A remarkable number of biopharma companies, under the gun to get their research and products to market quicker, aren't happy with design-build and design-build-bid methods of construction project delivery. However, lean and integrated delivery models are still being adopted warily by this sector, with questions about quality being among the primary barriers.

These are some of the key findings in “Horizons: Life Sciences,” a report released by the AEC and consulting firm CRB, that explores trends and attitudes about processes and manufacturing for the biopharmaceutical industry, based on responses of more than 500 industry leaders to nearly 80 questions.

The report presents a biopharma industry that has been turned upside down by the coronavirus pandemic and the urgency it has fomented to provide solutions to these kinds of health events. This disruption has spurred “a whole new mindset, which casts off our industry’s conservative nature in favor of more innovation, more speed, and more flexibility in the name of more lives saved,” Noel Maestre, CRB’s Vice President of Life Sciences, writes in the report’s executive summary. “We will one day defeat this pandemic, but the waves of change that are overtaking the life sciences are only just gathering momentum.”

GAUGING NEW MODELS FOR COST AND RISK

The report touches on a host of topics that include cell and gene therapy production, the role that technology like AI and blockchain is playing in biopharma research and manufacturing, and how what the report calls “Pharma 4.0”—an incorporation of the state-of-the art operating models—is introducing digitization to the pharmaceutical sector. “Companies that embrace Pharma 4.0 are able to harmonize the flow of data from R&D through manufacturing and distribution, enhance cybersecurity, and improve their quality and regulatory compliance,” the report states.

However, to reach that plateau—what the report calls the next Digital Plant Maturity Model—biopharma companies must find ways to assuage their concerns about cost, risk management, and security, and look realistically at their operational parameters and limitations. For example, two-thirds of respondents were confident that their companies are ready to implement blockchain to secure their supply chains, which CRB thinks is overly optimistic: “What is holding back widespread adoption of blockchain is the lack of computational power.”

In that same vein, despite acknowledging shortages in skilled data analysts and concerns about cost and cybersecurity, respondents intend to use AI for quality testing (71%), to improve material planning (59%), for predictive analytics (53%), and to improve efficiency (52%).

NOT ENOUGH AEC FIRMS FOR LIFE SCIENCES PROJECTS

A good portion of this 106-page report addresses life sciences-related construction. If digitalization represents level four of the manufacturing process, CRB thinks that most construction companies are at level three, “having moved beyond the data silos that that can exist between design and construction teams.”

CRB’s internal Construction 4.0 initiative is applying Digital twin and augmented reality to the design and construction of biopharma facilities. “AR is a good starting point for incorporating aspects of Pharma 4.0 into the construction process,” the report states. And CRB is “beginning to see the ease with which 3D printing is becoming possible in manufacturing and even construction.”

