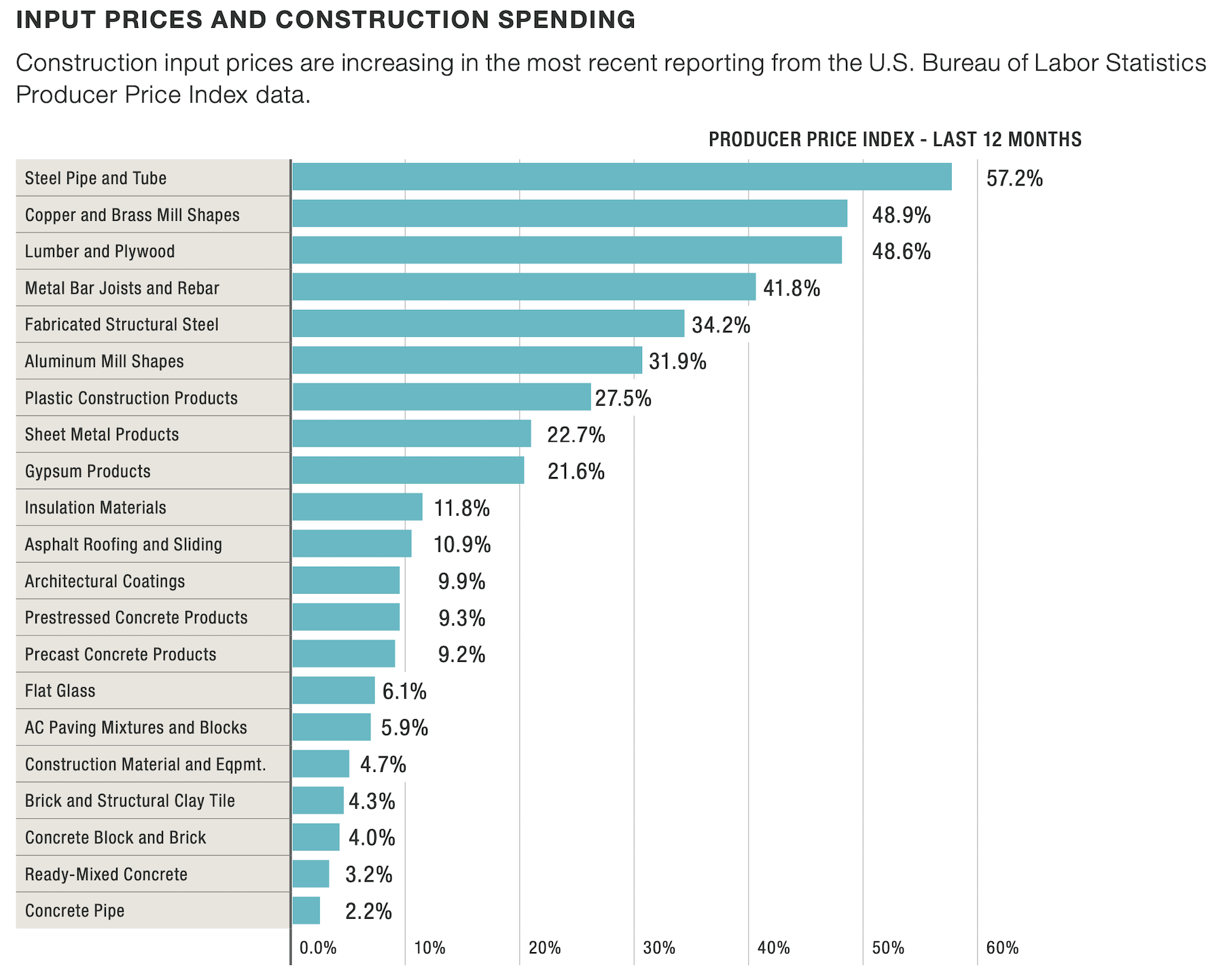

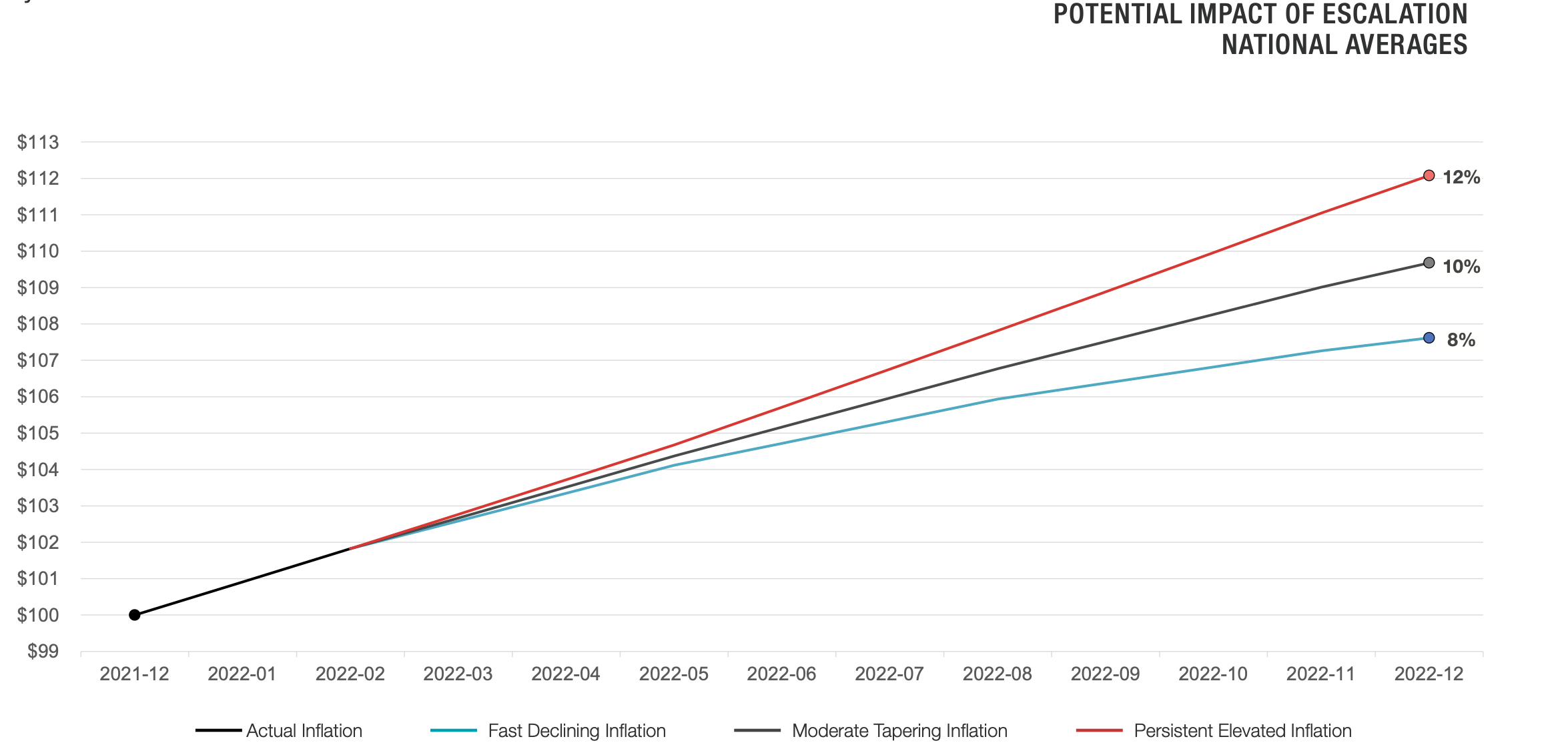

In the first six months of 2022, quarter-to-quarter inflation for construction materials showed signs of easing, but only slightly. “It’s important to clarify that costs are not decreasing; a more accurate description is that [they are] getting expensive less quickly,” stated Dallas-based architecture and construction firm The Beck Group, in its Summer 2022 Biannual Cost Report, which Beck released this week.

Covering January through June of this year, the report combines market data from a variety of sources—including AIA, FMI, McKinsey & Company, Autodesk, Cumming, the Urban Land Institute, and Associated General Contractors of America—with insights from the firm’s preconstruction teams in six markets: Atlanta, Austin, Charlotte, Dallas-Fort Worth, Denver, and the state of Florida.

Market conditions remain challenging nearly everywhere. “Schedule-related constraints are a new norm in today’s market,” The Beck Group contends. “Construction firms are in the middle of suppliers who can’t or won’t commit to pricing longer than 10 days and owners with historically prolonged approval processes. This reality conflicts with the past when it was still possible to hold pricing for upwards of 60 days.”

