About one in 10 households in the U.S. is renting space from a self-storage facility. And demand in recent years has soared. About 15 million sf of storage space were added nationwide last year, and another 500 to 600 facilities with an aggregate 30 million sf of space should be completed in 2016.

“It’s a hell of a party,” said Ron Havner, CEO and President of Public Storage, the industry’s biggest storage operator, during the Self-Storage Association Fall Conference and Trade Show in Las Vegas last September. When he made that comment, Public Storage was operating more than 2,200 locations in the U.S. and Europe, and had another 60 facilities in its pipeline. The Glendale, Calif.-based company is targeting Dallas and Houston in particular for aggressive growth.

Expansion through acquisition, however, has been the game plan for the big REITs in this sector, like Public Storage, CubeSmart, and Sovran Self-Storage, as well as large private operators. One REIT, CubeSmart, plans to spend between $200 million and $250 million on acquisitions this year, while spending another $168.3 million on opening seven new facilities

One of CubeSmart’s recent purchases is All Stor Self-Storage, a three-story building with more than 600 units, which was built only a year ago by Preferred Self Storage Builders. Last month, JLL, the financial services firm, singled out All Stor as an example of how self-storage was breaking free of its industrial, bland, square-box image and was leaning more toward appealing design.

“We have begun to see local governments step up and enforce codes that are intended to make self storage assets blend in with the community,” wrote Brian Somoza, JLL’s Capital Markets’ Managing Director. “These facilities need to adhere to specific architectural guidelines, and they have to have all the bells and whistles.”

In fact, self storage has been moving in this direction for more than a decade, says Edd Haskins, owner of Preferred Self Storage Builders, which over the past 15 years has built more than a dozen facilities. “It’s been necessary to upgrade just to receive entitlements,” he tells BD+C.

However, zoning hasn’t always kept pace with the industry. Haskins says that too many municipalities still zone self storage industrial. “But I can’t make money” when one of his buildings is in an industrial area, he explains, because 70% of his customers are women, “and they need to feel confident about the neighborhood and the facility.”

That customer base has certainly been a factor driving better design of these facilities. “The trend now is toward multistory, climate-controlled buildings, with more building materials like brick, architectural panels, glass, and offices that are more retail oriented,” says Ketan Patel, Senior Director of real estate development for CubeSmart.

All Stor Self Storage sits at the foot of Steiner Ranch, one of Austin’s largest residential subdivisions. Haskins notes that this facility’s “modernistic” design is unique, partly because the first floor is built into the side of a hill.

JLL highlighted this 61,440-sf facility’s large windows, electronic access, drive-up units and common area lights that are motion activated as evidence of upgraded design. The exterior leads into a retail-oriented office where boxes and moving items are available for sale. Haskins confirms that All-Stor includes a two-bedroom, one-bath apartment for its building manager.

JLL notes that self-storage aesthetics are also driven by investment into this sector. Last year, this market saw a 73% increase, to $3.3 billion, in commercial mortgage-backed securities issuance in the storage sector, according to data from Trepp.com. JLL reports that a “large part” of that investment can be attributed to new construction in this sector.

Haskins says that a lot of newer self-storage buildings are “camouflaged” to look like something else. Indeed, one of CubeSmart’s newer facilities is a five-story building in Arlington, Va., on nearly fives, which could easily be mistaken for an office. (Patel says that Butz Wilbern of Falls Church, Va., and Frank G. Relf Architect in Melville, N.Y., are among the architectural firms his company works with.)

“That’s not my focus,” counters Haskins. “We always want to build something that’s distinct and identifiable. I’m proud to be in the self-storage business and don’t want to hide that.”

Preferred has several new self-storage buildings under construction or development. But Haskins says he’s selling buildings almost as fast as he can build them. “There’s a tremendous demand for this asset class,” he says, adding that cap rates for Class A self-storage buildings are “pretty aggressive, at between 5% and 7%.”

Last November, CubeSmart paid $13.1 million for a 4.7-acre parcel in Arlington, Va., that included a warehouse, which the company demolished to make way for its five-story self-storage unit that resembles an office building. Self-storage operators are paying a lot more attention to design and amenities, as women account for more than 70% of their renters. Image: CubeSmart

Related Stories

Industrial Facilities | Jun 20, 2023

A new study presses for measuring embodied carbon in industrial buildings

The embodied carbon (EC) intensity in core and shell industrial buildings in the U.S. averages 23.0 kilograms per sf, according to a recent analysis of 26 whole building life-cycle assessments. That means a 300,000-sf warehouse would emit 6,890 megatons of carbon over its lifespan, or the equivalent of the carbon emitted by 1,530 gas-powered cars driven for one year. Those sobering estimates come from a new benchmark study, “Embodied Carbon U.S. Industrial Real Estate.”

