1. Mobile ordering is a centerpiece of Burger King’s new design (BD+C)

"The first new designed restaurants will be built in Miami (Restaurant Brands’ headquarters city), Latin America, and the Caribbean islands. Restaurant Brands did not disclose when the new designs would be extended to other cities in the U.S. Burger King has 18,756 locations in more than 100 countries, nearly all of which are independently owned franchises."

2. Property values face collapse as more hotels hit the market (American City Business Journals via National Real Estate Investor)

"More San Antonio hotel owners may be compelled to sell at reduced rates as loan payments become tougher to cover."

3. How lenders are helping AEC firms cross COVID hurdles (Commercial Property Executive)

"Financially stable architecture, engineering and construction firms have been able to roll with work stoppages and workforce issues, says Phillip Ross of Anchin."

4. SURVEY: 63% of the Empire State's restaurants could be gone 'In A New York Minute' by 2021 (Bisnow)

"Nearly two-thirds of New York’s restaurants are on track to close by the end of 2020 and over half of those restaurants are likely to do so within the next two months. Just under 64% of some 1,042 restaurants across the state said they would close by New Year’s Day without monetary assistance and 54.8% said they would be forced to close by Nov. 1, according to a survey conducted by the New York State Restaurant Association and released Thursday."

5. New digital weapons in the apartment amenities arms race (Propmodo)

"The amenities arms race. That is what the real estate industry loves to call the escalating level of services offered by apartment buildings. For decades in the country’s hottest luxury rental markets property owners have been investing outside of their units, providing all kinds of high-end facilities and high-touch services. In these competitive markets, gyms become closer to fitness clubs than weight rooms, doormen are more like concierge than security, and common areas more closely resemble private lounges than they do motel lobbies."

6. Rent collection high In most asset types, Marcus & Millichap finds (Commercial Property Executive)

"While in some sectors more than 95 percent of tenants are meeting their rent obligations, some retail assets continue to struggle."

Related Stories

Market Data | Mar 14, 2024

Download BD+C's March 2024 Market Intelligence Report

U.S. construction spending on buildings-related work rose 1.4% in January, but project teams continue to face headwinds related to inflation, interest rates, and supply chain issues, according to Building Design+Construction's March 2024 Market Intelligence Report (free PDF download).

Contractors | Mar 12, 2024

The average U.S. contractor has 8.1 months worth of construction work in the pipeline, as of February 2024

Associated Builders and Contractors reported that its Construction Backlog Indicator declined to 8.1 months in February, according to an ABC member survey conducted Feb. 20 to March 5. The reading is down 1.1 months from February 2023.

Market Data | Mar 6, 2024

Nonresidential construction spending slips 0.4% in January

National nonresidential construction spending decreased 0.4% in January, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.190 trillion.

Multifamily Housing | Mar 4, 2024

Single-family rentals continue to grow in BTR communities

Single-family rentals are continuing to grow in built-to-rent communities. Both rent and occupancy growth have been strong in recent months while remaining a financially viable option for renters.

MFPRO+ News | Mar 2, 2024

Job gains boost Yardi Matrix National Rent Forecast for 2024

Multifamily asking rents broke the five-month streak of sequential average declines in January, rising 0.07 percent, shows a new special report from Yardi Matrix.

K-12 Schools | Feb 29, 2024

Average age of U.S. school buildings is just under 50 years

The average age of a main instructional school building in the United States is 49 years, according to a survey by the National Center for Education Statistics (NCES). About 38% of schools were built before 1970. Roughly half of the schools surveyed have undergone a major building renovation or addition.

MFPRO+ Research | Feb 27, 2024

Most competitive rental markets of early 2024

The U.S. rental market in early 2024 is moderately competitive, with apartments taking an average of 41 days to find tenants, according to the latest RentCafe Market Competitivity Report.

Construction Costs | Feb 22, 2024

K-12 school construction costs for 2024

Data from Gordian breaks down the average cost per square foot for four different types of K-12 school buildings (elementary schools, junior high schools, high schools, and vocational schools) across 10 U.S. cities.

Student Housing | Feb 21, 2024

Student housing preleasing continues to grow at record pace

Student housing preleasing continues to be robust even as rent growth has decelerated, according to the latest Yardi Matrix National Student Housing Report.

Architects | Feb 21, 2024

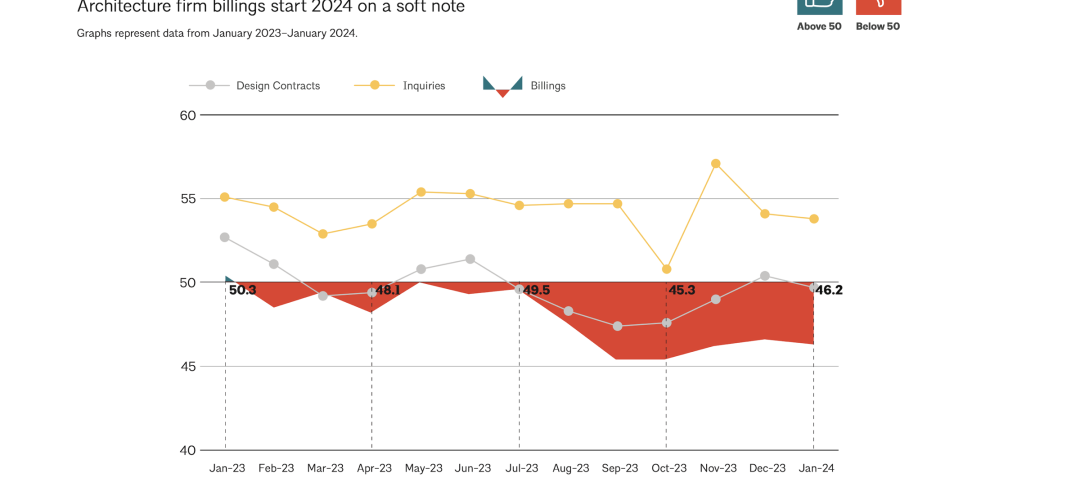

Architecture Billings Index remains in 'declining billings' state in January 2024

Architecture firm billings remained soft entering into 2024, with an AIA/Deltek Architecture Billings Index (ABI) score of 46.2 in January. Any score below 50.0 indicates decreasing business conditions.