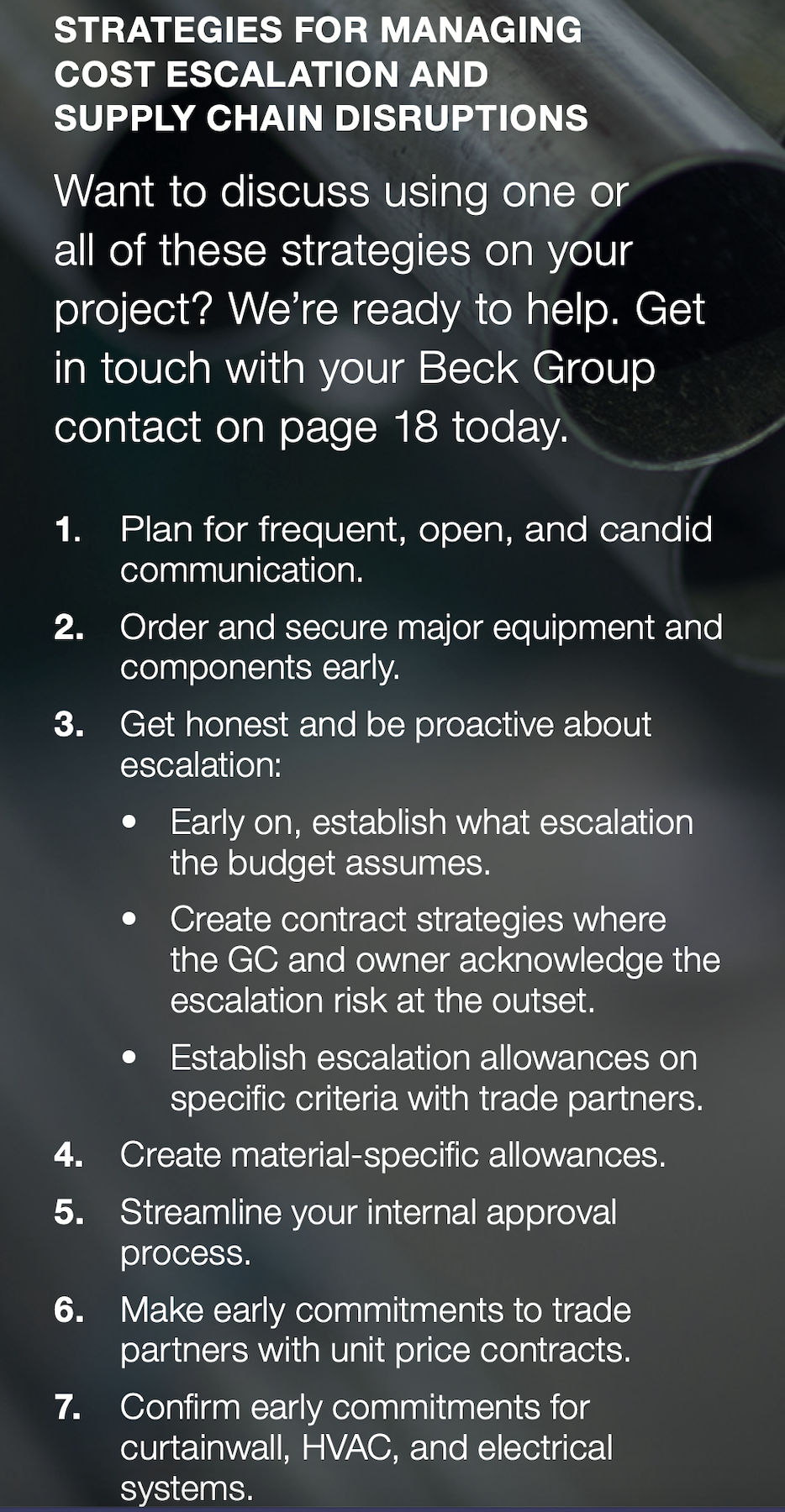

That being said, The Beck Group claims that the industry is on the cusp of a “new era in collaboration to manage costs and schedules.” That is especially true for developers and owners that bring their AEC partners into projects as early as possible. In its report, The Beck Group offers a list of strategies for managing inflation and supply-chain disruptions that mostly revolve around earlier procurement (see box).

