Construction employment rebounded from April to May in 45 states and the District of Columbia, following the loss of nearly one million construction jobs nationwide in April, but the gains may be short-lived, according to an analysis by the Associated General Contractors of America of government data released today and a survey the association released on Thursday. Association officials urged officials in Washington to promptly enact measures to fund infrastructure projects and plug looming state and local budget deficits to avoid a “second wave” of job losses.

“The widespread uptick in construction employment in May is welcome news following a month in which industry employment shrank in all but one state,” said Ken Simonson, the association’s chief economist. “Our association’s latest survey shows many firms have been recalling or adding employees in recent weeks, thanks in part to rapid receipt of Paycheck Protection Program loans. But only about one-fifth of firms report winning new or expanded projects, while almost one-third of firms say an upcoming project has been canceled.”

Simonson noted that the association’s latest survey found that nearly one-fourth of contractors reported a project that was scheduled to start in June or later had been canceled. He added that with most states and localities starting a new fiscal year on July 1, even more public construction is likely to be canceled unless the federal government makes up for some of their lost revenue and unbudgeted expenses.

Of the 45 states with construction job gains over the month, Pennsylvania had the largest increase (77,400 jobs or 48.9%). Michigan had the largest percentage increase (51.4%, 50,500 construction jobs). Construction employment declined from April to May in five states. Hawaii lost the largest number and highest percentage of construction jobs (-700 jobs, -1.9%).

From May 2019 to May 2020, 12 states added construction jobs while 38 states and D.C lost jobs. Utah added the most construction jobs over the year (8,200 jobs, 7.6%). South Dakota—the only state to add construction jobs in April—had the largest year-over-year percentage increase (10.3%, 2,400 jobs). Both states set new highs for construction employment, in a series dating to 1990. New York lost the most construction jobs over the year (105,300 jobs, -25.9%). The largest percentage decline occurred in Vermont (-26.1%, -4,000 jobs).

Association officials cautioned that even as the immediate impacts of the coronavirus appear to be easing, the industry is just beginning to appreciate the longer-term impacts of the pandemic. They warned that without new federal recovery measures, the industry was likely to experience a second wave of job losses. They urged Congress and the Trump administration to enact liability reform, pass new infrastructure funding measures, and find a way to incentivize laid-off employees to return to work.

“The economic boost that comes with lifting economic lockdowns will not be enough to sustain long-term growth for the industry,” said Stephen E. Sandherr, the association’s chief executive officer. “Boosting infrastructure spending, protecting firms that are operating safely and encouraging people to return to work will help convert short-term gains into longer-term growth.”

View the state employment data, rankings, map and high and lows. Click here for the association’s survey results and here for a video summary of the survey responses.

Related Stories

Construction Costs | Apr 18, 2024

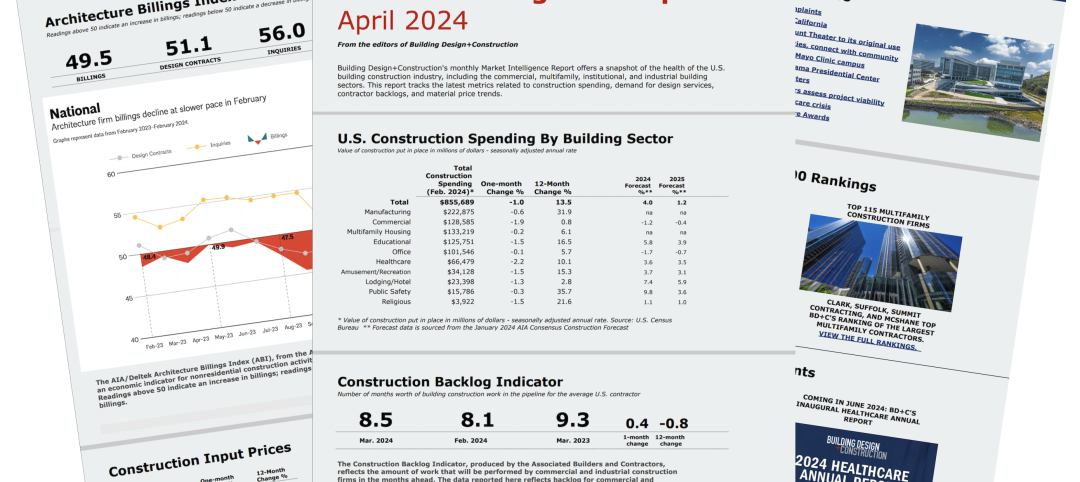

New download: BD+C's April 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

Market Data | Apr 16, 2024

The average U.S. contractor has 8.2 months worth of construction work in the pipeline, as of March 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator increased to 8.2 months in March from 8.1 months in February, according to an ABC member survey conducted March 20 to April 3. The reading is down 0.5 months from March 2023.

