A remarkable number of biopharma companies, under the gun to get their research and products to market quicker, aren't happy with design-build and design-build-bid methods of construction project delivery. However, lean and integrated delivery models are still being adopted warily by this sector, with questions about quality being among the primary barriers.

These are some of the key findings in “Horizons: Life Sciences,” a report released by the AEC and consulting firm CRB, that explores trends and attitudes about processes and manufacturing for the biopharmaceutical industry, based on responses of more than 500 industry leaders to nearly 80 questions.

The report presents a biopharma industry that has been turned upside down by the coronavirus pandemic and the urgency it has fomented to provide solutions to these kinds of health events. This disruption has spurred “a whole new mindset, which casts off our industry’s conservative nature in favor of more innovation, more speed, and more flexibility in the name of more lives saved,” Noel Maestre, CRB’s Vice President of Life Sciences, writes in the report’s executive summary. “We will one day defeat this pandemic, but the waves of change that are overtaking the life sciences are only just gathering momentum.”

GAUGING NEW MODELS FOR COST AND RISK

The report touches on a host of topics that include cell and gene therapy production, the role that technology like AI and blockchain is playing in biopharma research and manufacturing, and how what the report calls “Pharma 4.0”—an incorporation of the state-of-the art operating models—is introducing digitization to the pharmaceutical sector. “Companies that embrace Pharma 4.0 are able to harmonize the flow of data from R&D through manufacturing and distribution, enhance cybersecurity, and improve their quality and regulatory compliance,” the report states.

