In June, the Dwight D. Eisenhower National Airport in Wichita, Kan., opened a new 275,000-sf, 12-gate terminal. According to an airport press release, the new facility “expresses …Wichita’s globally prominent position in Aviation as the Air Capital of the World.” The $200 million-plus terminal (which includes a new consolidated rental car facility) can handle two million passengers annually. It was designed (by HTNB) to support future growth up to 2.4 million.

Passenger traffic at the airport (formerly known as Wichita Mid-Continent Airport) was about 1.5 million in 2014, up 6% from the previous year. As of mid-2015, it is running about even with last year, says Victor White, Wichita Airport Authority’s Director of Airports.

Regional airports like Eisenhower National—which offers flights to and from Atlanta, Chicago, Dallas, Denver, Houston, Las Vegas, Los Angeles, Minneapolis-St. Paul, and Phoenix—are doing everything they can to hold onto business. But small-to-midsize airports are still battling for their lives, as big carriers are cut or eliminate service to non-hub cities.

A 2013 report from Massachusetts Institute of Technology’s International Center for Air Transportation found that small- and medium-sized airports ”have been disproportionally affected by reductions in service,” with medium-sized airports having felt “the biggest brunt” of airline network strategies.

This report predicts that smaller airports close to major hubs could be at risk of losing all of their carrier service by 2018. That’s bad news for local municipalities that see their airports as economic engines.

San Luis Obispo County (Calif.) Regional Airport is a case in point. In 2008 Delta ceased service to Salt Lake City, U.S. Air discontinued flights to Las Vegas, and American Airlines pulled out of the airport altogether. About 60% of travelers in this region now fly out of Los Angeles or the San Francisco Bay Area, according to The Tribune, a newspaper that covers this market.

County officials believe San Luis Obispo’s prosperity hinges on its airport’s growth. Despite ongoing discussions with several carriers, the airport has had trouble finding airlines willing to provide service to Dallas, Salt Lake, or Denver.

White says that over the past decade, Wichita’s airport has managed to grow through aggressive marketing and airline recruitment. Four of the nation’s largest carriers—American, Delta, United, and Southwest—all fly out of Eisenhower, as does Allegiant Air, which caters to leisure travelers.

Wichita’s airport was also one of the first to offer incentives to carriers in the form of guaranteeing revenue and other subsidies, a practice that is now common among small and medium size airports. “Southwest Airlines wouldn’t have come here if we hadn’t provided guarantees and subsidies,” White says.

Rent income from airlines is one of the revenue streams that Wichita tapped to pay for its new terminal, along with user fees, commissions on retail sales, and a $4.50 per passenger facility fee. It also received a $60 million FAA grant, and another $7 million from TSA, says White.

The MIT report noted that while airlines have been grounding their older, smaller turbo planes and moving to larger jets with more seats, they still aren’t offering small and midsize airports enough flights to match demand.

At Eisenhower, White says that carriers are mostly flying Airbus or Boeing jets. But, he’s quick to add, demand continues to outpace availability. “The biggest complaint that passengers have is that flights are too full and it is hard to find a seat at the time and price they want to fly.”

