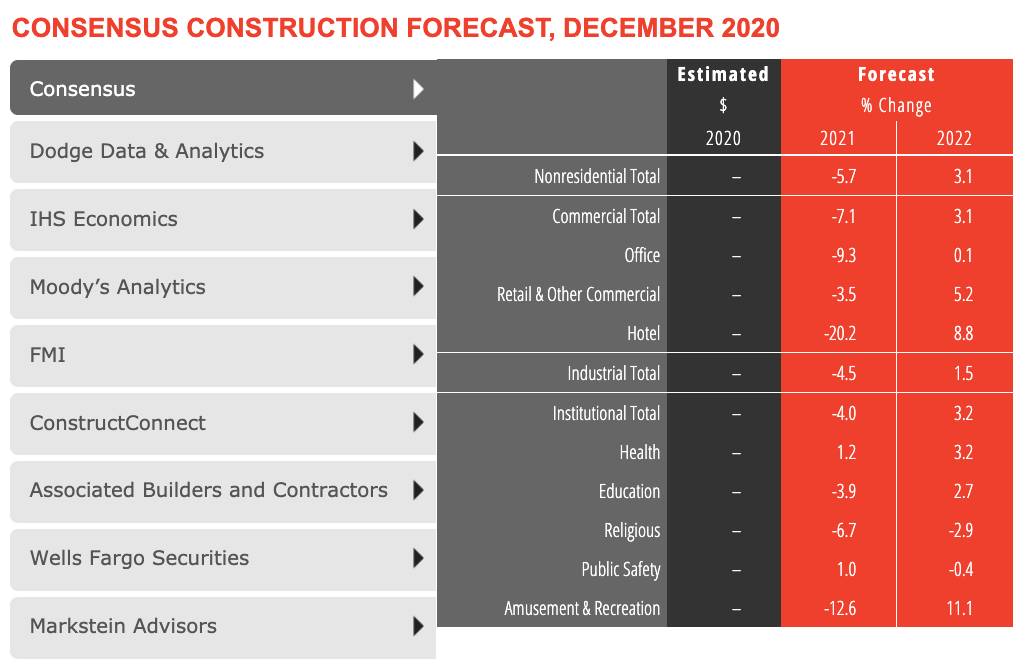

Slowing demand at architecture firms last year is expected to contribute to a projected 5.7% decline in construction spending for 2021, according to a new consensus forecast from The American Institute of Architects (AIA).

The AIA Consensus Construction Forecast Panel—comprised of leading economic forecasters—expects steep declines this year in construction spending on office buildings, hotels, and amusement and recreation centers. Health care and public safety are the only major sectors that are slated to produce gains in 2021.

Growth in nonresidential construction is expected for 2022, with 3% gains projected for the overall building market matched by both the commercial and institutional sectors.

“The December jobs report confirmed that the economy needs additional support in order to move to a sustainable economic expansion,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “As pandemic concerns begin to wane and economic activity begins to pick up later in 2021, there is likely to be considerable pent-up demand for nonresidential space, leading to anticipated growth in construction spending in 2022.”

CLICK CHART TO LAUNCH INTERACTIVE CHART FROM AIA

Here are some takeaways from AIA's Chief Economist Kermit Baker, Hon. AIA:

• Hotel, airlines, and recreation industry jobs have been decimated by the pandemic. "The December jobs report confirmed that the economy needs additional support in order to move to a sustainable economic expansion. Of particular concern were the 500,000 payroll positions lost in the leisure and hospitality sector. That means that this sector has lost almost 25% of payroll positions since February 2020, matching losses in the airline industry."

• The $900 billion stimulus package passed in December 2020 is not nearly enough to sustain economic growth. "Key elements of this package include another $600 in direct payments to qualifying individuals, $300 per week in supplemental unemployment insurance for up to 11 weeks, and $280 billion designated for the Paycheck Protection Program, which provided incentives for small businesses to keep employees on their payrolls. These initiatives were generally very effective in providing a safety net for impacted households and small businesses last spring. However, they weren’t designed to provide sufficient support for an extended period of economic weakness, and the December jobs report suggests that we may already be heading into another down cycle. Even this additional funding is unlikely to provide sufficient financial support for economic growth through the entire vaccination period, suggesting that even more stimulus will be needed in the coming months or else our economy likely will be in for an extended period of stagnant growth or modest declines."

