The pandemic hit some building sectors, notably hospitality, extremely hard, while others—warehouses, cold storage, and life science facilities—have experienced an unexpected bump thanks to the pandemic.

Meanwhile, multifamily housing keeps rolling merrily along. The U.S. Census Bureau (“Construction Spending,” January 2021) estimated multifamily construction at $92.7 billion for 2021, up 16.9% year over year. That makes multifamily the second-largest commercial construction sector, after Education ($106.2 billion). As one multifamily developer put it (in response to our exclusive “Amenities Survey 2021”), “We have 1,250 units under construction and 2,000 on the boards.” What, me worry?

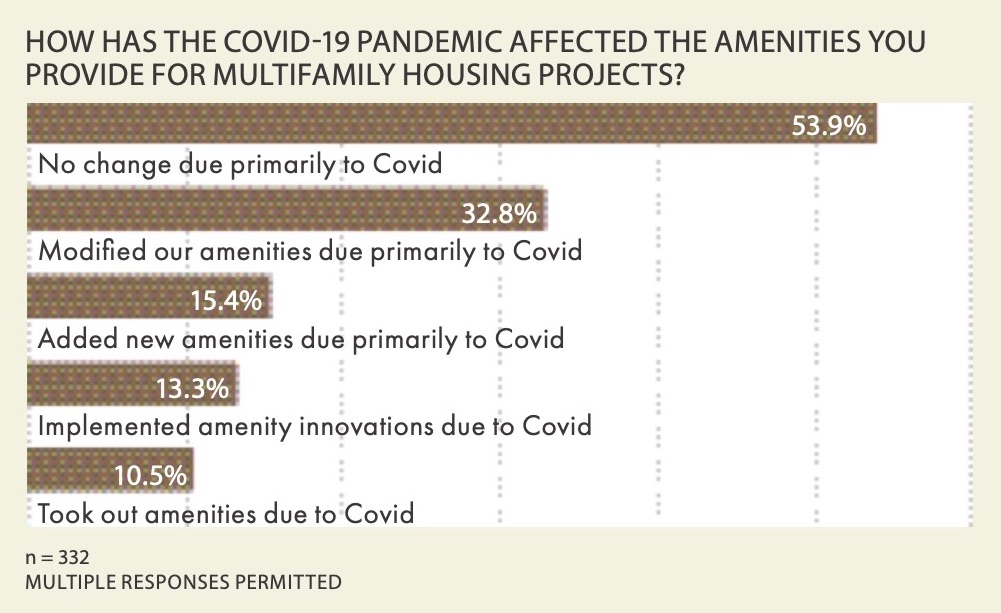

For our third Multifamily Amenities Survey, we asked multifamily developers, architects, contractors, and others in the sector how the pandemic had affected the amenities they provided for their rental, condominium, senior living, and student housing communities. Free download: Multifamily Amenities 2021 report

The majority of respondents to our “Amenities Survey 2021” said they had not changed their amenities due primarily to the pandemic, but others said they had modified, added, or removed amenities or introduced amenity innovations.

The majority of respondents to our “Amenities Survey 2021” said they had not changed their amenities due primarily to the pandemic, but others said they had modified, added, or removed amenities or introduced amenity innovations.

COVID’S EFFECT ON MULTIFAMILY AMENITIES: NOT SO MUCH

Perhaps the most surprising finding was that most respondents (53.9%) said they had made no changes to their amenities due to Covid. “We have not cut back the usual high-quality amenities,” said one respondent. Said another, “Our projects are anticipated to be completed in the future and clients believe Covid will be behind us.”

Others were too far down the construction path to make changes. “No change,” said Christopher L. Gartner, PE, CEO of Texas project management firm Gartner & Associates, “we’re thinking life goes back to a more normal condition soon.”

R. Vickie Alani, AIA, Principal at Boston-based CBT, has developed floor plans to create workspaces by adding a little footage to studio and one-bedroom apartments. Here, a 427-sf studio is lengthened six inches and widened two feet three inches, resulting in a 474-sf unit with a workspace. See: https://bit.ly/3h1dpao for more CBT floor plans.

R. Vickie Alani, AIA, Principal at Boston-based CBT, has developed floor plans to create workspaces by adding a little footage to studio and one-bedroom apartments. Here, a 427-sf studio is lengthened six inches and widened two feet three inches, resulting in a 474-sf unit with a workspace. See: https://bit.ly/3h1dpao for more CBT floor plans.

MAKING ‘MODIFICATIONS’ TO MULTIFAMILY AMENITIES

Some respondents (10.5%) said they had eliminated or mothballed amenities in light of CDC guidelines and state/local mandates. “We had to remove the free coffee bar,” said Cameron Anderson, Vice President of Construction, Westchase Construction Ltd., Houston.

Other responses: “Exercise rooms were closed, then reopened with limited access.” “Some of our retail closed entirely.” One respondent simply removed some furniture in common areas. Many respondents said they closed recreation amenities like dog parks, children’s playgrounds, volleyball courts, and game rooms, at least until their local social distancing guidelines loosened up.

