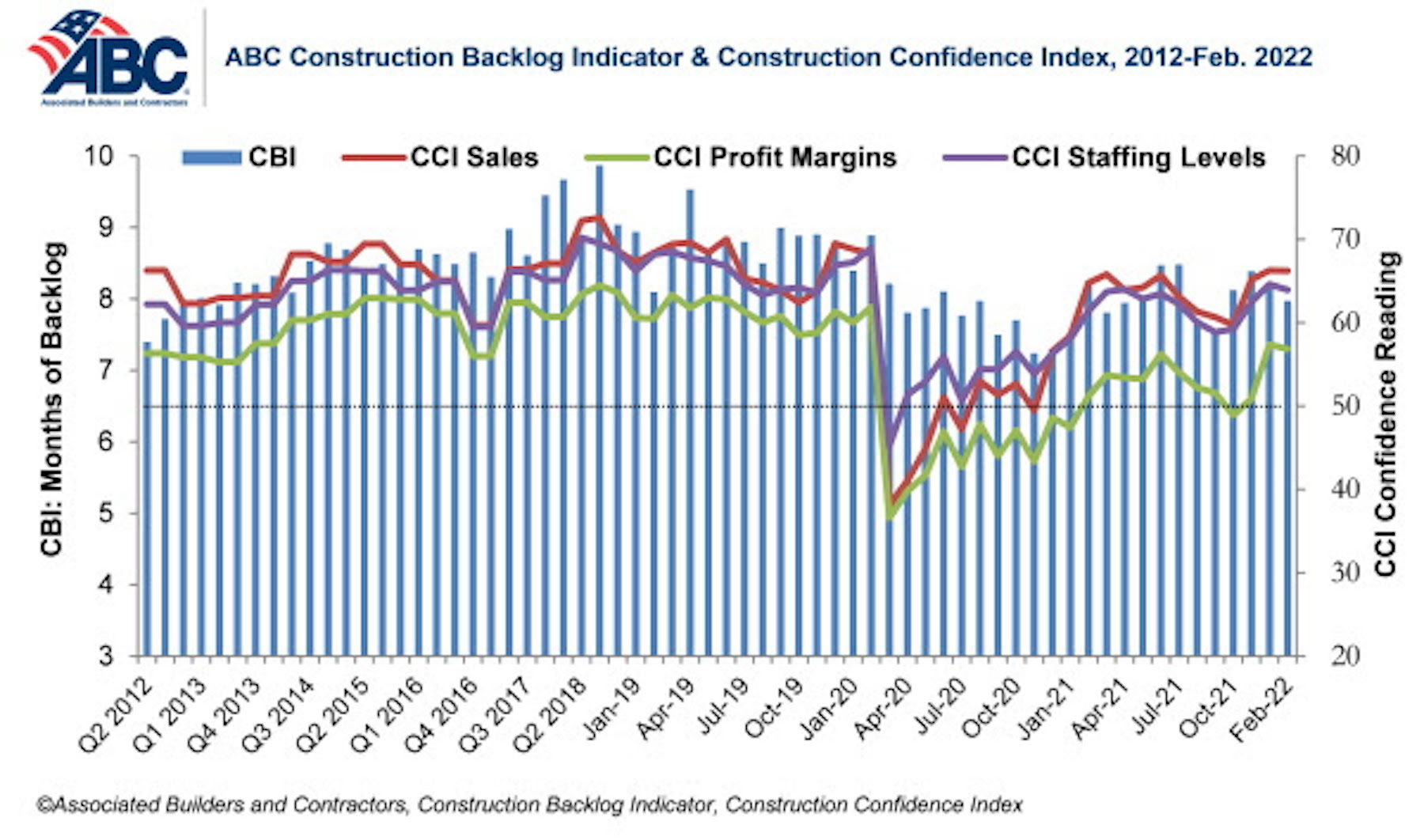

Associated Builders and Contractors reported that its Construction Backlog Indicator remained unchanged at 8.0 months in February, according to an ABC member survey conducted Feb. 21 to March 8. The reading is down 0.2 months from February 2021.

View ABC’s Construction Backlog Indicator and Construction Confidence Index tables for February 2022.

Survey respondents in all four regions cited labor and material availability and costs as the factors chipping away at their backlog, while a few respondents in the Midwest cited winter weather as a frustrating factor.

ABC’s Construction Confidence Index readings for sales and staffing increased in February, while the reading for profit margins inched lower. All three indices remain above the threshold of 50, indicating expectations of growth over the next six months.

“The level of demand for construction services is simply staggering,” said ABC Chief Economist Anirban Basu. “Despite sky-high materials prices, surging compensation costs and attendant impacts on bids, many project owners continue to move forward with projects because they recognize construction costs could rise even further. There is also significant investment capital flowing through the economy in search of yield. Real estate projects often satisfy the need to deploy considerable capital quickly, but only if construction is permitted to move forward.

“Accordingly, despite elevated costs and workforce challenges, construction backlog remains stable,” said Basu. “Backlog would likely be rising rapidly if costs were more stable. Nonetheless, construction confidence indicators continue to improve. Collectively, contractors expect sales and employment to expand over the next six months. But what is far more remarkable is the expectation that profit margins will expand, indicating that demand for construction services remains elevated enough to countervail cost increases as we head into the heart of 2022.”

Related Stories

Market Data | Mar 26, 2021

Construction employment in February trails pre-pandemic level in 44 states

Soaring costs, supply-chain problems jeopardize future jobs.

Market Data | Mar 24, 2021

Architecture billings climb into positive territory after a year of monthly declines

AIA’s ABI score for February was 53.3 compared to 44.9 in January.

Market Data | Mar 22, 2021

Construction employment slips in 225 metros from January 2020 to January 2021

Rampant cancellations augur further declines ahead.

Market Data | Mar 18, 2021

Commercial Construction Contractors’ Outlook lifts on rising revenue expectations

Concerns about finding skilled workers, material costs, and steel tariffs linger.

Market Data | Mar 16, 2021

Construction employment in January lags pre-pandemic mark in 42 states

Canceled projects, supply-chain woes threaten future jobs.

Market Data | Mar 15, 2021

Rising materials prices and supply chain disruptions are hurting many construction firms

The same firms are already struggling to cope with pandemic impacts.

Market Data | Mar 11, 2021

Soaring materials costs, supply-chain problems, and project cancellations continue to impact construction industry

Costs and delayed deliveries of materials, parts, and supplies are vexing many contractors.

Market Data | Mar 8, 2021

Construction employment declines by 61,000 in February

Association officials urge congress and Biden administration to focus on new infrastructure funding.

Market Data | Mar 2, 2021

Construction spending rises in January as private nonresidential sector stages rare gain

Private nonresidential market shrinks 10% since January 2020 with declines in all 11 segments.

Market Data | Feb 24, 2021

2021 won’t be a growth year for construction spending, says latest JLL forecast

Predicts second-half improvement toward normalization next year.