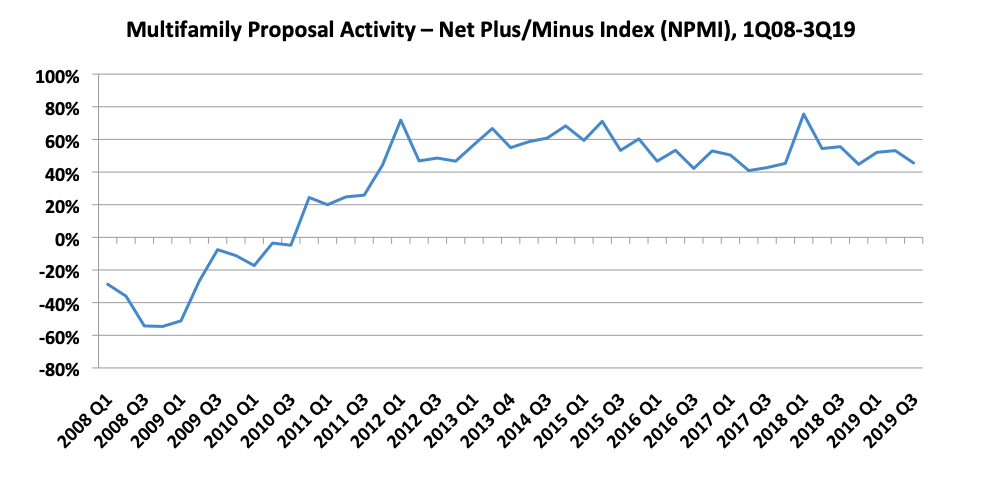

Multifamily housing will remain a robust market for A/E/C companies heading into 2020, according to the most recent results of PSMJ’s Quarterly Market Forecast (QMF) survey. For the third quarter of 2019, the survey found that less than 9% of the nearly 100 respondents doing multifamily work reported a decrease in proposal activity compared with the prior quarter, while more than 54% saw an increase.

The Multifamily market’s third quarter Net Plus/Minus Index (NPMI) of 46% marked the 31st consecutive quarter that the submarket exceeded an NPMI of 40%. The last time it was below that level was the third quarter of 2011.

PSMJ’s NPMI measures the difference between the percentage of firms reporting an increase in proposal activity and those reporting a decrease, quarter over quarter. PSMJ has been using the QMF as a predictor of the A/E/C industry’s health since 2003, tracking 12 major markets and 58 submarkets every three months. The company chose proposal activity to gauge the industry’s long-term outlook because it is among the earliest stages of the project lifecycle. Approximately 200 firms participate in the survey each quarter.

The Senior and Assisted Living submarket also performed well with a third-quarter NPMI of 49%. Only 4 of the 86 responding firms working in the senior care submarket reported declining proposal activity. The Senior/Assisted Living market has also been a consistently stellar performer in the QMF. Its NPMI hasn’t dipped below 50% since the fourth quarter of 2012.

“Multifamily and Senior/Assisted Living have been two of the hottest markets for proposal activity for quite some time, not only among the Housing submarkets, but throughout all 58 submarkets,” says PSMJ’s Greg Hart, a consultant who also oversees the QMF. “It is remarkable that both have seen such steady proposal growth for so long. Very few submarkets have been this consistently strong throughout the 16-year history of our survey.”

Housing (all submarkets) recorded an NPMI of 40% in the third quarter, a potentially noteworthy drop from the 59% recorded in the second quarter. After ranking the second-highest of the 12 major markets measured in the second quarter, Housing fell completely out of the top five in the third quarter. Transportation (49%) and Healthcare (46%) were tops among major markets.

Among the other Housing submarkets, Condominiums recorded a respectable NPMI of 24%, its sixth consecutive quarter in the mid-20% range. Individual single-family homes (15%) and subdivisions (8%) trailed the Housing field in the third quarter, falling markedly from 25% and 23%, respectively, in the second quarter. PSMJ Director and Senior Consultant Dave Burstein, PE, notes that the results are still positive, if potentially troubling in the longer term. He adds that lower mortgage interest rates on the horizon are likely to spur a rebound in the single-family and subdivision subsectors.

PSMJ Resources, Inc., based in Newton, Massachusetts, is a publishing, executive education, and advisory company dedicated to serving architecture, engineering and construction (A/E/C) organizations worldwide.

Related Stories

Industry Research | Jan 31, 2024

ASID identifies 11 design trends coming in 2024

The Trends Outlook Report by the American Society of Interior Designers (ASID) is the first of a three-part outlook series on interior design. This design trends report demonstrates the importance of connection and authenticity.

Mixed-Use | Jan 29, 2024

12 U.S. markets where entertainment districts are under consideration or construction

The Pomp, a 223-acre district located 10 miles north of Fort Lauderdale, Fla., and The Armory, a 225,000-sf dining and entertainment venue on six acres in St Louis, are among the top entertainment districts in the works across the U.S.

Sponsored | BD+C University Course | Jan 17, 2024

Waterproofing deep foundations for new construction

This continuing education course, by Walter P Moore's Amos Chan, P.E., BECxP, CxA+BE, covers design considerations for below-grade waterproofing for new construction, the types of below-grade systems available, and specific concerns associated with waterproofing deep foundations.

Multifamily Housing | Jan 15, 2024

Multifamily rent growth rate unchanged at 0.3%

The National Multifamily Report by Yardi Matrix highlights the highs and lows of the multifamily market in 2023. Despite strong demand, rent growth remained unchanged at 0.3 percent.

Adaptive Reuse | Jan 12, 2024

Office-to-residential conversions put pressure on curbside management and parking

With many office and commercial buildings being converted to residential use, two important issues—curbside management and parking—are sometimes not given their due attention. Cities need to assess how vehicle storage, bike and bus lanes, and drop-off zones in front of buildings may need to change because of office-to-residential conversions.

MFPRO+ News | Jan 12, 2024

Detroit may tax land more than buildings to spur development of vacant sites

The City of Detroit is considering a revamp of how it taxes property to encourage development of more vacant lots. The land-value tax has rarely been tried in the U.S., but versions of it have been adopted in many other countries.

MFPRO+ News | Jan 12, 2024

As demand rises for EV chargers at multifamily housing properties, options and incentives multiply

As electric vehicle sales continue to increase, more renters are looking for apartments that offer charging options.

Sustainability | Jan 10, 2024

New passive house partnership allows lower cost financing for developers

The new partnership between PACE Equity and Phius allows commercial passive house projects to be automatically eligible for CIRRUS Low Carbon financing.

Giants 400 | Jan 8, 2024

Top 60 Senior Living Facility Construction Firms for 2023

Whiting-Turner, Ryan Companies US, Weis Builders, Suffolk Construction, and W.E. O'Neil Construction top BD+C's ranking of the nation's largest senior living facility general contractors and construction management (CM) firms for 2023, as reported in the 2023 Giants 400 Report.

Giants 400 | Jan 8, 2024

Top 40 Senior Living Facility Engineering Firms for 2023

Kimley-Horn, Olsson, Tetra Tech, EXP, and IMEG head BD+C's ranking of the nation's largest senior living facility engineering and engineering/architecture (EA) firms for 2023, as reported in the 2023 Giants 400 Report.