Buildings have become data-rich environments, thanks to the proliferation of lower-cost sensing devices with greater computational power and data storage capacity.

As buildings get “smarter,” property owners and managers are looking for ways to organize data sets that derive from myriad formats, naming conventions, and syntaxes within buildings. Consequently, the global market for data integration technologies for buildings is expanding rapidly.

A new report by Navigant Research, “Data Integration for Intelligent Buildings,” estimates that revenue from the sale of these technologies will increase to $971.3 million in 2025, from $89.9 million in 2016.

Data integration still poses challenges, particularly in the area of analysis. The report points specifically to energy management systems in buildings that would be far more efficient if their data could be incorporated with data emanating from a building’s lighting systems, access controls, and demand response systems.

“For years, data-integrated buildings have shown promise in reducing energy and operational costs, especially as regulatory energy efficiency pressures and corporate sustainability strategies increase customer demand for data-driven solutions,” says Alvin Chen, Navigant’s research analyst. “The analytics software to effectively provide actionable insights is still being developed to deliver on this promise.”

The new report focuses on market demand in three areas: software, services, and hardware. It provides insights into the future of fully integrated energy management systems. And it provides forecasts for global market demand segmented by region (North America, Europe, Asia Pacific, and the rest of the world), offering type, and customer type (office, retail, education, healthcare, hotels and restaurants, institutional and assembly, warehouse, and transport), through 2025.

Some key questions the report addresses include:

• What are the challenges to developing expert systems for building integration?

• Which companies are pushing this market forward, and why?

• Which regions show the strongest investments for fully integrated energy management systems?

• How will the interoperability of these systems be further developed?

• Which customer types are likely to adopt data integration technologies the quickest?

The 44-page report identifies and takes a closer look at the marketing strategies of key industry players that include the usual suspects like Cisco Systems, Honeywell and Tridium, Johnson Controls, Intel, and Schneider Electric, along with other suppliers such as Candi Controls, SkyFoundry, Lucid, and Siemens Building Technologies.

Related Stories

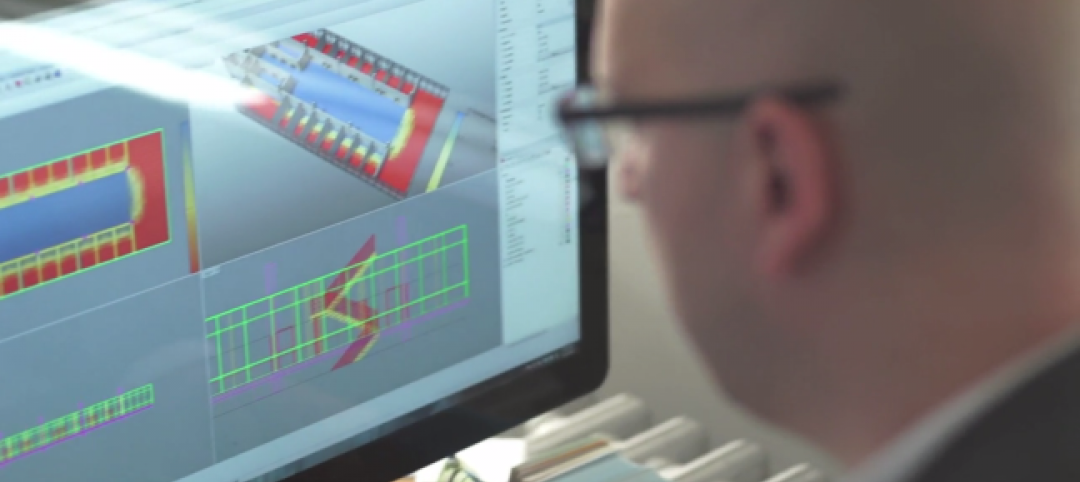

Big Data | Aug 23, 2018

Data driven design: The benefits of building energy modeling

As technology advances, Building Energy Modeling (BEM) is becoming an even more powerful tool for making informed design decisions. This is the first post in our series examining the benefits of BEM in balancing occupant comfort and design features with energy efficiency.

