Contractors continue to face a shortage of building materials like lumber and steel, while cost fluctuations for the building products are having increasing impact on business, according to second quarter data from the U.S. Chamber of Commerce Commercial Construction (Index). This quarter, 84% of contractors are facing at least one material shortage. Almost half (46%) of contractors say less availability of building products has been a top concern lately, up from 33% who said the same last quarter.

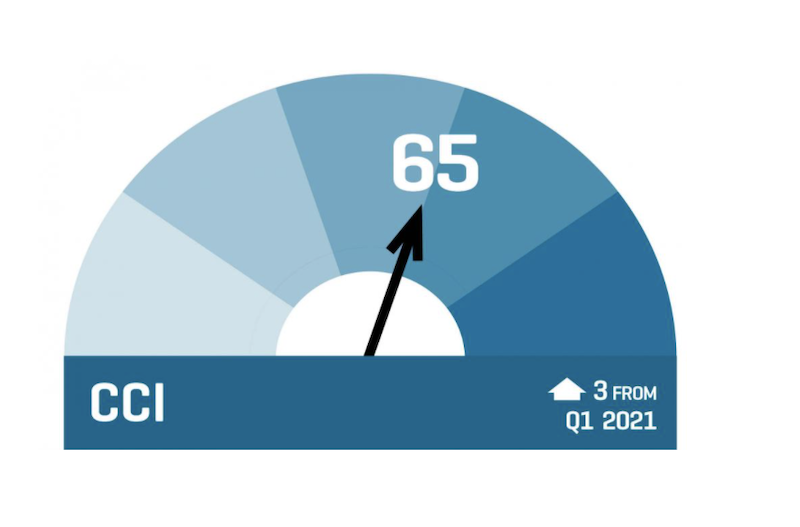

Despite the materials challenges, the overall Index score rose three points to 65 (its highest reading since a score of 74 in Q1 2020 ahead of the pandemic) and contractors are optimistic on outlook for revenue expectations, new business

— 89% of contractors report a moderate to high level of confidence in new business opportunities in the next 12 months, up from 86% in Q1. Those indicating a high level of confidence jumped 10 points to 34% from last quarter.

— Over half (52%) of contractors say they will hire more employees in the next six months, up from 46% in Q1.

— More contractors (39%) expect

— For the first time in a year, the percentage of contractors planning to spend more on tools and equipment in the next six months (44%) is higher than those who say they will not spend more (42%).

“Businesses are experiencing a great resurgence as vaccines allow the economy to fully reopen. Rising optimism from the commercial construction industry reflects what we’re seeing across the broader economy,” said U.S. Chamber of Commerce Executive Vice President and Chief Policy Officer Neil Bradley. “However, contractors continue to face challenges navigating materials shortages and

Materials Shortages Worsen

Most (84%) contractors say they face at least one material shortage, up from 71% in Q1. One in three (33%) are experiencing a shortage in wood/lumber, and 29% are seeing a shortage of steel. Of those contractors experiencing shortages, 46% say they are having a high impact on projects, up from 20% saying the same in Q1.

Additionally, almost all (94%) contractors say cost fluctuations are having a moderate to high impact on their business, up 12 percentage points from Q1 and up 35 points year-over-year. Wood/lumber and steel are the products of highest concern.

Contractors Face Worker Shortage Crisis

In the midst of a deepening workforce crisis, finding skilled labor continues to be a challenge for contractors. This quarter, 88% report moderate to high levels of difficulty finding skilled workers, of which, nearly half (45%) report a high level of difficulty. Of those who reported difficulty finding skilled labor, over a third (35%) have turned down work because of skilled labor shortages.

Most (87%) contractors also report a moderate to high level of concern about the cost of skilled labor. Of those who expressed concern, 64% say the cost has increased over the past six months, and more than three-quarters (77%) expect it to continue to increase over the next year.

Trade and Tariff Concerns are Up

This quarter, contractors expressed increasing concern about the potential effect of tariffs and trade wars on access to materials over the next three years.

More (45%) say steel and aluminum tariffs will have a high to very-high degree of impact, up from 35% in Q1. Forty percent now say new construction material and equipment tariffs will have a high to very-high degree of impact, up from 29% in Q1. And 30% expect high impacts from trade conflicts with other countries, up from 19% in Q1.

About the Index

The U.S. Chamber of Commerce Commercial Construction Index is a quarterly economic index designed to gauge the outlook for, and resulting confidence in, the commercial construction industry. The Index comprises three leading indicators to gauge confidence in the commercial construction industry, generating a composite Index on the scale of 0 to 100 that serves as an indicator of health of the contractor segment on a quarterly basis.

The Q2 2021 results from the three key drivers are:

— Revenue: Contractors’ revenue expectations over the next 12 months increased to 61 (up four points from Q1).

— New Business Confidence: The overall level of contractor confidence increased to 62 (up three points from Q1).

