The office market continues to improve, with many projects in development. Rents are rising as vacancy decreases, according to Jones Lang LaSalle’s 2014 U.S. Office Outlook (http://bit.ly/1ildrS7). Dozens of markets are classified as experiencing a “rising phase” (among them, Phoenix, Chicago, Salt Lake City, and Atlanta), while Dallas, Houston, San Francisco, and the Silicon Valley are believed to be peaking.

New-construction leaders include Houston and New York City, and even in calmer markets, AEC firms are busy with workplace fitouts and renovations.

The adage “doing more with less” has become a byword for many businesses since the Great Recession, and clients are trying to maximize every precious inch. “Everyone is looking to use less space,” says Daniel P. Perruzzi, Jr., AIA, LEED AP, Principal at Boston-based Margulies Perruzzi Architects. “They’re looking at ways to modify their office and workplace standards so that they can fit into less.”

Hierarchical office assignments are becoming passé, as is the notion that people will stay in their cubicles for much of the day. “A lot of companies are going down to a single size for offices, so they’re not awarding that space on the basis of rank,” notes Perruzzi. “And as a rule, companies are looking to change the ratio between offices and open workstations. It’s all driven by collaboration.”

Non-assigned space concepts continue to gain popularity. Whether or not they’re actual telecommuters, workers on the move require well-considered accommodations, including easily accessible plug-ins for laptops, tablets, and smartphones. Says Perruzzi, “You have to think about the accommodations both technically and physically. Workers want to be able to plug in their devices and see their desktop no matter which workstation they’re using.”

Analyses by experts like CoreNet Global indicate that space per worker may drop below 100 sf within five years. Perruzzi says workstations won’t necessarily keep shrinking but will likely keep reducing in number. Margulies Perruzzi’s design for Philips North America’s first Workplace Innovation Center involved no private offices and 200 physical workstations for about 260 employees. Called “free addressing,” the plan allows employees to migrate from desk to desk while reducing the number of empty spots left by workers who are off-site.

Says Perruzzi: “There’s no such thing as an individual contributor anymore. It’s about people working in teams that change on a regular basis, are very dynamic, and need constant access to each other.”