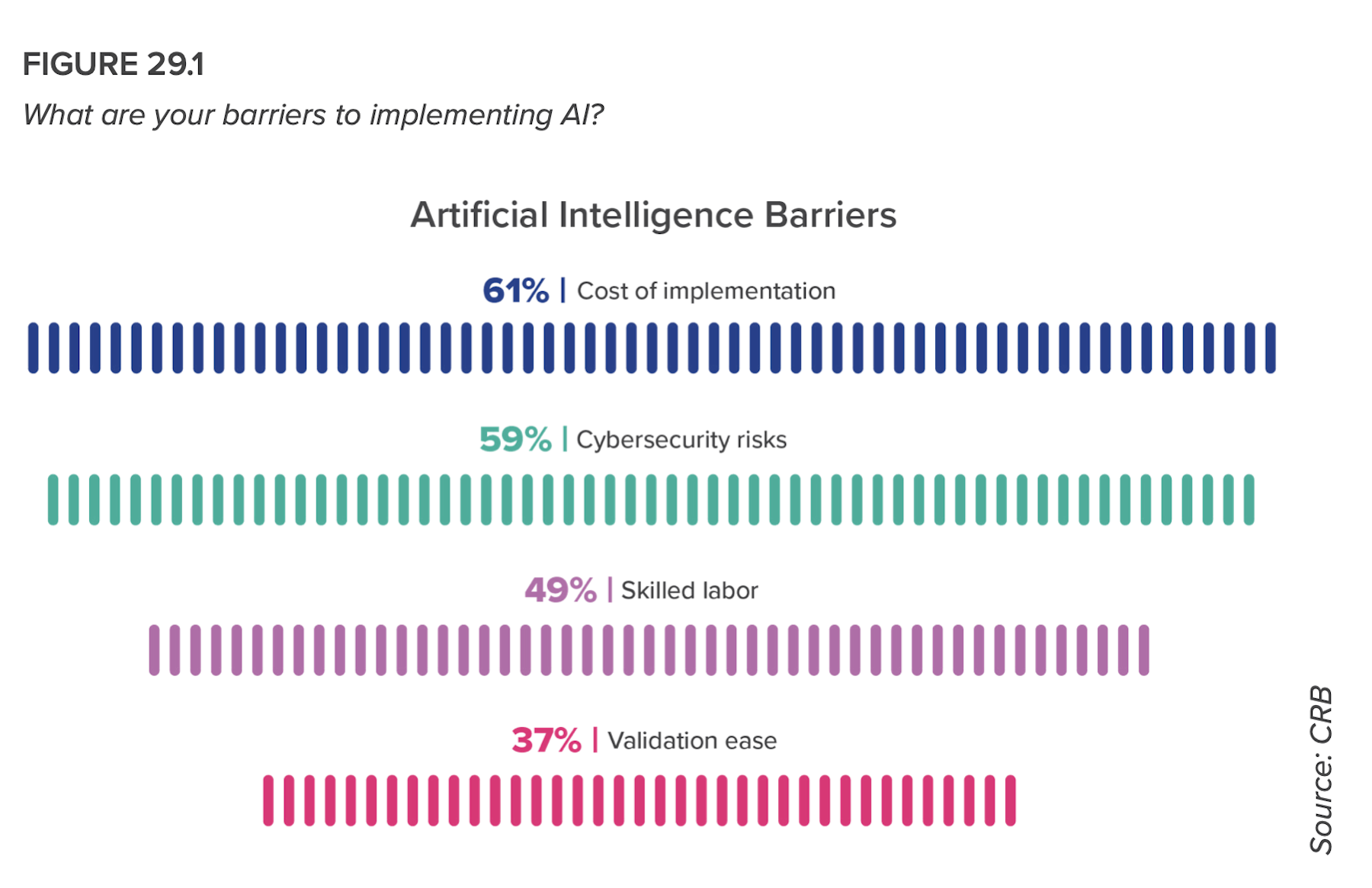

However, to reach that plateau—what the report calls the next Digital Plant Maturity Model—biopharma companies must find ways to assuage their concerns about cost, risk management, and security, and look realistically at their operational parameters and limitations. For example, two-thirds of respondents were confident that their companies are ready to implement blockchain to secure their supply chains, which CRB thinks is overly optimistic: “What is holding back widespread adoption of blockchain is the lack of computational power.”

In that same vein, despite acknowledging shortages in skilled data analysts and concerns about cost and cybersecurity, respondents intend to use AI for quality testing (71%), to improve material planning (59%), for predictive analytics (53%), and to improve efficiency (52%).

NOT ENOUGH AEC FIRMS FOR LIFE SCIENCES PROJECTS

A good portion of this 106-page report addresses life sciences-related construction. If digitalization represents level four of the manufacturing process, CRB thinks that most construction companies are at level three, “having moved beyond the data silos that that can exist between design and construction teams.”

CRB’s internal Construction 4.0 initiative is applying Digital twin and augmented reality to the design and construction of biopharma facilities. “AR is a good starting point for incorporating aspects of Pharma 4.0 into the construction process,” the report states. And CRB is “beginning to see the ease with which 3D printing is becoming possible in manufacturing and even construction.”

