Wayne Gretzky, arguably the greatest hockey player ever, once said, “I skate to where the puck is going to be, not where it has been.” Wouldn’t it be grand if AEC firms could apply the Great One’s predictive skill to the real estate market? Then you’d know exactly where to deploy your resources, human and financial.

Thanks to the Urban Land Institute’s “Emerging Trends in Real Estate 2014,” you have some hope of scoring like the Great One (and, I promise, this will be my one and only sports analogy of 2013). At the recent ULI national conference, in Chicago, ULI staff and experts from the consulting firm PricewaterhouseCoopers decoded the institute’s annual survey of more than 1,000 individuals from investment and real estate service firms, banks, REITs, residential land development companies, and institutional/equity investors.

The good news, according to ULI CEO Patrick L. Phillips, is that the U.S. commercial real estate market is gradually “recovering from the recovery” and will “gain momentum” in 2014. As stated in the 94-page report, “The market has progressed further through the economic and real estate cycles,” and there is “real evidence” of momentum in the marketplace. Hallelujah!

According to Stephen R. Blank, Senior Resident Fellow at ULI, “Fundamentals are strengthening across all property groups.” The average property score went up from 5.6 (out of 9) last year to 5.8, and private direct real estate investments had the highest score of all, 6.43.

The biggest shocker: Industrial/distribution real estate prospects surpassed multifamily development in respondents’ eyes. “It’s mostly warehouse, to meet next-day demand for online retail,” said PwC Director Andrew Warren, a co-author of the report, As for multifamily, ULI’s Blank said the market expressed some concern “due to possibly too much [apartment] construction” taking place.

For 2014, the strongest investment prospects among commercial property types (on a scale of 9) look like industrial/distribution (6.45), hotels (6.23), and apartments (6.14). Office buildings (5.76) and retail (5.72) managed to stay in the “fair” range as investment prospects among U.S. respondents to the survey, although central city offices got a respectable 6.08 score.

In geographic terms, San Francisco, New York, and Boston remain developer favorites, while several cities that were in the dumps—Atlanta, Miami, and can-you-believe-it Las Vegas—are showing solid prospects for the year ahead, along with Orange County and San Jose, Calif., two regions that were hit hard by the housing bubble.

“For these markets, it’s the homebuilding sector that’s driving them [upward],” said PwC’s Warren.

One “strong player” that has slipped dramatically: Washington, D.C., which dropped to 22nd place in ULI’s list of U.S. real estate markets to watch. “It’s a kind of guilt by association,” said Phillips. The decline in office absorption in the District may reflect what Warren called “federal fatigue,” which is having a dampening effect on private-sector real estate investment in D.C.

Two (or, more accurately, three) other cities to watch: Portland, Ore., and Minneapolis/St. Paul. The Twin Cities were “a little bit of a surprise,” said Warren, but they’ve become attractive to recent college grads who want to stay in the Midwest.

Also worth a second look for real estate development opportunities: Charlotte, Denver, Los Angeles, Nashville, Raleigh, and Salt Lake City.

But uncertainty over unemployment and government fiscal policy, China’s moderating growth, and economic troubles in the Eurozone will weigh heavily on U.S. real estate investors in 2014.

More from Author

Rob Cassidy | Mar 30, 2020

Your turn: Has COVID-19 spelled the death knell for open-plan offices?

COVID-19 has designers worrying if open-plan offices are safe for workers.

Rob Cassidy | Mar 25, 2020

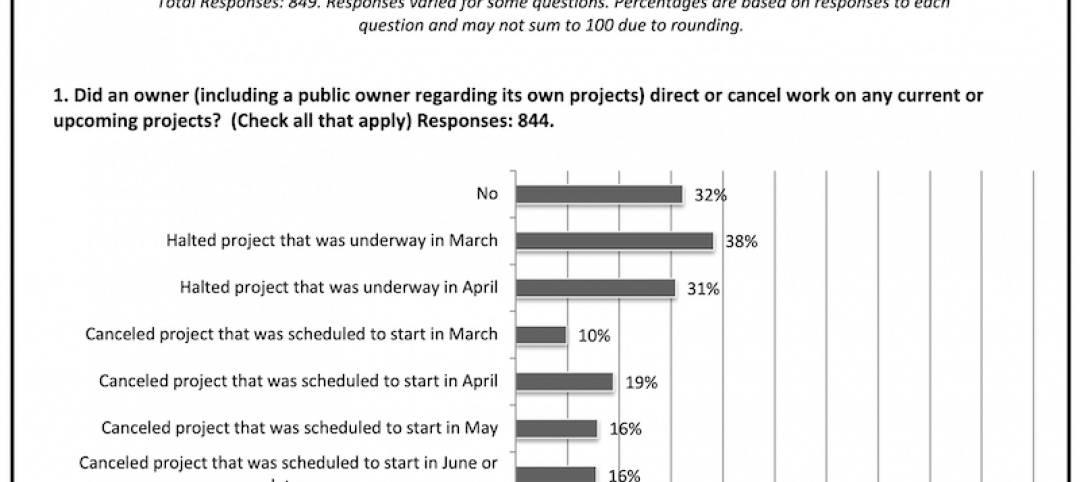

Coronavirus pandemic's impact on U.S. construction, notably the multifamily sector - 04-30-20 update

Coronavirus pandemic's impact on U.S. construction, notably the multifamily sector - 04-30-20 update

Rob Cassidy | Nov 20, 2019

Word of the Year: "climate emergency," says the Oxford English Dictionary

The Oxford Word of the Year 2019 is climate emergency.

