Looking at trends and predictions from the beginning of 2013, many anticipated that it would be a transformational year as healthcare organizations evolved to confront the challenges of a changing marketplace. As the year draws to a close and we look to the future, despite the lack of clarity regarding many elements of healthcare reform, there are several core tenets that will likely continue to drive transition within our industry.

While each of these trends is widely acknowledged and publicized, their pervasive impact on healthcare real estate warrants further examination. Healthcare providers will be challenged to provide higher quality care to an expanded patient base at a significantly lower overall cost. To achieve these objectives and thrive in the marketplace of the future, many healthcare organizations will be required to transition and transform their portfolio of real estate assets, as well as the manner in which those assets are planned, financed, constructed and managed.

1. INSURANCE EXPANSION AND REFORM

Expanded Coverage for All?

Until very recently, prevailing expectations held that the Affordable Care Act would result in a net increase in the number of insured Americans by as many as 30 million individuals. However, the highly publicized shortcomings of government sponsored insurance enrollment portals, the relative lack of interest in enrollment among younger age cohorts and the increasing number of individuals receiving coverage cancellation notices in the past two months may actually result in a short term decrease in the total insured population.

Financial Incentives - Focus on Patient Outcomes

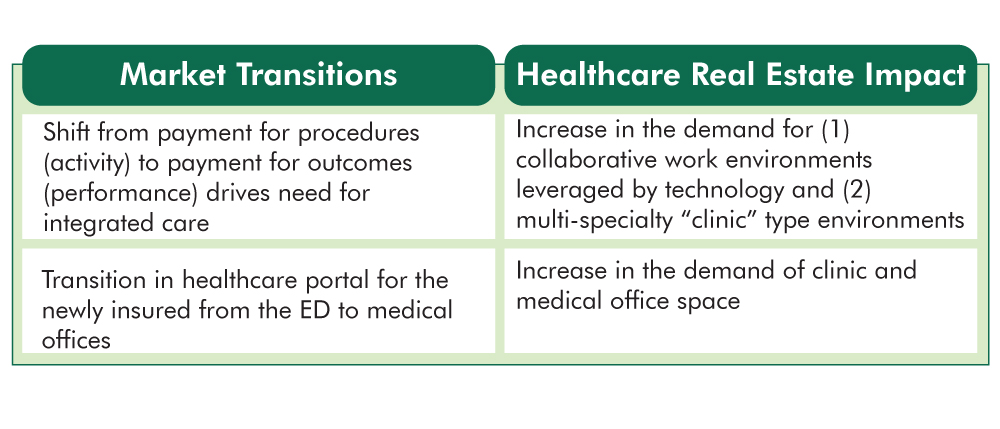

Providers have traditionally been compensated for episodes of care. There has been little financial incentive to coordinate care between physicians and many procedures are criticized as contributing little to patient outcomes. This reimbursement environment is commonly criticized as a primary driver in the escalation of healthcare expenditures in this nation.

A central objective of the Affordable Care Act is to transition to a Value Based Reimbursement environment in which “bundled payments” are made to coordinated teams of care providers and are based on patient outcomes rather than the number of procedures performed. There will be little to no reimbursement for patient readmissions. This seismic shift will mandate that high quality patient outcomes are achieved consistently in the most coordinated and efficient manner possible.

Responding to Insurance Expansion and Reform – The Role of Healthcare Real Estate: So, how does real estate enter the discussion regarding insurance and financial incentives? To achieve the objective of delivering best in class patient outcomes in a consistent manner at the lowest possible cost, providers will benefit significantly from standardizing best practices across their organizations. As “form follows function”, healthcare real estate portfolios must be comprised of replicable care environments. It is difficult to expect consistent patient outcomes unless the very environment in which that care is delivered is also consistent.