Beck itself creates procurement packages for its clients to secure materials and equipment, a service that involves the firm’s design and construction teams.

DENVER AN EXPENSIVE PLACE TO BUILD IN

On the whole, The Beck Group is seeing significant demand and construction activities in the Sun Belt, in line with the “constant migration” of people and businesses to that region. (It points out, for example, that 43 high-rise towers are under development or construction in Austin.) To keep up with that demand, subcontractors in Texas must rely on imported cement (which, ironically, is among the construction materials least affected by current inflation).

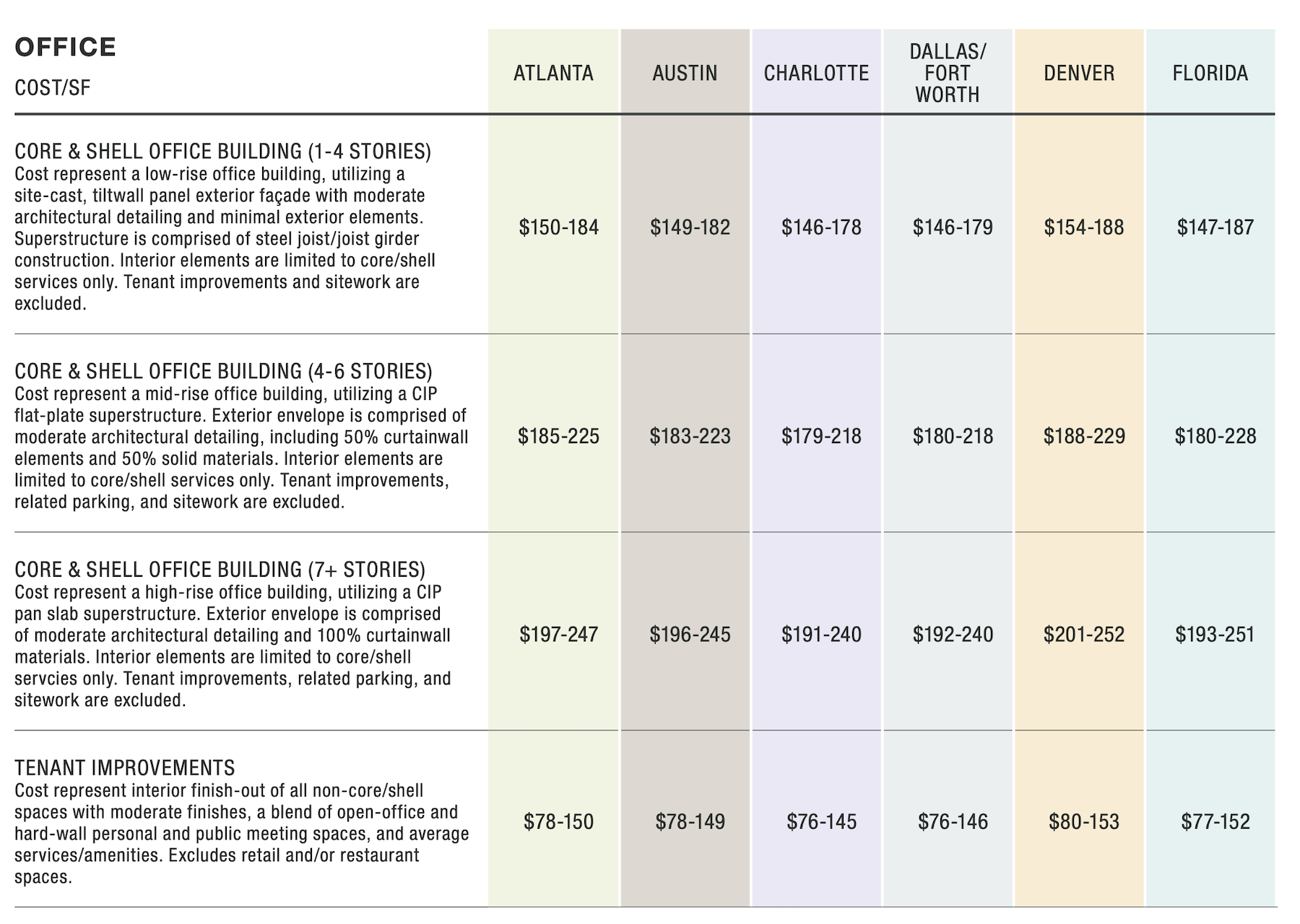

The report takes a deeper dive into the six Sun Belt markets mentioned above, and breaks down project costs by building types—office, healthcare, higher education, faith-based, hospitality, parking, and site work—and their respective sub niches.

