Recently released county and metro-level population growth data by the U.S. Census Bureau shows that the fastest growing areas are found in exurbs and emerging suburbs.

Analysis of the data by Cushman & Wakefield shows population growth in all areas since the 2020 census, with the exception of urban cores that have had declining numbers. In 2022, however, the rate of decline in urban counties slowed significantly, buoyed by the resumption of international migration following the Covid pandemic.

The Dallas–Fort Worth metroplex grew by roughly 170,000 residents, outpacing the metro area with the second largest population gains, Houston, by nearly 50,000 people. The New York metro region saw its population shrink by about 139,000.

Since the 2020 Census, Austin, Texas and Raleigh, N.C., rank as the two fastest growing metros on a percentage basis among major markets.

Here are Cushman & Wakefield's five takeaways from its recent analysis of the census, as authored by Sam Tenenbaum, Head of Multifamily Insights:

- Further-flung counties, those in Exurbs and Emerging suburbs, saw their population grow the fastest, with the former growing by 1.9% and the latter by 1.5%. These areas continue to accelerate population gains.

- All districts saw population gains with the exception of Urban Cores. However, with international migration making a big rebound in 2022, those counties saw the biggest change in population, stemming the tide of major population declines experienced from 2020-2021.

- Urban cores saw 70% of international migration among major U.S. counties in 2022 but high costs pushed more residents out, with domestic migration outflows of more than 1.1 million people.

- Mirroring the urban core rebound, Gateway markets largely saw the largest turnaround in population growth with New York, San Francisco, King County (Seattle) and Miami representing the biggest change in population growth from 2021 to 2022. New York and San Francisco still saw net population losses, but they were much limited than 2021.

- The Dallas–Fort Worth metroplex grew by roughly 170,000 residents, dwarfing No. 2 Houston by nearly 50,000 people. On the other hand, the New York metro division saw its population shrink by about 139,000. Since the 2020 Census, Austin, TX and Raleigh, NC rank as the two fastest growing metros on a percentage basis among major markets.

Related Stories

Industry Research | Feb 13, 2017

How thought leadership marketing can generate referrals for your firm

The most effective way to boost your reputation is through thought leadership marketing.

Market Data | Feb 1, 2017

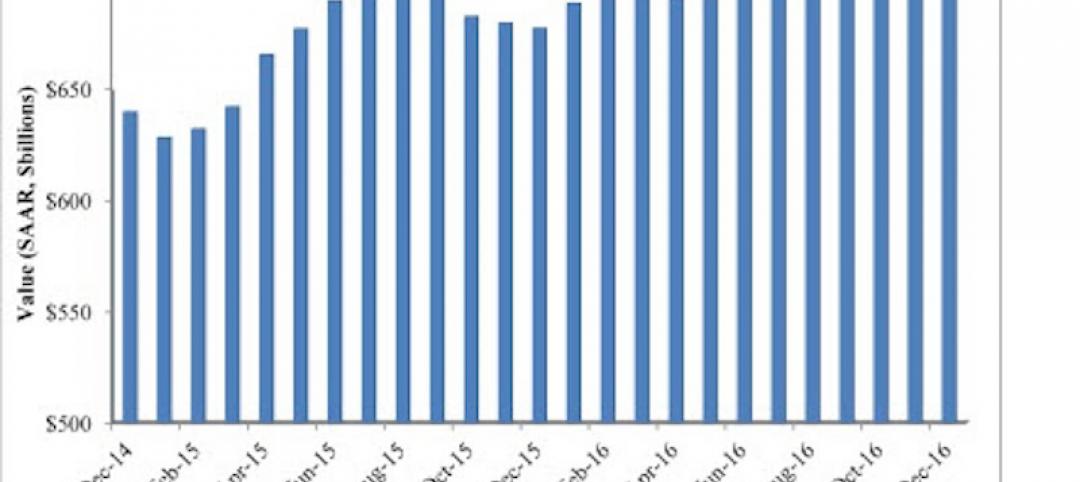

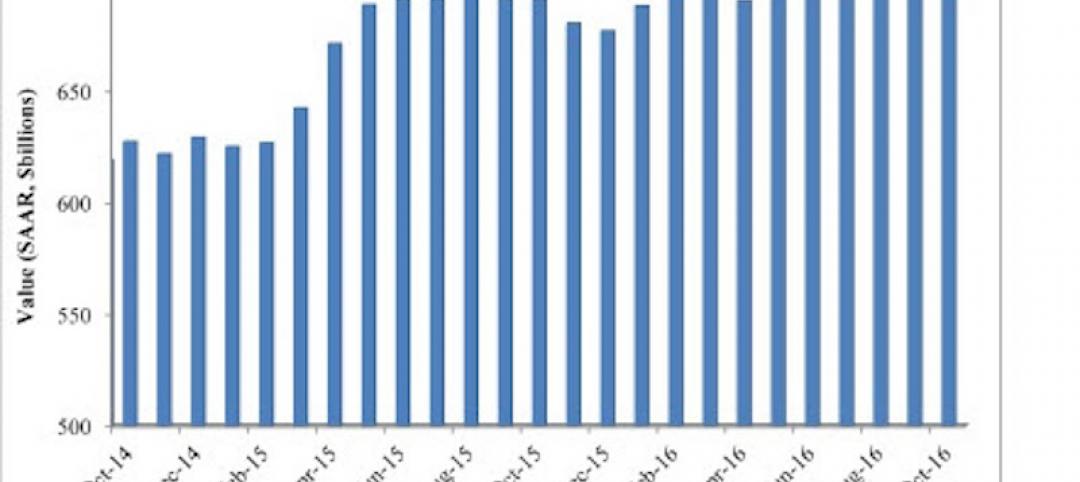

Nonresidential spending falters slightly to end 2016

Nonresidential spending decreased from $713.1 billion in November to $708.2 billion in December.

