ latest disection of America’s housing market finds moderate- and low-priced rentals in short supply.