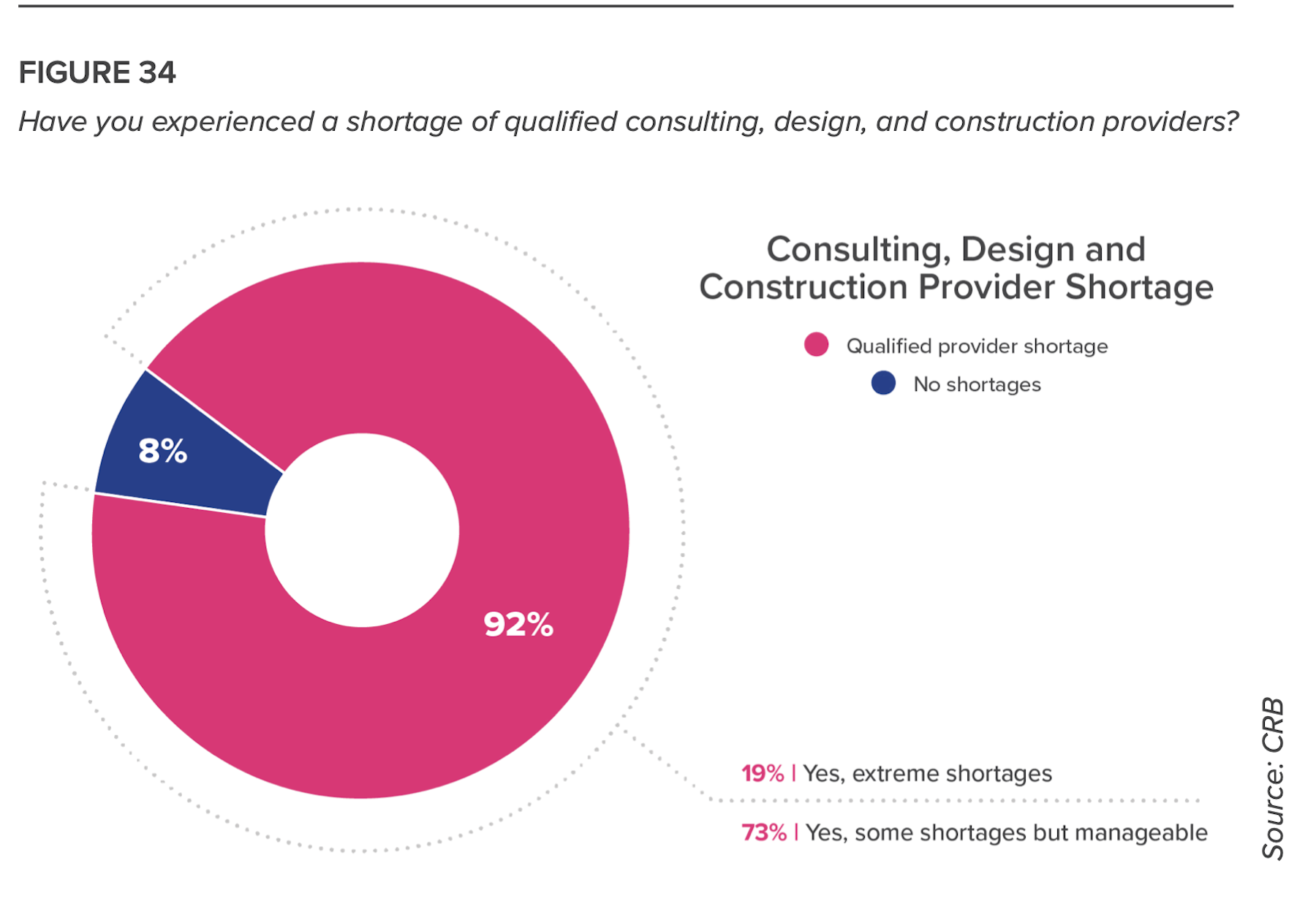

One major problem, however, is impeding a broader involvement in this movement: A sizable number of respondents to this survey cited a shortage of available AEC partners for their building projects. The answer, suggests CRB, is “to find partners capable of keeping schedules on track by establishing a phased project delivery approach.”