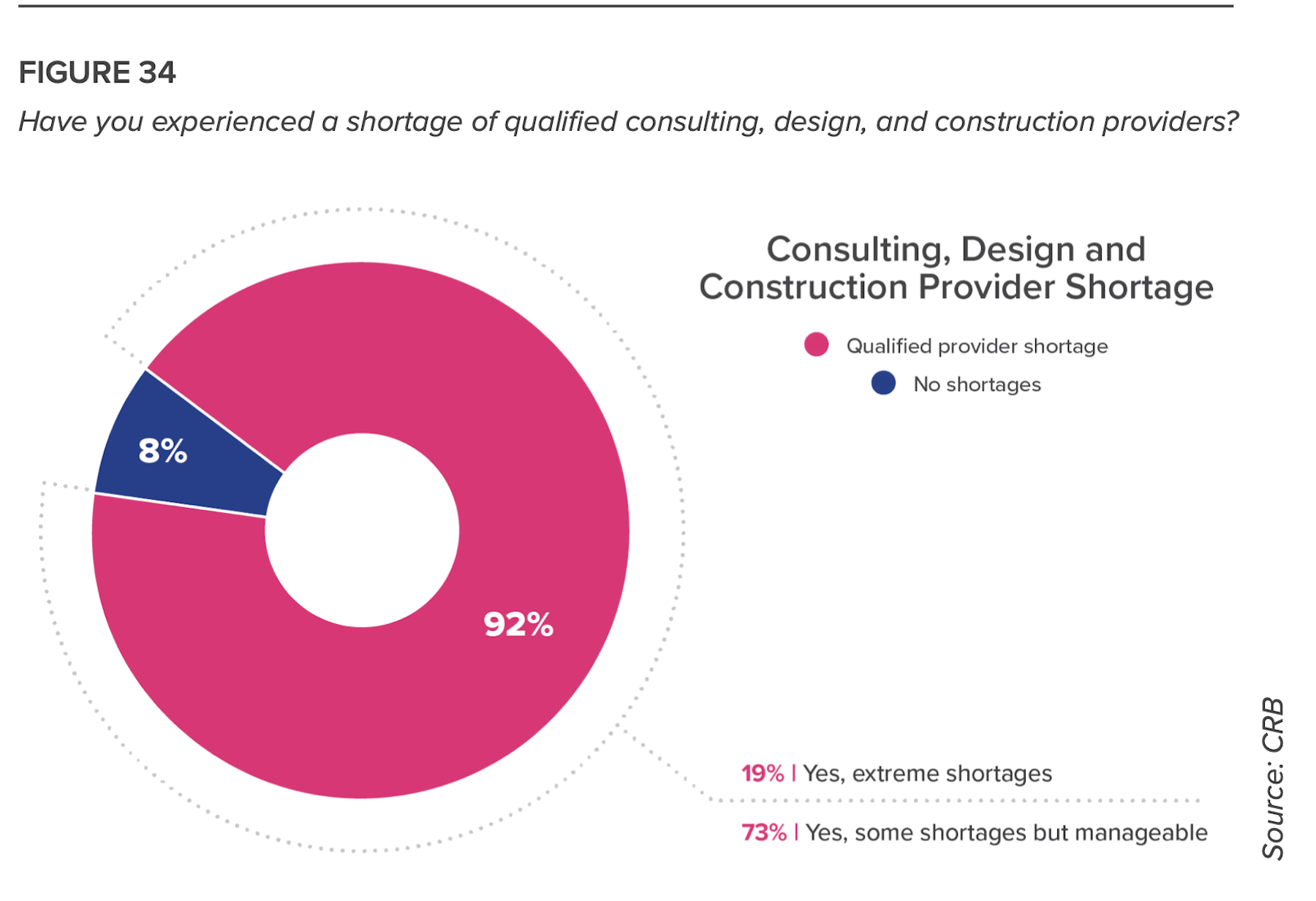

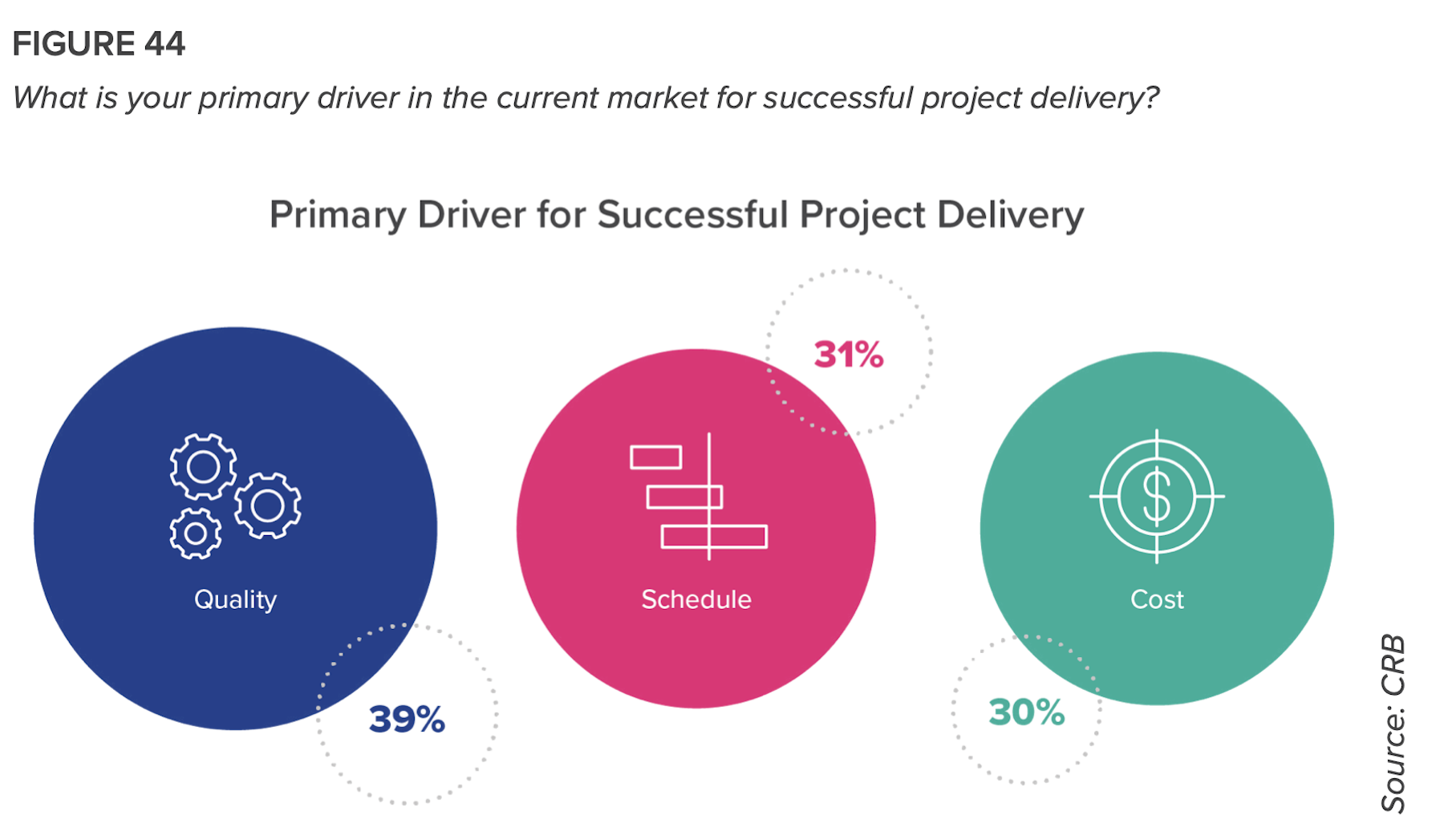

One major problem, however, is impeding a broader involvement in this movement: A sizable number of respondents to this survey cited a shortage of available AEC partners for their building projects. The answer, suggests CRB, is “to find partners capable of keeping schedules on track by establishing a phased project delivery approach.”

But such approaches have been slow to catch on among biopharma companies. Despite “significant dissatisfaction” with the dominant delivery models, more than 60 percent of respondents continue to favor design-build or design-build-bid. Only 13 percent prefer Integrated Project Delivery, and that drops to just 6 percent among Contract Manufacturing Organizations (CMOs).

CRB infers that many biopharma companies are making delivery choices out of ignorance: just 9 percent of respondents said they were “very familiar” with lean principles. (That number rises to 20 percent among big pharma companies.)

And while 90 percent of respondents said they are open to alternative delivery methods, 60 percent also said that procurement-method constraints were holding them back.

“If it’s a 10-step path to universal acceptance of IPD, we’re probably at about Step 3, and reaching full acceptance won’t likely happen in this decade,” the report states. “But there is movement, and a clear recognition of the shortcomings of the traditional models. The pandemic has opened the gates to welcome a different way of doing things.”