K-12 Schools | Apr 10, 2024

Surprise, surprise: Students excel in modernized K-12 school buildings

Too many of the nation’s school districts are having to make it work with less-than-ideal educational facilities. But at what cost to student performance and staff satisfaction?

Multifamily Housing | Apr 9, 2024

March reports record gains in multifamily rent growth in 20 months

Asking rents for multifamily units increased $8 during the month to $1,721; year-over-year growth grew 30 basis points to 0.9 percent—a normal seasonal growth pattern according to Yardi Matrix.

Retail Centers | Apr 4, 2024

Retail design trends: Consumers are looking for wellness in where they shop

Consumers are making lifestyle choices with wellness in mind, which ignites in them a feeling of purpose and a sense of motivation. That’s the conclusion that the architecture and design firm MG2 draws from a survey of 1,182 U.S. adult consumers the firm conducted last December about retail design and what consumers want in healthier shopping experiences.

Market Data | Apr 1, 2024

Nonresidential construction spending dips 1.0% in February, reaches $1.179 trillion

National nonresidential construction spending declined 1.0% in February, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.179 trillion.

Market Data | Mar 26, 2024

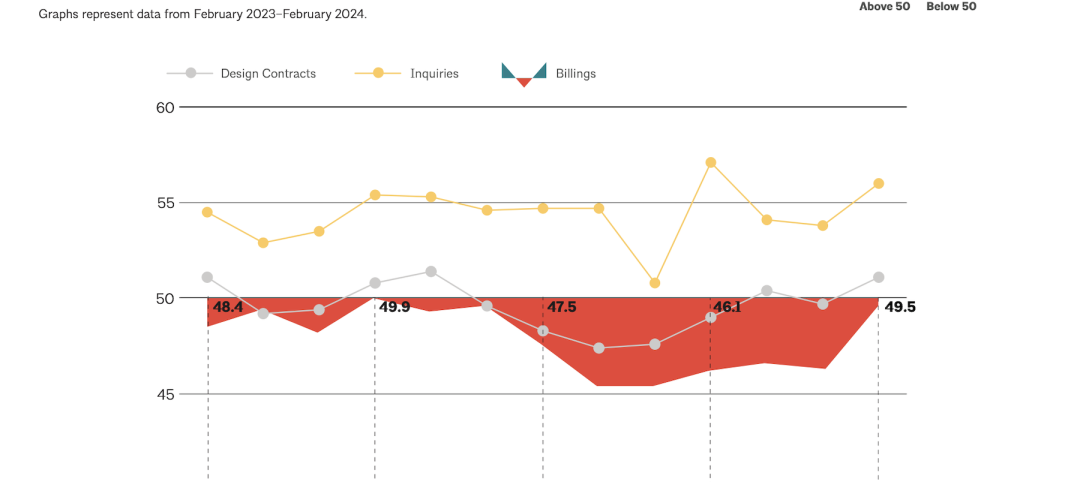

Architecture firm billings see modest easing in February

Architecture firm billings continued to decline in February, with an AIA/Deltek Architecture Billings Index (ABI) score of 49.5 for the month. However, February’s score marks the most modest easing in billings since July 2023 and suggests that the recent slowdown may be receding.

K-12 Schools | Mar 18, 2024

New study shows connections between K-12 school modernizations, improved test scores, graduation rates

Conducted by Drexel University in conjunction with Perkins Eastman, the research study reveals K-12 school modernizations significantly impact key educational indicators, including test scores, graduation rates, and enrollment over time.

MFPRO+ News | Mar 16, 2024

Multifamily rents stable heading into spring 2024

National asking multifamily rents posted their first increase in over seven months in February. The average U.S. asking rent rose $1 to $1,713 in February 2024, up 0.6% year-over-year.

Market Data | Mar 14, 2024

Download BD+C's March 2024 Market Intelligence Report

U.S. construction spending on buildings-related work rose 1.4% in January, but project teams continue to face headwinds related to inflation, interest rates, and supply chain issues, according to Building Design+Construction's March 2024 Market Intelligence Report (free PDF download).