2. TRANSFORMING THE ORGANIZATIONAL MODEL OF CARE

Here Today....There Tomorrow

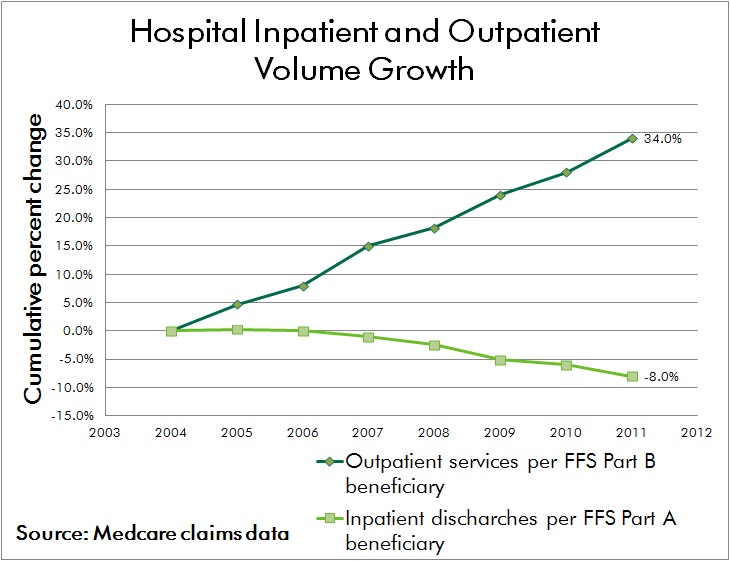

Advances in medical technology have driven a shift in procedural volume to the outpatient environment for decades. With the added imperative to provide care in the lowest cost responsible setting, this trend is expected to continue. Advances in technology will not only enable a continued shift from inpatient to outpatient procedures, but it’s highly likely that certain elements of care currently provided in outpatient and medical office environments can be achieved through remote monitoring and electronic communication while patients remain at home or work.