A RELUCTANT EMBRACE OF PREFAB AND MODULAR

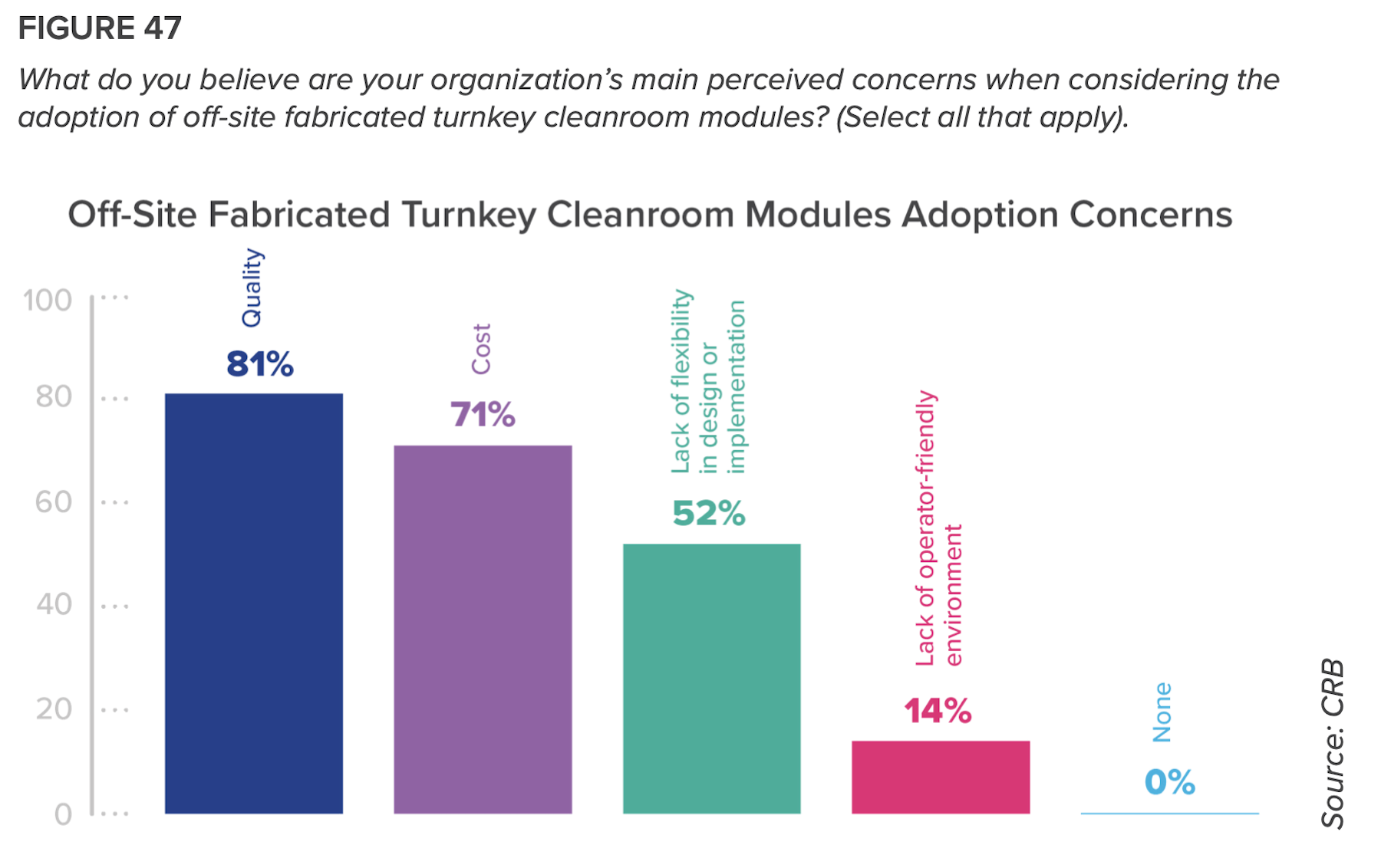

The report takes a closer look at the pharma industry’s acceptance of prefabrication, modularization, and off-site manufacturing, and finds it wanting. Only half of respondents think that these alternatives are “moderately valuable” to their projects, and another 48% think they are of slight or no value.

