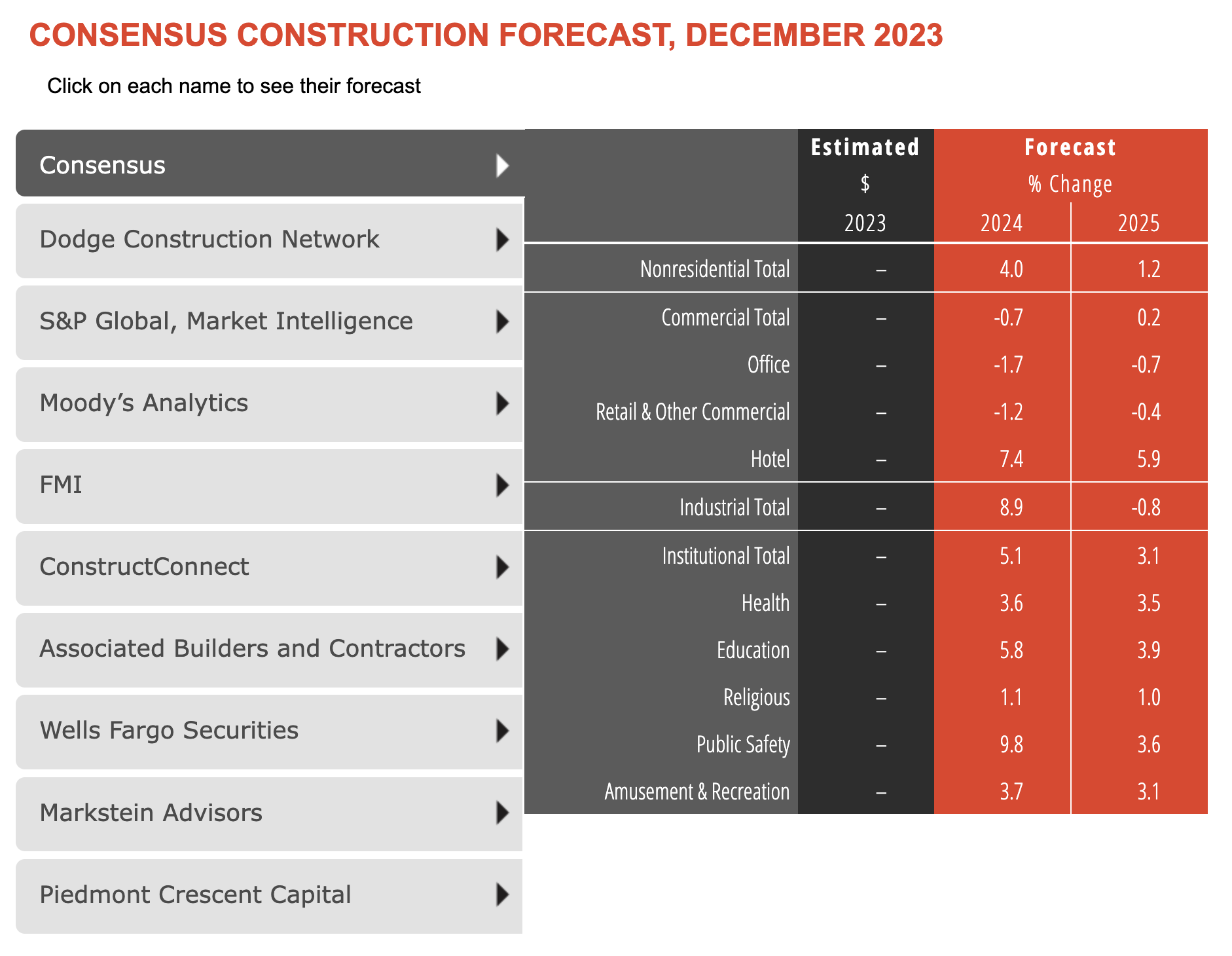

Spending on nonresidential buildings will see a modest 4% increase in 2024, after increasing by more than 20% last year according to The American Institute of Architects’ latest Consensus Construction Forecast.

The pace will slow to just over 1% growth in 2025, a marked difference from the strong performance in 2023. Spending on commercial facilities will be flat this year and next, manufacturing construction will increase almost 10% this year before stabilizing in 2025, and institutional construction will see mid-single-digit gains this year and next.

The Consensus Construction Forecast panelists, a group comprised of the leading construction forecasters from across the country, found there are many factors fueling the projected slowdown:

- Tighter credit conditions continue to put pressure on many regional banks that account for a sizeable share of construction lending.

- Higher construction input costs due to inflation in materials costs and labor in recent years.

- Declines in commercial property values as weak demand continues in many sectors.

- Structural changes in demand, disrupting notoriously cyclical construction industry.