Organizing for Success

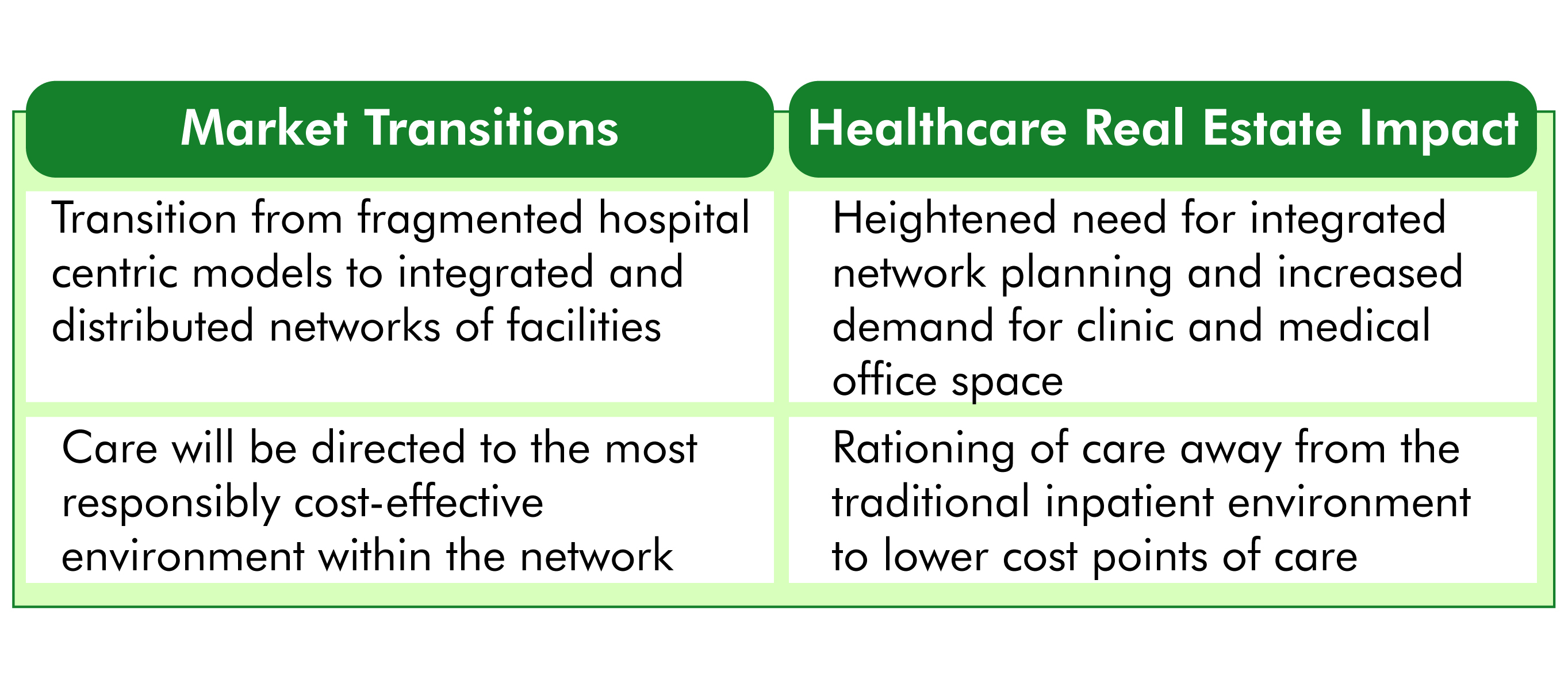

While the physical environment of care continues to shift, the organizational structure of healthcare providers must keep pace as well. The hospital centric model of the past has already given way to a hub and spoke network of care in most markets, where outpatient centers provide convenient and accessible care to patients and refer volumes to affiliated inpatient facilities.

The prevailing hub and spoke network will give way to a distributed model of care that is physically dispersed yet highly integrated. Electronic medical records and advances in medical information technology will allow seamless handoffs between care providers, many of whom will be geographically dispersed across the network. Primary care and internal medicine specialists will coordinate care regimens, a patient centric concept known as the “medical home.”

Responding to Organizational Transformation – The Role of Healthcare Real Estate: Reflecting the significant capital investment in acute care facilities and traditional medical office environments that currently resides on providers’ balance sheets, the transition of healthcare real estate portfolios to nimble, distributed networks of care will be a long term process. Given the lengthy cycle of major facility planning and development schedules, it's imperative that providers initiate coordinated market and facility planning efforts today in order to begin their journey of transformation.