Ninety-three percent of those polled ranked quality as their top adoption concern. More than three-quarters of startup companies listed cost as their main barrier.

But CRB insists that prefab and modular production “is not just a fad.” Indeed, the survey’s respondents ranked financial modeling the most important among tools needed to achieve greater adoption. “An important component of adoption is to quantify how potential additional costs are recouped,” the report states.

Related Stories

Healthcare Facilities | Jan 7, 2024

Two new projects could be economic catalysts for a central New Jersey city

A Cancer Center and Innovation district are under construction and expected to start opening in 2025 in New Brunswick.

Giants 400 | Nov 16, 2023

Top 70 Science + Technology Facility Engineering Firms for 2023

Jacobs, Fluor, SSOE, Tetra Tech, and Affiliated Engineers head BD+C's ranking of the nation's largest science and technology (S+T) facility engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking factors revenue from all science and technology (S+T) buildings work, including laboratories, research buildings, technology/innovation buildings, pharmaceutical production facilities, and semiconductor production facilities.

Giants 400 | Nov 16, 2023

Top 100 Science + Technology Facility Architecture Firms for 2023

Gensler, HDR, Page Southerland Page, Flad Architects, and DGA top BD+C's ranking of the nation's largest science and technology (S+T) facility architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking factors revenue from all science and technology (S+T) buildings work, including laboratories, research buildings, technology/innovation buildings, pharmaceutical production facilities, and semiconductor production facilities.

Giants 400 | Aug 22, 2023

2023 Giants 400 Report: Ranking the nation's largest architecture, engineering, and construction firms

A record 552 AEC firms submitted data for BD+C's 2023 Giants 400 Report. The final report includes 137 rankings across 25 building sectors and specialty categories.

Giants 400 | Aug 22, 2023

Top 175 Architecture Firms for 2023

Gensler, HKS, Perkins&Will, Corgan, and Perkins Eastman top the rankings of the nation's largest architecture firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Healthcare Facilities | Aug 10, 2023

The present and future of crisis mental health design

BWBR principal Melanie Baumhover sat down with the firm’s behavioral and mental health designers to talk about how intentional design can play a role in combatting the crisis.

Laboratories | Jul 10, 2023

U.S. Department of Agriculture opens nation’s first biosafety level 4 containment facility for animal disease research

Replacing a seven-decade-old animal disease center, the National Bio and Agro-Defense Facility includes the nation’s first facility with biosafety containment capable of housing large livestock.

Laboratories | Jun 23, 2023

A New Jersey development represents the state’s largest-ever investment in life sciences and medical education

In New Brunswick, N.J., a life sciences development that’s now underway aims to bring together academics and researchers to work, learn, and experiment under one roof. HELIX Health + Life Science Exchange is an innovation district under development on a four-acre downtown site. At $731 million, HELIX, which will be built in three phases, represents New Jersey’s largest-ever investment in life sciences and medical education, according to a press statement.

Mass Timber | May 1, 2023

SOM designs mass timber climate solutions center on Governors Island, anchored by Stony Brook University

Governors Island in New York Harbor will be home to a new climate-solutions center called The New York Climate Exchange. Designed by Skidmore, Owings & Merrill (SOM), The Exchange will develop and deploy solutions to the global climate crisis while also acting as a regional hub for the green economy. New York’s Stony Brook University will serve as the center’s anchor institution.

Healthcare Facilities | Mar 13, 2023

Next-gen behavioral health facilities use design innovation as part of the treatment

An exponential increase in mental illness incidences triggers new behavioral health facilities whose design is part of the treatment.