Rob Cassidy | Nov 8, 2019

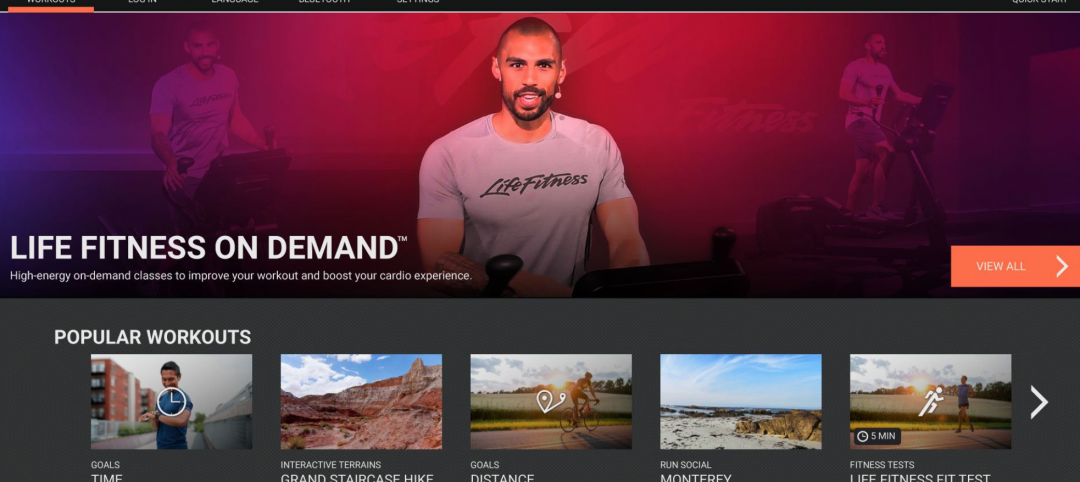

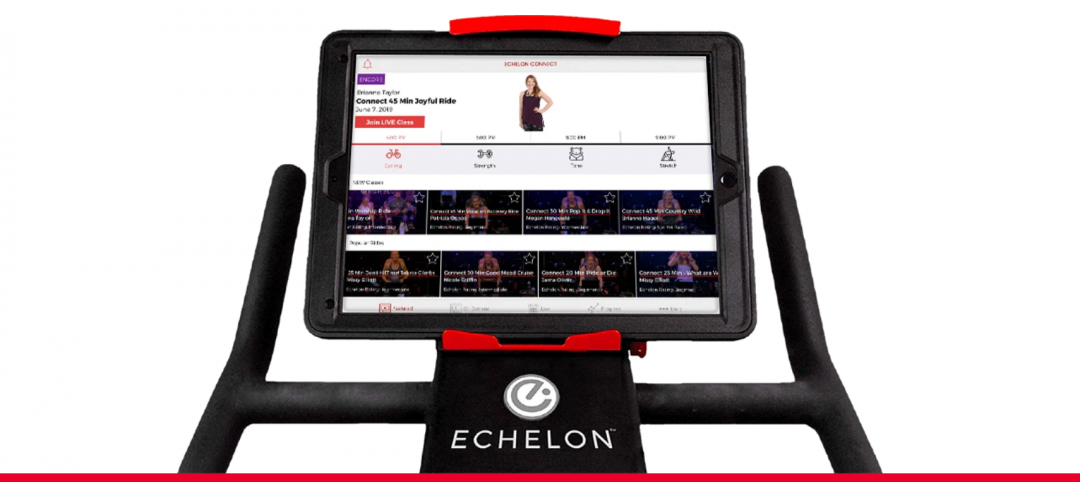

The Peloton Wars, Part III - More alternatives for apartment building owners

ProForm Studio Bike Pro review.

Rob Cassidy | Nov 1, 2019

Do car-free downtown zones work? Oslo, yes; Chicago, no

Two recent reports (October 2019) explore whether car-free downtowns really work, based on experience in Oslo, Norway, and Chicago.

Rob Cassidy | Oct 9, 2019

Multifamily developers vs. Peloton: Round 2... Fight!

Readers and experts offer alternatives to Peloton bicycles for their apartment and condo projects.

Rob Cassidy | Sep 4, 2019

Peloton to multifamily communities: Drop dead

Peloton will no longer sell its bikes to apartment communities.