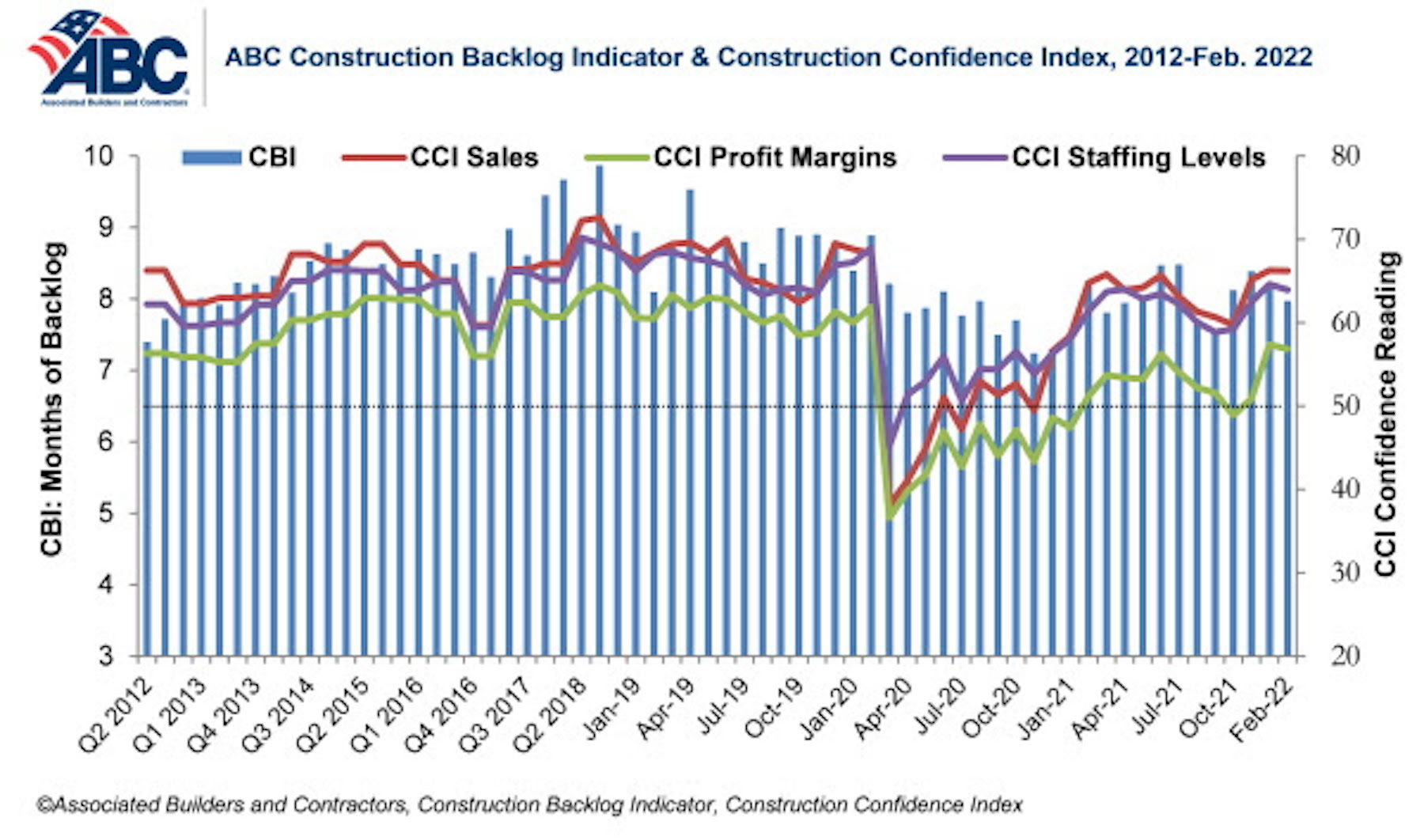

Associated Builders and Contractors reported that its Construction Backlog Indicator remained unchanged at 8.0 months in February, according to an ABC member survey conducted Feb. 21 to March 8. The reading is down 0.2 months from February 2021.

View ABC’s Construction Backlog Indicator and Construction Confidence Index tables for February 2022.

Survey respondents in all four regions cited labor and material availability and costs as the factors chipping away at their backlog, while a few respondents in the Midwest cited winter weather as a frustrating factor.

