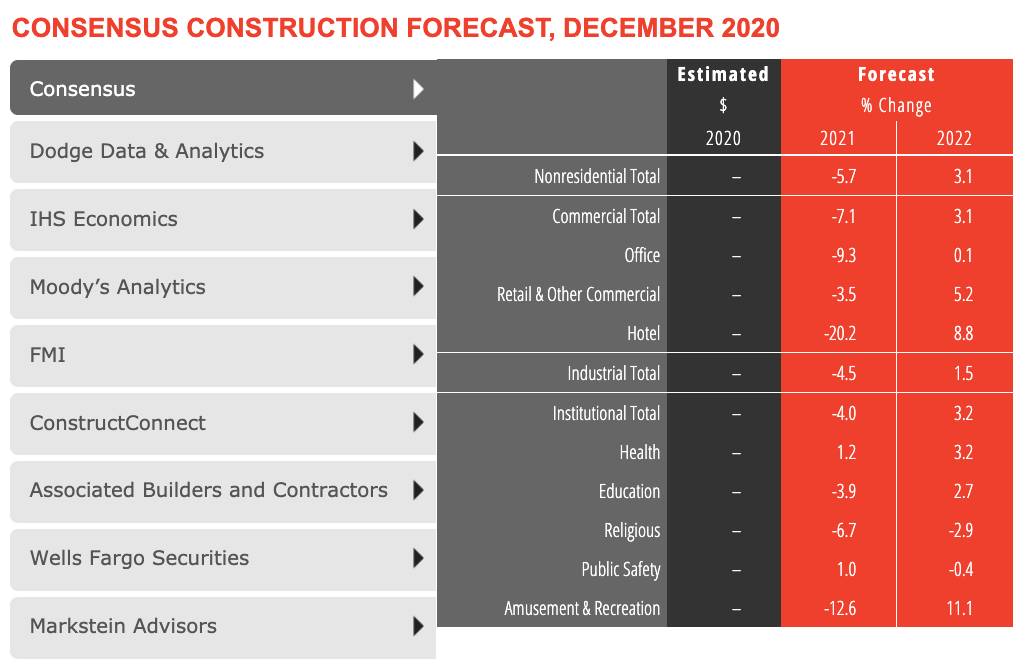

Slowing demand at architecture firms last year is expected to contribute to a projected 5.7% decline in construction spending for 2021, according to a new consensus forecast from The American Institute of Architects (AIA).

The AIA Consensus Construction Forecast Panel—comprised of leading economic forecasters—expects steep declines this year in construction spending on office buildings, hotels, and amusement and recreation centers. Health care and public safety are the only major sectors that are slated to produce gains in 2021.

Growth in nonresidential construction is expected for 2022, with 3% gains projected for the overall building market matched by both the commercial and institutional sectors.

“The December jobs report confirmed that the economy needs additional support in order to move to a sustainable economic expansion,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “As pandemic concerns begin to wane and economic activity begins to pick up later in 2021, there is likely to be considerable pent-up demand for nonresidential space, leading to anticipated growth in construction spending in 2022.”

CLICK CHART TO LAUNCH INTERACTIVE CHART FROM AIA

Here are some takeaways from AIA's Chief Economist Kermit Baker, Hon. AIA:

• Hotel, airlines, and recreation industry jobs have been decimated by the pandemic. "The December jobs report confirmed that the economy needs additional support in order to move to a sustainable economic expansion. Of particular concern were the 500,000 payroll positions lost in the leisure and hospitality sector. That means that this sector has lost almost 25% of payroll positions since February 2020, matching losses in the airline industry."

• The $900 billion stimulus package passed in December 2020 is not nearly enough to sustain economic growth. "Key elements of this package include another $600 in direct payments to qualifying individuals, $300 per week in supplemental unemployment insurance for up to 11 weeks, and $280 billion designated for the Paycheck Protection Program, which provided incentives for small businesses to keep employees on their payrolls. These initiatives were generally very effective in providing a safety net for impacted households and small businesses last spring. However, they weren’t designed to provide sufficient support for an extended period of economic weakness, and the December jobs report suggests that we may already be heading into another down cycle. Even this additional funding is unlikely to provide sufficient financial support for economic growth through the entire vaccination period, suggesting that even more stimulus will be needed in the coming months or else our economy likely will be in for an extended period of stagnant growth or modest declines."