3. MARGIN COMPRESSION

The Future Ain’t What it Used to Be

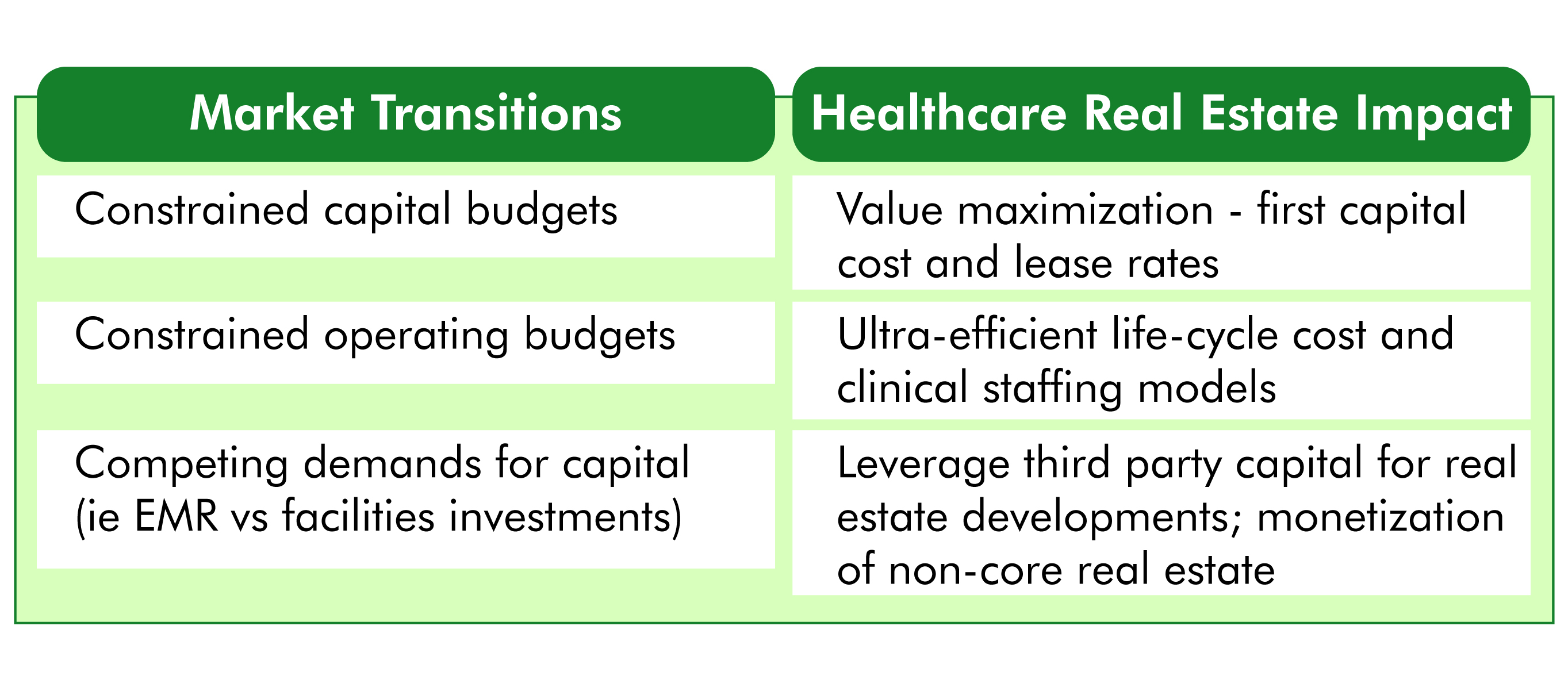

The seismic shifts in healthcare finance being driven by insurance reform threaten the long term viability of many healthcare providers who have traditionally operated near breakeven. According to Moody's Investors Service, nonprofit hospitals had a strong balance sheer in fiscal year 2012 but profitability metrics were down compared with FY 2011. For the first time since FY 2008, Moody's found that growth in expenses outpaced revenue growth in nonprofit hospitals and health systems. Even a modest shift in revenue outlook for these organizations may constitute the difference between operating in the black or confronting financial loss.

While a substantial portion of the nation’s hospitals and health systems are non-profit institutions, there is common recognition that erosion of financial performance will compromise the ability to provide philanthropic and charity care. “No margin – No mission.” Few expect brighter prospects for revenue; therefore, organizational survival will depend on the ability to decrease expenditures without compromising care.

Competing Demands for Scarce Capital

Despite concern regarding future operating margins, the demand for capital investment is greater than ever. Conversion to electronic medical records is an enormously expensive undertaking, often running into the hundreds of millions of dollars for large health systems. Mergers, acquisitions and affiliations among providers also demand organizational focus and capital.

Responding to Margin Compression – The Role of Healthcare Real Estate: Real estate assets often constitute the single greatest balance sheet asset for healthcare providers and real estate related expenses are typically exceeded only by the cost of labor on providers’ income statements. To meet the imperative of cost reduction, in the most general terms, healthcare real estate must be developed and operated in a more cost effective manner. Facility layouts also have an integral impact on the efficiency of patient care delivery processes; and therefore play a key role in reducing labor expense without compromising quality of care.

4. INDUSTRY CONSOLIDATION

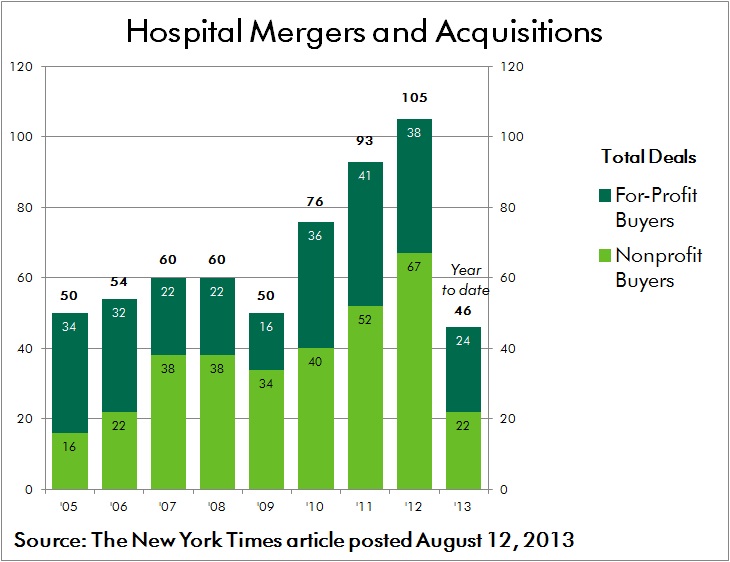

One of the most significant byproducts of insurance reform and financial pressures faced by healthcare providers has been an unprecedented wave of industry consolidation. Many independent hospitals and small health systems are not sufficiently capitalized to effectively reinvest and reinvent themselves. Similar challenges are faced by physicians operating in small group practices as they struggle to cover traditional costs such as malpractice insurance, as well as the added burden of conversion to electronic medical records.