Top Office Sector Architecture Firms

| Rank | Company | 2013 Office Revenue |

| 1 | Gensler | $472,552,752 |

| 2 | HOK | 141,723,793 |

| 3 | Perkins+will | 112,815,842 |

| 4 | Skidmore, Owings & Merrill | 83,599,900 |

| 5 | NBBJ | 64,107,000 |

| 6 | Stantec | 62,594,213 |

| 7 | ZGF Architects | 43,902,072 |

| 8 | Page | 37,460,000 |

| 9 | Kohn Pedersen Fox Associates | 36,176,000 |

| 10 | Nelson | 36,089,550 |

| 11 | SmithGroupJJR | 35,614,366 |

| 12 | Hammel, Green and Abrahamson | 33,267,365 |

| 13 | RTKL Associates | 30,705,000 |

| 14 | EYP Architecture & Engineering | 30,000,000 |

| 15 | CannonDesign | 29,000,000 |

| 16 | HKS | 26,255,885 |

| 17 | Corgan | 24,977,990 |

| 18 | HDR | 24,700,000 |

| 19 | RSP Architects | 23,106,000 |

| 20 | Leo A Daly | 20,101,466 |

| 21 | Heery International | 20,011,958 |

| 22 | LS3P | 17,522,964 |

| 23 | Ware Malcomb | 17,500,000 |

| 24 | Kirksey | 15,989,864 |

| 25 | LPA | 15,875,503 |

| 26 | Perkins Eastman | 15,000,000 |

| 27 | NORR | 14,244,421 |

| 28 | Goettsch Partners | 12,070,000 |

| 29 | VOA Associates | 11,040,757 |

| 30 | Epstein | 10,752,000 |

| 31 | CTA Architects Engineers | 10,438,159 |

| 32 | Margulies Perruzzi Architects | 10,191,746 |

| 33 | Cuningham Group Architecture | 10,068,814 |

| 34 | BRPH | 9,906,000 |

| 35 | DLR Group | 9,800,000 |

| 36 | Environetics | 9,612,351 |

| 37 | Vocon | 9,203,152 |

| 38 | RNL | 8,941,000 |

| 39 | Gresham, Smith and Partners | 8,768,000 |

| 40 | Ziegler Cooper | 8,676,816 |

| 41 | Davis Brody Bond | 8,369,474 |

| 42 | FXFOWLE Architects | 7,880,000 |

| 43 | Adrian Smith + Gordon Gill Architecture | 7,750,000 |

| 44 | Clark Nexsen | 7,707,493 |

| 45 | LMN Architects | 7,368,900 |

| 46 | Little | 7,253,565 |

| 47 | Cooper Carry | 7,227,738 |

| 48 | Symmes Maini & McKee Associates | 6,490,000 |

| 49 | WDG Architecture | 5,844,000 |

| 50 | Solomon Cordwell Buenz | 5,300,000 |

| 51 | Carrier Johnson + Culture | 5,118,818 |

| 52 | Swanke Hayden Connell Architects | 4,990,000 |

| 53 | Eppstein Uhen Architects | 4,972,955 |

| 54 | Fentress Architects | 4,551,790 |

| 55 | Francis Cauffman | 4,187,463 |

| 56 | Wight & Company | 3,683,000 |

| 57 | Smallwood, Reynolds, Stewart, Stewart & Associates | 3,653,284 |

| 58 | OZ Architecture | 3,625,600 |

| 59 | GBBN Architects | 3,540,500 |

| 60 | Callison | 3,481,227 |

| 61 | HMC Architects | 3,388,658 |

| 62 | Albert Kahn Associates | 3,297,848 |

| 63 | Baskervill | 3,226,678 |

| 64 | Rule Joy Trammell + Rubio | 3,120,000 |

| 65 | Montroy Andersen DeMarco | 3,107,000 |

| 66 | Goodwyn Mills & Cawood | 2,932,849 |

| 67 | Good Fulton & Farrell | 2,928,000 |

| 68 | JRS Architect | 2,850,000 |

| 69 | HNTB Corp. | 2,793,299 |

| 70 | Ratio Architects | 2,720,819 |

| 71 | Inventure Design Group | 2,711,701 |

| 72 | ai Design Group | 2,663,516 |

| 73 | KZF Design | 2,544,819 |

| 74 | EwingCole | 2,510,000 |

| 75 | RS&H | 2,450,000 |

| 76 | Integrus Architecture | 2,410,899 |

| 77 | MulvannyG2 Architecture | 2,200,000 |

| 78 | Wilson Architects | 2,200,000 |

| 79 | Rosser International | 1,921,665 |

