Select-service hotels, which are designed with space efficiency and a lean labor model in mind, accounted for 70% of the total U.S. hotel construction pipeline at the end of last year. About that same percentage of investors surveyed by JLL recently were bullish on select-services hotels, believing they enhance portfolio returns.

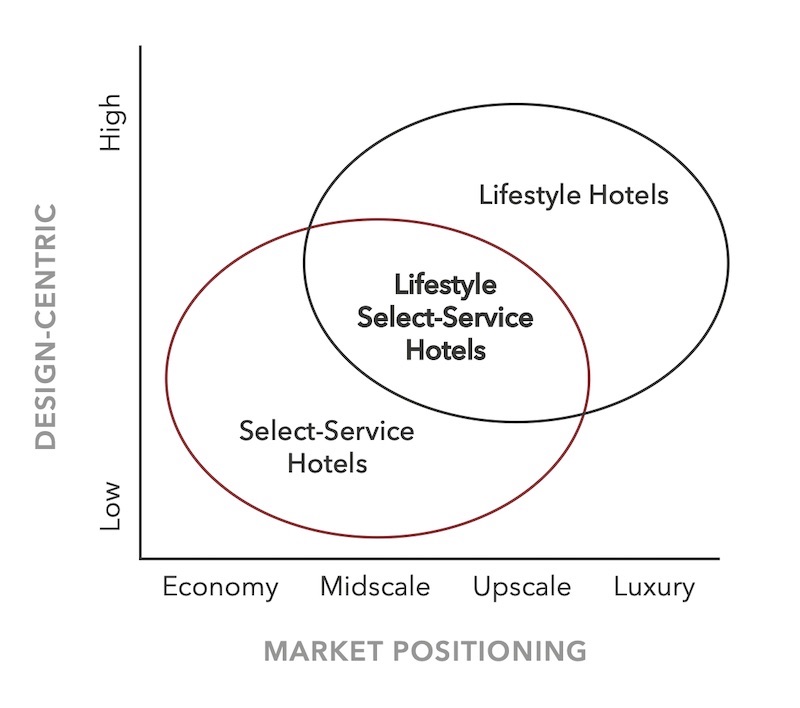

But lifestyle and cost-sensitive hotel concepts have been making inroads into the select-service space, causing traditional select-service brands to refresh and update, often with “lifestyle” qualities that place more emphasis on design and localization, and connecting modern travelers to local communities.

In a new 14-page white paper, WATG Strategy explores the intersection of select-service and lifestyle. “This breed of hotels, when differentiated by design and driven by efficiency, is at once style and lucrative,” the paper’s authors conclude.

Lifestyle and select-service hotel models are intersecting at the midscale-upscale price level. Image: WATG Strategy