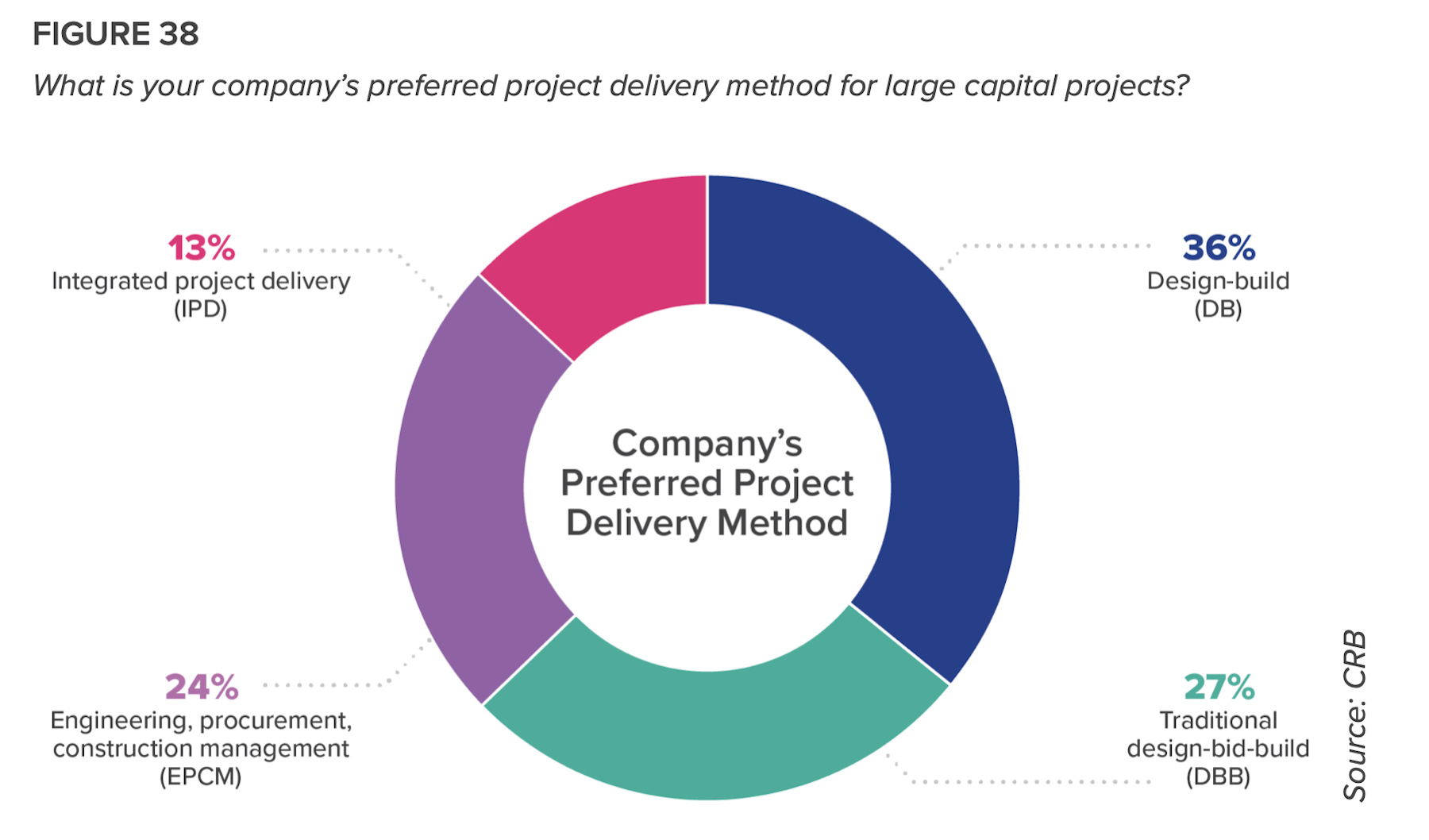

But such approaches have been slow to catch on among biopharma companies. Despite “significant dissatisfaction” with the dominant delivery models, more than 60 percent of respondents continue to favor design-build or design-build-bid. Only 13 percent prefer Integrated Project Delivery, and that drops to just 6 percent among Contract Manufacturing Organizations (CMOs).

CRB infers that many biopharma companies are making delivery choices out of ignorance: just 9 percent of respondents said they were “very familiar” with lean principles. (That number rises to 20 percent among big pharma companies.)

And while 90 percent of respondents said they are open to alternative delivery methods, 60 percent also said that procurement-method constraints were holding them back.