“There are several economic headwinds behind the projected slowdown,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “We already started to see construction starts either slow dramatically or turn negative in virtually all construction sectors in the latter part of 2023 and the weaker conditions are expected to stay into 2025.”

Related Stories

Engineers | May 3, 2017

At first buoyed by Trump election, U.S. engineers now less optimistic about markets, new survey shows

The first quarter 2017 (Q1/17) of ACEC’s Engineering Business Index (EBI) dipped slightly (0.5 points) to 66.0.

Market Data | May 2, 2017

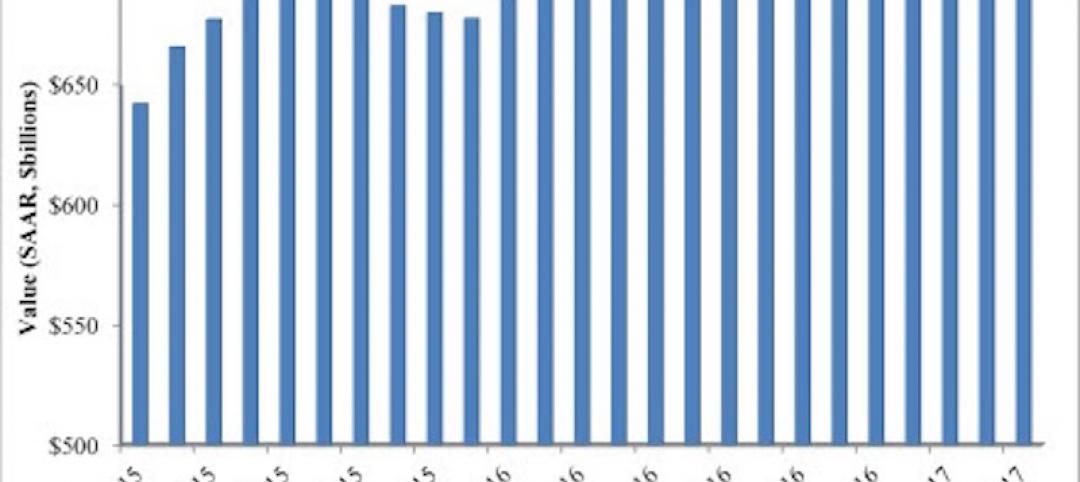

Nonresidential Spending loses steam after strong start to year

Spending in the segment totaled $708.6 billion on a seasonally adjusted, annualized basis.

Market Data | May 1, 2017

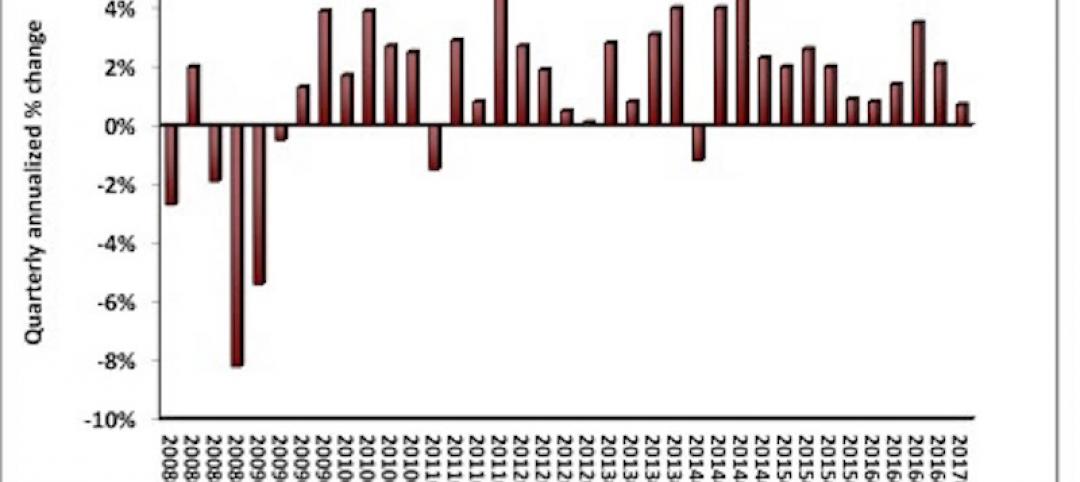

Nonresidential Fixed Investment surges despite sluggish economic in first quarter

Real gross domestic product (GDP) expanded 0.7 percent on a seasonally adjusted annualized rate during the first three months of the year.

Industry Research | Apr 28, 2017

A/E Industry lacks planning, but still spending large on hiring

The average 200-person A/E Firm is spending $200,000 on hiring, and not budgeting at all.

Architects | Apr 27, 2017

Number of U.S. architects holds steady, while professional mobility increases

New data from NCARB reveals that while the number of architects remains consistent, practitioners are looking to get licensed in multiple states.

