It’s late November, which means it is market forecast season for the AEC industry. Construction outlook reports from the American Institute of Architects, Associated Builders and Contractors, ConstructConnect, Dodge Data & Analytics, and FMI are beginning to roll in. And if the early prognostications are any indication, 2018 is shaping up to be a little less rosy for the nonresidential and multifamily construction markets.

Dodge suggests the U.S. construction industry has shifted into a “mature stage of expansion.” The 11-13% annual growth in construction starts we witnessed in 2012-15 will slow to 4% in 2017 and 3% in 2018. ConstructConnect is calling for 2-3% growth in nonresidential building starts between 2018 and 2021. FMI is a bit more bullish: 5% growth in nonresidential construction spending in 2018, then 4-5% in 2019-21.

Despite the tepid outlook by construction economists—and numerous reports throughout 2017 that pointed to a looming growth slowdown for several major building sectors—optimism among AEC professionals has not waned. In fact, it has strengthened, according to a November 2017 survey of 356 architects, engineers, and contractors by Building Design+Construction.

While it has been an erratic and drama-filled first year for the Trump Administration, the vast majority of AEC professionals are not overly concerned that the Trump-led White House will negatively impact their businesses.

Six in 10 survey respondents predict that 2018 will be an “excellent” or “very good” business year for their firm. Barely half (50.3%) felt the same way this time last year, according to BD+C’s 2016 survey. Same for revenue forecasts: 62.0% predict their firm’s revenue will increase next year, and only 6.1% are calling for a drop in revenue. This is a markedly rosier outlook than last year’s, when 55.3% of respondents forecasted revenue growth and 11.5% anticipated a drop.

And while it has been an erratic and drama-filled first year for the Trump Administration—travel ban, Russian election interference probe, border wall financing fiasco, Paris Agreement withdrawal—the vast majority of AEC professionals are not overly concerned that the Trump-led White House will negatively impact their businesses. Just 16.6% of respondents cited “business impacts from the Presidential election” as a top-three concern heading into 2018. This sentiment is a somewhat dramatic turn from the post-election attitude, when nearly a third (31.7%) indicated that Trump was a major concern heading into 2017.

So, what are the top AEC business concerns for 2018? Competition from other firms (54.3%), general economic conditions (43.5%), price increases in materials and services (33.8%), and insufficient capital funding for projects (25.8%) top the list. Trump was at the bottom, along with avoiding benefit reductions, avoiding layoffs, and keeping staff motivated.

When asked about their top business development strategies for the next 12-24 months, respondents most often cited: an increase in marketing/PR efforts (47.4%), selective hires to increase competitiveness (46.3%), investment in technology (44.3%), staff training/education (43.5%), and launching a new service or business opportunity (38.0%). At the bottom: open a new office, strategic acquisition, and acquiring a new service or business opportunity.

Multifamily housing and senior living developments head the list of the hottest sectors heading into 2018, according to survey respondents. Well more than half (57.4%) indicated that the prospects for multifamily work were either “excellent” or “good” for 2018; 55.9% said the same for senior living work. Other strong building sectors: office interior/fitouts (55.2%), healthcare (50.1%), office buildings (44.5%), industrial/warehouses (44.1%), data centers (42.3%), and hotels/hospitality (41.3%). At the bottom of the list: religious/places of worship, sports/recreation, transit facilities, and cultural/performing arts buildings.

Related Stories

Green | Apr 8, 2024

LEED v5 released for public comment

The U.S. Green Building Council (USGBC) has opened the first public comment period for the first draft of LEED v5. The new version of the LEED green building rating system will drive deep decarbonization, quality of life improvements, and ecological conservation and restoration, USGBC says.

Codes and Standards | Apr 8, 2024

Boston’s plans to hold back rising seawater stall amid real estate slowdown

Boston has placed significant aspects of its plan to protect the city from rising sea levels on the actions of private developers. Amid a post-Covid commercial development slump, though, efforts to build protective infrastructure have stalled.

Sustainability | Apr 8, 2024

3 sustainable design decisions to make early

In her experience as an architect, Megan Valentine AIA, LEED AP, NCARB, WELL AP, Fitwel, Director of Sustainability, KTGY has found three impactful sustainable design decisions: site selection, massing and orientation, and proper window-to-wall ratios.

