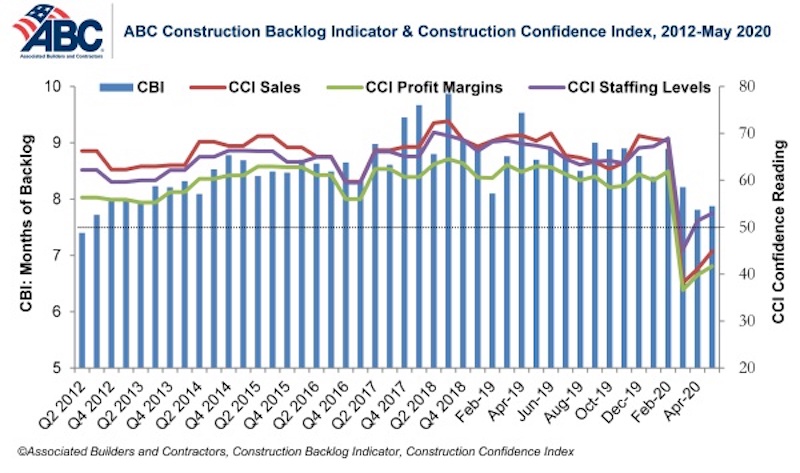

Construction Backlog Indicator rose to 7.9 months in May, an increase of less than 0.1 months from April’s reading. Furthermore, based on an ABC member survey conducted May 20-June 3, results indicate that confidence among U.S. construction industry leaders continued to rebound from the historically low levels observed in the March survey.

Nonresidential construction backlog is down 0.8 months compared to May 2019 and declined year over year in every industry, classification and region. Backlog in the heavy industrial category, however, increased by nearly one month in May after reaching its lowest level in the history of the series in April.

ABC’s Construction Confidence Index readings for sales, profit margins and staffing levels expectations all increased in May, although sales and profit margin expectations remain below the threshold of 50, indicating ongoing anticipation of contraction. The staffing level index remained above that threshold, with more than 38% of contractors expecting to expand their staff during the next six months.

More than 45% of contractors expect their sales to decline during the next six months while 35% expect sales to increase. More than 48% of contractors expect their profit margins to decrease over the next two quarters.

- The CCI for sales expectations increased from 41.1 to 44.9 in May.

- The CCI for profit margin expectations increased from 39.8 to 41.7.

- The CCI for staffing levels increased from 51.4 to 53.

“Given the depth of the economic downturn and myriad other issues facing America today, backlog and contractor confidence data have held up better than one might have anticipated,” said ABC Chief Economist Anirban Basu. “But the marketplace is still tilted toward pessimism. For instance, more contractors expect sales and profit margins to decline than increase over the next six months, which is consistent with anecdotal information suggesting that many project owners are considering postponing projects and possibly rebidding them.

“After falling meaningfully in April, backlog remained relatively unchanged in May, hinting at a stable nonresidential construction marketplace,” said Basu. “However, the underlying survey received fewer responses compared to earlier months in the COVID-19 crisis, perhaps suggesting that some contractors are no longer operating at previous capacity, inducing available work to move toward better-positioned contractors. To the extent that these stronger contractors are reflected in the survey, this would tend to bolster average backlog even in the context of a subdued marketplace.

“Contractors still expect to boost staffing levels over the next six months,” said Basu. “But this may simply be a function of jobsites reopening as construction shutdowns end. Almost 70% of respondents had jobsites shut down due to government mandates and other reasons, and with labor shortages in place before the pandemic, contractors may have residual staffing needs. It remains to be seen whether expected employment growth going forward coincides with speedy recovery in overall contractor confidence and backlog.”

Note: The reference months for the Construction Backlog Indicator and Construction Confidence Index data series were revised on May 12 to better reflect the survey period. CBI quantifies the previous month’s work under contract based on the latest financials available, while CCI measures contractors’ outlook for the next six months.

Related Stories

Contractors | Oct 19, 2023

Crane Index indicates slowing private-sector construction

Private-sector construction in major North American cities is slowing, according to the latest RLB Crane Index. The number of tower cranes in use declined 10% since the first quarter of 2023. The index, compiled by consulting firm Rider Levett Bucknall (RLB), found that only two of 14 cities—Boston and Toronto—saw increased crane counts.

Market Data | Oct 2, 2023

Nonresidential construction spending rises 0.4% in August 2023, led by manufacturing and public works sectors

National nonresidential construction spending increased 0.4% in August, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.09 trillion.