Industrial Facilities | May 31, 2023

Nascent cowarehousing firm steps forward with facilities that offer a communal user experience

The design firm Ware Malcomb has partnered with FlexHQ, a Los Angeles-based firm offering cowarehouse leasing solutions, to create a scalable workspace that emphasizes leasing flexibility and higher-quality and environmentally friendlier amenities than aren’t commonly found in this building type, say representatives from both companies.

Multifamily Housing | May 12, 2023

An industrial ‘eyesore’ is getting new life as an apartment complex

The project, in Metuchen, N.J., includes significant improvements to a nearby wildlife preserve.

Industrial Facilities | Apr 10, 2023

Implementing human-centric design in operations and maintenance facilities

Stantec's Ryan Odell suggests using the human experience to advance OMSF design that puts a focus on wellness and efficiency.

Warehouses | Mar 29, 2023

Construction completed on Canada’s first multi-story distribution center

Construction was recently completed on Canada’s first major multi-story industrial project, a distribution center in Burnaby, British Columbia. The project provides infrastructure for last-mile delivery in a world where consumers have come to expect next-day and same-day delivery, according to Ware Malcomb, the project's architect of record.

Industrial Facilities | Mar 6, 2023

The largest planned logistics and business park in North America gets under way in Southern California

The $25 billion World Logistics Center will boost the supply chain capabilities of Southern California and will serve as a distribution center for destinations across the continent.

Intelligent Lighting | Feb 13, 2023

Exploring intelligent lighting usage in healthcare, commercial facilities

SSR's Todd Herrmann, PE, LEEP AP, explains intelligent lighting's potential use cases in healthcare facilities and more.

Giants 400 | Feb 9, 2023

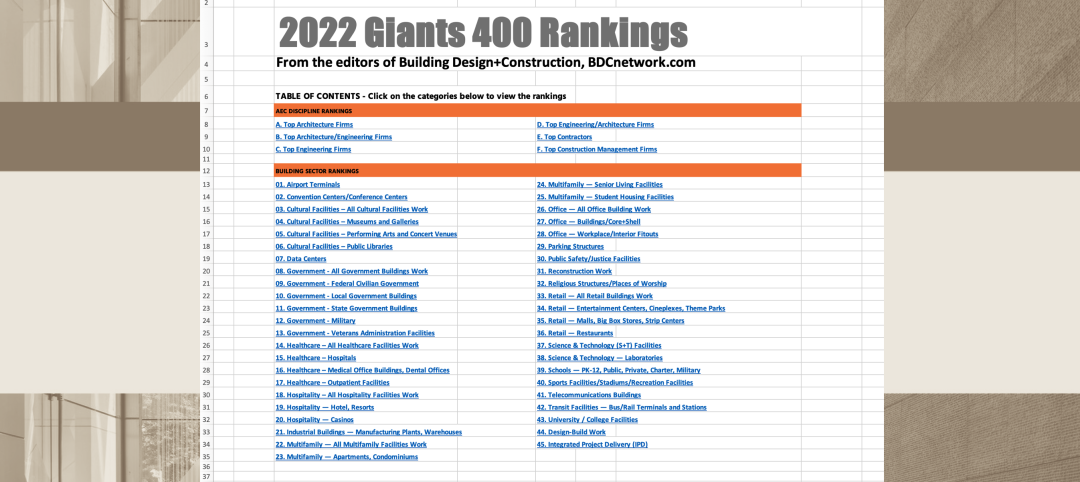

New Giants 400 download: Get the complete at-a-glance 2022 Giants 400 rankings in Excel

See how your architecture, engineering, or construction firm stacks up against the nation's AEC Giants. For more than 45 years, the editors of Building Design+Construction have surveyed the largest AEC firms in the U.S./Canada to create the annual Giants 400 report. This year, a record 519 firms participated in the Giants 400 report. The final report includes 137 rankings across 25 building sectors and specialty categories.

Giants 400 | Feb 6, 2023

2022 Telecommunications Facility Sector Giants: Top architecture, engineering, and construction firms in the U.S. telecommunications facility sector

AECOM, Alfa Tech, Kraus-Anderson, and Stantec head BD+C's rankings of the nation's largest telecommunications facility sector architecture, engineering, and construction firms, as reported in the 2022 Giants 400 Report.

Industrial Facilities | Dec 21, 2022

New York City’s largest industrial building is nearing completion

The multistory facility is arriving at a time when space remains at a premium.