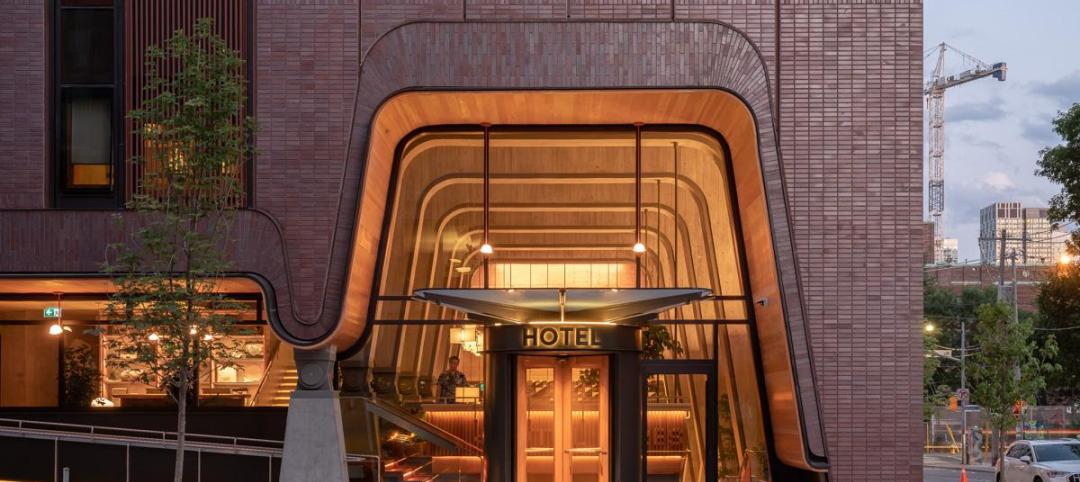

Brick and Masonry | Apr 4, 2024

Best in brick buildings: 9 projects take top honors in the Brick in Architecture Awards

The Ace Hotel Toronto, designed by Shim-Sutcliffe Architects, and the TCU Music Center by Bora Architecture & Interiors are among nine "Best in Class" winners and 44 overall winners in the Brick Industry Association's 2023 Brick in Architecture Awards.

Retail Centers | Apr 4, 2024

Retail design trends: Consumers are looking for wellness in where they shop

Consumers are making lifestyle choices with wellness in mind, which ignites in them a feeling of purpose and a sense of motivation. That’s the conclusion that the architecture and design firm MG2 draws from a survey of 1,182 U.S. adult consumers the firm conducted last December about retail design and what consumers want in healthier shopping experiences.

Healthcare Facilities | Apr 3, 2024

Foster + Partners, CannonDesign unveil design for Mayo Clinic campus expansion

A redesign of the Mayo Clinic’s downtown campus in Rochester, Minn., centers around two new clinical high-rise buildings. The two nine-story structures will reach a height of 221 feet, with the potential to expand to 420 feet.

Sports and Recreational Facilities | Apr 2, 2024

How university rec centers are evolving to support wellbeing

In a LinkedIn Live, Recreation & Wellbeing’s Sadat Khan and Abby Diehl joined HOK architect Emily Ostertag to discuss the growing trend to design and program rec centers to support mental wellbeing and holistic health.

Architects | Apr 2, 2024

AE Works announces strategic acquisition of WTW Architects

AE Works, an award-winning building design and consulting firm is excited to announce that WTW Architects, a national leader in higher education design, has joined the firm.

Office Buildings | Apr 2, 2024

SOM designs pleated façade for Star River Headquarters for optimal daylighting and views

In Guangzhou, China, Skidmore, Owings & Merrill (SOM) has designed the recently completed Star River Headquarters to minimize embodied carbon, reduce energy consumption, and create a healthy work environment. The 48-story tower is located in the business district on Guangzhou’s Pazhou Island.

K-12 Schools | Apr 1, 2024

High school includes YMCA to share facilities and connect with the broader community

In Omaha, Neb., a public high school and a YMCA come together in one facility, connecting the school with the broader community. The 285,000-sf Westview High School, programmed and designed by the team of Perkins&Will and architect of record BCDM Architects, has its own athletic facilities but shares a pool, weight room, and more with the 30,000-sf YMCA.