The BD+C editorial team spent two days last week walking the expo hall at the AIA Conference on Architecture 2019. Our goal: to see what's new in products, materials, and technology for the nonresidential buildings market.

Here's a recap of the highlights from AIA 2019:

SCENES FROM THE SHOW

Sculptor Victor Vehovod (above) plied his craft within Interstate Brick and GMB’s booth, where attendees (below) could also try their hand at brick carving. Images: BD+C

Sherwin-Williams’ booth encouraged attendees to “Think in Color.” A headset read a person’s brainwaves and translated them into color chips, that the subject could then match to the closest shade in Sherwin-Williams’ color palette. Image: BD+C

Bob Borson, FAIA, and Andrew Hawkins (above) conducted interviews for their biweekly “Life of an Architect” podcast. Their soundproof booth was next to BD+C’s exhibit space, where the publication hosted a Whiskey Social Hour (or three) on the first afternoon of the convention (below). Images: BD+C

Bob Borson, FAIA, and Andrew Hawkins (above) conducted interviews for their biweekly “Life of an Architect” podcast. Their soundproof booth was next to BD+C’s exhibit space, where the publication hosted a Whiskey Social Hour (or three) on the first afternoon of the convention (below). Images: BD+C

Owens Corning’s booth included a live wall that called attention to the company’s environmental and sustainable stewardship. (You could also get your picture taken with the Pink Panther.)

OFFSITE

The International Training Center, United Brotherhood of Carpenters

The afternoon before the conference started, we took a tour of this 1.3 million-sf facility on 50 acres near McCarran International Airport. The ITC completed its sixth phase of expansion last year, and is in the process of constructing its third on-campus hotel. When that’s completed, the facility will be able to train up to 600 trainers a week for its 250-plus training centers across North America. The Center, with 11 full-time and 60 part-time instructors, provides all facets of carpenter training, including 40-hour building envelope program (seen below, with technical coordinator Alfonso Bastidos showing how wall installations are tested for water and wind penetration); and a 12-ft-deep dive tank for underwater welding training. Images: BD+C

Tours

Each morning, a section of the convention center’s main hallway turned into a flash mob of attendees waiting to board buses for one of the many tours of residential and commercial destinations in and around Las Vegas. Image: BD+C

THE PRODUCTS

BD+C’s editors visited with several dozen of the suppliers and service providers whose companies accounted for more than 650 exhibits at the conference. Here’s a sampling of who we spoke with and what we learned:

BASF

BASF held a press briefing that focused on the variety of uses for its Neopor rigid thermal insulation product. Business development manager Justin DeMarco noted that BASF had worked with a third-party testing service to validate its Environmental Product Declaration that claims Neopor has the lowest “cradle to gate” carbon footprint of comparable products, the lowest net energy consumption, and the lowest requirement of raw material mass. Katherine Klosowski-Blatz, BASF’s Director of Virtual Design & Construction, noted that her company has created a network of 75 VDC experts, and this year was the official launch of its Global VDC Team and Resource Center. Working with NBS National Library, BIMobject and BIMSmith, BASF’s goal is to become a single source of data for developing BIM objects that support design, scheduling, estimating, installation, and econ-analysis.

Sierra Pacific Windows

Prominent in this supplier’s booth was its timber curtainwall, which since its introduction four years ago has been gaining popularity, especially on new builds and renos on college campuses, said director of architectural sales Andrea Smith.

LG Electronics USA

The company touted its Multi V HVAC technology, whose suite includes newer products with heat and cooling all in one unit. Spokesperson Leigh-Ann Oberg said that architects are becoming more “comfortable” with Variable Refrigerant Flow (VRF) technology, and as proof pointed to last year’s renovation of the 55,000-sf Mackie Building in Milwaukee, Wis. (below), that included a new LG Multi V IV VRF heat-recovery system installed in the building’s clock tower. (The architect on this project was Continuum Architects + Planners. Graef was the ME, and the local HVAC expert was Vyron Corporation.)

The Mackie Building, Milwaukee, Wis. (above), and the HVAC system installed in its clock tower (below). Images: Courtesy of LG Electronics

Cornell Cookson

The company’s Defender Series recently added a StormDefender door designed specifically for safe room protection against tornadoes and hurricanes. The door can be embedded into precast concrete as to be virtually undetectable. Cornell Cookson was also showing a new garage-door design that’s customizable for both residential and commercial installation.

