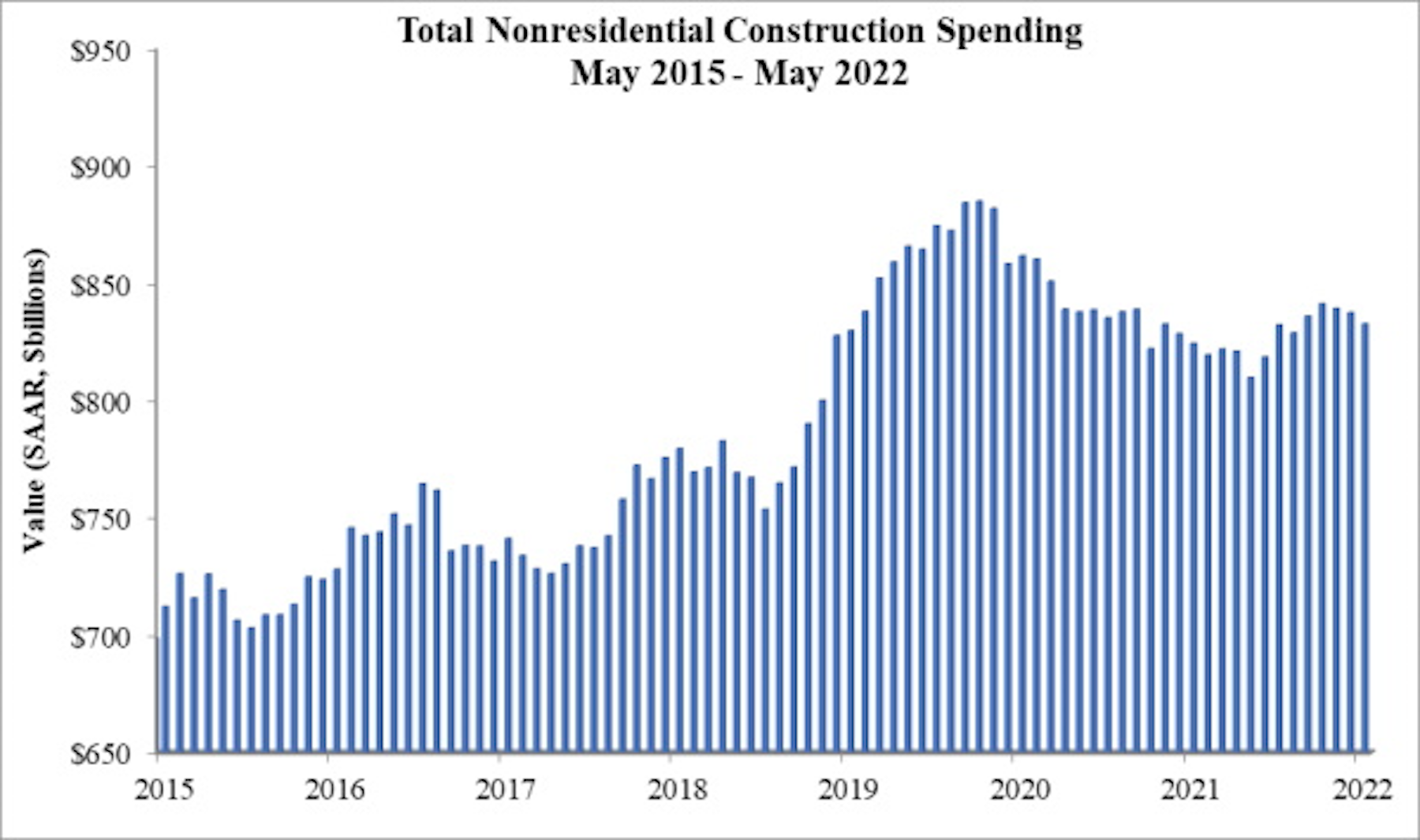

National nonresidential construction spending was down by 0.6% in May, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $832.5 billion for the month.

Spending was down on a monthly basis in 10 of the 16 nonresidential subcategories. Private nonresidential spending was down 0.4%, while public nonresidential construction spending was down 0.8% in May. Nonresidential construction spending is up 1.0% over the past year, though spending is down in 10 of 16 categories over that span. The best performer is manufacturing, a segment in which construction spending is up 26.3% on a year-over-year basis.

“Many contractors continue to report that they are operating at capacity despite a lack of strong nonresidential construction spending recovery,” said ABC Chief Economist Anirban Basu. “That juxtaposition provides solid evidence that the supply side of the U.S. economy remains heavily constrained by worker shortages, domestic and global supply chain disruptions and resulting high prices.

“Since the early months of the pandemic, contractors have reported that they are able to pass along their cost increases to project owners, according to ABC’s Construction Confidence Index,” said Basu. “But there are growing concerns among industry leaders that the ability to pass along cost increases will dissipate during the months ahead as financial conditions tighten and confidence in economic performance wanes.

“A primary implication is that contractor margins may be squeezed going forward, and there is growing anecdotal evidence that this is already occurring,” said Basu. “There is also a growing risk of a significant number of project postponements in both private and public construction segments due to high materials prices and labor costs.

“The key to sustaining nonresidential construction’s recovery will be slower inflation,” said Basu. “As long as inflation remains elevated, monetary policy will continue to tighten and project owners will be less willing to move forward with projects in an effort to preserve cash. Unfortunately, ongoing efforts to limit inflation are likely to result in recession or at least further economic slowing, which will create additional issues for many contractors. However, less inflation and more favorable construction materials prices would create a foundation for renewed construction spending vigor.”

Related Stories

Market Data | Feb 10, 2016

Nonresidential building starts and spending should see solid gains in 2016: Gilbane report

But finding skilled workers continues to be a problem and could inflate a project's costs.

Market Data | Feb 9, 2016

Cushman & Wakefield is bullish on U.S. economy and its property markets

Sees positive signs for construction and investment growth in warehouses, offices, and retail

Market Data | Feb 5, 2016

CMD/Oxford forecast: Nonresidential building growth will recover modestly in 2016

Increased government spending on infrastructure projects should help.

Market Data | Feb 4, 2016

Mortenson: Nonresidential construction costs expected to increase in six major metros

The Construction Cost Index, from Mortenson Construction, indicated rises between 3 and 4% on average.

Contractors | Feb 1, 2016

ABC: Tepid GDP growth a sign construction spending may sputter

Though the economy did not have a strong ending to 2015, the data does not suggest that nonresidential construction spending is set to decline.

Data Centers | Jan 28, 2016

Top 10 markets for data center construction

JLL’s latest outlook foresees a maturation in certain metros.

Market Data | Jan 20, 2016

Nonresidential building starts sag in 2015

CDM Research finds only a few positive signs among the leading sectors.

Market Data | Jan 20, 2016

Architecture Billings Index ends year on positive note

While volatility persists, architecture firms reported healthy performance for 2015.

Market Data | Jan 15, 2016

ABC: Construction material prices continue free fall in December

In December, construction material prices fell for the sixth consecutive month. Prices have declined 7.2% since peaking in August 2014.

Market Data | Jan 13, 2016

Morgan Stanley bucks gloom and doom, thinks U.S. economy has legs through 2020

Strong job growth and dwindling consumer debt give rise to hope.