Two leading consulting firms that focus on data centers and other mission-critical facilities have released a white paper on data center sustainability, the first in a series of reports that will provide technical analysis for data center operators to help lower their centers’ carbon footprints in line with regulations targeting carbon neutrality by 2030.

The authors of the white paper—which earlier this year formed a Greenhouse Gas Abatement Group—are i3 Solutions Group, a globally recognized data center MEP consulting engineering firm; and New York-based EYP Mission Critical Facilities, which performs MEP design and commissioning, operational procedures. multi-cloud and data center strategy, due diligence and site evaluation.

To download the first white paper and sign-up to receive alerts for future publications, click here.

CARBON NEUTRALITY AND REVENUE GENERATION AREN’T MUTUALLY EXCLUSIVE

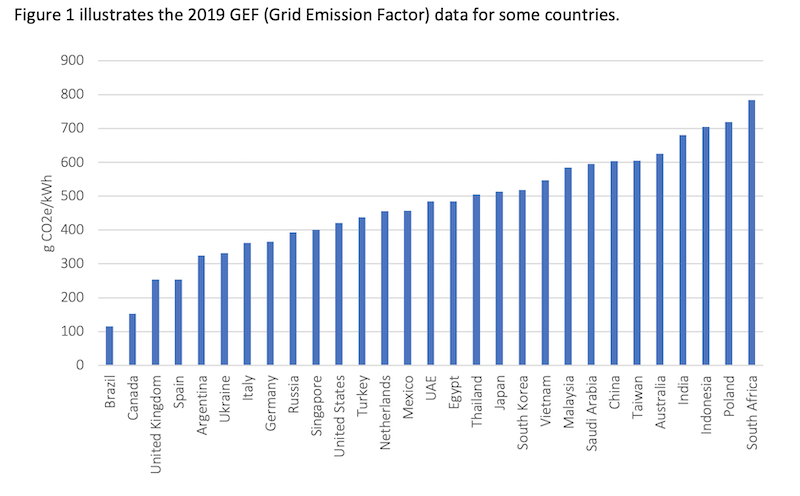

Greenhouse gas emissions from data centers vary widely by country. Chart: Greenhouse Gas Abatement Group

By almost every measure, data center demand is growing steadily and rapidly. Apex Market Research, for one, estimates that construction spending will increase by 7.7% annually and reach nearly $32 billion by 2025. To a greater extent than ever, operators are seeking ways to mitigate their facilities’ environmental effects, either voluntarily or in response to government mandates.

Titled “Infrastructure Sustainability Options and Revenue Opportunities for Data Centers,” the first white paper covers how targets for reducing greenhouse gas (GHG) emissions and increasing revenue-generating opportunities are not mutually exclusive objectives. “The falling costs of low-carbon distributed energy systems provide data center operators with opportunities to satisfy the requirements of hyperscale end-users with ambitions for a Zero Carbon Solution,” the white paper states.

Indeed, the energy sector has been moving in this direction for a while. Figures released in February by the International Energy Agency (IEA) reveal that global emissions from the electricity sector dropped by 450 million tons last year. This decline resulted partly from lower electricity demand but also from increases in electricity generation by solar PV and wind.

However, IEA also estimates that emissions in China increased last year by 0.8%. And while emissions in the U.S. fell by 10%, they started to bounce back in the later stages of 2020.

The white paper provides in-depth technical insight into areas where operators might reduce their facilities’ environmental impacts and monetize the process to boot. These areas include Demand Side Response, Data Center Power Generation, Energy Storage and Sustainable Energy Trading, as well as System Selection criteria such as Sustainability Performance Indices.

The white paper cautions there are no quick fixes to this problem of greenhouse gas emissions. For example, it postulates that when a company buys renewable energy from a private utility as a way of reducing its carbon footprint, it actually doesn’t improve its sustainability unless that purchase is coupled with a higher ratio of additional renewable energy and a reduction in the national grid emission factor (GEF).

