December 3, 2017 - The American Institute of Architects (AIA) will lobby aggressively in coming days against significant inequities in both the House and Senate versions of the Tax Cuts and Jobs Act, just as the legislation heads into conference.

The House legislation abolishes the Historic Tax Credit (HTC), vital to the revitalization of America’s city centers and widely hailed as an economic engine since the Reagan Administration put them into place more than three decades ago. The Senate bill eliminates the current 10 percent credit for pre-1936 structures, and significantly dilutes the current 20 percent credit for certified historic structures by spreading it over a five-year period.

The Senate's tax reform bill allows small businesses that are organized as “pass through” companies (i.e. partnerships, sole proprietorships and S-Corporations) to reduce income through a 23 percent deduction. But, like the House-passed bill, the Senate bill totally excludes certain professional services companies - including all but the smallest architecture firms - from tax relief.

AIA 2017 President Thomas Vonier, FAIA, says:

"By weakening the Historic Tax Credits, Congress and the Administration will hurt historic rehabilitation projects all across the country - something to which architects have been committed for decades. Since 1976, the HTCs have generated some $132 billion in private investment, involving nearly 43,000 projects. The Historic Tax Credit is fundamental to maintaining America's architectural heritage.

"Unfortunately, both bills for some reason continue to exclude architects and other small business service professions by name from lower tax rates. There's no public policy reason to do this. Design and construction firms do much more than provide a service; they produce a major component of the nation's gross domestic product and are a major catalyst for job growth.

"Our members across the country are already mobilized to make sure their Congressional delegations know these views. In the coming days, we will spare no effort to make sure members of the House-Senate conference committee know the views of the AIA's more than 90,000 members on the inequities in both pieces of legislation

"We say this again: tax reforms must achieve three basic goals to ensure the vitality of small business and the health, safety and welfare of our communities:

· Preserve tax policies that support and strengthen small businesses.

· Support innovative, economically vibrant, sustainable and resilient buildings and communities.

· Ensure fairness.

"So far, this legislation still falls well short of these goals. If passed, Congress would be making a terrible mistake."

Related Stories

| Oct 4, 2011

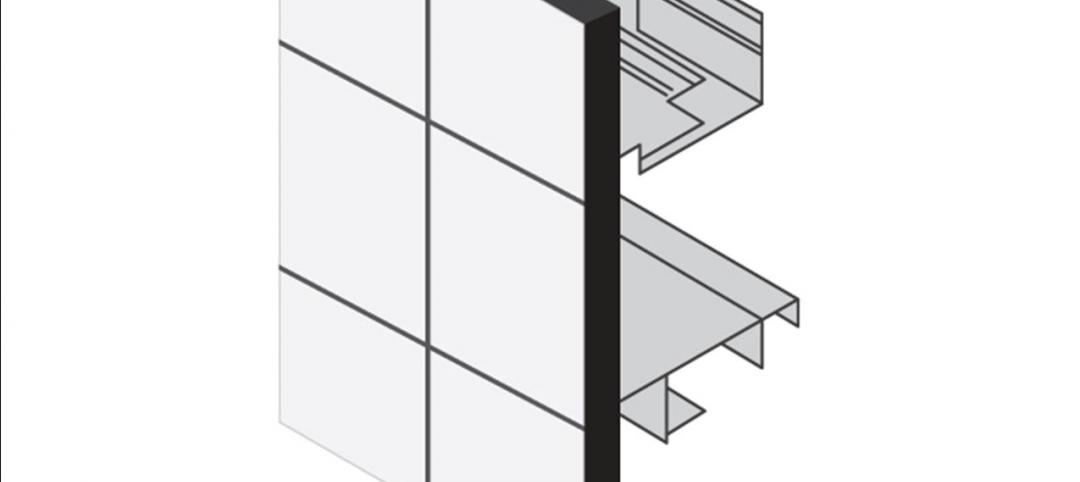

GREENBUILD 2011: Nearly seamless highly insulated glass curtain-wall system introduced

Low insulation value reflects value of entire curtain-wall system.

| Oct 4, 2011

GREENBUILD 2011: Ready-to-use wood primer unveiled

Maintains strong UV protection, clarity even with application of lighter, natural wood tones.

| Oct 4, 2011

GREENBUILD 2011: Two new recycled glass products announced

The two collections offer both larger and smaller particulates.

| Oct 4, 2011

GREENBUILD 2011: Mythic Paint launches two new paint products

A high performance paint, and a combination paint and primer now available.

| Oct 4, 2011

GREENBUILD 2011: Wall protection line now eligible to contribute to LEED Pilot Credit 43

The Cradle-to-Cradle Certified Wall Protection Line offers an additional option for customers to achieve LEED project certification.

| Oct 3, 2011

Magellan Development Group opens Village Market in Chicago’s Lakeshore East neighborhood

Magellan Development Group and Hanwha Engineering & Construction are joint-venture development partners on the project. The Village Market was designed for Silver LEED certification by Loewenberg Architects and built by McHugh Construction.

| Oct 3, 2011

Balance bunker and Phase III projects breaks ground at Mitsubishi Plant in Georgia

The facility, a modification of similar facilities used by Mitsubishi Heavy Industries, Inc. (MHI) in Japan, was designed by a joint design team of engineers and architects from The Austin Company of Cleveland, Ohio, MPSA and MHI.

| Oct 3, 2011

Cauceglia to lead Allsteel’s global accounts

Cauceglia is responsible for developing new global business strategies and expanding existing business within the Fortune 500 sector.

| Sep 30, 2011

BBS Architects & Engineers completes welcoming center at St. Charles Resurrection Cemetery

The new structure serves as the cemetery's focal architectural point and center of operations.

| Sep 30, 2011

Kilbourn joins Perkins Eastman

Kilbourn joins with more than 28 years of design and planning experience for communities, buildings, and interiors in hospitality, retail/mixed-use, corporate office, and healthcare.