At Hickory Hills East, Great Mills, Md., Raleigh Apt. Management removed all pool furniture, “but we allowed residents to bring their own chairs,” said a respondent. But “residents were very angry” when operators had to close fitness centers and swimming pools, said another respondent.

The second-largest group of respondents, nearly one-third (32.8%), said they had made efforts to “modify” amenities due to Covid, often through simple means: “Made dining areas larger so tables/chairs could be farther apart.” One reported benefiting from the pandemic: “Our workload has increased due to Covid. Clients are coming back to us to design Covid retrofits of existing buildings.”

WFH—’MORE SPACE, PLEASE’

Multifamily project teams had to scramble to accommodate the overwhelming demand for work-from-home spaces for adults and study spaces for children. Neil Liebman, AIA, LEED AP, Managing Principal, said his firm, Bernardon, had “allocated space for a desk in all units, either in the bedroom or living spaces.” Jeff Mulcrone, AIA, Associate | Design Director in the Chicago office of BSB Design, said his firm is looking at adding 35-50 sf per unit to create WFH nooks.

At Market Central, Boston, architecture firm CBT specified plexiglass separators to be placed between pieces of fitness equipment in response to Covid conditions. The plexiglass units were set on pads so that they could be moved easily. Twining Properties was the developer. Photo: @Flauntboston

At Market Central, Boston, architecture firm CBT specified plexiglass separators to be placed between pieces of fitness equipment in response to Covid conditions. The plexiglass units were set on pads so that they could be moved easily. Twining Properties was the developer. Photo: @Flauntboston

In addition to “larger units,” other WFH actions respondents had taken or were considering included:

• “In-unit work nooks”

• “Isolation suites”

• “Private phone booths” in business centers

• Greater emphasis on sound transmission between units

• “Need for solid Internet speed and bandwidth”

• “Varied environments,” based on cues from coworking spaces

Coworking spaces were a hot topic among respondents, one of whom stated, “In one project, we converted an entire floor to coworking space.”

PACKAGE CENTERS—THE FOOD/CARDBOARD EXPLOSION

The pandemic tested the limits of multifamily package centers, not only the “overwhelming volume and frequent theft” cited by one respondent, but also the immense piles of cardboard waste from all those delivery boxes. Respondents also reported adding grocery lockers and cold storage units to their package centers to handle the flood of bulk food and meal deliveries.

BREATHE DEEP: HEALTH AND WELLNESS WORRIES

Many respondents heeded the call for more stringent health and wellness measures to counter the virus. “Touchless controls/access,” “touchless doors and elevators,” “sensor-driven technology” were all cited. As one of them said, “We’re rethinking and reimagining our amenities packages to be safer, healthier.”

Among the health/wellness options cited by respondents:

• Antibacterial countertop surfaces

• Ultraviolet lamps to destroy microbes

• Touchless faucets in kitchens and bathrooms

• Hand-sanitizing stations in common areas

• Sliding doors at the entry to the leasing office

• Easily cleanable furniture

Stephanie Kirkpatrick, IIDA, ASID, LEED AP, Principal, Director of Interior Design, Niles Bolton Associates, told Horizon TV’s “The Weekly” (https://bit.ly/3vFIEf2) that “there may even be a movement to vinyl” due to that material’s cleanability.

One developer of affordable rentals closed all their common laundry facilities and installed washer/dryer combos in individual apartments as a health and wellness measure. “We have also considered one bath per bedroom to help with the quarantine,” said this responder.

VE Design Group and Blair Kweskin Design, the interior designers on Hue, St. Louis, incorporated private offices into the business center. Covid-related “isolation pods” like this were mentioned by several Amenities Survey 2021 respondents. Green Street St. Louis was the developer on the 111-apartment complex. Photo: Square One - www.squareonepros.com

VE Design Group and Blair Kweskin Design, the interior designers on Hue, St. Louis, incorporated private offices into the business center. Covid-related “isolation pods” like this were mentioned by several Amenities Survey 2021 respondents. Green Street St. Louis was the developer on the 111-apartment complex. Photo: Square One - www.squareonepros.com

Healthier indoor air quality was a big item for respondents, who cited “HVAC upgrades,” “improved HVAC systems/filtration,” and “larger air purification systems.” One respondent was adding “commissioning of HVAC services” for existing projects. Another noted: “Installing air-purification systems at retrofit, in amenity spaces and elevators.” One predicted, “We will be adding air-purification systems to our amenity areas in future developments.”

GREATER ACCESS TO THE GREAT OUTDOORS

Access to nature and the outdoors captured the imagination of respondents. One pledged to “add more outdoor amenities to allow for social distancing.” Another said, “We’ve been asked to double/triple exterior areas” in upcoming projects. One respondent’s strategy was to “disperse amenities throughout the project rather than in one mega-amenity.” Yet another cited “proximity to parks” as a factor in future project location decisions.

Balconies gained attention as a means to reduce stress and the sense of isolation brought on by the pandemic. One respondent was able to capitalize on this in a project that was still in Design Development: “We added exterior balconies to every apartment.”

‘COVID EFFECT’: HOW LONG WILL IT LAST?