Related Stories

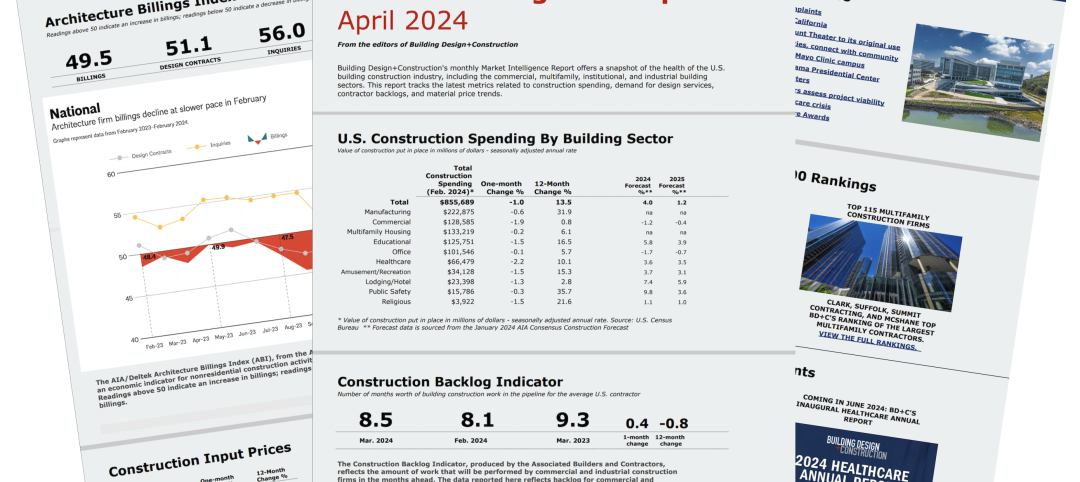

Construction Costs | Apr 18, 2024

New download: BD+C's April 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

MFPRO+ New Projects | Apr 16, 2024

Marvel-designed Gowanus Green will offer 955 affordable rental units in Brooklyn

The community consists of approximately 955 units of 100% affordable housing, 28,000 sf of neighborhood service retail and community space, a site for a new public school, and a new 1.5-acre public park.

Construction Costs | Apr 16, 2024

How the new prevailing wage calculation will impact construction labor costs

Looking ahead to 2024 and beyond, two pivotal changes in federal construction labor dynamics are likely to exacerbate increasing construction labor costs, according to Gordian's Samuel Giffin.

Healthcare Facilities | Apr 16, 2024

Mexico’s ‘premier private academic health center’ under design

The design and construction contract for what is envisioned to be “the premier private academic health center in Mexico and Latin America” was recently awarded to The Beck Group. The TecSalud Health Sciences Campus will be located at Tec De Monterrey’s flagship healthcare facility, Zambrano Hellion Hospital, in Monterrey, Mexico.

Market Data | Apr 16, 2024

The average U.S. contractor has 8.2 months worth of construction work in the pipeline, as of March 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator increased to 8.2 months in March from 8.1 months in February, according to an ABC member survey conducted March 20 to April 3. The reading is down 0.5 months from March 2023.

Laboratories | Apr 15, 2024

HGA unveils plans to transform an abandoned rock quarry into a new research and innovation campus

In the coastal town of Manchester-by-the-Sea, Mass., an abandoned rock quarry will be transformed into a new research and innovation campus designed by HGA. The campus will reuse and upcycle the granite left onsite. The project for Cell Signaling Technology (CST), a life sciences technology company, will turn an environmentally depleted site into a net-zero laboratory campus, with building electrification and onsite renewables.

Codes and Standards | Apr 12, 2024

ICC eliminates building electrification provisions from 2024 update

The International Code Council stripped out provisions from the 2024 update to the International Energy Conservation Code (IECC) that would have included beefed up circuitry for hooking up electric appliances and car chargers.

Urban Planning | Apr 12, 2024

Popular Denver e-bike voucher program aids carbon reduction goals

Denver’s e-bike voucher program that helps citizens pay for e-bikes, a component of the city’s carbon reduction plan, has proven extremely popular with residents. Earlier this year, Denver’s effort to get residents to swap some motor vehicle trips for bike trips ran out of vouchers in less than 10 minutes after the program opened to online applications.

Laboratories | Apr 12, 2024

Life science construction completions will peak this year, then drop off substantially

There will be a record amount of construction completions in the U.S. life science market in 2024, followed by a dramatic drop in 2025, according to CBRE. In 2024, 21.3 million sf of life science space will be completed in the 13 largest U.S. markets. That’s up from 13.9 million sf last year and 5.6 million sf in 2022.

Multifamily Housing | Apr 12, 2024

Habitat starts leasing Cassidy on Canal, a new luxury rental high-rise in Chicago

New 33-story Class A rental tower, designed by SCB, will offer 343 rental units.