| 80 | Hoffmann Architects | 1,602,000 |

| 81 | Beyer Blinder Belle | 1,496,952 |

| 82 | LaBella Associates | 1,493,586 |

| 83 | Hnedak Bobo Group | 1,339,000 |

| 84 | Commonwealth Architects | 1,212,741 |

| 85 | Hord Coplan Macht | 1,113,153 |

| 86 | MBH Architects | 1,090,000 |

| 87 | PGAL | 1,074,700 |

| 88 | Nadel | 1,000,000 |

| 88 | Polytech Associates | 1,000,000 |

| 90 | P+R Architects | 982,666 |

| 91 | Parkhill, Smith & Cooper | 945,000 |

| 92 | Bergmann Associates | 939,420 |

| 93 | Niles Bolton Associates | 840,919 |

| 94 | Moseley Architects | 744,501 |

| 95 | Moody Nolan | 722,616 |

| 96 | H+L Architecture | 711,172 |

| 97 | EDI International | 630,916 |

| 98 | BLTa | 630,000 |

| 99 | H3 Hardy Collaboration Architecture | 611,898 |

| 100 | Hoefer Wysocki Architecture | 605,000 |

| 101 | WATG | Wimberly Interiors | 568,000 |

| 102 | Cambridge Seven Associates | 460,000 |

| 103 | Morris Architects | 335,000 |

| 104 | Emersion Design | 332,073 |

| 105 | DLA Architects | 317,730 |

| 106 | BLDD Architects | 280,000 |

| 107 | Hastings+Chivetta Architects | 243,171 |

| 108 | DesignGroup | 242,580 |

| 109 | Sherlock, Smith & Adams | 235,000 |

| 110 | Slaterpaull Architects | 230,000 |

| 111 | FitzGerald Associates Architects | 210,500 |

| 112 | Poskanzer Skott | 200,000 |

| 113 | SchenkelShultz Architecture | 197,000 |

| 114 | PHX Architecture | 180,000 |

| 115 | FGM Architects | 179,784 |

| 116 | BSA LifeStructures | 174,437 |

Top Office Sector Engineering Firms

| Rank | Company | 2013 Office Revenue |

| 1 | AECOM Technology Corp. | $964,240,000 |

| 2 | Jacobs | 504,890,000 |

| 3 | Parsons Brinckerhoff | 158,130,489 |

| 4 | Burns & McDonnell | 102,620,000 |

| 5 | Thornton Tomasetti | 63,427,107 |

| 6 | URS Corp. | 49,783,891 |

| 7 | WSP Group | 49,230,000 |

| 8 | Arup | 43,201,720 |

| 9 | H&A Architects & Engineers | 36,000,000 |

| 10 | Leidos | 28,150,000 |

| 11 | AKF Group | 27,835,000 |

| 12 | KPFF Consulting Engineers | 27,000,000 |

| 13 | Syska Hennessy Group | 26,817,533 |

| 14 | Magnusson Klemencic Associates | 16,437,499 |

| 15 | Wiss, Janney, Elstner Associates | 14,220,000 |

| 16 | Glumac | 14,102,479 |

| 17 | Dewberry | 13,478,149 |

| 18 | Bala Consulting Engineers | 12,507,000 |

| 19 | Environmental Systems Design | 12,505,965 |

| 20 | RDK Engineers | 10,690,000 |

| 21 | Vanderweil Engineers | 10,533,700 |

| 22 | GHT Limited | 9,665,000 |

| 23 | Simpson Gumpertz & Heger | 7,430,000 |

| 24 | Allen & Shariff | 7,200,000 |

| 25 | KCI Technologies | 6,400,000 |

| 26 | Walter P Moore and Associates | 6,002,650 |

| 27 | Highland Associates | 6,000,000 |

| 28 | STV | 5,339,000 |

| 29 | DeSimone Consulting Engineers | 5,084,661 |

| 30 | Aon Fire Protection Engineering Corp. | 5,000,000 |

| 31 | Hixson Architecture, Engineering, Interiors | 5,000,000 |

| 32 | SSOE Group | 4,656,959 |

| 33 | H.F. Lenz | 4,362,698 |

| 34 | Joseph R. Loring & Associates | 4,000,000 |

| 35 | KLH Engineers | 3,875,841 |

| 36 | M-E Engineers | 3,863,000 |

| 37 | Newcomb & Boyd | 3,802,993 |

| 38 | Sparling | 3,799,152 |

| 39 | Bridgers & Paxton Consulting Engineers | 3,612,041 |

