Gordian’s most recent Quarterly Construction Cost Insights Report for Q4 2023 describes an industry still attempting to recover from the impact of COVID. This was complicated by inflation, weather, and geopolitical factors that resulted in widespread pricing adjustments throughout the construction materials industries.

Gordian’s RSMeans Data team analyzed overall pricing trends in construction sector supply chains, reviewing both the quarter-over-quarter historical cost index, as well as the city and state market variations reflected in the cost data.

In addition to the Gordian experts, industry contributors for the Q4 report included PCL Construction, Skanska USA Building, and Webcor, who offered their informed perspectives on specific materials:

- Structural steel

- Framing lumber

- Concrete block

- Conduit

- Copper electric wire

- Fiberglass insulation

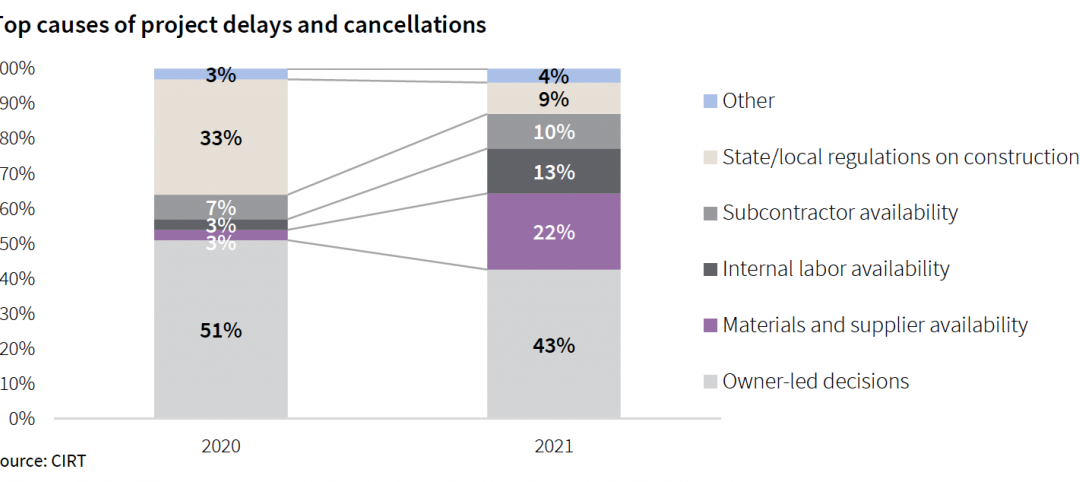

The report reveals that commodity and labor shortages continued to create supply chain challenges that impacted project schedules and caused order backlogs. In addition, weather conditions had a significant impact, with droughts along major river shipping corridors causing delivery delays and a resultant increase in prices.

The data also indicates that while construction material prices remained steady on average over the course of 2023, there was variability among individual materials. For example, structural steel, framing lumber, and conduit all decreased compared to the previous year, but pricing for fiberglass insulation increased by more than 20%. Gordian notes that this is due in part to the significant demand generated from the credits for installing new residential insulation offered by the Inflation Reduction Act.

At the state level in Q4, the average total cost of construction increased in Alaska, Hawaii, California, Illinois, and several northeastern states. In general, the further away the location from the Mississippi River and major manufacturing centers, the higher the material and labor costs.

Looking ahead into 2024, it is anticipated that while regional cost pressures will continue to impact pricing in various locations, there will be a continuing trend toward price stabilization compared to the market volatility previously seen. This normalization is expected to be driven by a trend away from offshore suppliers and instead toward more reliable onshore and near-shore sources.

While the construction industry is still experiencing a degree of unpredictability, there is cautious optimism. By leveraging a proactive approach to supply chains, implementing strategies gleaned through data analytics, and through the use of data-driven technological tools, the industry is positioning itself to better anticipate and mitigate supply chain challenges in 2024 and beyond.

The full Quarterly Construction Costs Insights Report for Q4 2023 can be accessed here.

Related Stories

| Sep 8, 2022

U.S. construction costs expected to rise 14% year over year by close of 2022

Coldwell Banker Richard Ellis (CBRE) is forecasting a 14.1% year-on-year increase in U.S. construction costs by the close of 2022.

Market Data | Oct 11, 2021

No decline in construction costs in sight

Construction cost gains are occurring at a time when nonresidential construction spending was down by 9.5 percent for the 12 months through July 2021.