BIM and Information Technology | Jul 2, 2018

Data, Dynamo, and design iteration

We’re well into the digital era of architecture which favors processes that have a better innovation cycle.

Accelerate Live! | Jun 24, 2018

Watch all 19 Accelerate Live! talks on demand

BD+C’s second annual Accelerate Live! AEC innovation conference (May 10, 2018, Chicago) featured talks on AI for construction scheduling, regenerative design, the micro-buildings movement, post-occupancy evaluation, predictive visual data analytics, digital fabrication, and more. Take in all 19 talks on demand.

Market Data | Jun 18, 2018

AI is the path to maximum profitability for retail and FMCG firms

Leading retailers including Amazon, Alibaba, Lowe’s and Tesco are developing their own AI solutions for automation, analytics and robotics use cases.

| Jun 11, 2018

Accelerate Live! talk: ‘AEC can has Blockchains?’

In this 15-minute talk at BD+C’s Accelerate Live! conference (May 10, 2018, Chicago), HOK’s Greg Schleusner explores how the AEC industry could adapt the best ideas from other industries (banking, manufacturing, tech) to modernize inefficient design and construction processes.

| May 30, 2018

Accelerate Live! talk: Seven technologies that restore glory to the master builder

In this 15-minute talk at BD+C’s Accelerate Live! conference (May 10, 2018, Chicago), AEC technophile Rohit Arora outlines emerging innovations that are poised to transform how we design and build structures in the near future.

Big Data | Jan 5, 2018

In the age of data-driven design, has POE’s time finally come?

At a time when research- and data-based methods are playing a larger role in architecture, there remains a surprisingly scant amount of post-occupancy research. But that’s starting to change.

Green | Dec 22, 2017

Green builders can use ‘big data’ to make design decisions

More and more, green project teams are relying on publicly available “external datasets” to prioritize sustainable design decisions, says sustainability consultant Adele Houghton.

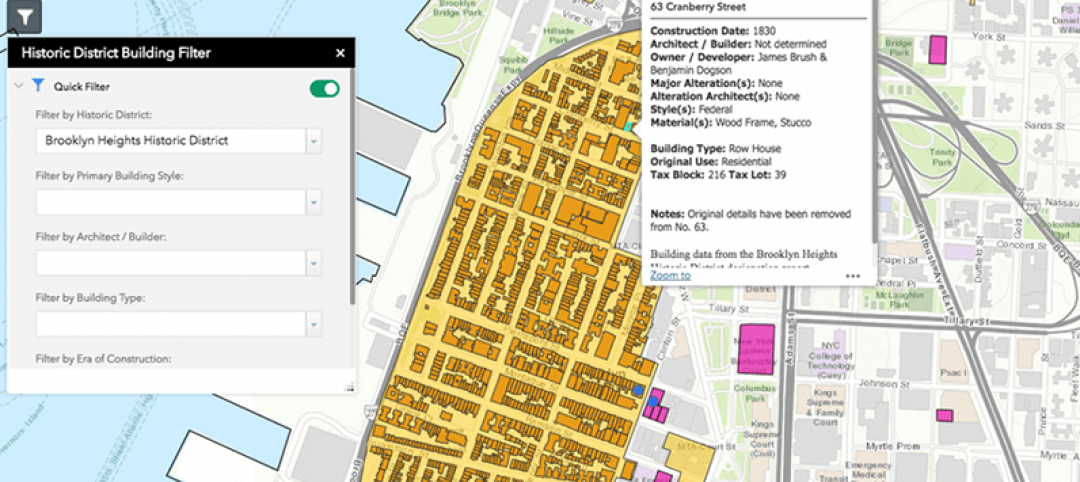

Reconstruction & Renovation | Dec 21, 2017

Interactive map includes detailed information on historic New York City buildings

The New York City Landmarks Preservation Commission launched a new, enhanced version of its interactive map, Discover NYC Landmarks.

AEC Tech | Oct 6, 2017

How professional bias can sabotage industry transformation

Professional bias can take the form of change-resistant thinking that can keep transformational or innovative ambitions at bay. Tech consultant Nate Miller presents three kinds of bias that often emerge when a professional is confronted with new technology.