Giants 400 | Sep 28, 2023

Top 100 University Building Construction Firms for 2023

Turner Construction, Whiting-Turner Contracting Co., STO Building Group, Suffolk Construction, and Skanska USA top BD+C's ranking of the nation's largest university sector contractors and construction management firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking includes revenue for all university/college-related buildings except student residence halls, sports/recreation facilities, laboratories, S+T-related buildings, parking facilities, and performing arts centers (revenue for those buildings are reported in their respective Giants 400 ranking).

Construction Costs | Sep 28, 2023

U.S. construction market moves toward building material price stabilization

The newly released Quarterly Construction Cost Insights Report for Q3 2023 from Gordian reveals material costs remain high compared to prior years, but there is a move towards price stabilization for building and construction materials after years of significant fluctuations. In this report, top industry experts from Gordian, as well as from Gilbane, McCarthy Building Companies, and DPR Construction weigh in on the overall trends seen for construction material costs, and offer innovative solutions to navigate this terrain.

Data Centers | Sep 21, 2023

North American data center construction rises 25% to record high in first half of 2023, driven by growth of artificial intelligence

CBRE’s latest North American Data Center Trends Report found there is 2,287.6 megawatts (MW) of data center supply currently under construction in primary markets, reaching a new all-time high with more than 70% already preleased.

Contractors | Sep 12, 2023

The average U.S. contractor has 9.2 months worth of construction work in the pipeline, as of August 2023

Associated Builders and Contractors' Construction Backlog Indicator declined to 9.2 months in August, down 0.1 month, according to an ABC member survey conducted from Aug. 21 to Sept. 6. The reading is 0.5 months above the August 2022 level.

Contractors | Sep 11, 2023

Construction industry skills shortage is contributing to project delays

Relatively few candidates looking for work in the construction industry have the necessary skills to do the job well, according to a survey of construction industry managers by the Associated General Contractors of America (AGC) and Autodesk.

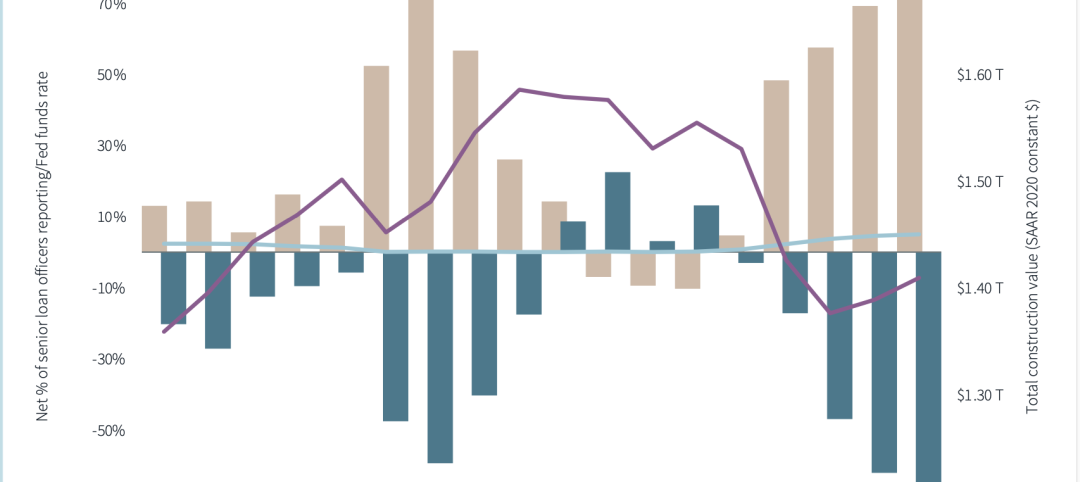

Market Data | Sep 6, 2023

Far slower construction activity forecast in JLL’s Midyear update

The good news is that market data indicate total construction costs are leveling off.

Giants 400 | Sep 5, 2023

Top 80 Construction Management Firms for 2023

Alfa Tech, CBRE Group, Skyline Construction, Hill International, and JLL top the rankings of the nation's largest construction management (as agent) and program/project management firms for nonresidential buildings and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Sep 5, 2023

Top 150 Contractors for 2023

Turner Construction, STO Building Group, DPR Construction, Whiting-Turner Contracting Co., and Clark Group head the ranking of the nation's largest general contractors, CM at risk firms, and design-builders for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2023 Giants 400 Report.