The long-term effect of the pandemic on multifamily amenities is hard to calculate. Can developers really afford larger unit sizes to squeeze in work-from-home nooks? Will multifamily design teams “incorporate better distancing into future projects,” as another suggested? Or will the multifamily sector revert to business as usual as soon as face masks are no longer mandatory?

Still, the long-term psychological impact of the worldwide pandemic cannot be underestimated. Even as many multifamily teams strive to create more of a sense of “community” in their projects, the pandemic “has taken the personality and companionship and human interaction out of play,” according to one respondent.

Will the multifamily sector—and society at large—find the means to overcome that malaise?

Related Stories

Sustainability | Nov 20, 2023

8 strategies for multifamily passive house design projects

Stantec's Brett Lambert, Principal of Architecture and Passive House Certified Consultant, uses the Northland Newton Development project to guide designers with eight tips for designing multifamily passive house projects.

MFPRO+ News | Nov 15, 2023

Average U.S multifamily rents drop $3 to $1,718 in October 2023: Yardi Matrix

Multifamily fundamentals continued to soften and impact rents last month, according to the latest Yardi Matrix National Multifamily Report. The average U.S. asking rent dropped $3 to $1,718 in October, with year-over-year growth moderating to 0.4%, down 40 basis points from September. Occupancy slid to 94.9%, marking the first decline in four months.

Industrial Facilities | Nov 14, 2023

Some AEC firms are plugging into EV charging market

Decentralized electrical distribution is broadening recharger installation to several building types.

MFPRO+ Special Reports | Nov 14, 2023

Register today! Key trends in the multifamily housing market for 2024 - BD+C Live Webinar

Join the BD+C and Multifamily Pro+ editorial team for this live webinar on key trends and innovations in the $110 billion U.S. multifamily housing market. A trio of multifamily design and construction experts will present their latest projects, trends, innovations, and data/research on the three primary multifamily sub-sectors: rental housing, senior living, and student housing.

Multifamily Housing | Nov 9, 2023

Multifamily project completions forecast to slow starting 2026

Yardi Matrix has released its Q4 2023 Multifamily Supply Forecast, emphasizing a short-term spike and plateau of new construction.

MFPRO+ News | Nov 1, 2023

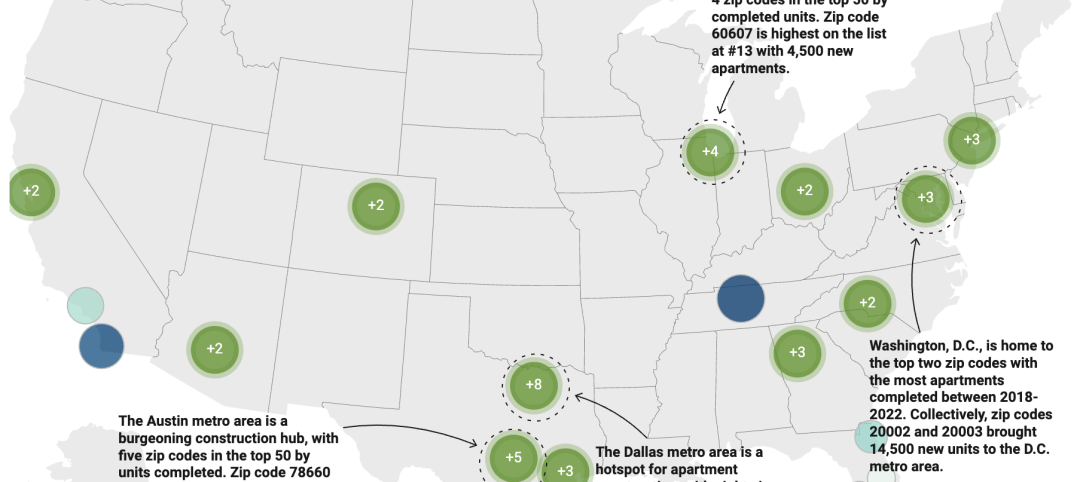

Washington, D.C., Queens, N.Y., lead nation in number of new apartments by zip code

A study of new apartment construction by zip code showed Washington D.C., and the Queens borough of New York City are the hottest multifamily markets since 2018, according to RentCafe.

Adaptive Reuse | Nov 1, 2023

Biden Administration reveals plan to spur more office-to-residential conversions

The Biden Administration recently announced plans to encourage more office buildings to be converted to residential use. The plan includes using federal money to lend to developers for conversion projects and selling government property that is suitable for conversions.

Sponsored | MFPRO+ Course | Oct 30, 2023

For the Multifamily Sector, Product Innovations Boost Design and Construction Success

This course covers emerging trends in exterior design and products/systems selection in the low- and mid-rise market-rate and luxury multifamily rental market. Topics include facade design, cladding material trends, fenestration trends/innovations, indoor/outdoor connection, and rooftop spaces.

MFPRO+ Special Reports | Oct 27, 2023

Download the 2023 Multifamily Annual Report

Welcome to Building Design+Construction and Multifamily Pro+’s first Multifamily Annual Report. This 76-page special report is our first-ever “state of the state” update on the $110 billion multifamily housing construction sector.