Last week, The World Bank lowered its estimate for global growth in 2016 to 2.9%, from its 3.5% prediction last June. The Bank is particularly concerned about slowdowns in China and developing companies that could reverberate, long term, to advanced economies.

However, the Bank’s forecast was more optimistic about the United States, whose 2.7% economic growth in 2016, if realized, would be its fastest pace since 2006.

Whether the U.S. can outpace other nations’ economies is a topic of some debate. James Pethokoukis, a Fellow at the American Enterprise Institute, thinks the U.S. could face decades of “unhealthy economic populism” if GDP and job growth aren’t matched by productivity gains, which over the past five years have averaged only 0.6%. More dour is Citigroup, which is on record that there’s a 65% chance of another recession in the U.S. this year.

The current state of America’s stock market, which got off to a miserable start in 2016, doesn’t exactly augur happy days ahead. But that downturn, and the generally mediocre pace at which the world’s economies are moving, didn’t deter Morgan Stanley from reiterating its belief that the U.S. would continue growing through 2020, and thereby achieve the longest economic expansion in the post-World War II era.

Morgan also thinks that if the U.S. skirts another recession, corporate profit growth could lift the S&P 500 to 3,000 by 2020. (That Index ended Jan. 13 at 1,890.28, down 48.40 to its lowest level since last September. Morgan’s prediction is in sharp contrast with economic bears who are already predicting the S&P 500 could collapse by as much as 75% from its peak of 2100 last year, driven down by China’s currency deflation.)

There are three main reasons why Morgan Stanley remains bullish about the American economy:

•The U.S added about 200,000 jobs per month in 2015, its second-best year for employment gains since 1999. The employment picture spurred consumer confidence, as measured by the University of Michigan, to average 92.9 last year, the highest it’s been at since 2004.

•Americans are getting themselves out of the red. Morgan Stanley notes that debt to disposable income, at about 106%, has fallen from 138% in 2008. And the portion of loan balances that are 90-plus days delinquent fell below 4% for the first time since the recession ended.

•Big companies are cleaning up their balance sheets and being a lot more careful about what they invest in. Morgan Stanley expects capital spending-to sales at the largest 1,500 corporations to fall to 4.6%, compared to between 6% and 9% before the last two recessions. S&P 500 companies have about $100 billion in loans coming due this year and $300 billion in 2017, which Morgan considers manageable amounts.

Related Stories

Market Data | Mar 14, 2024

Download BD+C's March 2024 Market Intelligence Report

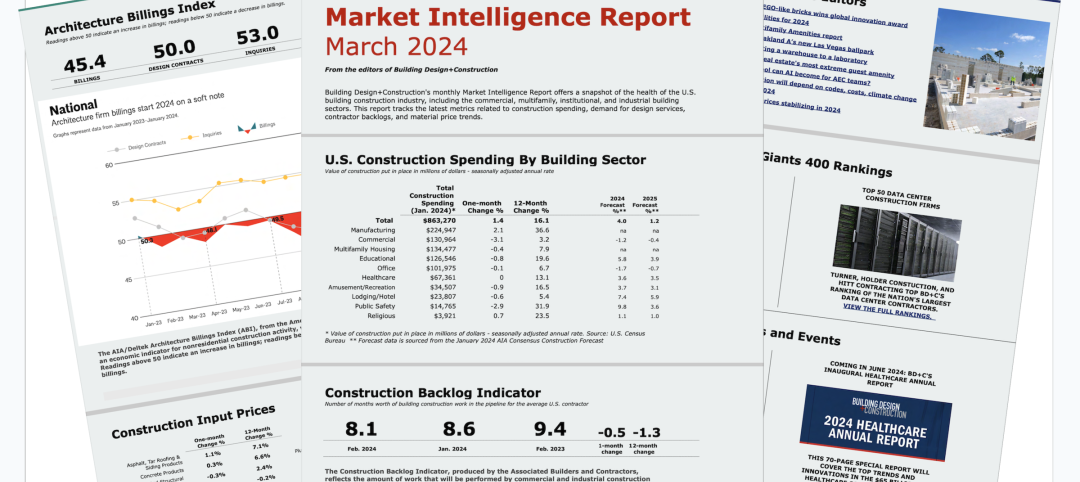

U.S. construction spending on buildings-related work rose 1.4% in January, but project teams continue to face headwinds related to inflation, interest rates, and supply chain issues, according to Building Design+Construction's March 2024 Market Intelligence Report (free PDF download).