— Backlog: The ratio of average current to ideal backlog rose three points to 72 (up three points from Q1).

The research was developed with Dodge Data & Analytics (DD&A), the leading provider of insights and data for the construction industry, by surveying commercial and institutional contractors.

Visit www.

Related Stories

Hotel Facilities | Jul 26, 2023

Hospitality building construction costs for 2023

Data from Gordian breaks down the average cost per square foot for 15-story hotels, restaurants, fast food restaurants, and movie theaters across 10 U.S. cities: Boston, Chicago, Las Vegas, Los Angeles, Miami, New Orleans, New York, Phoenix, Seattle, and Washington, D.C.

Market Data | Jul 24, 2023

Leading economists call for 2% increase in building construction spending in 2024

Following a 19.7% surge in spending for commercial, institutional, and industrial buildings in 2023, leading construction industry economists expect spending growth to come back to earth in 2024, according to the July 2023 AIA Consensus Construction Forecast Panel.

Contractors | Jul 13, 2023

Construction input prices remain unchanged in June, inflation slowing

Construction input prices remained unchanged in June compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics Producer Price Index data released today. Nonresidential construction input prices were also unchanged for the month.

Contractors | Jul 11, 2023

The average U.S. contractor has 8.9 months worth of construction work in the pipeline, as of June 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator remained unchanged at 8.9 months in June 2023, according to an ABC member survey conducted June 20 to July 5. The reading is unchanged from June 2022.

Market Data | Jul 5, 2023

Nonresidential construction spending decreased in May, its first drop in nearly a year

National nonresidential construction spending decreased 0.2% in May, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.06 trillion.

Apartments | Jun 27, 2023

Average U.S. apartment rent reached all-time high in May, at $1,716

Multifamily rents continued to increase through the first half of 2023, despite challenges for the sector and continuing economic uncertainty. But job growth has remained robust and new households keep forming, creating apartment demand and ongoing rent growth. The average U.S. apartment rent reached an all-time high of $1,716 in May.

Industry Research | Jun 15, 2023

Exurbs and emerging suburbs having fastest population growth, says Cushman & Wakefield

Recently released county and metro-level population growth data by the U.S. Census Bureau shows that the fastest growing areas are found in exurbs and emerging suburbs.

Contractors | Jun 13, 2023

The average U.S. contractor has 8.9 months worth of construction work in the pipeline, as of May 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator remained unchanged at 8.9 months in May, according to an ABC member survey conducted May 20 to June 7. The reading is 0.1 months lower than in May 2022. Backlog in the infrastructure category ticked up again and has now returned to May 2022 levels. On a regional basis, backlog increased in every region but the Northeast.

Industry Research | Jun 13, 2023

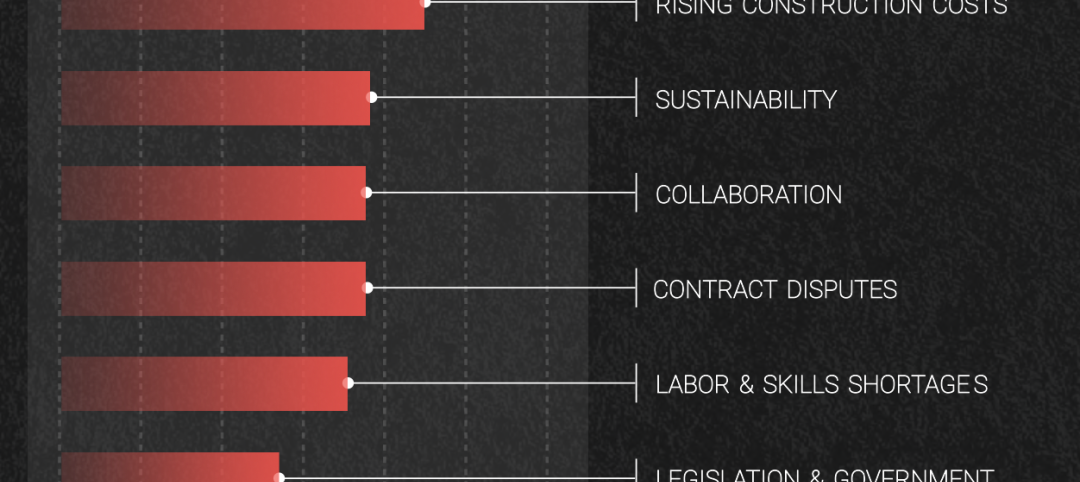

Two new surveys track how the construction industry, in the U.S. and globally, is navigating market disruption and volatility

The surveys, conducted by XYZ Reality and KPMG International, found greater willingness to embrace technology, workplace diversity, and ESG precepts.

| Jun 5, 2023

Communication is the key to AEC firms’ mental health programs and training

The core of recent awareness efforts—and their greatest challenge—is getting workers to come forward and share stories.