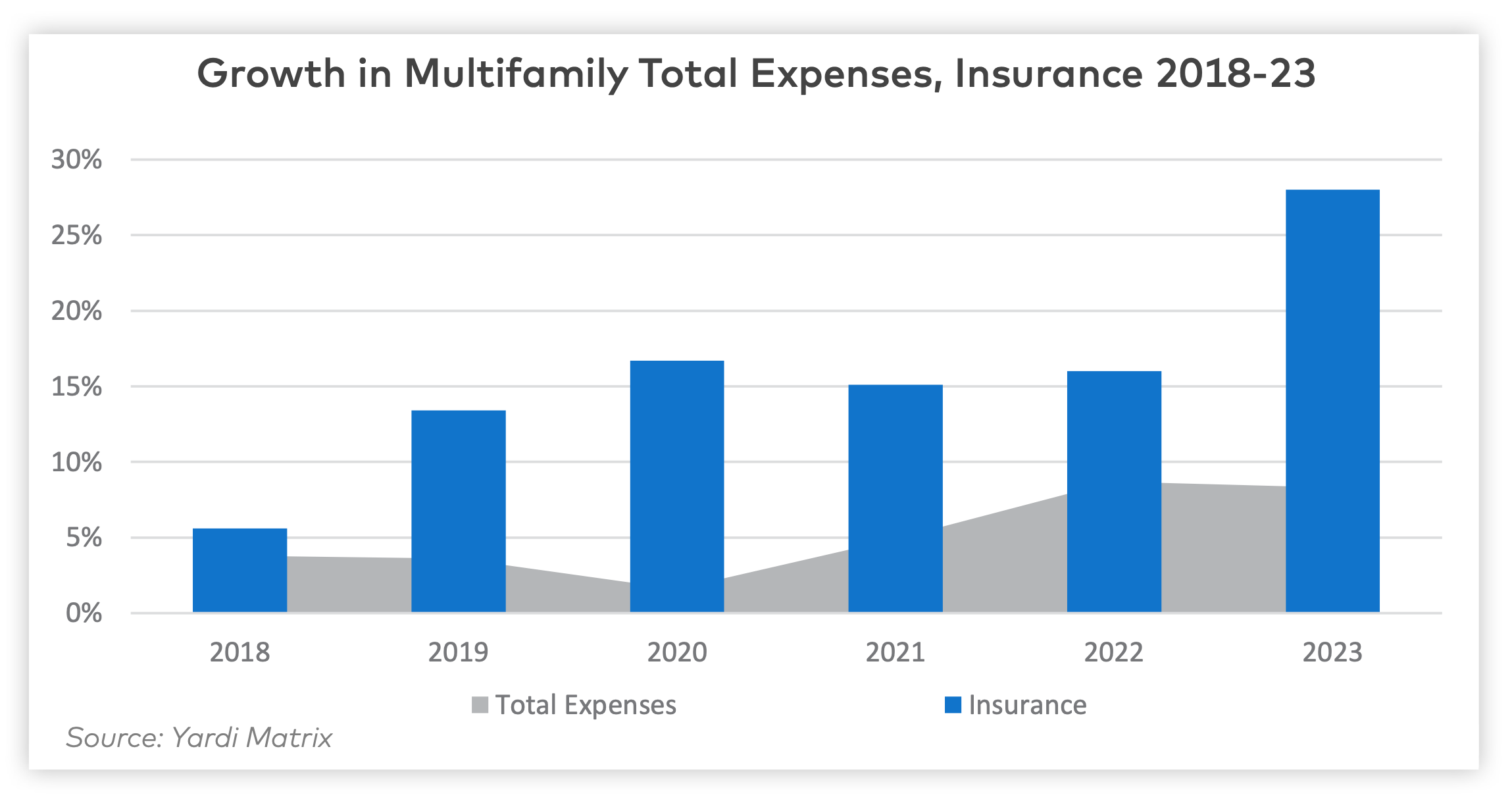

Overall expenses per multifamily unit rose to $8,950, a 7.1% increase year-over-year (YOY) as of January 2024, according to an examination of more than 20,000 properties analyzed by Yardi Matrix.

