December 3, 2017 - The American Institute of Architects (AIA) will lobby aggressively in coming days against significant inequities in both the House and Senate versions of the Tax Cuts and Jobs Act, just as the legislation heads into conference.

The House legislation abolishes the Historic Tax Credit (HTC), vital to the revitalization of America’s city centers and widely hailed as an economic engine since the Reagan Administration put them into place more than three decades ago. The Senate bill eliminates the current 10 percent credit for pre-1936 structures, and significantly dilutes the current 20 percent credit for certified historic structures by spreading it over a five-year period.

The Senate's tax reform bill allows small businesses that are organized as “pass through” companies (i.e. partnerships, sole proprietorships and S-Corporations) to reduce income through a 23 percent deduction. But, like the House-passed bill, the Senate bill totally excludes certain professional services companies - including all but the smallest architecture firms - from tax relief.

AIA 2017 President Thomas Vonier, FAIA, says:

"By weakening the Historic Tax Credits, Congress and the Administration will hurt historic rehabilitation projects all across the country - something to which architects have been committed for decades. Since 1976, the HTCs have generated some $132 billion in private investment, involving nearly 43,000 projects. The Historic Tax Credit is fundamental to maintaining America's architectural heritage.

"Unfortunately, both bills for some reason continue to exclude architects and other small business service professions by name from lower tax rates. There's no public policy reason to do this. Design and construction firms do much more than provide a service; they produce a major component of the nation's gross domestic product and are a major catalyst for job growth.

"Our members across the country are already mobilized to make sure their Congressional delegations know these views. In the coming days, we will spare no effort to make sure members of the House-Senate conference committee know the views of the AIA's more than 90,000 members on the inequities in both pieces of legislation

"We say this again: tax reforms must achieve three basic goals to ensure the vitality of small business and the health, safety and welfare of our communities:

· Preserve tax policies that support and strengthen small businesses.

· Support innovative, economically vibrant, sustainable and resilient buildings and communities.

· Ensure fairness.

"So far, this legislation still falls well short of these goals. If passed, Congress would be making a terrible mistake."

Related Stories

| Oct 17, 2011

Austin's newest urban apartment complex under construction

Complex sits on a four-acre waterfront site along Lady Bird Lake with spectacular city and lake views, and is slated to open spring 2013.

| Oct 17, 2011

Aerialogics announces technology partnership with CertainTeed Corp.

CertainTeed to provide Aerialogics’ Aerial Measurement Services to its credentialed contractor base and utilize the technology in its Roofing Products Division.

| Oct 17, 2011

Big D Floor covering supplies to offer Johnsonite Products??

Strategic partnership expands offering to south and west coast customers.

| Oct 17, 2011

Clery Act report reveals community colleges lacking integrated mass notification systems

“Detailed Analysis of U.S. College and University Annual Clery Act Reports” study now available.

| Oct 17, 2011

USGBC L.A. Chapter's Green Gala to feature Jason McLennan as keynote speaker

Chapter to presents inaugural Sustainable Innovation Awards,

| Oct 17, 2011

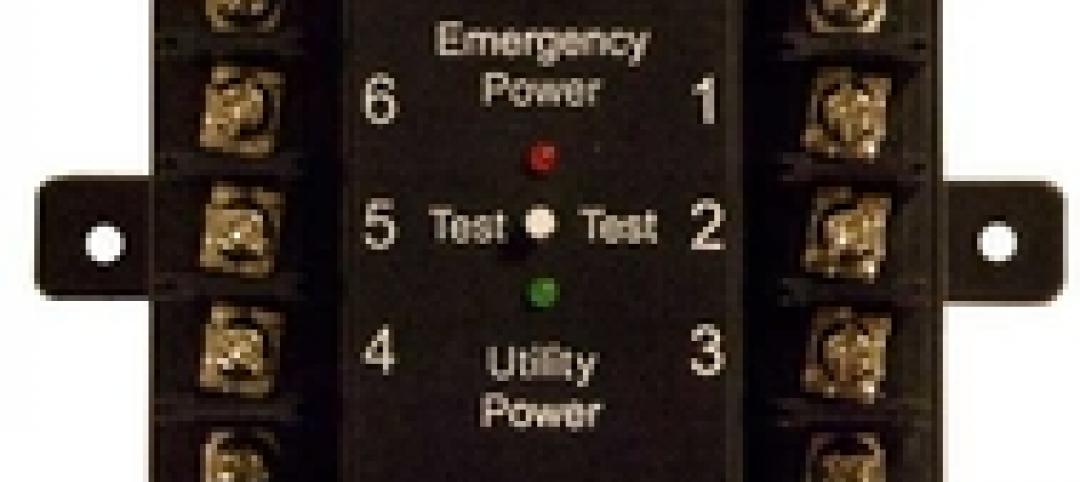

Schneider Electric introduces UL924 emergency lighting control devices

The emergency lighting control devices require fewer maintenance costs and testing requirements than backup batteries because they comply with the UL924 standard, reducing installation time.

| Oct 14, 2011

AISC develops new interoperability strategy to move construction industry forward

AISC is working to bring that vision to reality by developing a three-step interoperability strategy to evaluate data exchanges and integrate structural steel information into buildingSMART's Industry Foundation Classes.

| Oct 14, 2011

University of New Mexico Science & Math Learning Center attains LEED for Schools Gold

Van H. Gilbert architects enhances sustainability credentials.

| Oct 14, 2011

BD+C Survey on Building Information Modeling: The Good, the Bad, and the Solutions

In a recent survey conducted by Building Design+Construction, more than 75% of respondents indicated they currently use BIM or plan to use it. Respondents were also asked to comment on their experiences with BIM, what they liked and disliked about BIM, and what BIM-related advice they would give to their peers.

| Oct 14, 2011

ACI partners with CRSI to launch new adhesive anchor certification program

Adhesive anchor installer certification required in new ACI 318-11.