| 40 | Smith Seckman Reid | 3,508,905 |

| 41 | Affiliated Engineers | 3,104,000 |

| 42 | Interface Engineering | 2,946,713 |

| 43 | Martin/Martin | 2,793,639 |

| 44 | KJWW Engineering Consultants | 2,711,604 |

| 45 | I. C. Thomasson Associates | 2,600,000 |

| 46 | TLC Engineering for Architecture | 2,329,558 |

| 47 | Henderson Engineers | 2,269,347 |

| 48 | ThermalTech Engineering | 2,250,000 |

| 49 | Heapy Engineering | 2,145,190 |

| 50 | CJL Engineering | 1,878,330 |

| 51 | Dunham Associates | 1,750,000 |

| 52 | Wick Fisher White | 1,734,113 |

| 53 | Karpinski Engineering | 1,695,420 |

| 54 | Shive-Hattery | 1,581,161 |

| 55 | CTLGroup | 1,560,000 |

| 56 | Graef | 1,469,354 |

| 57 | Paulus, Sokolowski and Sartor | 1,400,000 |

| 58 | OLA Consulting Engineers | 1,398,000 |

| 59 | TTG | 1,383,325 |

| 60 | Kamm Consulting | 1,344,151 |

| 61 | CCRD Partners | 1,270,000 |

| 62 | G&W Engineering Corp. | 1,091,000 |

| 63 | M/E Engineering | 1,034,842 |

| 64 | Brinjac Engineering | 1,032,104 |

| 65 | Coffman Engineers | 1,028,004 |

| 66 | Mazzetti | 1,013,140 |

| 67 | Rist-Frost-Shumway Engineering | 1,000,000 |

| 68 | Guernsey | 958,526 |

| 69 | Ross & Baruzzini | 828,783 |

| 70 | Apogee Consulting Group | 815,250 |

| 71 | GRW | 562,957 |

| 72 | CRB | 495,240 |

| 73 | Zak Companies | 458,187 |

| 74 | Davis, Bowen & Friedel | 331,004 |

| 75 | Wallace Engineering | 310,000 |

| 76 | French & Parrello Associates | 264,900 |

| 77 | Primera Engineers | 253,000 |

| 78 | RMF Engineering | 150,000 |

| 79 | Integrated Design Group | 137,118 |

| 80 | P2S Engineering | 135,228 |

| 81 | Spectrum Engineers | 85,926 |

| 82 | Stanley Consultants | 12,178 |

| 83 | Total Building Commissioning | 4,798 |

Top Office Sector Construction Firms

| Rank | Company | 2013 Office Revenue |

| 1 | Turner Construction | $1,965,630,000 |

| 2 | Structure Tone | 1,770,996,000 |

| 3 | Balfour Beatty US | 1,083,107,816 |

| 4 | PCL Construction | 965,124,704 |

| 5 | Gilbane | 850,668,144 |

| 6 | Clark Group | 768,213,069 |

| 7 | Skanska USA | 756,888,741 |

| 8 | Hensel Phelps | 595,480,000 |

| 9 | Suffolk Construction | 575,149,178 |

| 10 | HITT Contracting | 510,600,000 |

| 11 | Whiting-Turner Contracting Co., The | 483,040,306 |

| 12 | Hathaway Dinwiddie Construction | 478,000,000 |

| 13 | Clayco | 474,300,000 |

| 14 | DPR Construction | 419,864,261 |

| 15 | James G. Davis Construction | 409,209,373 |

| 16 | Holder Construction | 375,561,000 |

| 17 | Clune Construction | 350,356,681 |

| 18 | Walsh Group, The | 330,591,769 |

| 19 | JE Dunn Construction | 319,712,834 |

| 20 | Tutor Perini Corp. | 299,785,799 |

| 21 | Plaza Construction | 281,000,000 |

| 22 | Brasfield & Gorrie | 255,289,660 |

| 23 | Lend Lease | 203,243,000 |

| 24 | Ryan Companies US | 198,980,348 |

| 25 | Manhattan Construction | 195,656,000 |

| 26 | Choate Construction | 176,908,443 |

| 27 | Parsons Brinckerhoff | 158,130,489 |

| 28 | McGough | 144,000,000 |

| 29 | Austin Commercial | 126,751,064 |

| 30 | Swinerton Builders | 125,070,000 |

| 31 | McShane Companies, The | 120,701,443 |