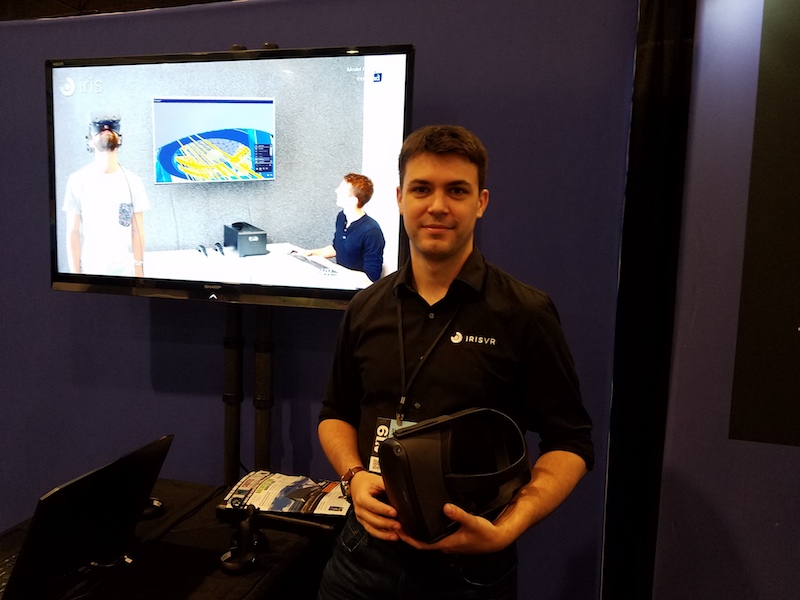

Iris VR

Last year, Iris VR began supporting Navisworks, and more recently it released its support for the mobile headset Oculus Quest, which allows users to download information into the device without the need of being near a computer. CEO and cofounder Shane Scranton forsees his company’s future in supporting as many platforms as possible. He also sees augmented reality as “the other part of the equation” although he doesn’t think AR or avatars are quite there yet for the AEC industry.

Shane Scranton, Iris VR. Image: BD+C

Covestro

This Germany-based company, which spun off from Behr Paint in 2015, makes high-tech polymer materials that go into building products. “Our biggest challenge is keeping up with demand,” said Ian Hughes, senior marketing manager for building and construction. Last October, Covestro revealed its plans for a new $1.7 billion chemical plant in Baytown, Texas, which should operational by 2024 with annual production capacity of 1.1 billion tons of methylene diphenyl diisocyanate, a chemical base for polyurethanes.

Mitsubishi Electric Trane

Spokesperson D. Michael Smith said his company is “all in” on VRF technology for HVAC systems, which give owners more flexibility in terms of how buildings can be zoned for heating and cooling, and doing so with units that, said Smith, are more compact. Some of Mitsubishi’s newer products have a 30% smaller carbon footprint that previous models, and are using less materials in their production. Smith added that smart technology and artificial intelligence continued to work its way into HVAC arena.

National Council of Architectural Registration Boards (NCARB)

NCARB is celebrating its 100th anniversary this year. And the number of licensed architects in the U.S. rose 2% to 115,316 in 2018 over the previous year, and by 13% over the past decade.

But the Council isn’t sitting on its laurels, said CEO Michael Armstrong. Its Futures Task Force has been meeting over the past two years to determine whether the tools for architecture are still appropriate. “NCARB needs to be open” to adjusting to market conditions and industry trends, he said. NCARB will also spend the next two years evaluating data in preparation for the eventual release of its Multiyear Practice Analysis of Architecture.

Michael Armstrong, NCARB CEO. Image: BD+C

Bentley Systems

The theme for Bentley, at the conference and strategically, is “open,” says Solutions Executive Andy Smith, AIA. That means apps for designing site development (OpenSite Designer CONNECT), multidisciplinary building design apps that enable BIM workflows to create information-rich models (OpenBuilding Designer CONNECT), and cloud-base services that enable 2- and 3-D visualization for urban planning (OpenCities Planner). Last year, Bentley made seven acquisitions, including Plaxis, which allows for finite element analysis of soil and rock deformation and stability. Smith said the company is also delving deeper into digital twin technology; it’s iTwin Services enables organizations to create, visualize, and analyze digital twins of infrastructure projects and assets. Bentley has also created an iModelHub, a relational database whose focus is identification and management of change.

CertainTeed Ceilings

CertainTeed’s booth displayed a potpourri of ceiling solutions, including its Rondolo line of perforated panels that are medium-density fiberboard wrapped in a natural wood veneer. Its brand new Wave and Zig Zag baffles (launched that week) are good options for open spaces and acoustical remediation. In conjunction with Hunter Douglas (which CertainTeed acquired a year ago), the company will start offering felt-veneer ceilings later this year under the Heartfelt brand. The booth was also showcasing CertainTeed’s textile ceilings, 30- and 48-inch panels that are durable, bendable, lightweight, and snap easily into aluminum frames.

