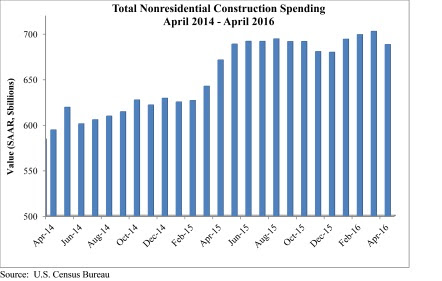

Nonresidential construction spending fell 2.1% in April according to analysis of U.S. Census Bureau data released by Associated Builders and Contractors (ABC). Nonresidential spending totaled $688.2 billion on a seasonally adjusted, annualized rate.

Much like last month, the sting of a disappointing headline number was mitigated by upward revisions to the previous two months of data. March's estimate was revised from $695.7 billion to $702.6 billion, while February's estimate saw a 0.1% increase. March represents the first month in which spending exceeded $700 billion since March 2009.

"Nonresidential construction spending growth continues to struggle to maintain momentum," said ABC Chief Economist Anirban Basu. "The amount of nonresidential construction value put in place has expanded by just 2.5% over the past year, with private spending up 3.4% and public spending up just 1.4%. While many will primarily attribute this to a sluggish U.S. economy, one that has expanded by less than 1.5% during each of the last two completed calendar quarters, there are other factors at work.

"Lower materials prices are embodied in the value of completed work," said Basu. "Though commodity prices have been firming recently, commodity prices had been in decline for more than a year. Moreover, in some communities, nonresidential construction is facing severe constraints given an insufficient number of qualified workers. Both factors would tend to constrain the level of observed growth in nonresidential construction spending.

"There may also be growing skittishness among private developers, who have become increasingly concerned by possible overbuilding in commercial, office and lodging markets," warned Basu. "Both lodging and commercial construction spending dipped in April. This hesitancy is reflected in many ways, including in the Architectural Billings Index, which has struggled to consistently stand meaningfully above its threshold value of 50. Public spending also remains lackluster as many states deal with underfunded pensions and ballooning Medicaid costs."

Only five of 16 nonresidential construction sectors experienced spending increases in April on a monthly basis:

- Religious-related spending expanded 9.6% from March 2016 and 7.3% from April 2015.

- Spending in the public safety category grew 5.2% on a monthly basis but fell 6.2% on a yearly basis.

- Office-related spending expanded 1.6% for the month and 20.3% for the year.

- Amusement and recreation-related spending expanded 0.8% month-over-month and 8.3% year-over-year.

- Spending in the power category rose by 0.3% for the month and 0.6% from April 2015.

Spending in 11 of the nonresidential construction subsectors fell in April on a monthly basis:

- Spending in the communication category fell 7.7% from March 2016 and is down 16.4% from April 2015.

- Highway and street-related spending fell 6.5% on a monthly basis but is up 4% on a yearly basis.

- Commercial-related spending dipped 3.7% for the month but is up 6.8% from April 2015.

- Spending in the health care category fell 3% from March 2016 and is down 0.6% from the same month one year ago.

- Educational-related spending dropped 2.4% month-over-month but is up 5.4% year-over-year.

- Spending in the lodging category fell 2% on a monthly basis but is up 24.6% on a yearly basis.

- Transportation-related spending fell 1.7% since March 2016 and is down 1% from April 2015.

- Sewage and waste disposal-related spending fell 1.4% for the month but is up 1% from April 2015.

- Manufacturing-related spending fell 1.4% month-over-month and 9.8% year-over-year.

- Spending in the conservation and development category dipped 1.2% for the month and 6.5% year-over-year.

- Water supply-related spending fell 0.5% on a monthly basis and 6.5% on a yearly basis.

Related Stories

| Aug 24, 2022

Architecture Billings Index slows but remains healthy

For the eighteenth consecutive month architecture firms reported increasing demand for design services in July, according to a new report today from The American Institute of Architects (AIA).

| Aug 23, 2022

New Mass. climate and energy law allows local bans on fossil fuel-powered appliances

A sweeping Massachusetts climate and energy bill recently signed into law by Republican governor Charlie Baker allows local bans on fossil fuel-powered appliances.

Giants 400 | Aug 22, 2022

Top 70 Science + Technology Facility Contractors + CM Firms 2022

Whiting-Turner, Hensel Phelps, DPR Construction, and Skanska USA top the rankings of the nation's largest science and technology (S+T) facility contractors and construction management (CM) firms, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Aug 22, 2022

Top 45 Laboratory Facility Contractors and Construction Management Firms for 2022

Whiting-Turner, Hensel Phelps, McCarthy, and STO Building Group top the ranking of the nation's largest science and technology (S+T) laboratory facility contractors and construction management (CM) firms, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Aug 22, 2022

Top 90 University Contractors and Construction Management Firms for 2022

Turner Construction, Whiting-Turner Contracting, PCL Construction Enterprises, and DPR Construction lead the ranking of the nation's largest university sector contractors and construction management (CM) firms, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Aug 22, 2022

Top 90 Construction Management Firms for 2022

CBRE, Alfa Tech, Jacobs, and Hill International head the rankings of the nation's largest construction management (as agent) and program/project management firms for nonresidential and multifamily buildings work, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Aug 22, 2022

Top 200 Contractors for 2022

Turner Construction, STO Building Group, Whiting-Turner, and DPR Construction top the ranking of the nation's largest general contractors, CM at risk firms, and design-builders for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2022 Giants 400 Report.

| Aug 22, 2022

Gainesville, Fla., lawmakers moved to end single-family zoning

The Gainesville City Commission recently voted to advance zoning changes that would allow duplexes, triplexes, and quadplexes to be built on land currently zoned for single-family homes.

| Aug 22, 2022

For Gen Z, “enhanced communication” won’t cut it

As the fastest-growing generation, Generation Z, loosely defined as those born between the mid-1990s and early 2000s, has become a hot topic in conversations surrounding workplace design.

| Aug 22, 2022

Less bad is no longer good enough

As we enter the next phase of our fight against climate change, I am cautiously optimistic about our sustainable future and the design industry’s ability to affect what the American Institute of Architects (AIA) calls the biggest challenge of our generation.