The construction industry gained 22,000 jobs between August and September as nonresidential construction firms added employees for the first time in six months, according to an analysis by the Associated General Contractors of America of government data released today. Association officials said nonresidential construction has been affected by the widespread supply chain problems, which are causing owners already uncertain about future demand for commercial space to delay or even cancel some projects.

“While it is refreshing to see job gains in both residential and nonresidential construction, nonresidential building and infrastructure employment remains far below its pre-pandemic peak,” said Ken Simonson, the association’s chief economist. “It will take more than a few months of gains to match the overall economy.”

Construction employment in September totaled 7,447,000, an increase of 22,000 since August. However, industry employment remained 201,000 below the pre-pandemic peak set in February 2020.

The nonresidential segment, comprising nonresidential building and specialty trade contractors plus heavy and civil engineering construction firms, added 18,600 employees in September. But nonresidential employment is 281,000 below the February 2020 level, as the sector has recovered only 56 percent of the jobs lost in the first two months of the pandemic.

Residential construction--including building contractors such as homebuilders, along with residential specialty trades--added 3,600 employees in September. Residential employment tops the February 2020 mark by 80,000.

Simonson cited an unending series of supply-chain bottlenecks, as well as extreme price increases and long lead times for a variety of construction materials, as threats to further growth of nonresidential construction. He said he had heard about an increasing number of project owners deciding to postpone projects because of excessive cost increases and lead times. He noted that the association has again updated its Construction Inflation Alert, a guide to inform owners, officials, and others about the cost and supply-chain challenges.

Association officials urged the Biden administration to remove tariffs and import quotas on a range of key construction materials to help address supply chain disruptions. They added that Congress can help offset declining nonresidential demand for construction by passing the bipartisan infrastructure bill that has already cleared the Senate.

“Both parties in the House should make passing the infrastructure bill a top priority because it is the best way to create new construction careers and make our economy more efficient,” said Stephen E. Sandherr, the association’s chief executive officer. “If the President acts to address supply chain problems and Congress passes the infrastructure bill, construction employment is likely to surge.”

Related Stories

Hotel Facilities | Jul 26, 2023

Hospitality building construction costs for 2023

Data from Gordian breaks down the average cost per square foot for 15-story hotels, restaurants, fast food restaurants, and movie theaters across 10 U.S. cities: Boston, Chicago, Las Vegas, Los Angeles, Miami, New Orleans, New York, Phoenix, Seattle, and Washington, D.C.

Market Data | Jul 24, 2023

Leading economists call for 2% increase in building construction spending in 2024

Following a 19.7% surge in spending for commercial, institutional, and industrial buildings in 2023, leading construction industry economists expect spending growth to come back to earth in 2024, according to the July 2023 AIA Consensus Construction Forecast Panel.

Contractors | Jul 13, 2023

Construction input prices remain unchanged in June, inflation slowing

Construction input prices remained unchanged in June compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics Producer Price Index data released today. Nonresidential construction input prices were also unchanged for the month.

Contractors | Jul 11, 2023

The average U.S. contractor has 8.9 months worth of construction work in the pipeline, as of June 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator remained unchanged at 8.9 months in June 2023, according to an ABC member survey conducted June 20 to July 5. The reading is unchanged from June 2022.

Market Data | Jul 5, 2023

Nonresidential construction spending decreased in May, its first drop in nearly a year

National nonresidential construction spending decreased 0.2% in May, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.06 trillion.

Apartments | Jun 27, 2023

Average U.S. apartment rent reached all-time high in May, at $1,716

Multifamily rents continued to increase through the first half of 2023, despite challenges for the sector and continuing economic uncertainty. But job growth has remained robust and new households keep forming, creating apartment demand and ongoing rent growth. The average U.S. apartment rent reached an all-time high of $1,716 in May.

Industry Research | Jun 15, 2023

Exurbs and emerging suburbs having fastest population growth, says Cushman & Wakefield

Recently released county and metro-level population growth data by the U.S. Census Bureau shows that the fastest growing areas are found in exurbs and emerging suburbs.

Contractors | Jun 13, 2023

The average U.S. contractor has 8.9 months worth of construction work in the pipeline, as of May 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator remained unchanged at 8.9 months in May, according to an ABC member survey conducted May 20 to June 7. The reading is 0.1 months lower than in May 2022. Backlog in the infrastructure category ticked up again and has now returned to May 2022 levels. On a regional basis, backlog increased in every region but the Northeast.

Industry Research | Jun 13, 2023

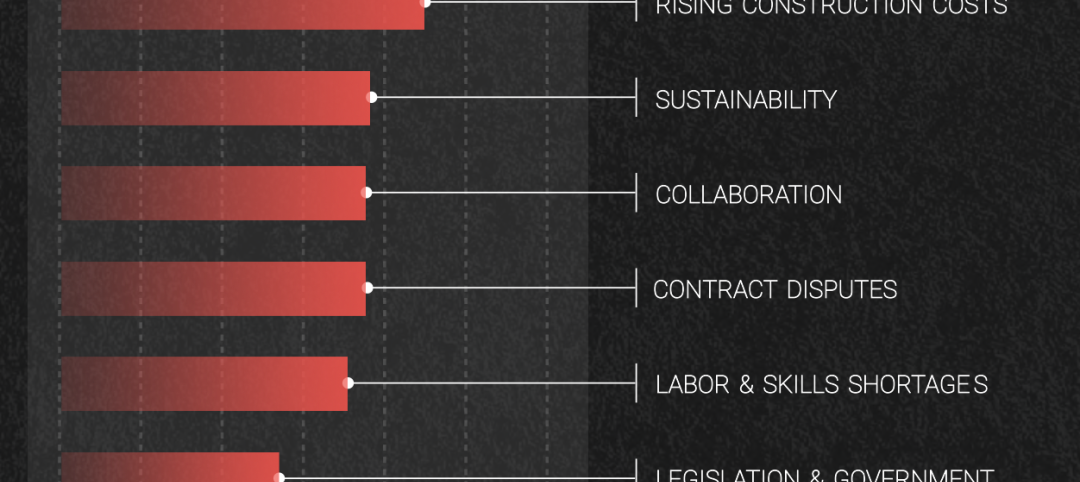

Two new surveys track how the construction industry, in the U.S. and globally, is navigating market disruption and volatility

The surveys, conducted by XYZ Reality and KPMG International, found greater willingness to embrace technology, workplace diversity, and ESG precepts.

| Jun 5, 2023

Communication is the key to AEC firms’ mental health programs and training

The core of recent awareness efforts—and their greatest challenge—is getting workers to come forward and share stories.