BD&C: What is happening with your corporate portfolio? Are there any strong commercial markets right now?

Samuel S. Unger: Most U.S. markets are still soft. There is some perceived bottoming in some very local submarkets in San Francisco, San Jose, and certain New York City submarkets. Downtown Seattle is tightening. Other markets have limited inventory in given classes of buildings, so there is better control over those segments. I am also surprised by how tight some of the smaller Canadian cities are. Researching the brokerage house reports looking for consensus is still helpful, as are ongoing discussions with trusted brokers. We always try to stay ahead of the requirement by trying to understand forward momentum in given markets. It’s also important to note that markets can be quite local, varying by view and size of requirement, so generalities need to be closely tempered by the requirement you are presenting to the market.

BD+C: Where is the best place to invest in real estate right now?

SU: There has been competition for trophy assets in commercial real estate, and a fair amount of money chasing discounted retail assets, according to what I hear. Unfortunately, real estate assets are very difficult to dispose of in weak markets, as too many have discovered to their chagrin. Diversification still rules.

‘Try to understand forward momentum in given markets’

BD+C: When is the commercial real estate market going to rebound?

SU: When you see three or four quarters of positive white collar job growth, you might be tempted to get out of your foxhole. But a critical caution is the fact that all markets and submarkets are local, and impacted by the movement of major companies or particular industry segments.

BD+C: In regard to commercial properties, are owners upgrading or reconstructing these properties? How long does it take for an owner to see a return on their investment after upgrading or reconstructing a property? How is this impacting their portfolio?

SU: This is a thesis question. It all depends on an owner’s portfolio, competitive pressure, leverage, and access to capital. We’ve seen a number of owners of Class A property begin to do reasonable upgrades to comply with the lower tiers of LEED certification because they believe they need this to remain competitive in the market, and we welcome that.

BD+C: Is it more advantageous to construct a new building, or upgrade an existing structure?

SU: I stress that we as an organization are not owners of buildings for reasons specific to the Ernst & Young partnership. We have a very competent advisory services business that assists owners with questions like this. As with any complex question, it all depends on the specific market and the arbitrage available in making a conversion.

BD+C: Are there particular mistakes or errors that you see BD+C readers making in regard to commercial real estate?

SU: If you are talking ownership, the first law is that real estate is volatile and illiquid, and keeps absorbing capital. The second law is to remember the first.

BD+C: How can BD+C readers—architects, MEP engineers, and contractors—work more effectively with a firm like Ernst & Young and other CoreNet members?

SU: We encourage contact with design professionals and contractors. We mandate that members of our real estate group get involved with national and local organizations, and we’re not shy about it. I encourage professionals to get involved with CoreNet. It’s important to realize that the organization encourages mutual long-term benefit—no quick sells, no heavy marketing, but a great opportunity to let people understand both the type of individual you are and something of your business over time. The people of CoreNet are also a tremendous resource, with literally hundreds of years of collective experience in the allied professions.

BD+C: What do architecture, engineering, and construction firms continually do wrong in their dealings with organizations that are CoreNet members? What mistakes do you see them making? What advice would you have for AEC firms to work more effectively?

SU: Great question, and another thesis topic. Approach CoreNet members as a long-term investment. Share experiences and understand the pressures and questions of your potential clients. Don’t talk consultant speak—if asked, talk solutions. Otherwise, grab a beer and share war stories.

BD+C: What is the most important thing you can take away from your involvement with CoreNet on both a personal and professional level?

SU: CoreNet has been a tremendously valuable resource for me. I have established friendships and had the opportunity to go beyond professional relationships with a number of our members. I have also realized that many of the issues I faced, both personally and professionally, are shared problems, with shared solutions. On a professional level, deeper discussion of the issues we face as an organization, and the similarities to the issues faced by my colleagues in CoreNet, help generate more thoughtful solutions. The opportunity to review strategies and tactics for these issues is valuable, as is the review of resources available through service providers, contractors, and suppliers. BD+C

Related Stories

Affordable Housing | Apr 1, 2024

Chicago voters nix ‘mansion tax’ to fund efforts to reduce homelessness

Chicago voters in March rejected a proposed “mansion tax” that would have funded efforts to reduce homelessness in the city.

Standards | Apr 1, 2024

New technical bulletin covers window opening control devices

A new technical bulletin clarifies the definition of a window opening control device (WOCD) to promote greater understanding of the role of WOCDs and provide an understanding of a WOCD’s function.