The Denver metro is experiencing high demand for multifamily and mixed-use projects. Existing and planned projects are plentiful in the Atlanta market, and subcontractors report substantial backlogs. Building activity in the Florida market remains healthy, bolstered by the state’s economy that is expected to expand by 4 percent between now and 2024. The most significant demand for construction is education, healthcare, and aviation.

Across all building types, it costs more to build or renovate in Denver than in the other five markets, albeit only marginally so in several cases. For example, in healthcare, Denver’s costs per sf for ambulatory surgery centers—ranging from $477 to $583—were around $10 to $25 higher than the other metros. Science and lab buildings cost from $650 to $901 per sf to construct in Denver, versus $631 to $885 in Austin, another S+T hotbed.

The report also compares the cost per key to build or renovate hotels in these six markets, as well as the cost per space for parking and the cost per acre for site development.

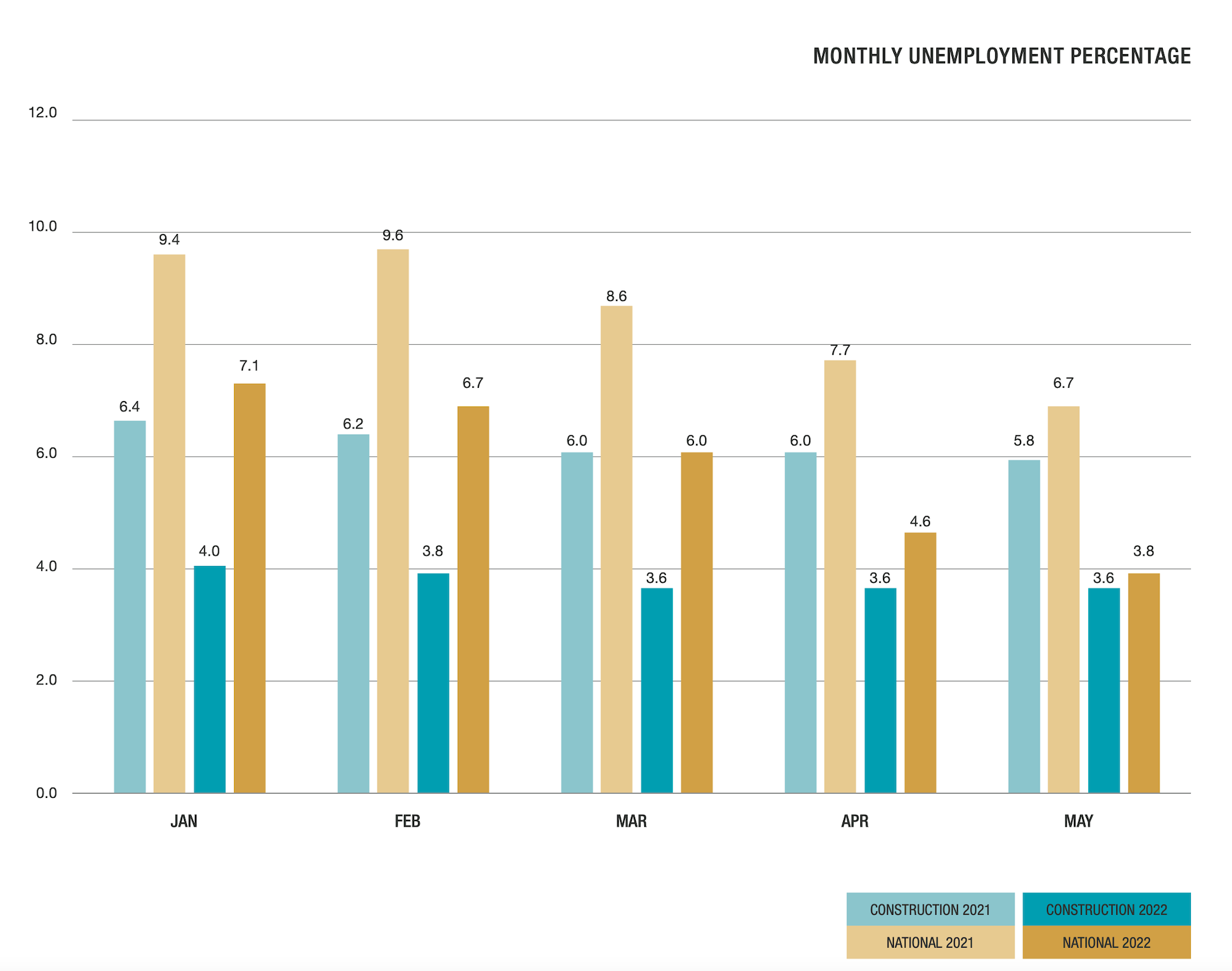

CONSTRUCTION EMPLOYMENT STRENGTHENING

The Beck Group report corroborates what other recent studies have been finding: that the construction employment market, nationally, is improving. Beck predicts this trend to continue as higher wages lure more people into the profession. The employment situation might also explain the slight bump in industry confidence that was evident in the first half of the year.

