The cost of goods used in construction jumped in April at the fastest year-over-year rate since 2011, with ongoing increases for a wide range of building materials, including many that are subject to proposed tariffs that could drive prices still higher and cause scarcities, according to an analysis by the Associated General Contractors of America of Labor Department data released today. Association officials said that the new data indicates many firms are already being squeezed by higher materials prices that they are unable to pass along to their customers.

"Contractors have started to boost the prices they charge, but they are falling further behind on the cost of materials they buy," said the association's chief economist, Ken Simonson. "This imbalance poses two risks—either contractors will suffer decreased profit margins or project owners with fixed budgets will cut back on the projects they undertake."

The producer price index for inputs to construction industries, goods—a measure of all materials used in construction projects including items consumed by contractors, such as diesel fuel—rose 1.0% in April alone and 6.4% over 12 months. The year-over-year increase was the steepest since 2011, the economist noted. Meanwhile, the producer price index for nonresidential construction—a measure of what contractors say they would charge to put up a mix of school, office, warehouse, industrial and health care buildings—increased 1.1% for the month and 4.2% year-over-year.

"The gap between the 6.4% rise in the cost of construction goods and the 4.2% increase in prices charged is ominous," Simonson observed. "Unfortunately, the gap may widen further if tariffs or quotas push up costs further for the many steel, aluminum and wood products used in construction."

From April 2017 to April 2018, the producer price index jumped by 11.9% for aluminum mill shapes, 11.0% for lumber and plywood and 7.4% for steel mill products. The U.S. has been in a dispute with Canada over lumber imports, has imposed tariffs on several types of steel and has announced or recently imposed additional tariffs—not reflected in the April price index—on steel, aluminum and numerous Chinese construction products.

Other construction inputs that rose sharply in price from April 2017 to April 2018 include diesel fuel, 41.6%; copper and brass mill shapes, 10.5%; gypsum products, 7.5%; ready-mix concrete, 6.9%; and truck transportation of freight, 6.0%.

Association officials said the Trump Administration's tariffs pose a real threat to the continued growth of the construction industry. As steel, aluminum, and wood prices continue to surge, contractors will be forced to charge more, potentially discouraging or delaying new infrastructure and development projects.

"The new tariffs have the potential to undermine many of the benefits of the President's recently enacted tax and regulatory reforms," said Stephen E. Sandherr, the association's chief executive officer. "Instead of investing their tax savings in new personnel and equipment, many firms are being forced to use them to cover increasing steel and aluminum costs."

View producer price indexes for construction.

Related Stories

Market Data | Apr 19, 2017

Architecture Billings Index continues to strengthen

Balanced growth results in billings gains in all regions.

Market Data | Apr 13, 2017

2016’s top 10 states for commercial development

Three new states creep into the top 10 while first and second place remain unchanged.

Market Data | Apr 6, 2017

Architecture marketing: 5 tools to measure success

We’ve identified five architecture marketing tools that will help your firm evaluate if it’s on the track to more leads, higher growth, and broader brand visibility.

