The pressure to reduce cap-ex and op-ex costs in the data center sector, while meeting an ever-growing demand for IT capacity, is driving owners and operators to employ advanced tools and services for the precise tracking and monitoring of nearly every component within their installations—from energy performance and power reliability to IT systems capacity and space utilization.

With better information, and more of it, data center owners believe they will be able to extend the life and optimize the performance of their buildings and IT infrastructure, enabling them to defer, or even avoid, costly upgrades, renovations, expansions, and new construction projects.

The demand for sophisticated monitoring solutions has spurred a new market segment—data center infrastructure management (DCIM)—that is likely to impact the way data center projects are planned, designed, built, and operated.

“DCIM is a powerful tool, when properly designed and deployed, to help manage the capacity, delivery, consumption, and energy across a data center,” says Jay Chester, PE, Senior Project Manager with SSOE’s Advanced Technology group (www.ssoe.com). “The data captured for analysis models can be structured to help predict performance and allow for ‘what if’ testing of equipment placement and operational scheduling.”

While still in its infancy, the DCIM movement is expected to grow sixfold by 2020, according to a new report by Navigant Research (www.navigantresearch.com). The firm’s Research Director, Eric Woods, predicts annual spending on DCIM-related software and services will balloon to more than $4.5 billion over the next six years, from its current market size of $663 million. Moreover, research firm Gartner predicts that 60% of large data centers (at least 3,000 sf) in North America will adopt some type of DCIM solution by 2017.

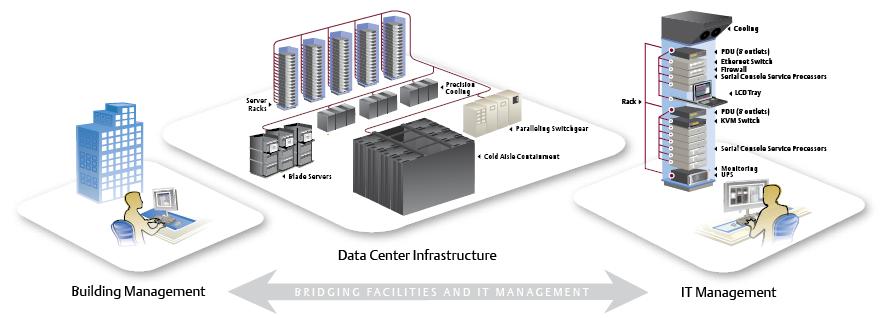

“One of the underlying trends driving the greater adoption and visibility of DCIM solutions is new thinking about the relationship between the building infrastructure for data centers and the IT capacity,” says Woods. “Traditionally, you built the building, put in the basic infrastructure management systems, and largely forgot about it. That is, all the changes occurred at the IT level, in terms of the various evolutions of technology. The two functions—facilities and IT—operated in silos.”

Emerson’s Trellis DCIM platform combines software and hardware into a solution that is managed with a single, Web-enabled, real-time view. It allows data center owners to monitor and measure, in real time, everything from energy and space efficiency to power allocation and server capacity.

Using advanced data collection and monitoring tools, data center providers believe they can bridge the gap between the facilities management function and IT function to offer a holistic, real-time view of their data centers, in an effort to optimize performance, utilization, and longevity.

“What we’re seeing among leading-edge players, as well as in academic research, is moving in the direction of thinking about data centers as a whole unit, sort of like a giant computer,” says Woods. “The data center is a big box that itself is part of the optimized capacity of the computing power in the space.”

DCIM's impact on the Building Team

This more holistic approach to data center planning and operations means that the design table is about to get a little more crowded, as IT managers begin to play a larger role in the planning, design, and preconstruction processes. It also means that Building Teams will be partly responsible for fostering collaboration between their clients’ facilities staff and IT team—two groups with very different priorities and agendas, says Addam Friedl, Senior Vice President, Mission Critical Facilities, with Environmental Systems Design (www.esdesign.com).

“Getting the two sides to sit down at the same table and agree on what the systems are supposed to do, what information needs to be gathered, and how it should be disseminated can be a real challenge, depending on the client,” says Friedl.

A thornier issue, he says, is the mind-boggling amount of data being collected and figuring out how to put it to use. Depending on the scale of the DCIM implementation, data center facilities could be looking at millions of data points that must be collected, organized, and analyzed.

“My challenge to the client is always: What are you going to do with all this data?” says Friedl. “A large data center with just a basic building management system and power monitoring system will have tens of thousands of data points; a DCIM setup could have millions. A lot of operators don’t use the data to the level they think they want to use it to.”

Furthermore, who’s going to be responsible for crunching the data? Facilities? IT? A third-party DCIM provider? An AEC firm? These are questions that need to be sorted out well before the data center is constructed and occupied. Friedl envisions many data center owners outsourcing the DCIM functions, either to an AEC firm involved in the project or a DCIM solutions provider.

Other advice for Building Teams from our experts includes:

Be prepared to coach clients through the DCIM implementation process. Because the movement is so new, clients will likely lean on the Building Team for guidance on everything from choosing the DCIM components to identifying critical data points to figuring out how best to use the data for performance optimization.

Beef up the infrastructure. “As the DCIM system becomes more robust, you’ll need more cabling, a larger cable tray or raceway, and potentially more monitoring capabilities,” says SSOE’s Chester. A more sophisticated control room will also be required. In addition, he says Building Teams will need to design for I/O (input/output) points for gear and equipment that traditionally have not been monitored by a central system.