Coupled with the prospect of “bundled payment” reimbursements, these forces are driving consolidation in order to allow providers to better coordinate care and to spread costly investments across a larger operating platform. According to an Irving Levin report, healthcare mergers and acquisitions activity during the third quarter this year soared 16 percent over the second quarter of 2013. There were 267 deals announced, which is 20 percent more than the third quarter last year. Many of these alliances break from the traditional mold, including the acquisition of physician practices by insurance providers.

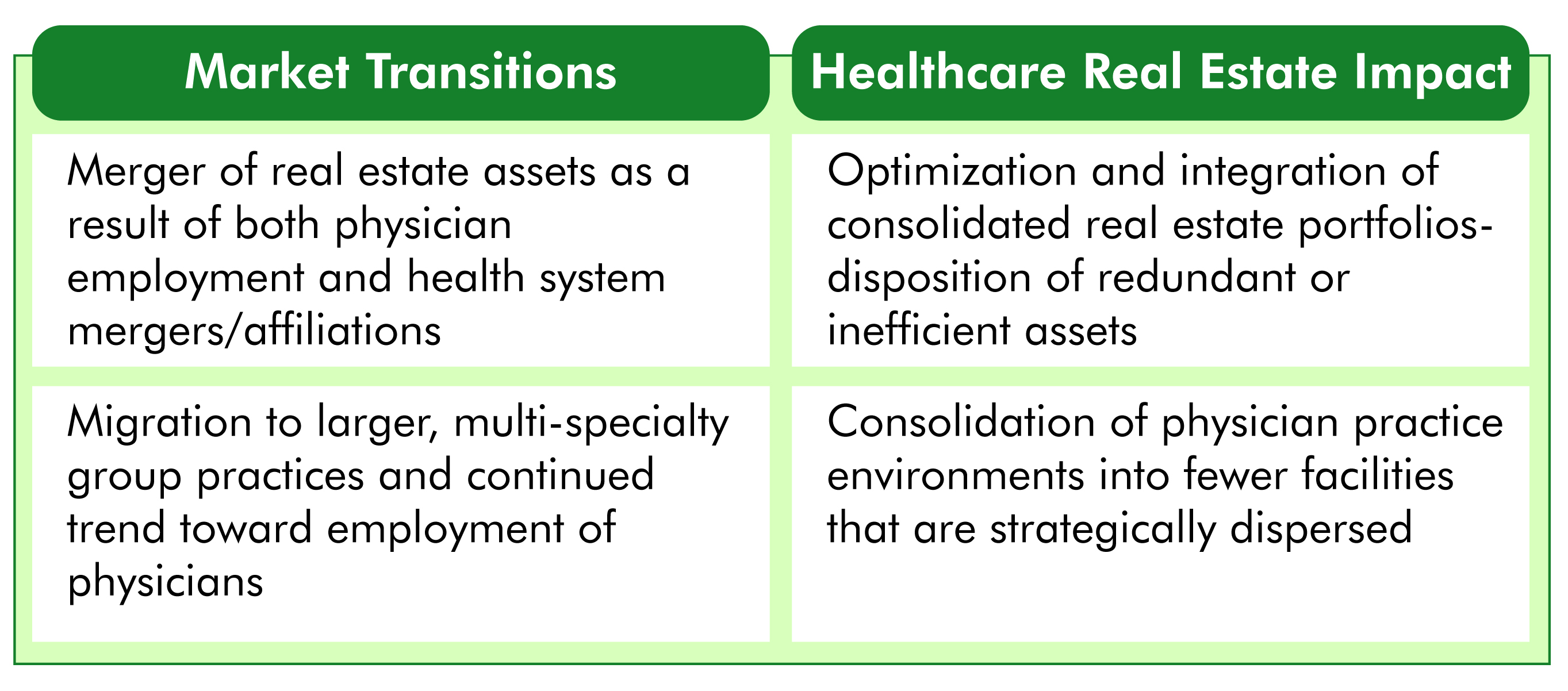

Responding to Consolidation – The Role of Healthcare Real Estate: As health systems, hospitals and physician groups merge and affiliate, the resulting portfolio of assets is often poorly positioned to serve the organization’s needs in an efficient manner. Fragmented networks of leased and owned facilities are located in close proximity to each other. Multiple systems and protocols are used to manage the development and operation of assets. Legacy policies and procedures are not synchronized.