FAVORABLE ECONOMICS

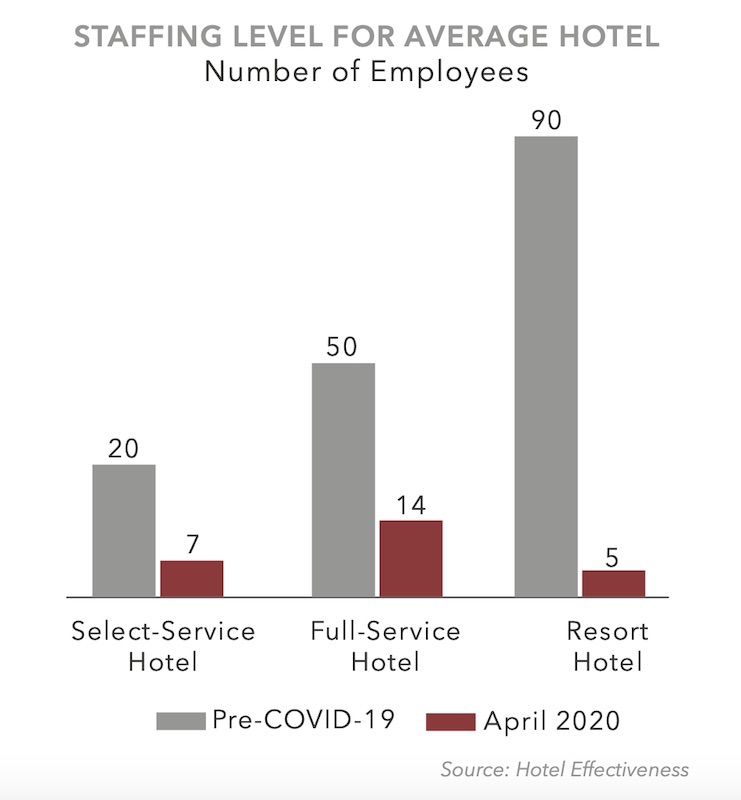

Select-service hotels focus on rooms, and their average room department profit margin—73% in the U.S.—far exceeds the average food and beverage profit margin of 29%. Given that staffing levels at select-service hotels are typically 40-50% of those in full-service hotels, their operational costs are significantly lower.

WATG Strategy, quoting the hospitality consultant HVS’s U.S. Hotel Development Cost Survey 2018-19, notes that building select-service hotels averages $290,000 per key, compared to $397,000 for full-service hotels. Select-service hotels are also more conducive to cost-saving modular construction.

Select-service hotels, with their flexible staffing model, typically have 40-50% of the employees of a full-service hotel. Image: WATG Strategy

During the pandemic, more select-service hotels, with a nimbler operations model, have been able to stay open than their full-service counterparts. For example, on its earnings call for the first quarter of 2020, Hyatt said it had temporarily closed 62% of its full-service hotels, but only 19% of its select-service hotels.

WATG Strategy also observes that lifestyle hotels of all service levels have shown financial resilience compared to traditional and standardized hotels. The benefits of lifestyle hotels include a flexible rate ceiling, additional revenue streams from locals who might frequent the hotels’ cafes, shops and lobbies; higher net revenue through direct bookings, and—when they’re design driven—photo-worthy spaces that travelers might post on social media.

Consequently, lifestyle select-service hotels have been popping up to the point where this market sector is now “fiercely competitive,” says WATG Strategy. Indeed, more of these hotels are shifting their branding to emphasize “lifestyle,” sometimes to the extent where the line between traditional and lifestyle gets blurred. (WATG Strategy explains that it’s easier and less expensive to alter a hotel’s image than it is to terminate a brand entirely.)

WATG Strategy also sees a trend toward proliferation, but without market dilution. Not every hotel brand wants to be in every market: Marriott, for example, had only 32 Moxy hotels in its North America pipeline as of year-end 2019.

DESIGN WILL INFLUENCE SUCCESS

Regardless of the number of hotels within a certain brand, “as the hotel industry braces itself for a period of reprioritization, whether a hotel brand and property can withstand the test of time will be influenced by a key factor: design,” states the white paper.

Key design trends that currently define today’s lifestyle select-service hotel include lobby and communal spaces, F&B service that features beverage and caters to the all-day grab-and-go patron, and what WATG Strategy calls “chameleon spaces,” such as Marriott’s AC Hotels that display museum-quality artifacts, or Hyatt’s Joie de Vivre brand that’s known to reflect its vibrant neighborhoods.

The Joie de Vivre brand includes the recently completed Hotel 50 Bowery in New York City, a boutique hotel with 229 rooms. There, past meets present in the reclaimed wood reception desk set resting on contemporary poured concrete, while a Corten steel screen to the rear evokes a Chinese landscape painting. The Crown, a rooftop bar and lounge occupies the 21st floor and provides views of Lower Manhattan and Brooklyn across the water.