Related Stories

Market Data | Sep 22, 2016

Architecture Billings Index slips, overall outlook remains positive

Business conditions are slumping in the Northeast.

Market Data | Sep 20, 2016

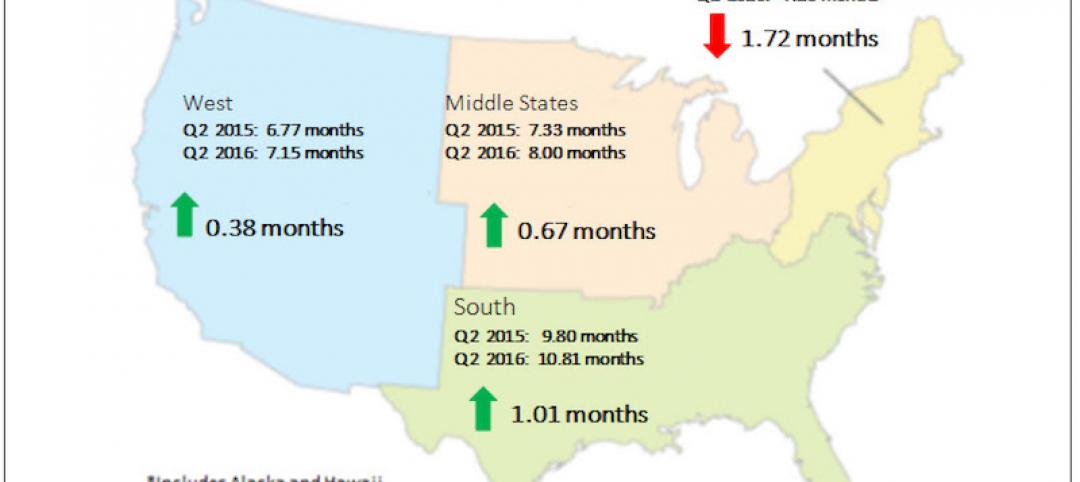

Backlog skyrockets for largest firms during second quarter, but falls to 8.5 months overall

While a handful of commercial construction segments continue to be associated with expanding volumes, for the most part, the average contractor is no longer getting busier, says ABC Chief Economist Anirban Basu.

Designers | Sep 13, 2016

5 trends propelling a new era of food halls

Food halls have not only become an economical solution for restauranteurs and chefs experiencing skyrocketing retail prices and rents in large cities, but they also tap into our increased interest in gourmet locally sourced food, writes Gensler's Toshi Kasai.

Building Team | Sep 6, 2016

Letting your resource take center stage: A guide to thoughtful site selection for interpretive centers

Thoughtful site selection is never about one factor, but rather a confluence of several components that ultimately present trade-offs for the owner.