| 32 | Pepper Construction | 116,840,000 |

| 33 | Mortenson Construction | 114,140,000 |

| 34 | JLL | 107,497,010 |

| 35 | Linbeck Group | 105,400,000 |

| 36 | C.W. Driver | 102,470,000 |

| 37 | Shawmut Design and Construction | 93,000,000 |

| 38 | B. L. Harbert International | 92,475,153 |

| 39 | CORE Construction Group | 91,118,620 |

| 40 | Leopardo Companies | 90,583,950 |

| 41 | McCarthy Holdings | 84,700,000 |

| 42 | Consigli Construction | 82,688,033 |

| 43 | Messer Construction | 75,756,377 |

| 44 | Power Construction | 67,000,000 |

| 45 | Hoar Construction | 66,258,000 |

| 46 | Weitz Company, The | 65,679,309 |

| 47 | Robins & Morton | 64,633,817 |

| 48 | Sundt Construction | 63,414,544 |

| 49 | Beck Group, The | 61,444,072 |

| 50 | Hill International | 61,000,000 |

| 51 | Yates Companies, The | 50,000,000 |

| 52 | URS Corp. | 49,783,891 |

| 53 | Hunt Construction Group | 46,000,000 |

| 54 | Fortis Construction | 41,800,000 |

| 55 | Adolfson & Peterson Construction | 40,492,626 |

| 56 | LeChase Construction Services | 39,360,000 |

| 57 | Bomel Construction | 38,747,785 |

| 58 | Rodgers Builders | 37,126,784 |

| 59 | Paric Corp. | 35,000,000 |

| 60 | Haselden Construction | 30,679,991 |

| 61 | IMC Construction | 30,597,000 |

| 62 | Barton Malow | 28,706,771 |

| 63 | Haskell | 28,625,841 |

| 64 | Coakley & Williams Construction | 26,086,629 |

| 65 | New South Construction | 22,590,000 |

| 66 | Flintco | 22,000,000 |

| 67 | EMJ Corp. | 21,000,000 |

| 68 | Layton Construction | 20,800,000 |

| 69 | E.W. Howell | 20,491,000 |

| 70 | O'Neil Industries/W.E. O'Neil | 20,354,165 |

| 71 | Heery International | 20,011,958 |

| 72 | Kitchell Corp. | 19,231,158 |

| 73 | Hill & Wilkinson | 19,149,000 |

| 74 | Walbridge | 18,100,000 |

| 75 | Wight & Company | 16,827,000 |

| 76 | Harkins Builders | 16,300,000 |

| 77 | James McHugh Construction | 14,829,260 |

| 78 | Hoffman Construction | 14,000,000 |

| 79 | Kraus-Anderson Construction | 10,000,000 |

| 80 | Batson-Cook | 8,329,557 |

| 81 | Gray Construction | 7,600,000 |

| 82 | Stalco Construction | 7,380,000 |

| 83 | Allen & Shariff | 7,200,000 |

| 84 | Boldt Company, The | 7,044,051 |

| 85 | Bernards | 6,700,000 |

| 86 | W. M. Jordan Company | 6,575,178 |

| 87 | Graycor | 6,456,452 |

| 88 | KBE Building Corp. | 5,964,801 |

| 89 | STV | 5,339,000 |

| 90 | Weis Builders | 5,031,000 |

| 91 | Bette Companies, The | 4,834,000 |

| 92 | Alberici Constructors | 2,961,966 |

| 93 | Absher Construction | 2,256,599 |

| 94 | S. M. Wilson & Co. | 1,607,814 |

| 95 | Douglas Company, The | 1,479,136 |

| 96 | LPCiminelli | 1,349,300 |

| 97 | Astorino | 1,334,650 |

Read BD+C's full 2014 Giants 300 Report

Related Stories

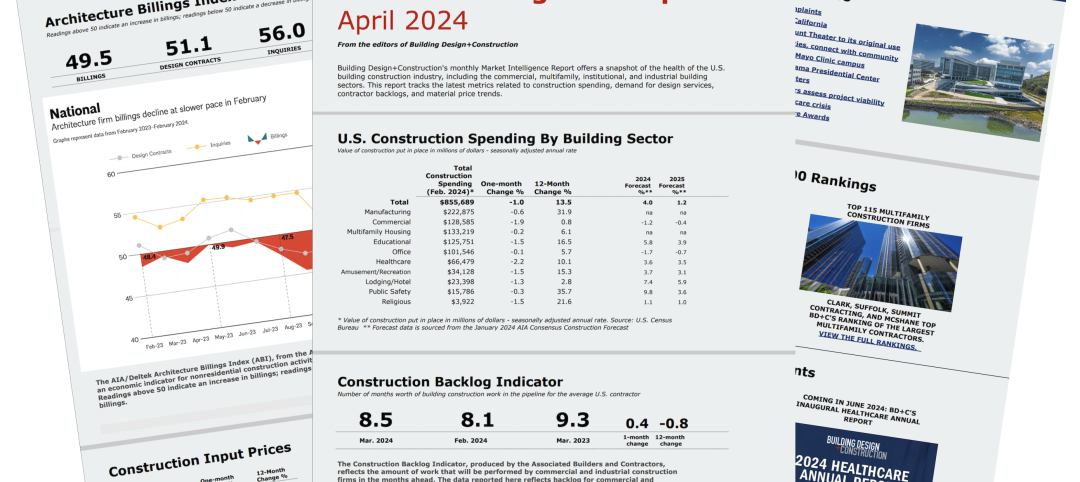

Construction Costs | Apr 18, 2024

New download: BD+C's April 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

MFPRO+ New Projects | Apr 16, 2024

Marvel-designed Gowanus Green will offer 955 affordable rental units in Brooklyn

The community consists of approximately 955 units of 100% affordable housing, 28,000 sf of neighborhood service retail and community space, a site for a new public school, and a new 1.5-acre public park.

