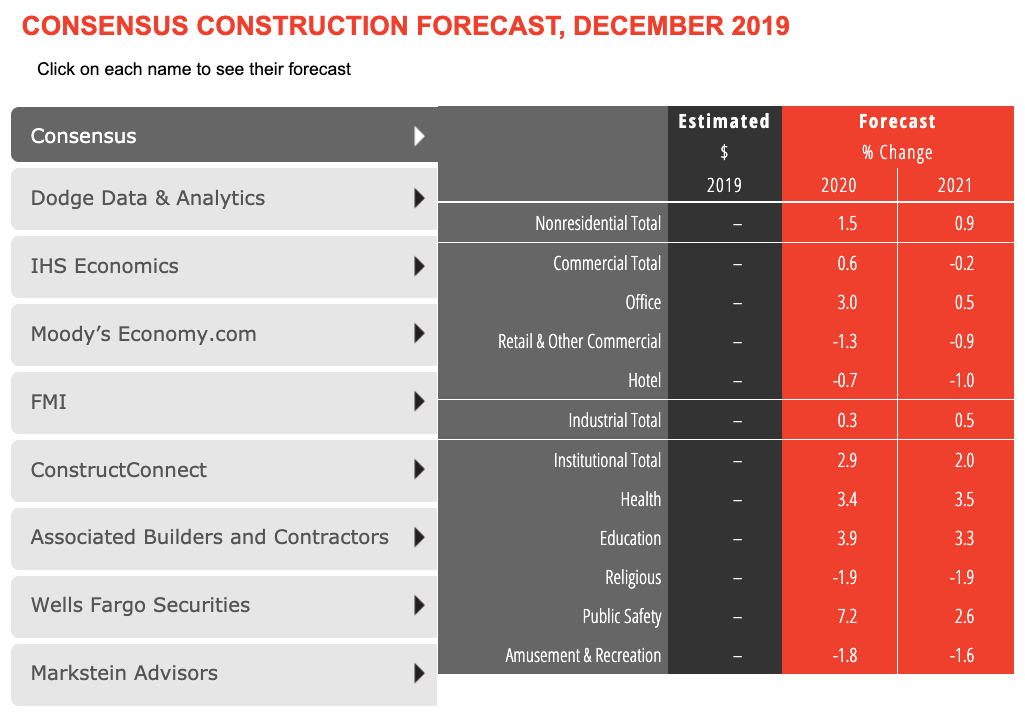

Following modest increases in construction spending for nonresidential buildings in 2019, economists from eight leading industry organizations forecast slight growth in 2020 and 2021—1.5% and 0.9%, according to AIA's latest Consensus Construction Forecast panel.

Public safety, education, healthcare, and office are the bright spots in a market that is entering growth-slowdown mode. However, no downturn is projected by the economists.

The public safety sector is expected to grow 7.2% in 2020, followed by education (3.9%), healthcare (3.4%), and office (3.0%). Four sectors—hotels, religious facilities, amusement/recreation, and retail—will take a step back in construction spending in 2020, according to the report.

More from the AIA Consensus Construction Forecast:

Construction spending last year was surprisingly weak, but current estimates suggest the industry had a modest increase in 2019. Retail construction activity was expected to underperform in 2019 but did not see the double-digit percentage declines that were expected. The AIA’s Consensus Construction forecast panel expects similar conditions this year and next.

“The broader economy is expected to continue to see slower growth this year, but the number of potential trouble spots seems to be diminishing,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “Revenue trends at architecture firms saw an uptick in the fourth quarter last year, which suggests construction spending will continue to see growth in the coming quarters.”

Related Stories

Architects | Aug 21, 2017

AIA: Architectural salaries exceed gains in the broader economy

AIA’s latest compensation report finds average compensation for staff positions up 2.8% from early 2015.

Market Data | Aug 20, 2017

Some suburban office markets are holding their own against corporate exodus to cities

An analysis of mortgage-backed loans suggests that demand remains relatively steady.

Market Data | Aug 17, 2017

Marcum Commercial Construction Index reports second quarter spending increase in commercial and office construction

Spending in all 12 of the remaining nonresidential construction subsectors retreated on both an annualized and monthly basis.

Industry Research | Aug 11, 2017

NCARB releases latest data on architectural education, licensure, and diversity

On average, becoming an architect takes 12.5 years—from the time a student enrolls in school to the moment they receive a license.

Market Data | Aug 4, 2017

U.S. grand total construction starts growth projection revised slightly downward

ConstructConnect’s quarterly report shows courthouses and sports stadiums to end 2017 with a flourish.

Market Data | Aug 2, 2017

Nonresidential Construction Spending falls in June, driven by public sector

June’s weak construction spending report can be largely attributed to the public sector.

Market Data | Jul 31, 2017

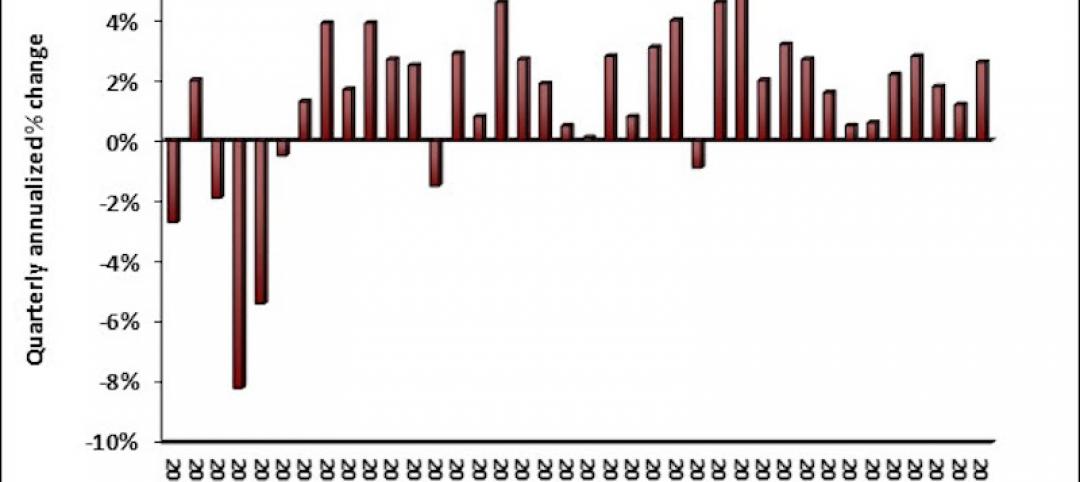

U.S. economic growth accelerates in second quarter; Nonresidential fixed investment maintains momentum

Nonresidential fixed investment, a category of GDP embodying nonresidential construction activity, expanded at a 5.2% seasonally adjusted annual rate.

Multifamily Housing | Jul 27, 2017

Apartment market index: Business conditions soften, but still solid

Despite some softness at the high end of the apartment market, demand for apartments will continue to be substantial for years to come, according to the National Multifamily Housing Council.

Market Data | Jul 25, 2017

What's your employer value proposition?

Hiring and retaining talent is one of the top challenges faced by most professional services firms.

Market Data | Jul 25, 2017

Moderating economic growth triggers construction forecast downgrade for 2017 and 2018

Prospects for the construction industry have weakened with developments over the first half of the year.