Market Data | Apr 3, 2017

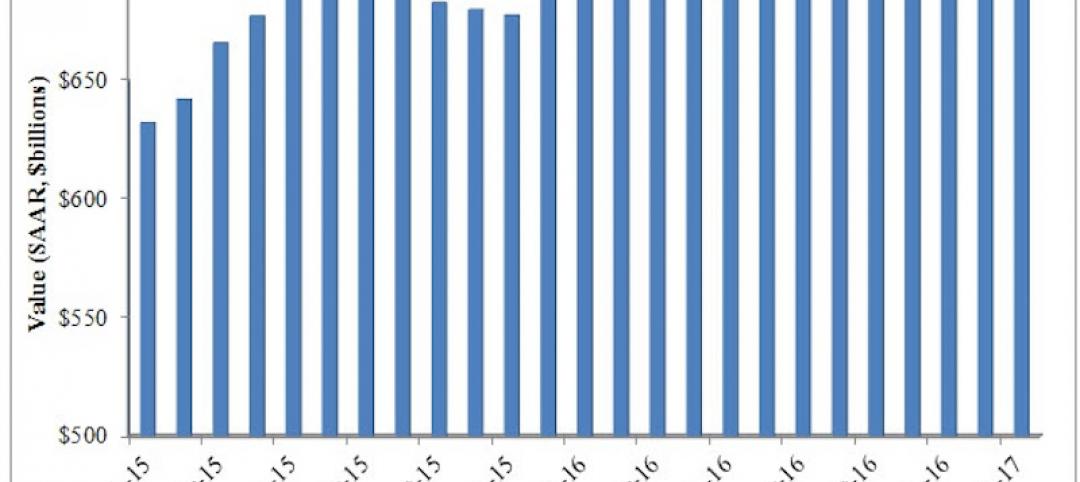

Public nonresidential construction spending rebounds; overall spending unchanged in February

The segment totaled $701.9 billion on a seasonally adjusted annualized rate for the month, marking the seventh consecutive month in which nonresidential spending sat above the $700 billion threshold.

Market Data | Mar 29, 2017

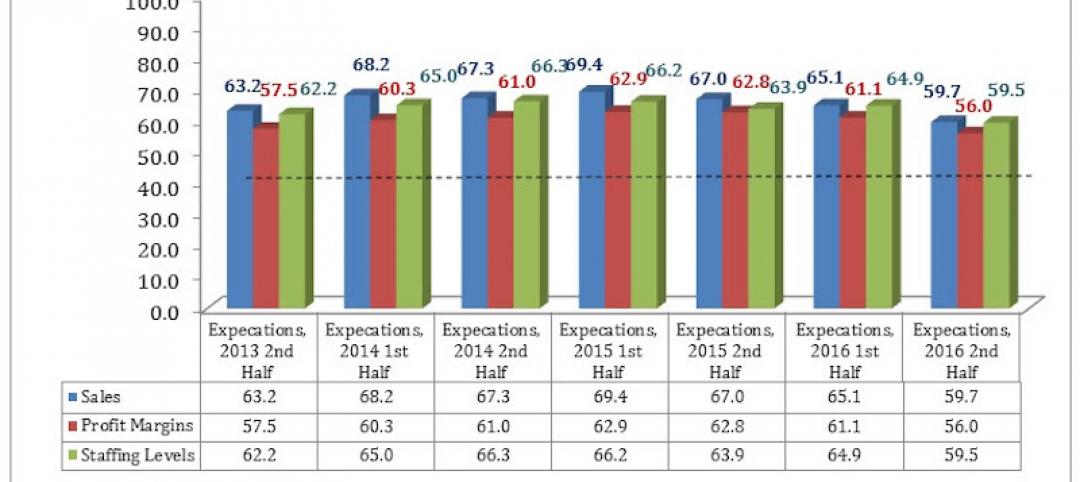

Contractor confidence ends 2016 down but still in positive territory

Although all three diffusion indices in the survey fell by more than five points they remain well above the threshold of 50, which signals that construction activity will continue to be one of the few significant drivers of economic growth.

Market Data | Mar 24, 2017

These are the most and least innovative states for 2017

Connecticut, Virginia, and Maryland are all in the top 10 most innovative states, but none of them were able to claim the number one spot.

Market Data | Mar 22, 2017

After a strong year, construction industry anxious about Washington’s proposed policy shifts

Impacts on labor and materials costs at issue, according to latest JLL report.

Market Data | Mar 22, 2017

Architecture Billings Index rebounds into positive territory

Business conditions projected to solidify moving into the spring and summer.

Market Data | Mar 15, 2017

ABC's Construction Backlog Indicator fell to end 2016

Contractors in each segment surveyed all saw lower backlog during the fourth quarter, with firms in the heavy industrial segment experiencing the largest drop.

Market Data | Feb 28, 2017

Leopardo’s 2017 Construction Economics Report shows year-over-year construction spending increase of 4.2%

The pace of growth was slower than in 2015, however.