Flexibility will become more crucial. The ultimate goal of DCIM is to minimize future capital expenditures, so clients will be looking to Building Teams to create facilities that can be easily and inexpensively expanded or reconfigured to keep up with the fast pace of technology and demand for computing power.

Expect to lose business to DCIM solution providers. Some data center clients may choose to completely outsource the DCIM-related functions to a third-party provider, which would almost certainly impact billings on the project.

Related Stories

Student Housing | Apr 19, 2024

Cal State Long Beach student housing project will add 424 beds

A new $115 million project recently broke ground at California State University, Long Beach (CSULB) that will add housing for 424 students at below-market rates. The 108,000 sf La Playa Residence Hall, funded by the State of California’s Higher Education Student Housing Grant Program, will consist of three five-story structures connected by bridges.

MFPRO+ News | Apr 18, 2024

Marquette Companies forms alliance with Orion Residential Advisors

Marquette Companies, a national leader in multifamily development, investment, and management, announces its strategic alliance with Deerfield, Ill.-based Orion Residential Advisors, an integrated multifamily investment and operating firm active in multiple markets nationwide.

Construction Costs | Apr 18, 2024

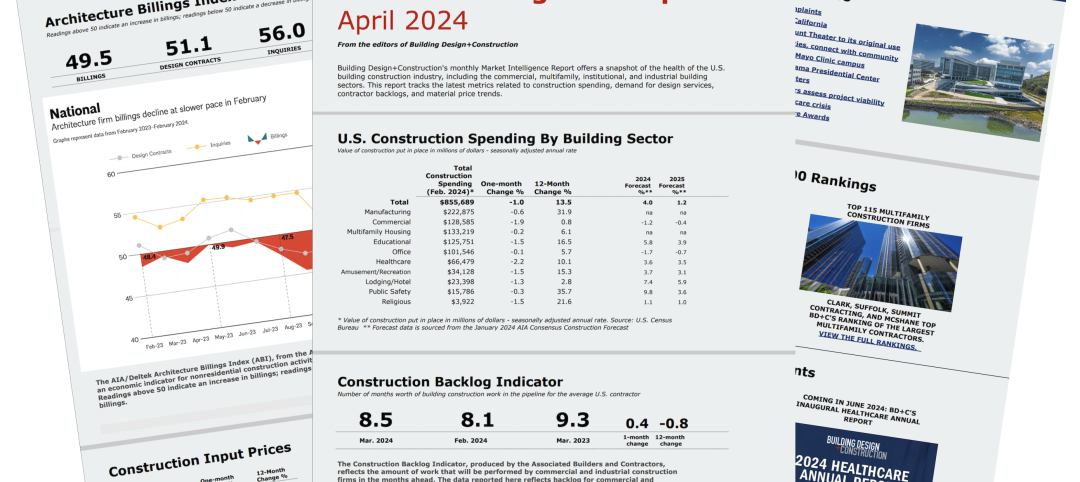

New download: BD+C's April 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

Construction Costs | Apr 16, 2024

How the new prevailing wage calculation will impact construction labor costs

Looking ahead to 2024 and beyond, two pivotal changes in federal construction labor dynamics are likely to exacerbate increasing construction labor costs, according to Gordian's Samuel Giffin.

Healthcare Facilities | Apr 16, 2024

Mexico’s ‘premier private academic health center’ under design

The design and construction contract for what is envisioned to be “the premier private academic health center in Mexico and Latin America” was recently awarded to The Beck Group. The TecSalud Health Sciences Campus will be located at Tec De Monterrey’s flagship healthcare facility, Zambrano Hellion Hospital, in Monterrey, Mexico.

Market Data | Apr 16, 2024

The average U.S. contractor has 8.2 months worth of construction work in the pipeline, as of March 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator increased to 8.2 months in March from 8.1 months in February, according to an ABC member survey conducted March 20 to April 3. The reading is down 0.5 months from March 2023.

Laboratories | Apr 15, 2024

HGA unveils plans to transform an abandoned rock quarry into a new research and innovation campus

In the coastal town of Manchester-by-the-Sea, Mass., an abandoned rock quarry will be transformed into a new research and innovation campus designed by HGA. The campus will reuse and upcycle the granite left onsite. The project for Cell Signaling Technology (CST), a life sciences technology company, will turn an environmentally depleted site into a net-zero laboratory campus, with building electrification and onsite renewables.

Codes and Standards | Apr 12, 2024

ICC eliminates building electrification provisions from 2024 update

The International Code Council stripped out provisions from the 2024 update to the International Energy Conservation Code (IECC) that would have included beefed up circuitry for hooking up electric appliances and car chargers.

Urban Planning | Apr 12, 2024

Popular Denver e-bike voucher program aids carbon reduction goals

Denver’s e-bike voucher program that helps citizens pay for e-bikes, a component of the city’s carbon reduction plan, has proven extremely popular with residents. Earlier this year, Denver’s effort to get residents to swap some motor vehicle trips for bike trips ran out of vouchers in less than 10 minutes after the program opened to online applications.

Laboratories | Apr 12, 2024

Life science construction completions will peak this year, then drop off substantially

There will be a record amount of construction completions in the U.S. life science market in 2024, followed by a dramatic drop in 2025, according to CBRE. In 2024, 21.3 million sf of life science space will be completed in the 13 largest U.S. markets. That’s up from 13.9 million sf last year and 5.6 million sf in 2022.