In June, the Dwight D. Eisenhower National Airport in Wichita, Kan., opened a new 275,000-sf, 12-gate terminal. According to an airport press release, the new facility “expresses …Wichita’s globally prominent position in Aviation as the Air Capital of the World.” The $200 million-plus terminal (which includes a new consolidated rental car facility) can handle two million passengers annually. It was designed (by HTNB) to support future growth up to 2.4 million.

Passenger traffic at the airport (formerly known as Wichita Mid-Continent Airport) was about 1.5 million in 2014, up 6% from the previous year. As of mid-2015, it is running about even with last year, says Victor White, Wichita Airport Authority’s Director of Airports.

Regional airports like Eisenhower National—which offers flights to and from Atlanta, Chicago, Dallas, Denver, Houston, Las Vegas, Los Angeles, Minneapolis-St. Paul, and Phoenix—are doing everything they can to hold onto business. But small-to-midsize airports are still battling for their lives, as big carriers are cut or eliminate service to non-hub cities.

A 2013 report from Massachusetts Institute of Technology’s International Center for Air Transportation found that small- and medium-sized airports ”have been disproportionally affected by reductions in service,” with medium-sized airports having felt “the biggest brunt” of airline network strategies.

This report predicts that smaller airports close to major hubs could be at risk of losing all of their carrier service by 2018. That’s bad news for local municipalities that see their airports as economic engines.

San Luis Obispo County (Calif.) Regional Airport is a case in point. In 2008 Delta ceased service to Salt Lake City, U.S. Air discontinued flights to Las Vegas, and American Airlines pulled out of the airport altogether. About 60% of travelers in this region now fly out of Los Angeles or the San Francisco Bay Area, according to The Tribune, a newspaper that covers this market.

County officials believe San Luis Obispo’s prosperity hinges on its airport’s growth. Despite ongoing discussions with several carriers, the airport has had trouble finding airlines willing to provide service to Dallas, Salt Lake, or Denver.

White says that over the past decade, Wichita’s airport has managed to grow through aggressive marketing and airline recruitment. Four of the nation’s largest carriers—American, Delta, United, and Southwest—all fly out of Eisenhower, as does Allegiant Air, which caters to leisure travelers.

Wichita’s airport was also one of the first to offer incentives to carriers in the form of guaranteeing revenue and other subsidies, a practice that is now common among small and medium size airports. “Southwest Airlines wouldn’t have come here if we hadn’t provided guarantees and subsidies,” White says.

Rent income from airlines is one of the revenue streams that Wichita tapped to pay for its new terminal, along with user fees, commissions on retail sales, and a $4.50 per passenger facility fee. It also received a $60 million FAA grant, and another $7 million from TSA, says White.

The MIT report noted that while airlines have been grounding their older, smaller turbo planes and moving to larger jets with more seats, they still aren’t offering small and midsize airports enough flights to match demand.

At Eisenhower, White says that carriers are mostly flying Airbus or Boeing jets. But, he’s quick to add, demand continues to outpace availability. “The biggest complaint that passengers have is that flights are too full and it is hard to find a seat at the time and price they want to fly.”

Related Stories

Office Buildings | Nov 2, 2023

Amazon’s second headquarters completes its first buildings: a pair of 22-story towers

Amazon has completed construction of the first two buildings of its second headquarters, located in Arlington, Va. The all-electric structures, featuring low carbon concrete and mass timber, help further the company’s commitment to achieving net zero carbon emissions by 2040 and 100% renewable energy consumption by 2030. Designed by ZGF Architects, the two 22-story buildings are on track to become the largest LEED v4 Platinum buildings in the U.S.

Sustainability | Nov 1, 2023

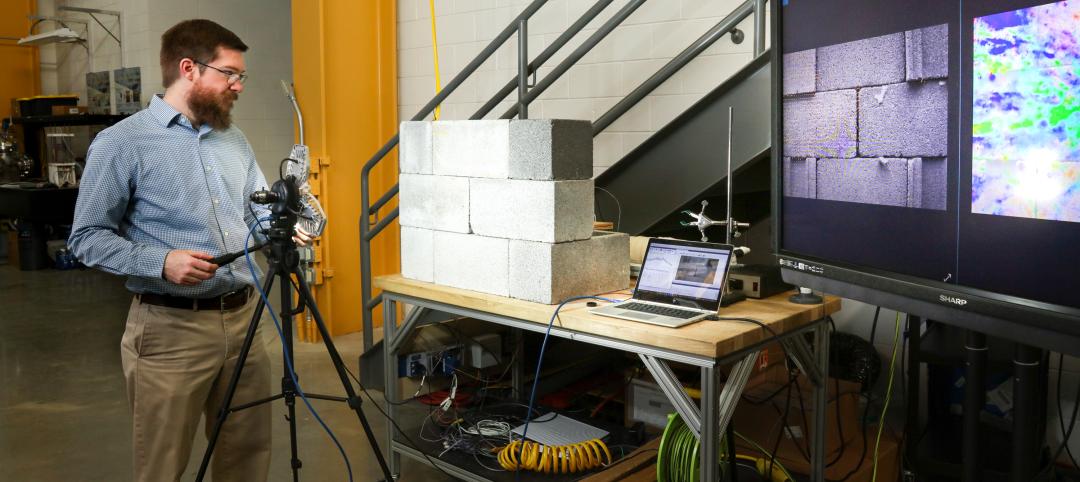

Researchers create building air leakage detection system using a camera in real time

Researchers at the U.S. Department of Energy’s Oak Ridge National Laboratory have developed a system that uses a camera to detect air leakage from buildings in real time.

Adaptive Reuse | Nov 1, 2023

Biden Administration reveals plan to spur more office-to-residential conversions

The Biden Administration recently announced plans to encourage more office buildings to be converted to residential use. The plan includes using federal money to lend to developers for conversion projects and selling government property that is suitable for conversions.

Sustainability | Nov 1, 2023

Tool identifies financial incentives for decarbonizing heavy industry, transportation projects

Rocky Mountain Institute (RMI) has released a tool to identify financial incentives to help developers, industrial companies, and investors find financial incentives for heavy industry and transport projects.

Contractors | Nov 1, 2023

Nonresidential construction spending increases for the 16th straight month, in September 2023

National nonresidential construction spending increased 0.3% in September, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.1 trillion.

Sponsored | MFPRO+ Course | Oct 30, 2023

For the Multifamily Sector, Product Innovations Boost Design and Construction Success

This course covers emerging trends in exterior design and products/systems selection in the low- and mid-rise market-rate and luxury multifamily rental market. Topics include facade design, cladding material trends, fenestration trends/innovations, indoor/outdoor connection, and rooftop spaces.

Office Buildings | Oct 30, 2023

Find Your 30: Creating a unique sense of place in the workplace while emphasizing brand identity

Finding Your 30 gives each office a sense of autonomy, and it allows for bigger and broader concepts that emphasize distinctive cultural, historic or other similar attributes.

Giants 400 | Oct 30, 2023

Top 170 K-12 School Architecture Firms for 2023

PBK Architects, Huckabee, DLR Group, VLK Architects, and Stantec top BD+C's ranking of the nation's largest K-12 school building architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Oct 30, 2023

Top 100 K-12 School Construction Firms for 2023

CORE Construction, Gilbane, Balfour Beatty, Skanska USA, and Adolfson & Peterson top BD+C's ranking of the nation's largest K-12 school building contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Oct 30, 2023

Top 80 K-12 School Engineering Firms for 2023

AECOM, CMTA, Jacobs, WSP, and IMEG head BD+C's ranking of the nation's largest K-12 school building engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.