The once steady 10% growth rate in healthcare construction spending has slowed, but hasn't entirely stopped.

Spending is currently 1.7% higher than the same time last year when construction materials costs were 8% higher. The 2.5% monthly jobsite spending decline since last fall is consistent with the decline in materials costs. A 7% decline is expected in the next six months, consistent with the year-to-date drop in the value of healthcare construction starts, which includes a 66% plunge in June.

The June drop is partly random but also reflects concern by healthcare project managers about how the outcome of the current healthcare debate in Congress will affect their operations. Specifically, they are concerned about reimbursement rates from federally operated or regulated insurance plans. With no final plan ready for a vote in early August, expect the cautious spending to continue through the summer.

|

| Healthcare construction spending is currently 1.7% higher than the same time last year, led by hospital work, which is 14% higher than a year ago. |

All options being considered in Washington envision expanded healthcare services that would require additional facility capacity by 2011—but financing for the expanded services remains fuzzy. Half the added cost appears to be vague promises of $40 billion plus annual fee cuts by hospitals and drug companies. Significant growth in healthcare construction will not resume until the healthcare financing arrangements are final and judged to be realistic.

Hospital construction spending is currently 14% higher than a year ago, while spending for other healthcare facilities, including specialized office buildings and residential care facilities, is off 25% from last year. The developers of these buildings react to a recession much as developers of commercial buildings do: They pull back when they see falling rental and occupancy rates. By this time next year, expect spending for medical office buildings and possible residential care facilities to be expanding again in a growing economy while spending for hospitals is expected to still be stuck at current levels.

Related Stories

Building Tech | Mar 14, 2023

Reaping the benefits of offsite construction, with ICC's Ryan Colker

Ryan Colker, VP of Innovation at the International Code Council, discusses how municipal regulations and inspections are keeping up with the expansion of off-site manufacturing for commercial construction. Colker speaks with BD+C's John Caulfield.

Healthcare Facilities | Mar 13, 2023

Next-gen behavioral health facilities use design innovation as part of the treatment

An exponential increase in mental illness incidences triggers new behavioral health facilities whose design is part of the treatment.

Healthcare Facilities | Mar 6, 2023

NBBJ kicks off new design podcast with discussion on behavioral health facilities

During the second week of November, the architecture firm NBBJ launched a podcast series called Uplift, that focuses on the transformative power of design. Its first 30-minute episode homed in on designing for behavioral healthcare facilities, a hot topic given the increasing number of new construction and renovation projects in this subsector.

Sustainability | Mar 2, 2023

The next steps for a sustainable, decarbonized future

For building owners and developers, the push to net zero energy and carbon neutrality is no longer an academic discussion.

University Buildings | Feb 23, 2023

Johns Hopkins shares design for new medical campus building named in honor of Henrietta Lacks

In November, Johns Hopkins University and Johns Hopkins Medicine shared the initial design plans for a campus building project named in honor of Henrietta Lacks, the Baltimore County woman whose cells have advanced medicine around the world. Diagnosed with cervical cancer, Lacks, an African-American mother of five, sought treatment at the Johns Hopkins Hospital in the early 1950s. Named HeLa cells, the cell line that began with Lacks has contributed to numerous medical breakthroughs.

Healthcare Facilities | Feb 21, 2023

Cleveland's Glick Center hospital anchors neighborhood revitalization

The newly opened MetroHealth Glick Center in Cleveland, a replacement acute care hospital for MetroHealth, is the centerpiece of a neighborhood revitalization. The eleven-story structure is located within a ‘hospital-in-a-park’ setting that will provide a bucolic space to the community where public green space is lacking. It will connect patients, visitors, and staff to the emotional and physical benefits of nature.

Multifamily Housing | Feb 16, 2023

Coastal Construction Group establishes an attainable multifamily housing division

Coastal Construction Group, one of the largest privately held construction companies in the Southeast, has announced a new division within their multifamily sector that will focus on the need for attainable housing in South Florida.

Intelligent Lighting | Feb 13, 2023

Exploring intelligent lighting usage in healthcare, commercial facilities

SSR's Todd Herrmann, PE, LEEP AP, explains intelligent lighting's potential use cases in healthcare facilities and more.

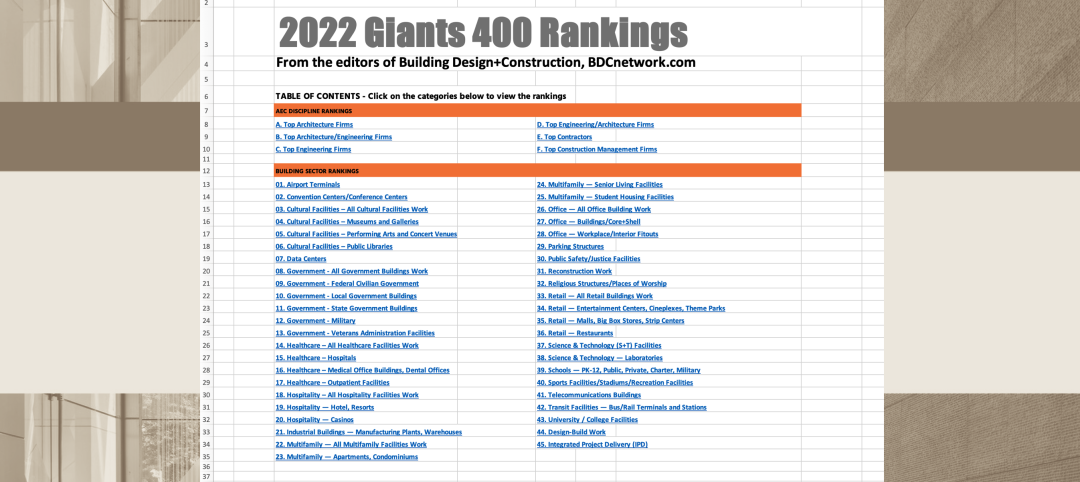

Giants 400 | Feb 9, 2023

New Giants 400 download: Get the complete at-a-glance 2022 Giants 400 rankings in Excel

See how your architecture, engineering, or construction firm stacks up against the nation's AEC Giants. For more than 45 years, the editors of Building Design+Construction have surveyed the largest AEC firms in the U.S./Canada to create the annual Giants 400 report. This year, a record 519 firms participated in the Giants 400 report. The final report includes 137 rankings across 25 building sectors and specialty categories.

Giants 400 | Feb 6, 2023

2022 Reconstruction Sector Giants: Top architecture, engineering, and construction firms in the U.S. building reconstruction and renovation sector

Gensler, Stantec, IPS, Alfa Tech, STO Building Group, and Turner Construction top BD+C's rankings of the nation's largest reconstruction sector architecture, engineering, and construction firms, as reported in the 2022 Giants 400 Report.