• Biden win bodes well for infrastructure investment. "With the two Georgia senate seats now in the democratic column, there are a new set of policy options for the Biden administration. Still, given the razor thin margins in both the House and the Senate, programs likely to be enacted will need to have at least modest levels of bipartisan support. An infrastructure program is likely near the top of the list of programs that both parties could support, and the Biden Administration seems ready to make this a priority, in part because it would be viewed as a stimulus program, but also because borrowing costs are near historical lows."

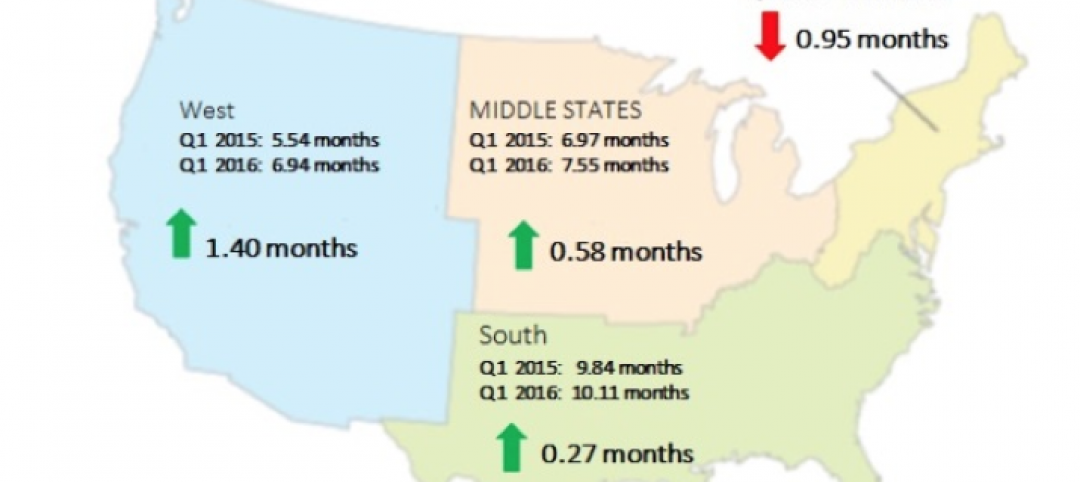

• Architecture firms are seeing more positive signs for the long-term. "Project inquiries from prospective and former clients have been strong recently, suggesting that new work may be picking up. More concretely, new design work coming into architecture firms has generally been more positive than billings in recent months, suggesting that firms are bringing in more project activity than they are completing. However, firms are seeing different business conditions regionally. Firms in the northeast saw the steepest downturns as the pandemic hit, and conditions remained the weakest for the remainder of the year. Business conditions at firms in the other three regions – all modestly declining – are fairly comparable."

Related Stories

Multifamily Housing | Aug 12, 2016

Apartment completions in largest metros on pace to increase by 50% in 2016

Texas is leading this multifamily construction boom, according to latest RENTCafé estimates.

Market Data | Jul 29, 2016

ABC: Output expands, but nonresidential fixed investment falters

Nonresidential fixed investment fell for a third consecutive quarter, as indicated by Bureau of Economic Analysis data.

Industry Research | Jul 26, 2016

AIA consensus forecast sees construction spending on rise through next year

But several factors could make the industry downshift.

Architects | Jul 20, 2016

AIA: Architecture Billings Index remains on solid footing

The June ABI score was down from May, but the figure was positive for the fifth consecutive month.

Market Data | Jul 7, 2016

Airbnb alleged to worsen housing crunch in New York City

Allegedly removing thousands of housing units from market, driving up rents.

Market Data | Jul 6, 2016

Construction spending falls 0.8% from April to May

The private and public sectors have a combined estimated seasonally adjusted annual rate of $1.14 trillion.

Market Data | Jul 6, 2016

A thriving economy and influx of businesses spur construction in downtown Seattle

Development investment is twice what it was five years ago.

Multifamily Housing | Jul 5, 2016

Apartments continue to shrink, rents continue to rise

Latest survey by RENTCafé tracks size changes in 95 metros.

Multifamily Housing | Jun 22, 2016

Can multifamily construction keep up with projected demand?

The Joint Center for Housing Studies’ latest disection of America’s housing market finds moderate- and low-priced rentals in short supply.

Contractors | Jun 21, 2016

Bigness counts when it comes to construction backlogs

Large companies that can attract talent are better able to commit to more work, according to a national trade group for builders and contractors.