“If it’s a 10-step path to universal acceptance of IPD, we’re probably at about Step 3, and reaching full acceptance won’t likely happen in this decade,” the report states. “But there is movement, and a clear recognition of the shortcomings of the traditional models. The pandemic has opened the gates to welcome a different way of doing things.”

A RELUCTANT EMBRACE OF PREFAB AND MODULAR

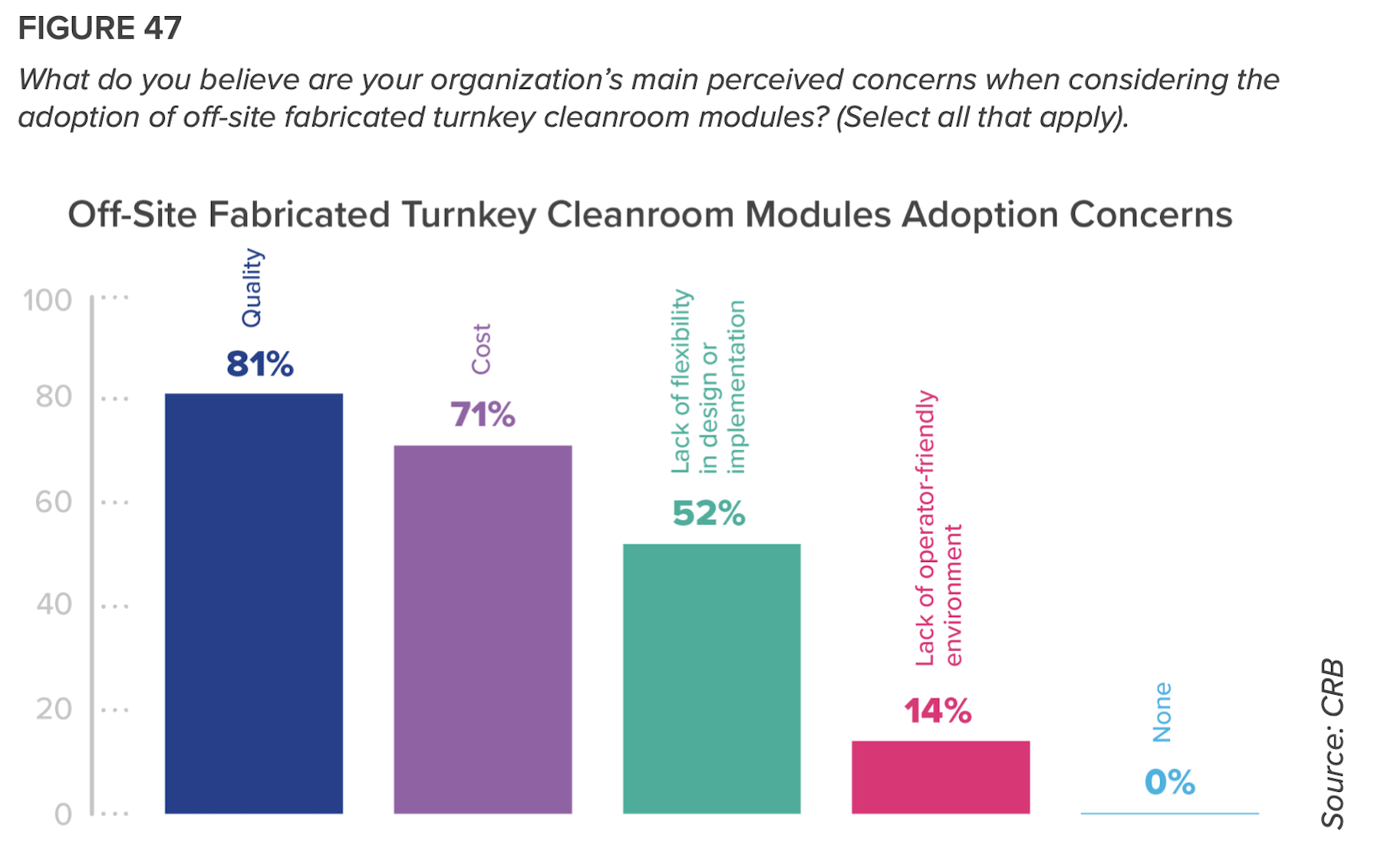

The report takes a closer look at the pharma industry’s acceptance of prefabrication, modularization, and off-site manufacturing, and finds it wanting. Only half of respondents think that these alternatives are “moderately valuable” to their projects, and another 48% think they are of slight or no value.