• Biden win bodes well for infrastructure investment. "With the two Georgia senate seats now in the democratic column, there are a new set of policy options for the Biden administration. Still, given the razor thin margins in both the House and the Senate, programs likely to be enacted will need to have at least modest levels of bipartisan support. An infrastructure program is likely near the top of the list of programs that both parties could support, and the Biden Administration seems ready to make this a priority, in part because it would be viewed as a stimulus program, but also because borrowing costs are near historical lows."

• Architecture firms are seeing more positive signs for the long-term. "Project inquiries from prospective and former clients have been strong recently, suggesting that new work may be picking up. More concretely, new design work coming into architecture firms has generally been more positive than billings in recent months, suggesting that firms are bringing in more project activity than they are completing. However, firms are seeing different business conditions regionally. Firms in the northeast saw the steepest downturns as the pandemic hit, and conditions remained the weakest for the remainder of the year. Business conditions at firms in the other three regions – all modestly declining – are fairly comparable."

Related Stories

Self-Storage Facilities | Jan 25, 2024

One-quarter of self-storage renters are Millennials

Interest in self-storage has increased in over 75% of the top metros according to the latest StorageCafe survey of self-storage preferences. Today, Millennials make up 25% of all self-storage renters.

Industry Research | Jan 23, 2024

Leading economists forecast 4% growth in construction spending for nonresidential buildings in 2024

Spending on nonresidential buildings will see a modest 4% increase in 2024, after increasing by more than 20% last year according to The American Institute of Architects’ latest Consensus Construction Forecast. The pace will slow to just over 1% growth in 2025, a marked difference from the strong performance in 2023.

Construction Costs | Jan 22, 2024

Construction material prices continue to normalize despite ongoing challenges

Gordian’s most recent Quarterly Construction Cost Insights Report for Q4 2023 describes an industry still attempting to recover from the impact of COVID. This was complicated by inflation, weather, and geopolitical factors that resulted in widespread pricing adjustments throughout the construction materials industries.

Hotel Facilities | Jan 22, 2024

U.S. hotel construction is booming, with a record-high 5,964 projects in the pipeline

The hotel construction pipeline hit record project counts at Q4, with the addition of 260 projects and 21,287 rooms over last quarter, according to Lodging Econometrics.

Multifamily Housing | Jan 15, 2024

Multifamily rent growth rate unchanged at 0.3%

The National Multifamily Report by Yardi Matrix highlights the highs and lows of the multifamily market in 2023. Despite strong demand, rent growth remained unchanged at 0.3 percent.

Self-Storage Facilities | Jan 5, 2024

The state of self-storage in early 2024

As the housing market cools down, storage facilities suffer from lower occupancy and falling rates, according to the December 2023 Yardi Matrix National Self Storage Report.

Designers | Dec 25, 2023

Redefining the workplace is a central theme in Gensler’s latest Design Report

The firm identifies eight mega trends that mostly stress human connections.

Contractors | Dec 12, 2023

The average U.S. contractor has 8.5 months worth of construction work in the pipeline, as of November 2023

Associated Builders and Contractors reported today that its Construction Backlog Indicator inched up to 8.5 months in November from 8.4 months in October, according to an ABC member survey conducted Nov. 20 to Dec. 4. The reading is down 0.7 months from November 2022.

Market Data | Nov 27, 2023

Number of employees returning to the office varies significantly by city

While the return-to-the-office trend is felt across the country, the percentage of employees moving back to their offices varies significantly according to geography, according to Eptura’s Q3 Workplace Index.

Market Data | Nov 14, 2023

The average U.S. contractor has 8.4 months worth of construction work in the pipeline, as of September 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator declined to 8.4 months in October from 9.0 months in September, according to an ABC member survey conducted from Oct. 19 to Nov. 2. The reading is down 0.4 months from October 2022. Backlog now stands at its lowest level since the first quarter of 2022.