Adaptive Reuse | Mar 30, 2024

Hotel vs. office: Different challenges in commercial to residential conversions

In the midst of a national housing shortage, developers are examining the viability of commercial to residential conversions as a solution to both problems.

Sustainability | Mar 29, 2024

Demystifying carbon offsets vs direct reductions

Chris Forney, Principal, Brightworks Sustainability, and Rob Atkinson, Senior Project Manager, IA Interior Architects, share the misconceptions about carbon offsets and identify opportunities for realizing a carbon-neutral building portfolio.

Reconstruction & Renovation | Mar 28, 2024

Longwood Gardens reimagines its horticulture experience with 17-acre conservatory

Longwood Gardens announced this week that Longwood Reimagined: A New Garden Experience, the most ambitious revitalization in a century of America’s greatest center for horticultural display, will open to the public on November 22, 2024.

Office Buildings | Mar 27, 2024

A new Singapore office campus inaugurates the Jurong Innovation District, a business park located in a tropical rainforest

Surbana Jurong, an urban, infrastructure and managed services consulting firm, recently opened its new headquarters in Singapore. Surbana Jurong Campus inaugurates the Jurong Innovation District, a business park set in a tropical rainforest.

Cultural Facilities | Mar 27, 2024

Kansas City’s new Sobela Ocean Aquarium home to nearly 8,000 animals in 34 habitats

Kansas City’s new Sobela Ocean Aquarium is a world-class facility home to nearly 8,000 animals in 34 habitats ranging from small tanks to a giant 400,000-gallon shark tank.

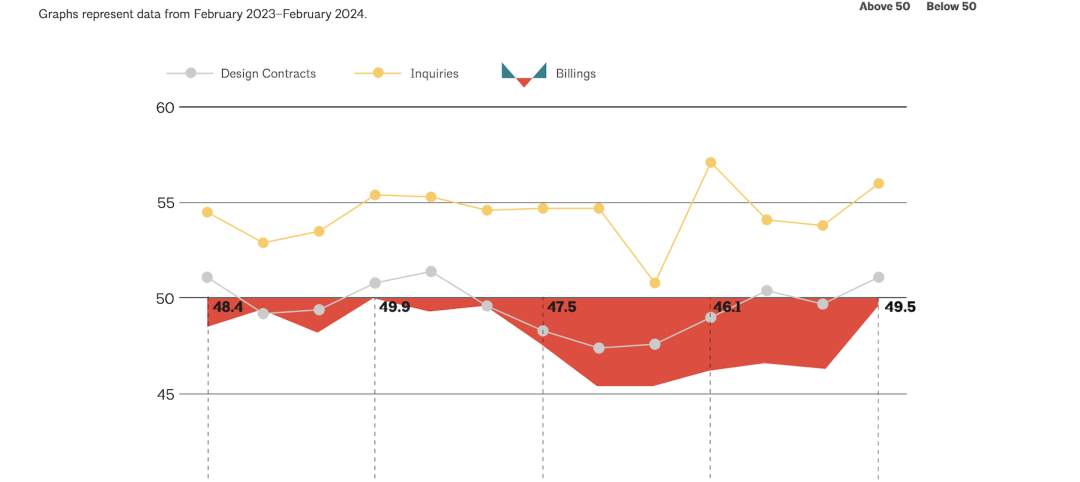

Market Data | Mar 26, 2024

Architecture firm billings see modest easing in February

Architecture firm billings continued to decline in February, with an AIA/Deltek Architecture Billings Index (ABI) score of 49.5 for the month. However, February’s score marks the most modest easing in billings since July 2023 and suggests that the recent slowdown may be receding.

Cultural Facilities | Mar 26, 2024

Renovation restores century-old Brooklyn Paramount Theater to its original use

The renovation of the iconic Brooklyn Paramount Theater restored the building to its original purpose as a movie theater and music performance venue. Long Island University had acquired the venue in the 1960s and repurposed it as the school’s basketball court.

Adaptive Reuse | Mar 26, 2024

Adaptive Reuse Scorecard released to help developers assess project viability

Lamar Johnson Collaborative announced the debut of the firm’s Adaptive Reuse Scorecard, a proprietary methodology to quickly analyze the viability of converting buildings to other uses.