Market Data | Sep 2, 2016

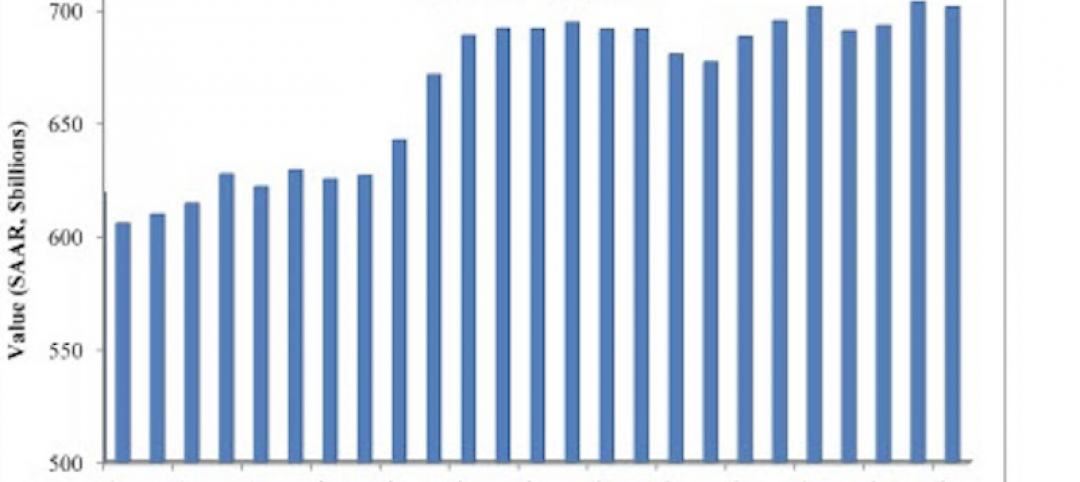

Nonresidential spending inches lower in July while June data is upwardly revised to eight-year record

Nonresidential construction spending has been suppressed over the last year or so with the primary factor being the lack of momentum in public spending.

Industry Research | Sep 1, 2016

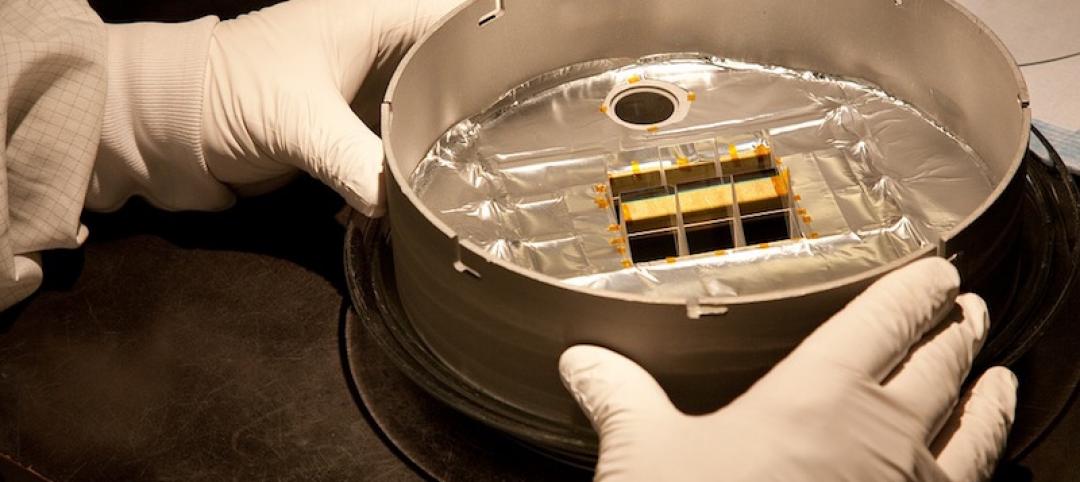

CannonDesign releases infographic to better help universities obtain more R&D funding

CannonDesign releases infographic to better help universities obtain more R&D funding.

Industry Research | Aug 25, 2016

Building bonds: The role of 'trusted advisor' is earned not acquired

A trusted advisor acts as a guiding partner over the full course of a professional relationship.

Multifamily Housing | Aug 17, 2016

A new research platform launches for a data-deprived multifamily sector

The list of leading developers, owners, and property managers that are funding the NMHC Research Foundation speaks to the information gap it hopes to fill.

Hotel Facilities | Aug 17, 2016

Hotel construction continues to flourish in major cities

But concerns about overbuilding persist.

Market Data | Aug 16, 2016

Leading economists predict construction industry growth through 2017

The Chief Economists for ABC, AIA, and NAHB all see the construction industry continuing to expand over the next year and a half.