Kingspan Insulation

This supplier shared research conducted by Currie & Brown, an asset management and construction consultant, to quantify the financial benefits of insulating external walls with Kingspan’s Kooltherm insulation board. Currie & Brown analyzed a database of 70,416 buildings, and reviewed 11 buildings in several U.S. cities. The results show that, in 91.5% of the buildings instances, Kooltherm provided better ROI, and yielded additional square footage vis-a-vis comparable insulation solutions. Kingspan’s booth also highlighted its QuadCore technology that raises the insulation board’s thermal performance, fire performance, and health and wellness certification. QuadCore offers a 30-year thermal warranty.

Suzanne Diaz, Kingspan's North America marketing manager, used AR technology and models to demonstrate where her company's thermal insulation products are installed in buildings in different cities. Image: BD+C

Echelon Masonry

The company, a business unit of Oldcastle, displayed a number of new products, including Aria Slim, a 36-inch-long 4-inch-deep brick veneer that comes in four colors for each of its four textures. Brand manager Dave Jackson said Aria is 4% more expensive than wood but 2% less expensive than steel, and the size of the brick quickens installation.

Reynolds Polymer

Reynolds Polymer is best known for its water-retaining engineering solutions using acrylics and polymers. Its projects range from aquariums, zoos, and sky pools to underwater restaurants. Mark Johnson, Vice President of sales and marketing, said his company—which dominates its field—has been expanding into non-water-retaining projects, such as lighting and indoor skydiving.

ASI Design

This company makes public bathroom products, such as its Phenolic line of privacy stalls, its Velare line of mirrors that hide commercial soap and air dispensers, and its Piatto collection of hand dryers and paper towel dispensers that recess into the wall.

Unity Technologies

Last November, Unity and Autodesk signed an interoperability agreement. During AIA, the two companies officially launched Unity Reflect, Unity’s first nongaming product, which provides users with a live link between Unity and Autodesk’s Revit for reviewing BIM projects and to sync detail changes. Tim McDonough, Unity’s Vice President and GM, says that Unity currently supports 28 different kinds of devices. “We want to be open, and it’s important to make data available to our user core,” said Vikram Dutt, Autodesk’s senior director-building business line. Image: Unity Technologies

Velux

Last year, this skylight manufacturer acquired three companies: Wasco, Jet Group (which makes industrial roof light systems), and Vitral (which sells skylights in England and Denmark). Velux is now placing far greater emphasis on commercial sales. In January, it launched Velux Commercial globally, increased its commercial manufacturing to three plants from one, and its commercial distribution to 9 (soon to be 10) DCs in the United States, where 11 people are now dedicated to its commercial division, says Candice Clark, LEED GA, CSI, Velux’s Commercial Business Development manager. She explained that since Velux is number one in residential skylight market share, commercial sales offer stronger growth potential opportunities.

Ingenious IO

This provider of data-focused solutions for the construction industry used the show to talk up OpenCA—Ingenious’s first solution for architecture, engineering, construction and owner-operators—dedicated primarily to eliminating external fragmentation within the industry. Nick Carter, Ingenious IO’s CEO and founder (below), said his company has developed apps for each stakeholder group that can interact for project administration and real-time external collaboration. OpenCA is being guided by a nine-company committee that includes Colliers International, HKS, DLR Group, ESD, McKinstry, and Bully & Andrews. Carter says he’d like to get subcontractors and manufacturers more involved in project admin, too. And his company’s next move will focus on automated decision making, and risk mitigation.

NIck Carter, Ingenious IO. Image: BD+C

DRI Design

This company, which Kingspan acquired five years ago, makes metal screen panels with framing built into them, which doubles as a water-management system. Jason Zeeff, DRI’s Vice President of sales, said that government and higher ed clients are among his company’s main customers. He added that a big selling feature of DRI’s panels—at a time when labor shortages continue to be a major concern—is the speed at which they can be cut and installed. Zeeff sees growth coming from DRI’s standard offering as a decorative element for more projects.

Nova USA

This Beaverton, Ore.-based lumber company diversified a few years ago into wood finishes, partly out of its owner, Steve Getsiv’s, frustration with the erratic quality of finishes on the market at the time. He said Nova’s production process uses tung oil, low VOC solvents, fungicides, and UV blockers. A gallon of its Exo Shield coating isn’t cheap—$125 a can—but Getsiv insists its coverage reduces the need to restain surfaces. This September, Nova plans to introduce a fastener line for wood decks and siding, made by the U.S.-based manufacturer ARaymond, which offers fastening and assembly solutions for the automotive, industrial, photovoltaic energy, agriculture and health markets.