Construction Costs | Apr 16, 2024

How the new prevailing wage calculation will impact construction labor costs

Looking ahead to 2024 and beyond, two pivotal changes in federal construction labor dynamics are likely to exacerbate increasing construction labor costs, according to Gordian's Samuel Giffin.

Healthcare Facilities | Apr 16, 2024

Mexico’s ‘premier private academic health center’ under design

The design and construction contract for what is envisioned to be “the premier private academic health center in Mexico and Latin America” was recently awarded to The Beck Group. The TecSalud Health Sciences Campus will be located at Tec De Monterrey’s flagship healthcare facility, Zambrano Hellion Hospital, in Monterrey, Mexico.

Market Data | Apr 16, 2024

The average U.S. contractor has 8.2 months worth of construction work in the pipeline, as of March 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator increased to 8.2 months in March from 8.1 months in February, according to an ABC member survey conducted March 20 to April 3. The reading is down 0.5 months from March 2023.

Laboratories | Apr 15, 2024

HGA unveils plans to transform an abandoned rock quarry into a new research and innovation campus

In the coastal town of Manchester-by-the-Sea, Mass., an abandoned rock quarry will be transformed into a new research and innovation campus designed by HGA. The campus will reuse and upcycle the granite left onsite. The project for Cell Signaling Technology (CST), a life sciences technology company, will turn an environmentally depleted site into a net-zero laboratory campus, with building electrification and onsite renewables.

Codes and Standards | Apr 12, 2024

ICC eliminates building electrification provisions from 2024 update

The International Code Council stripped out provisions from the 2024 update to the International Energy Conservation Code (IECC) that would have included beefed up circuitry for hooking up electric appliances and car chargers.

Urban Planning | Apr 12, 2024

Popular Denver e-bike voucher program aids carbon reduction goals

Denver’s e-bike voucher program that helps citizens pay for e-bikes, a component of the city’s carbon reduction plan, has proven extremely popular with residents. Earlier this year, Denver’s effort to get residents to swap some motor vehicle trips for bike trips ran out of vouchers in less than 10 minutes after the program opened to online applications.

Laboratories | Apr 12, 2024

Life science construction completions will peak this year, then drop off substantially

There will be a record amount of construction completions in the U.S. life science market in 2024, followed by a dramatic drop in 2025, according to CBRE. In 2024, 21.3 million sf of life science space will be completed in the 13 largest U.S. markets. That’s up from 13.9 million sf last year and 5.6 million sf in 2022.

Multifamily Housing | Apr 12, 2024

Habitat starts leasing Cassidy on Canal, a new luxury rental high-rise in Chicago

New 33-story Class A rental tower, designed by SCB, will offer 343 rental units.