Market Data | Apr 6, 2017

Architecture marketing: 5 tools to measure success

We’ve identified five architecture marketing tools that will help your firm evaluate if it’s on the track to more leads, higher growth, and broader brand visibility.

Market Data | Apr 3, 2017

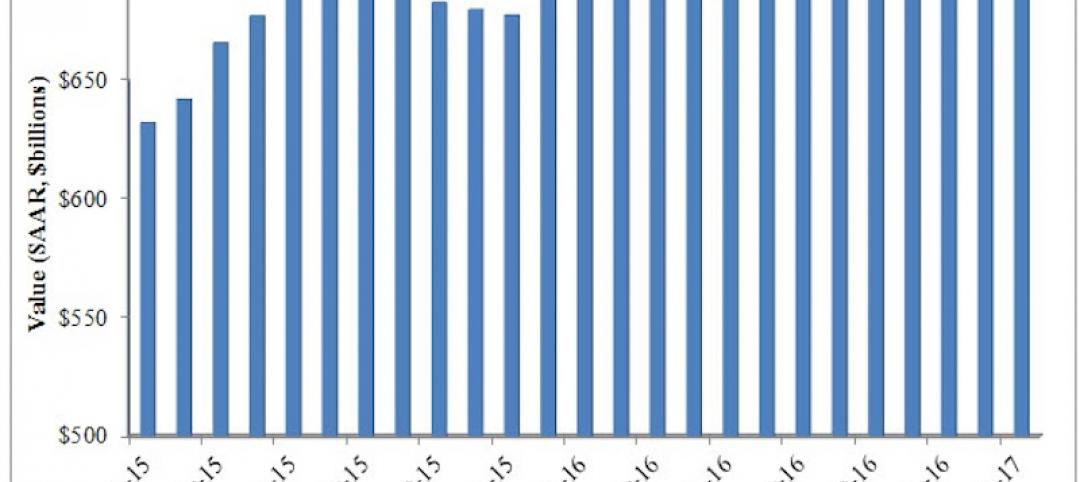

Public nonresidential construction spending rebounds; overall spending unchanged in February

The segment totaled $701.9 billion on a seasonally adjusted annualized rate for the month, marking the seventh consecutive month in which nonresidential spending sat above the $700 billion threshold.

Market Data | Mar 29, 2017

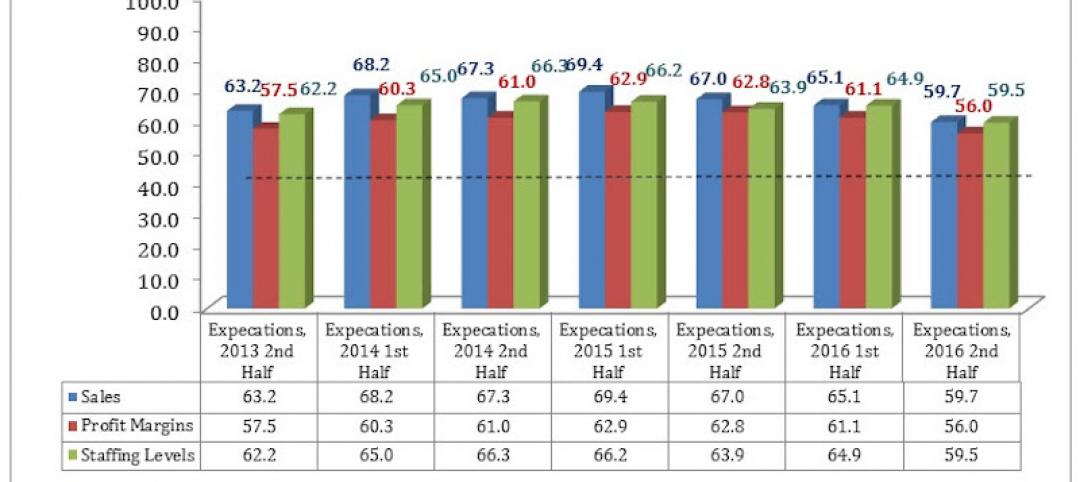

Contractor confidence ends 2016 down but still in positive territory

Although all three diffusion indices in the survey fell by more than five points they remain well above the threshold of 50, which signals that construction activity will continue to be one of the few significant drivers of economic growth.

Industry Research | Mar 24, 2017

The business costs and benefits of restroom maintenance

Businesses that have pleasant, well-maintained restrooms can turn into customer magnets.

Industry Research | Mar 22, 2017

Progress on addressing US infrastructure gap likely to be slow despite calls to action

Due to a lack of bipartisan agreement over funding mechanisms, as well as regulatory hurdles and practical constraints, Moody’s expects additional spending to be modest in 2017 and 2018.