The Crown roofdeck at Hotel 50 Bowery offers panoramic views of New York City. Image: Hyatt Joie de Vivre

SMALLER, MORE SUMPTUOUS ROOMS

However, the guestroom remains the focus of these hybrid hotels. “Lifestyle select-service hotels are all about the delicate balance of delivering a premium experience while maintaining cost efficiency,” says the white paper. “Therefore, they focus on what guests need in the guestrooms, and eliminate everything else.

Guestrooms are getting smaller in lifestyle select-service hotels, but compensate with sumptuous beds and customized touches like fresher air, controllable sound, and personalized lighting. These rooms are also more likely to have spacious showers and communal spaces such as kitchens or living rooms.

The next generation of lifestyle select-service hotels, predicts WATG Strategy, will balance efficiency and high perception of value. That balance, though, must transcend touchless technology that tends to make traditional select-service hotels somewhat antiseptic.

With the emergence, in more markets, of wellness, coworking, and co-living social clubs, WATG Strategy sees the next generation the lifestyle select-service hotel progressing alongside its users to become more than a place to sleep for a few nights. “It can become multi-faceted work-play-stay hub while continuing to deliver superior value for its owners and heartfelt hospitality for its guests.”

Related Stories

Hotel Facilities | Jul 28, 2022

As travel returns, U.S. hotel construction pipeline growth follows

According to the recently released United States Construction Pipeline Trend Report from Lodging Econometrics (LE), the total U.S. construction pipeline stands at 5,220 projects/621,268 rooms at the close of 2022’s second quarter, up 9% Year-Over-Year (YOY) by projects and 4% YOY by rooms.

Hotel Facilities | May 31, 2022

Checking out: Tips for converting hotels to housing

Many building owners are considering repositioning their hotels into another property type, such as senior living communities and rental apartments. Here's advice for getting started.

Sponsored | Multifamily Housing | May 8, 2022

Choosing the right paver system for rooftop amenity spaces

This AIA course by Hoffmann Architects offers best practices for choosing the right paver system for rooftop amenity spaces in multifamily buildings.

Sponsored | BD+C University Course | May 3, 2022

For glass openings, how big is too big?

Advances in glazing materials and glass building systems offer a seemingly unlimited horizon for not only glass performance, but also for the size and extent of these light, transparent forms. Both for enclosures and for indoor environments, novel products and assemblies allow for more glass and less opaque structure—often in places that previously limited their use.

Hotel Facilities | Apr 25, 2022

U.S. hotel construction pipeline up 2%, with 5,090 projects in the works

The total U.S. hotel construction pipeline stands at 5,090 projects and 606,302 rooms at the end of the first quarter of 2022, up 2% by projects, but down 3% by rooms, according to the Q1 2022 Construction Pipeline Trend Report for the United States from Lodging Econometrics (LE).

Hotel Facilities | Apr 12, 2022

A virtual hotel to open in the metaverse

A brand of affordable luxury hotels that launched in 2008, citizenM has announced it will purchase a digital land site in The Sandbox, a virtual game world owned by Animoca Brands.

Sponsored | Steel Buildings | Jan 25, 2022

Multifamily + Hospitality: Benefits of building in long-span composite floor systems

Long-span composite floor systems provide unique advantages in the construction of multi-family and hospitality facilities. This introductory course explains what composite deck is, how it works, what typical composite deck profiles look like and provides guidelines for using composite floor systems. This is a nano unit course.

Giants 400 | Dec 3, 2021

2021 Hotel Sector Giants: Top architecture, engineering, and construction firms in the U.S. hospitality sector

Gensler, Jacobs, Suffolk Construction, and WATG top BD+C's rankings of the nation's largest hotel sector architecture, engineering, and construction firms, as reported in the 2021 Giants 400 Report.

Hotel Facilities | Nov 12, 2021

A new Four Seasons resort opens in Napa Valley with a working winery

The property’s development was a decade in the making.

Hotel Facilities | Nov 3, 2021

California’s Hotel del Coronado is finishing up the final piece to its Master Plan

A 75-residence Shore House will be family oriented and meeting commodious.