High-rise Construction | Jan 23, 2017

Growth spurt: A record-breaking 128 buildings of 200 meters or taller were completed in 2016

This marks the third consecutive record-breaking year for building completions over 200 meters.

Market Data | Jan 18, 2017

Fraud and risk incidents on the rise for construction, engineering, and infrastructure businesses

Seven of the 10 executives in the sector surveyed in the report said their company fell victim to fraud in the past year.

Market Data | Jan 18, 2017

Architecture Billings Index ends year on positive note

Architecture firms close 2016 with the strongest performance of the year.

Industry Research | Jan 12, 2017

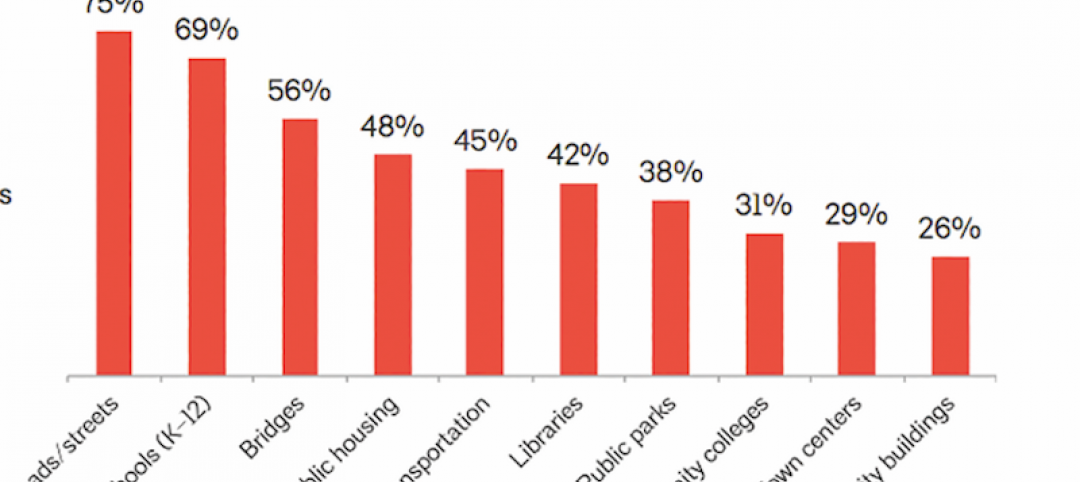

Are public buildings considered infrastructure?

A survey, conducted in October by The Harris Poll on behalf of AIA, asked 2,108 U.S. adults if they considered public buildings part of their community’s infrastructure.

Market Data | Jan 9, 2017

Trump market impact prompts surge in optimism for U.S. engineering firm leaders

The boost in firm leader optimism extends across almost the entire engineering marketplace.

Market Data | Jan 5, 2017

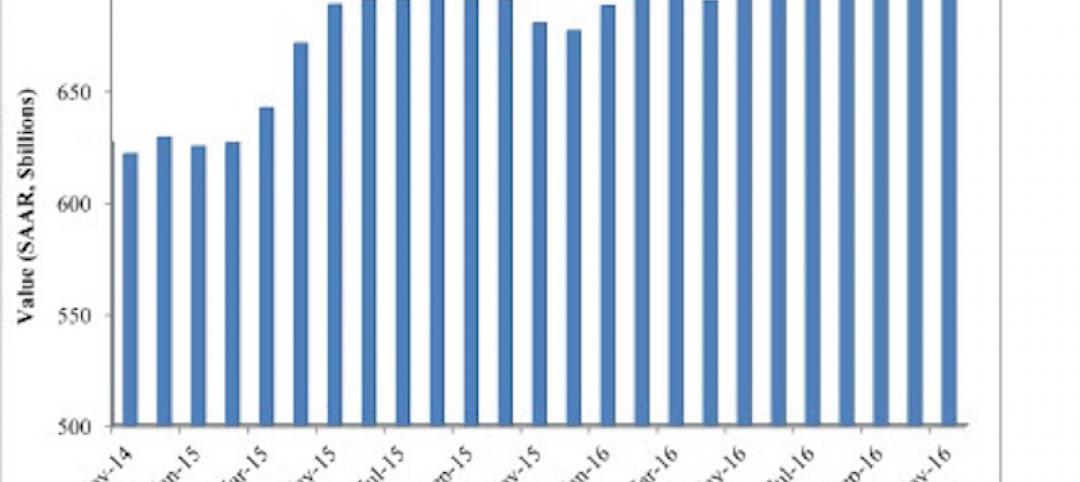

Nonresidential spending thrives in strong November spending report

Many construction firms have reported that they remain busy but have become concerned that work could dry up in certain markets in 2017 or 2018, says Anirban Basu, ABC Chief Economist.

Market Data | Dec 13, 2016

ABC predicts modest growth for 2017 nonresidential construction sector; warns of vulnerability for contractor

“The U.S. economy continues to expand amid a weak global economy and, despite risks to the construction industry, nonresidential spending should expand 3.5 percent in 2017,” says ABC Chief Economist Anirban Basu.

Market Data | Dec 2, 2016

Nonresidential construction spending gains momentum

Nonresidential spending is now 2.6 percent higher than at the same time one year ago.