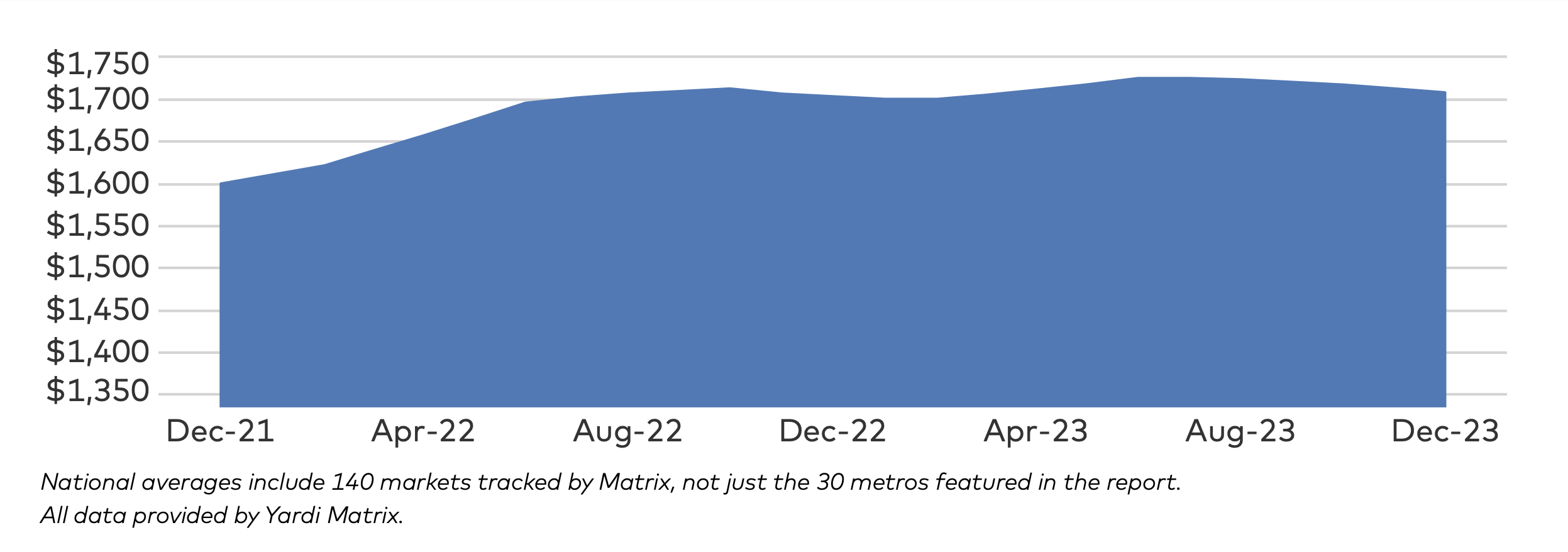

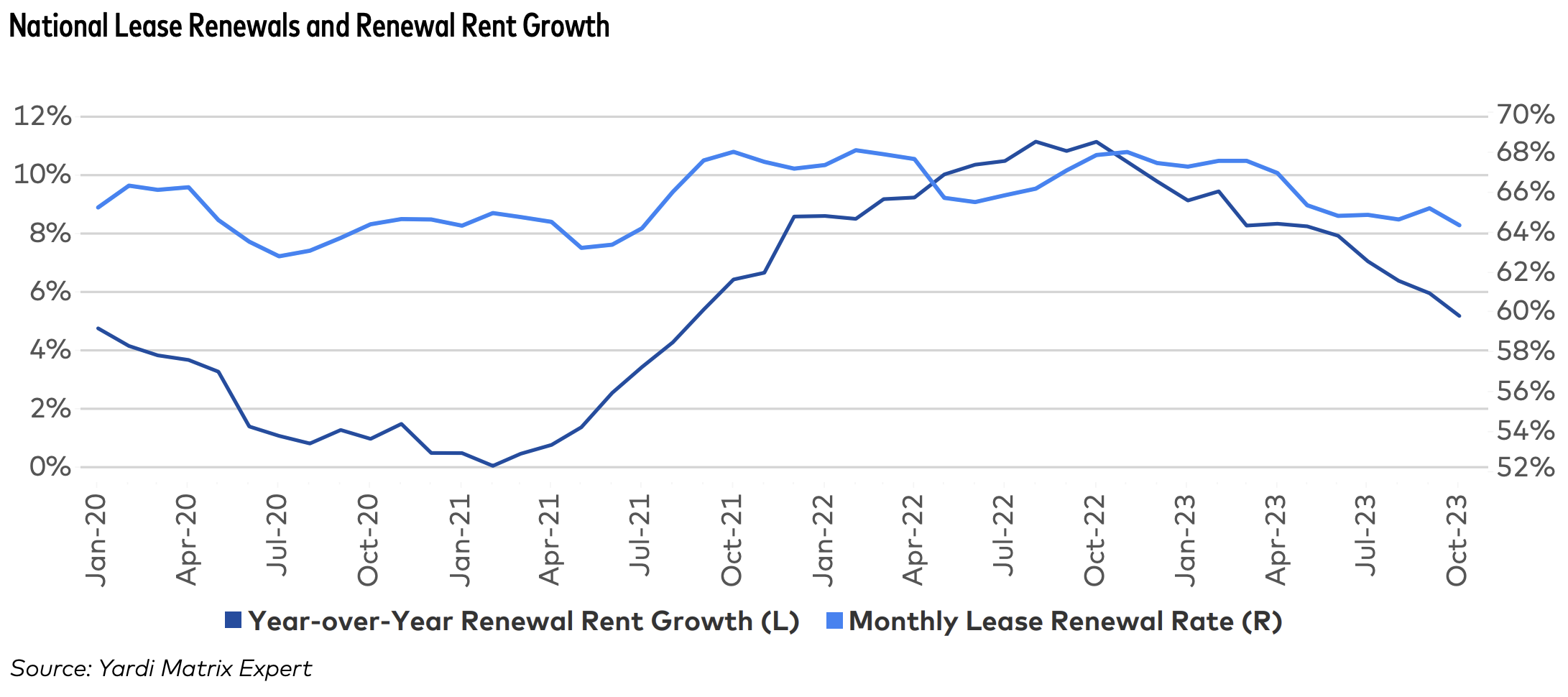

The December 2023 National Multifamily Report by Yardi Matrix highlights the highs and lows of the multifamily market in 2023. Despite strong demand, the year-over-year (YOY) growth for rent remained largely unchanged at 0.3 percent—a stark contrast to December 2022's 6.4% YOY increase.

According to Yardi Matrix, 2023's full-year rent growth of 0.3% is the weakest rent performance since the 0.2% increase in 2010 (barring the 2020 pandemic year's 0.1% gain). Negative rent growth is affecting several major metropolitan areas as well, with Austin, Texas, ending the year at a -5.7% growth rate. Other metros such as Orlando, Fla.; Portland, Ore.; Phoenix, Ariz.; and Atlanta, Ga.; all are down by at least 3% year-over-year.

Strong job market

Despite the multifamily market ending 2023 on a downswing, conditions may not be as weak as they appear. A strong job market continues to drive demand and shows signs of holding up following the Federal Reserve's rate hikes.

Also aiding in demand is net immigration, which has increased by more than one million annually, according to the report.

Occupancy rates

The national occupancy rate left December 2023 at 94.8 percent, unchanged from the previous month. Rates were either unchanged or down YOY in all but five markets: Chicago, Ill. (+0.2% YOY), Seattle, Wash. (+0.2% YOY), Denver, Colo. (+0.1% YOY), Washington, D.C. (+0.1% YOY), and the Twin Cities (+0.1% YOY).

Atlanta had the largest decline of the year, down 1.3 percent.

Overall outlook for multifamily housing in 2024

- Expenses, income, deliveries, and interest rates pose key challenges for the multifamily industry this year

- Though the market is expected to deliver over 500,000 units this year, there is a dramatic decrease in starts

- Recent interest rate declines alleviate potential distress for multifamily owners, but long-term stability remains uncertain