The coronavirus pandemic is accelerating momentum nationwide for life sciences real estate demand, according to a recent report from JLL's Healthcare and Life Sciences team.

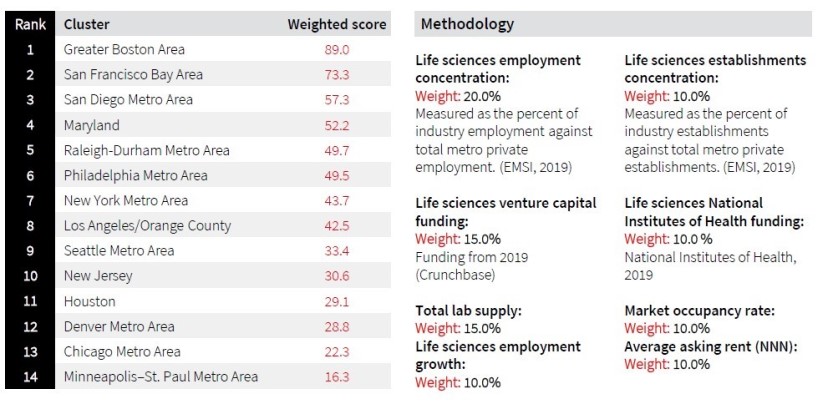

The report, 2020 Life Sciences Real Estate Outlook, outlines the nation's top life sciences cluster hubs (Boston and San Francisco top the list) and pinpoints emerging markets for life sciences real estate.

Audrey Symes, Research Director, JLL Healthcare and Life Sciences, joined BD+C's David Barista on the August 6 episode of The Weekly to discuss the primary drivers of growth across the nation's life sciences cluster hubs. Watch the highlights here:

Here are highlights from JLL's 2020 Life Sciences Real Estate Outlook (text from JLL):

Rankings of the top U.S. life sciences cluster hubs were released today in the JLL 2020 U.S. Life Sciences Outlook, which also tracks the progress of up-and-coming life science markets that are fast becoming options of choice for life science companies and investors alike. Emerging hubs are looking to real estate to boost productivity as they anticipate growth of the worldwide prescription drug market, expected to surpass $1 trillion by 2022.

Boston, San Francisco, and San Diego retained their rankings as leaders among U.S. life sciences ecosystems and top contenders for venture capital investment, capturing 70% of all venture capital (VC) investment in 2019. Boston and San Francisco also lead the other clusters significantly with respect to development, with 2.7 million square feet (MSF) and 4.0 MSF respectively under construction.

Massive infusion of venture capital is also quick to promote life sciences employment growth. In 2019, 11 of 14 cluster markets set or approached record VC funding levels, a significant positive for the reinforcement of cluster market strength, resilience and security.

New York, Los Angeles, and Philadelphia increased their cluster scores since 2019, reaching new peaks in venture capital funding and life sciences employment. As speed to market accelerates for many pharmaceuticals, proximity to incubators at major research institutions has also supported developing clusters such as Raleigh-Durham, Houston, and Maryland, which have attracted recent interest from developers such as ARE, Longfellow and Hines.

Additionally, the race for development of COVID-19-related vaccines is already beginning to energize demand in pharma-heavy New Jersey, a trend that should spread to more markets as 2020 progresses.

“Each cluster has a different specialty and occupies its own point along the maturity spectrum, providing a diverse range of options for investors and occupiers alike,” said Roger Humphrey, Executive Managing Director, JLL Life Sciences. “But they do a share a major commonality. Each cluster features a highly-educated workforce and ties to the research community, which in turn attracts a steady stream of multi-sourced investment that creates a need for institutional real estate.”

Beyond COVID-19’s recent acceleration of innovation in the life sciences industry, life-enhancing pharmaceuticals and medical devices have been increasingly sought out by Millennials reaching the peak of their earning potential and seeking personalized experiences.

And, the upcoming expiration of a suite of patents creates an opportunity for mid-tier life sciences companies to pursue new long-term profit sources. Many new products on the market and in development are curative rather than therapeutic, increasing marketing potential and overall category growth.

“Conditions are ideal for maximum profitability arising from innovative new pharmaceuticals and medical devices,” said Audrey Symes, Research Director, JLL Healthcare and Life Sciences. “Meaningful advances within the life sciences industry, such as machine learning, are creating new sources of workflow and thus real estate demand. This combination of simulative factors sets up the life sciences industry to expand at an unprecedented pace, both in terms of manufacturing and patient demand.”

Related Stories

Laboratories | Apr 22, 2024

Why lab designers should aim to ‘speak the language’ of scientists

Learning more about the scientific work being done in the lab gives designers of those spaces an edge, according to Adrian Walters, AIA, LEED AP BD+C, Principal and Director of SMMA's Science & Technology team.

Laboratories | Apr 15, 2024

HGA unveils plans to transform an abandoned rock quarry into a new research and innovation campus

In the coastal town of Manchester-by-the-Sea, Mass., an abandoned rock quarry will be transformed into a new research and innovation campus designed by HGA. The campus will reuse and upcycle the granite left onsite. The project for Cell Signaling Technology (CST), a life sciences technology company, will turn an environmentally depleted site into a net-zero laboratory campus, with building electrification and onsite renewables.

Laboratories | Apr 12, 2024

Life science construction completions will peak this year, then drop off substantially

There will be a record amount of construction completions in the U.S. life science market in 2024, followed by a dramatic drop in 2025, according to CBRE. In 2024, 21.3 million sf of life science space will be completed in the 13 largest U.S. markets. That’s up from 13.9 million sf last year and 5.6 million sf in 2022.

Sustainability | Mar 21, 2024

World’s first TRUE-certified building project completed in California

GENESIS Marina, an expansive laboratory and office campus in Brisbane, Calif., is the world’s first Total Resource Use and Efficiency (TRUE)-certified construction endeavor. The certification recognizes projects that achieve outstanding levels of resource efficiency through waste reduction, reuse, and recycling practices.

Adaptive Reuse | Mar 7, 2024

3 key considerations when converting a warehouse to a laboratory

Does your warehouse facility fit the profile for a successful laboratory conversion that can demand higher rents and lower vacancy rates? Here are three important considerations to factor before proceeding.

University Buildings | Feb 21, 2024

University design to help meet the demand for health professionals

Virginia Commonwealth University is a Page client, and the Dean of the College of Health Professions took time to talk about a pressing healthcare industry need that schools—and architects—can help address.

Urban Planning | Feb 5, 2024

Lessons learned from 70 years of building cities

As Sasaki looks back on 70 years of practice, we’re also looking to the future of cities. While we can’t predict what will be, we do know the needs of cities are as diverse as their scale, climate, economy, governance, and culture.

Laboratories | Feb 5, 2024

DOE selects design-build team for laboratory focused on clean energy innovation

JE Dunn Construction and SmithGroup will construct the 127,000-sf Energy Materials and Processing at Scale (EMAPS) clean energy laboratory in Colorado to create a direct path from lab-scale innovations to pilot-scale production.

Laboratories | Jan 25, 2024

Tactical issues for renovating university research buildings

Matthew Plecity, AIA, ASLA, Principal, GBBN, highlights the connection between the built environment and laboratory research, and weighs the benefits of renovation vs. new construction.

Laboratories | Jan 22, 2024

Speculative vs purpose-built labs: Pros and cons

Hanbury's George L. Kemper, AIA and R. David Cole, AIA share the unique advantages and challenges of both spec. and purpose-build labs.