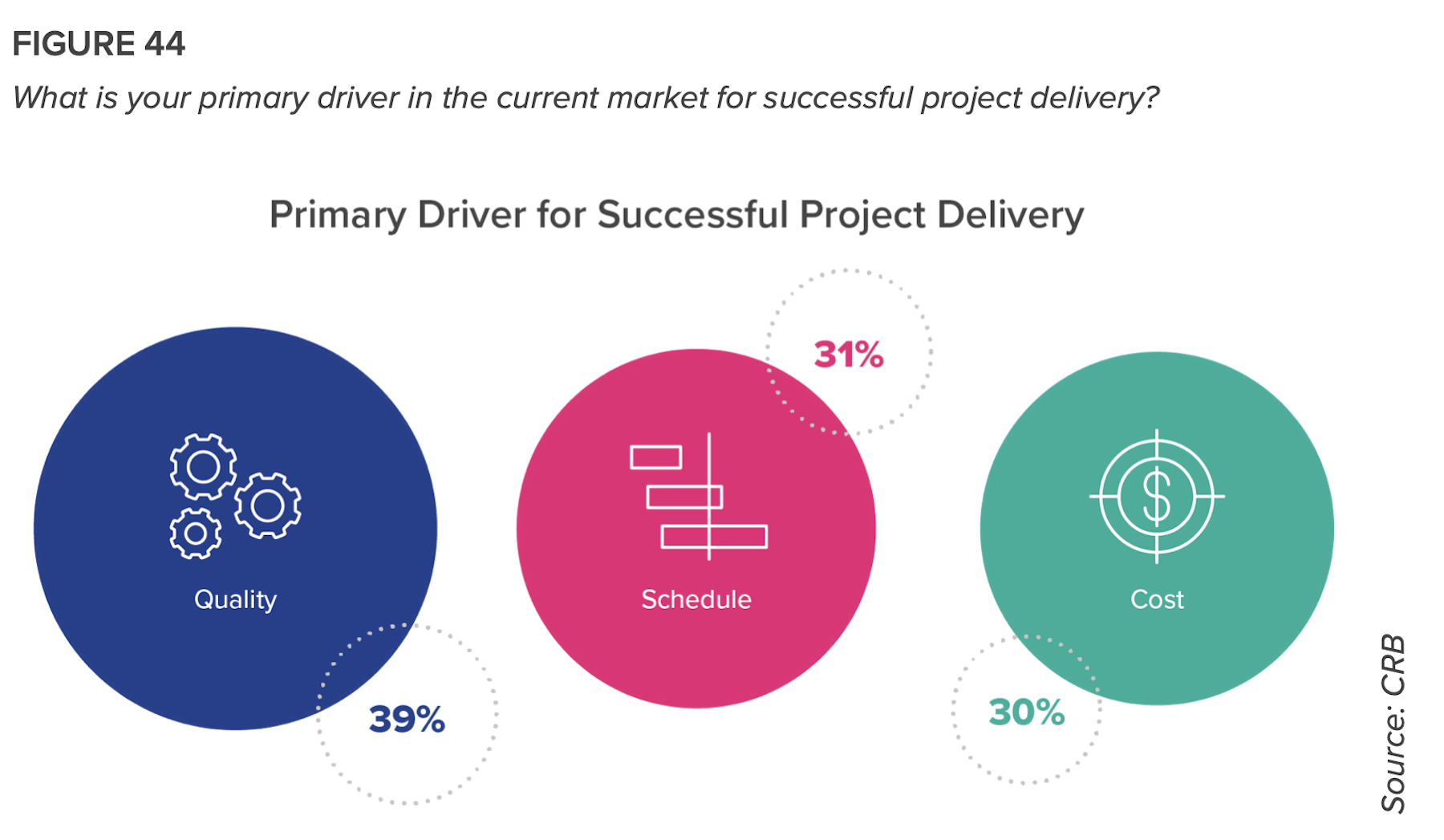

Ninety-three percent of those polled ranked quality as their top adoption concern. More than three-quarters of startup companies listed cost as their main barrier.

But CRB insists that prefab and modular production “is not just a fad.” Indeed, the survey’s respondents ranked financial modeling the most important among tools needed to achieve greater adoption. “An important component of adoption is to quantify how potential additional costs are recouped,” the report states.

Related Stories

Healthcare Facilities | Jan 7, 2024

Two new projects could be economic catalysts for a central New Jersey city

A Cancer Center and Innovation district are under construction and expected to start opening in 2025 in New Brunswick.

Laboratories | Jan 5, 2024

Office conversions are helping to meet the growing demand for life-science space

Ware Malcomb and Rock Creek Property Group led the team that recently completed the adaptive reuse of two office buildings in Maryland.

Mass Timber | Jan 2, 2024

5 ways mass timber will reshape the design of life sciences facilities

Here are five reasons why it has become increasingly evident that mass timber is ready to shape the future of laboratory spaces.

Giants 400 | Nov 28, 2023

Top 55 Laboratory Construction Firms for 2023

Whiting-Turner, DPR Construction, STO Building Group, Skanska, and Hensel Phelps top BD+C's ranking of the nation's largest laboratory general contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Nov 28, 2023

Top 60 Laboratory Engineering Firms for 2023

Jacobs, Affiliated Engineers, Burns & McDonnell, Tetra Tech, and WSP head BD+C's ranking of the nation's largest laboratory engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Nov 28, 2023

Top 100 Laboratory Design Firms for 2023

HDR, Flad Architects, DGA, Elkus Manfredi Architects, and Gensler top BD+C's ranking of the nation's largest laboratory architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Nov 16, 2023