ABC’s Construction Confidence Index readings for sales and staffing increased in February, while the reading for profit margins inched lower. All three indices remain above the threshold of 50, indicating expectations of growth over the next six months.

“The level of demand for construction services is simply staggering,” said ABC Chief Economist Anirban Basu. “Despite sky-high materials prices, surging compensation costs and attendant impacts on bids, many project owners continue to move forward with projects because they recognize construction costs could rise even further. There is also significant investment capital flowing through the economy in search of yield. Real estate projects often satisfy the need to deploy considerable capital quickly, but only if construction is permitted to move forward.

“Accordingly, despite elevated costs and workforce challenges, construction backlog remains stable,” said Basu. “Backlog would likely be rising rapidly if costs were more stable. Nonetheless, construction confidence indicators continue to improve. Collectively, contractors expect sales and employment to expand over the next six months. But what is far more remarkable is the expectation that profit margins will expand, indicating that demand for construction services remains elevated enough to countervail cost increases as we head into the heart of 2022.”

Related Stories

Industry Research | Nov 17, 2023

Air conditioning amenity sees largest growth in Pacific Northwest region

The 2024 Renter Preferences Survey Report sheds light on the demographics, lifestyle, connectivity needs, and more for the renters of today. At the top of this list—the feature that respondents are “interested in” or “won't rent without”—is air conditioning.

Multifamily Housing | Nov 9, 2023

Multifamily project completions forecast to slow starting 2026

Yardi Matrix has released its Q4 2023 Multifamily Supply Forecast, emphasizing a short-term spike and plateau of new construction.

MFPRO+ Special Reports | Oct 27, 2023

Download the 2023 Multifamily Annual Report

Welcome to Building Design+Construction and Multifamily Pro+’s first Multifamily Annual Report. This 76-page special report is our first-ever “state of the state” update on the $110 billion multifamily housing construction sector.

Market Data | Oct 23, 2023

New data finds that the majority of renters are cost-burdened

The most recent data derived from the 2022 Census American Community Survey reveals that the proportion of American renters facing housing cost burdens has reached its highest point since 2012, undoing the progress made in the ten years leading up to the pandemic.

Giants 400 | Oct 23, 2023

Top 115 Multifamily Construction Firms for 2023

Clark Group, Suffolk Construction, Summit Contracting Group, Whiting-Turner Contracting, and McShane Companies top the ranking of the nation's largest multifamily housing sector contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking factors revenue for all multifamily buildings work, including apartments, condominiums, student housing facilities, and senior living facilities.

Giants 400 | Oct 23, 2023

Top 75 Multifamily Engineering Firms for 2023

Kimley-Horn, WSP, Tetra Tech, Olsson, and Langan head the ranking of the nation's largest multifamily housing sector engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking factors revenue for all multifamily buildings work, including apartments, condominiums, student housing facilities, and senior living facilities.

Giants 400 | Oct 23, 2023

Top 190 Multifamily Architecture Firms for 2023

Humphreys and Partners, Gensler, Solomon Cordwell Buenz, Niles Bolton Associates, and AO top the ranking of the nation's largest multifamily housing sector architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking factors revenue for all multifamily buildings work, including apartments, condominiums, student housing facilities, and senior living facilities.

Senior Living Design | Oct 19, 2023

Senior living construction poised for steady recovery

Senior housing demand, as measured by the change in occupied units, continued to outpace new supply in the third quarter, according to NIC MAP Vision. It was the ninth consecutive quarter of growth with a net absorption gain. On the supply side, construction starts continued to be limited compared with pre-pandemic levels.

Warehouses | Oct 19, 2023

JLL report outlines 'tremendous potential' for multi-story warehouses

A new category of buildings, multi-story warehouses, is beginning to take hold in the U.S. and their potential is strong. A handful of such facilities, also called “urban logistics buildings” have been built over the past five years, notes a new report by JLL.

Contractors | Oct 19, 2023

Crane Index indicates slowing private-sector construction

Private-sector construction in major North American cities is slowing, according to the latest RLB Crane Index. The number of tower cranes in use declined 10% since the first quarter of 2023. The index, compiled by consulting firm Rider Levett Bucknall (RLB), found that only two of 14 cities—Boston and Toronto—saw increased crane counts.