Contractors | Mar 12, 2024

The average U.S. contractor has 8.1 months worth of construction work in the pipeline, as of February 2024

Associated Builders and Contractors reported that its Construction Backlog Indicator declined to 8.1 months in February, according to an ABC member survey conducted Feb. 20 to March 5. The reading is down 1.1 months from February 2023.

Market Data | Mar 6, 2024

Nonresidential construction spending slips 0.4% in January

National nonresidential construction spending decreased 0.4% in January, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.190 trillion.

Multifamily Housing | Mar 4, 2024

Single-family rentals continue to grow in BTR communities

Single-family rentals are continuing to grow in built-to-rent communities. Both rent and occupancy growth have been strong in recent months while remaining a financially viable option for renters.

MFPRO+ News | Mar 2, 2024

Job gains boost Yardi Matrix National Rent Forecast for 2024

Multifamily asking rents broke the five-month streak of sequential average declines in January, rising 0.07 percent, shows a new special report from Yardi Matrix.

K-12 Schools | Feb 29, 2024

Average age of U.S. school buildings is just under 50 years

The average age of a main instructional school building in the United States is 49 years, according to a survey by the National Center for Education Statistics (NCES). About 38% of schools were built before 1970. Roughly half of the schools surveyed have undergone a major building renovation or addition.

MFPRO+ Research | Feb 27, 2024

Most competitive rental markets of early 2024

The U.S. rental market in early 2024 is moderately competitive, with apartments taking an average of 41 days to find tenants, according to the latest RentCafe Market Competitivity Report.

Construction Costs | Feb 22, 2024

K-12 school construction costs for 2024

Data from Gordian breaks down the average cost per square foot for four different types of K-12 school buildings (elementary schools, junior high schools, high schools, and vocational schools) across 10 U.S. cities.

Student Housing | Feb 21, 2024

Student housing preleasing continues to grow at record pace

Student housing preleasing continues to be robust even as rent growth has decelerated, according to the latest Yardi Matrix National Student Housing Report.

Architects | Feb 21, 2024

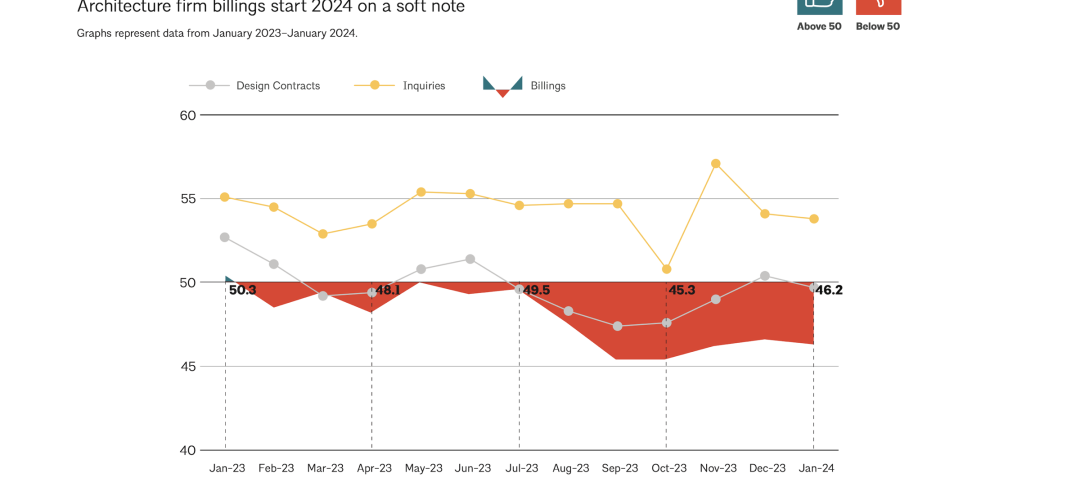

Architecture Billings Index remains in 'declining billings' state in January 2024

Architecture firm billings remained soft entering into 2024, with an AIA/Deltek Architecture Billings Index (ABI) score of 46.2 in January. Any score below 50.0 indicates decreasing business conditions.