Top 80 Science + Technology Facility Construction Firms for 2023

DPR Construction, Austin Industries, Whiting-Turner, and Gilbane top BD+C's ranking of the nation's largest science and technology (S+T) facility general contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking factors revenue from all science and technology (S+T) buildings work, including laboratories, research buildings, technology/innovation buildings, pharmaceutical production facilities, and semiconductor production facilities.

Giants 400 | Nov 16, 2023

Top 70 Science + Technology Facility Engineering Firms for 2023

Jacobs, Fluor, SSOE, Tetra Tech, and Affiliated Engineers head BD+C's ranking of the nation's largest science and technology (S+T) facility engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking factors revenue from all science and technology (S+T) buildings work, including laboratories, research buildings, technology/innovation buildings, pharmaceutical production facilities, and semiconductor production facilities.

Giants 400 | Nov 16, 2023

Top 100 Science + Technology Facility Architecture Firms for 2023

Gensler, HDR, Page Southerland Page, Flad Architects, and DGA top BD+C's ranking of the nation's largest science and technology (S+T) facility architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking factors revenue from all science and technology (S+T) buildings work, including laboratories, research buildings, technology/innovation buildings, pharmaceutical production facilities, and semiconductor production facilities.

Laboratories | Nov 8, 2023

Boston’s FORUM building to support cutting-edge life sciences research and development

Global real estate companies Lendlease and Ivanhoé Cambridge recently announced the topping-out of FORUM, a nine-story, 350,000-sf life science building in Boston. Located in Boston Landing, a 15-acre mixed-use community, the $545 million project will achieve operational net zero carbon upon completion in 2024.