NINE METRICS TO CONSIDER

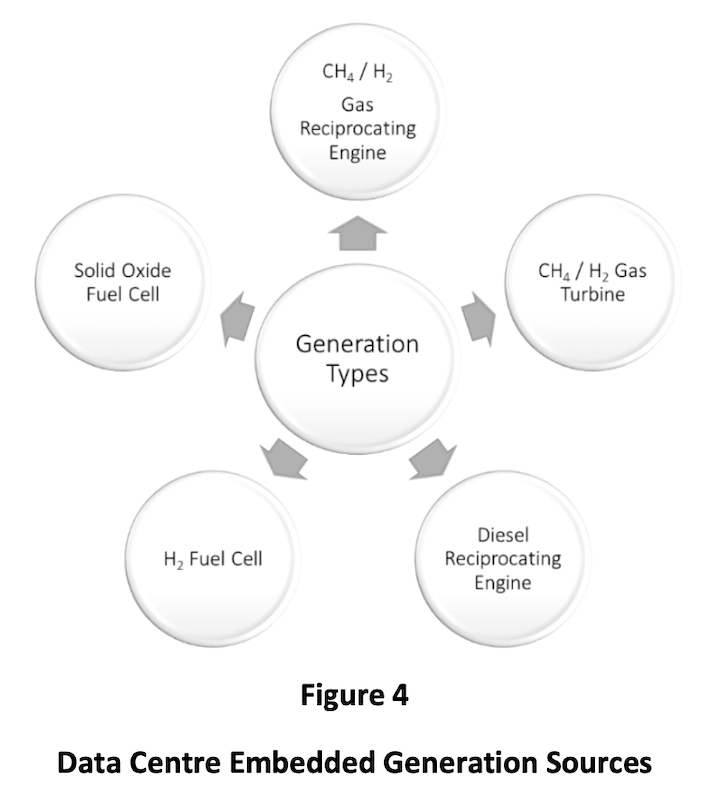

Most data centers have excess energy capacities. Image: Greenhouse Gas Abatement Group

Other ways of reducing a data center’s carbon footprint might include energy trading that provides additional power to a grid from intermittent sources like wind energy. Data center operators might also benefit financially from exporting power to the grid from distributed generation systems, which in some scenarios also reduces the center’s GHGs.

“Practically all data centers have some excess capacity,” the white paper states. “Data center owners should consider whether it is possible to increase the utilization of standby and redundant generation and energy storage assets for DSR [demand-side response] or, indeed, configuring low-carbon generation assets to be the primary source of power to the data center.” The sources of this potentially exportable energy capacity are typically mechanical generators, and hot or cold fuel cells.

In terms of sustainability, the white paper asserts there are at least nine metrics to consider, including product carbon footprint, water use, volatile organic compounds, carbon payback, embodied energy, recycling, source material environmental impact, electrical and thermal system efficiency. The paper points out that location, and specific national- and state-related conditions, invariably affect the selection of an appropriate low-carbon technology, in part due to resource availability.

Subsequent white papers will touch on a range of topics that include:

- Assessment and application of gas reciprocating engines and turbines

- Assessment and application of fuel cells to data centers

- Demand response opportunities for data center embedded generation and storage systems

- GHG reduction with blended hydrogen and natural gas generation

Related Stories

Giants 400 | Nov 9, 2022

Top 50 Data Center Contractors + CM Firms for 2022

Holder, Turner, DPR, and HITT Contracting head the ranking of the nation's largest data center contractors and construction management (CM) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Nov 9, 2022

Top 60 Data Center Engineering + EA Firms for 2022

Jacobs, Burns & McDonnell, WSP, and Alfa Tech top the ranking of the nation's largest data center engineering and engineering/architecture (EA) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Nov 9, 2022

Top 30 Data Center Architecture + AE Firms for 2022

HDR, Corgan, Sheehan Nagle Hartray Architects, and Gensler top the ranking of the nation's largest data center architecture and architecture/engineering (AE) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Data Centers | Oct 31, 2022

Data center construction facing record-breaking inflation, delays

Data center construction projects face record-breaking inflation amid delays to materials deliveries and competition for skilled labor, according to research from global professional services company Turner & Townsend.

Data Centers | Oct 25, 2022

Virginia county moves to restrict the growth of new server farms

Loudoun County, Va., home to the largest data center cluster in the world known as Data Center Alley, recently took steps to prohibit the growth of new server farms in certain parts of the county.

BAS and Security | Oct 19, 2022

The biggest cybersecurity threats in commercial real estate, and how to mitigate them

Coleman Wolf, Senior Security Systems Consultant with global engineering firm ESD, outlines the top-three cybersecurity threats to commercial and institutional building owners and property managers, and offers advice on how to deter and defend against hackers.

Giants 400 | Aug 22, 2022

Top 90 Construction Management Firms for 2022

CBRE, Alfa Tech, Jacobs, and Hill International head the rankings of the nation's largest construction management (as agent) and program/project management firms for nonresidential and multifamily buildings work, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Aug 22, 2022

Top 200 Contractors for 2022

Turner Construction, STO Building Group, Whiting-Turner, and DPR Construction top the ranking of the nation's largest general contractors, CM at risk firms, and design-builders for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Aug 22, 2022

Top 45 Engineering Architecture Firms for 2022

Jacobs, AECOM, WSP, and Burns & McDonnell top the rankings of the nation's largest engineering architecture (EA) firms for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Aug 22, 2022

Top 80 Engineering Firms for 2022

Kimley-Horn, Tetra Tech, Langan, and NV5 head the rankings of the nation's largest engineering firms for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2022 Giants 400 Report.