According to the March 2024 Matrix Research Bulletin for Multifamily Expenses, expense growth for multifamily properties was led by property insurance (up 27.7% YOY), marketing (12.3%), administrative costs (9.6%), and repairs and maintenance (8.8%).

Driven by inflationary pressures, total expenses at multifamily properties have “increased rapidly” in the past two years, peaking at 8.7% in 2022, the report states. This is compared to the average annual expense growth of 4.9% in 2021, 1.6% in 2020, 3.6% in 2019, and 3.8% in 2018.

Multifamily Expenses Rising, Led by Insurance

Insurance costs per unit continue to rise, and have increased 129% nationally since 2018. The current property insurance costs per unit are now at an average of $636.

While property insurance makes up just 7% of total expenses for properties, it's becoming a growing concern especially in the Southeast and other regions prone to severe weather events. In these high-risk areas prone to hurricanes, floods, and fires, obtaining insurance is becoming increasingly difficult.

The study showed that multifamily properties were still profitable in 2023, despite rising expenses. This is because income growth outpaced expenses. On average, gross income per unit increased by $1,056 nationally, while expenses only grew by $593, resulting in a $463 increase in net operating income (NOI).

Yardi Matrix forecasts that asking rents will increase by 1.8% during 2024, and we can expect renewal rent growth will continue to decelerate.

Related Stories

Adaptive Reuse | May 9, 2024

Hotels now account for over one-third of adaptive reuse projects

For the first time ever, hotel to apartment conversion projects have overtaken office-to-residential conversions.

MFPRO+ Special Reports | May 6, 2024

Top 10 trends in affordable housing

Among affordable housing developers today, there’s one commonality tying projects together: uncertainty. AEC firms share their latest insights and philosophies on the future of affordable housing in BD+C's 2023 Multifamily Annual Report.

Multifamily Housing | Apr 9, 2024

March reports record gains in multifamily rent growth in 20 months

Asking rents for multifamily units increased $8 during the month to $1,721; year-over-year growth grew 30 basis points to 0.9 percent—a normal seasonal growth pattern according to Yardi Matrix.

Student Housing | Mar 27, 2024

March student housing preleasing in line with last year

Preleasing is still increasing at a historically fast pace, surpassing 61% in February 2024 and marking a 4.5% increase year-over-year.

Adaptive Reuse | Mar 26, 2024

Adaptive Reuse Scorecard released to help developers assess project viability

Lamar Johnson Collaborative announced the debut of the firm’s Adaptive Reuse Scorecard, a proprietary methodology to quickly analyze the viability of converting buildings to other uses.

MFPRO+ News | Mar 16, 2024

Multifamily rents stable heading into spring 2024

National asking multifamily rents posted their first increase in over seven months in February. The average U.S. asking rent rose $1 to $1,713 in February 2024, up 0.6% year-over-year.

MFPRO+ News | Mar 12, 2024

Multifamily housing starts and permitting activity drop 10% year-over-year

The past year saw over 1.4 million new homes added to the national housing inventory. Despite the 4% growth in units, both the number of new homes under construction and the number of permits dropped year-over-year.

MFPRO+ Special Reports | Mar 6, 2024

Top 10 trends in senior living facilities for 2024

The 65-and-over population is growing faster than any other age group. Architects, engineers, and contractors are coming up with creative senior housing solutions to better serve this burgeoning cohort.

Multifamily Housing | Mar 4, 2024

Single-family rentals continue to grow in BTR communities

Single-family rentals are continuing to grow in built-to-rent communities. Both rent and occupancy growth have been strong in recent months while remaining a financially viable option for renters.

MFPRO+ News | Mar 1, 2024

Housing affordability, speed of construction are top of mind for multifamily architecture and construction firms

The 2023 Multifamily Giants get creative to solve the affordability crisis, while helping their developer clients build faster and more economically.