To meet the challenges of coordinated care and cost reduction, a transition plan must be enacted through which optimal facility network distribution and co-location of care providers is achieved. In many cases this will result in the consolidation of redundant and inefficient facilities, while in other cases there will be a need to develop facilities in new markets in order to effectively achieve population health management goals. Migrating to a common, best in class platform for managing consolidated portfolios of facilities often requires investment in both training and new technology.

CONCLUSION

As the pace of transformative change within the industry accelerates, healthcare leaders must heed the call to act decisively in order to position their organizations for survival and success. Effective planning, development and operation of healthcare real estate assets will be a critical element in ensuring that best in class, patient centered care is delivered consistently and cost effectively. As margins are compressed and care is increasingly distributed across broader provider networks, the integration of strategic, financial and facility initiatives is more critical than ever.

Within every challenge lies opportunity. Best wishes to all in capitalizing on those opportunities in the year ahead.

Related Stories

Healthcare Facilities | Dec 19, 2023

A new hospital in Duluth, Minn., is now the region’s largest healthcare facility

In Duluth, Minn., the new St. Mary’s Medical Center, designed by EwingCole, is now the largest healthcare facility in the region. The hospital consolidates Essentia Health’s healthcare services under one roof. At about 1 million sf spanning two city blocks, St. Mary’s overlooks Lake Superior, providing views on almost every floor of the world’s largest freshwater lake.

Government Buildings | Dec 19, 2023

New Pennsylvania State Archives building holds documents dating back to 1680

Work was recently completed on a new Pennsylvania State Archives building in Harrisburg, Penn. The HGA-designed, 146,000-sf facility offers numerous amenities, including computers, scanners, printers, a kitchenette with seating, lockers, a meeting room, a classroom, an interactive video wall, gallery, and all-gender restrooms. The features are all intended to provide a welcoming and comfortable environment for visitors.

MFPRO+ News | Dec 18, 2023

Berkeley, Calif., raises building height limits in downtown area

Facing a severe housing shortage, the City of Berkeley, Calif., increased the height limits on residential buildings to 12 stories in the area close to the University of California campus.

Green | Dec 18, 2023

Class B commercial properties gain more from LEED certification than Class A buildings

Class B office properties that are LEED certified command a greater relative benefit than LEED-certified Class A buildings, according to analysis from CBRE. The Class B LEED rent advantage over non-LEED is about three times larger than the premium earned by Class A LEED buildings.

Codes and Standards | Dec 18, 2023

ASHRAE releases guide on grid interactivity in the decarbonization process

A guide focusing on the critical role of grid interactivity in building decarbonization was recently published by ASHRAE. The Grid-Interactive Buildings for Decarbonization: Design and Operation Resource Guide provides information on maximizing carbon reduction through buildings’ interaction with the electric power grid.

Architects | Dec 18, 2023

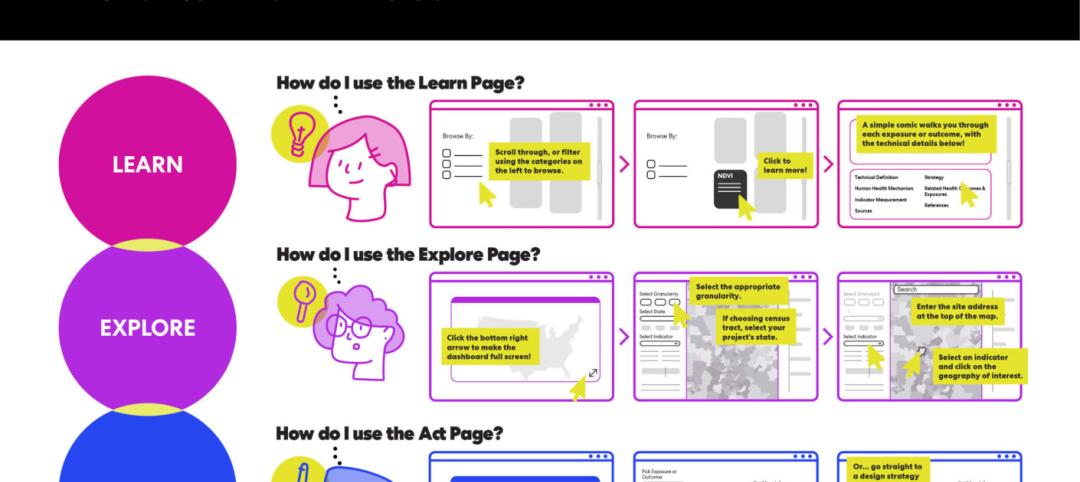

Perkins&Will’s new PRECEDE tool provides access to public health data to inform design decisions

Perkins&Will recently launched a free digital resource that allows architects and designers to access key public health data to inform design decisions. The “Public Repository to Engage Community and Enhance Design Equity,” or PRECEDE, centralizes demographic, environmental, and health data from across the U.S. into a geospatial database.

75 Top Building Products | Dec 13, 2023

75 top building products for 2023

From a bladeless rooftop wind energy system, to a troffer light fixture with built-in continuous visible light disinfection, innovation is plentiful in Building Design+Construction's annual 75 Top Products report.

Codes and Standards | Dec 11, 2023

Washington state tries new approach to phase out fossil fuels in new construction

After pausing a heat pump mandate earlier this year after a federal court overturned Berkeley, Calif.’s ban on gas appliances in new buildings, Washington state enacted a new code provision that seems poised to achieve the same goal.

Green | Dec 11, 2023

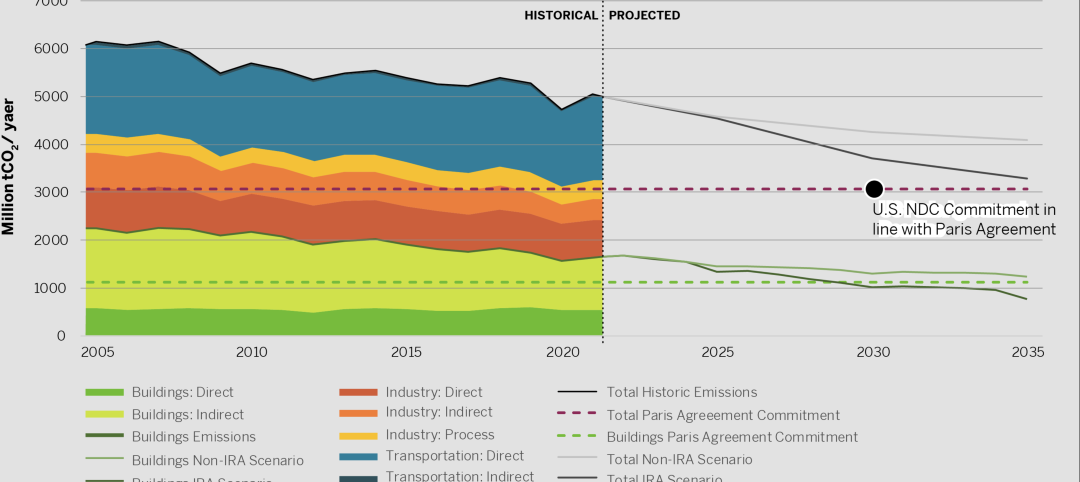

U.S. has tools to meet commercial building sector decarbonization goals early

The U.S. has the tools to reduce commercial building-related emissions to reach target goals in 2029, earlier than what it committed to when it signed the Paris Agreement, according to a report by the U.S. Green Building Council.

Office Buildings | Dec 11, 2023

Believe it or not, there could be a shortage of office space in the years ahead

With work-from-home firmly established, many real estate analysts predict a dramatic reduction in office space leasing and plummeting property values. But the high-end of the office segment might actually be headed for a shortage, according to real estate intelligence company CoStar Group.