Washington, D.C. – March 23, 2011 – During the first two months of 2011 the Architecture Billings Index (ABI) is not exhibiting the strength of business conditions that were seen in the final quarter of 2010. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to 12 month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the February ABI score was 50.6, up slightly from a reading of 50.0 the previous month. This score reflects a modest increase in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 56.4, compared to a mark of 56.5 in December.

“Overall demand for design services seems to be treading water over the last two months,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “We’ve been preaching patience and cautious optimism for a full recovery because there continues to be a wide range of business conditions for architecture firms that are also influenced by firm size, practice specialties and regional location. We still expect the road to recovery to move at a slow, but steady pace.”

Key February ABI highlights:

Regional averages: Midwest (55.3), South (50.1), West (49.1), Northeast (46.4)

Sector index breakdown: commercial / industrial (55.0), mixed practice (51.3),

multi-family residential (49.7), institutional (48.9)

Project inquiries index: 56.4

About the AIA Architecture Billings Index

The Architecture Billings Index (ABI), produced by the AIA Economics & Market Research Group <http://www.aia.org/practicing/economics> , is a leading economic indicator that provides an approximately nine to twelve month glimpse into the future of nonresidential construction spending activity. The diffusion indexes contained in the full report are derived from a monthly “Work-on-the-Boards” survey that is sent to a panel of AIA member-owned firms. Participants are asked whether their billings increased, decreased, or stayed the same in the month that just ended as compared to the prior month, and the results are then compiled into the ABI. These monthly results are also seasonally adjusted to allow for comparison to prior months. The monthly ABI index scores are centered around 50, with scores above 50 indicating an aggregate increase in billings, and scores below 50 indicating a decline. The regional and sector data are formulated using a three-month moving average. More information on the ABI and the analysis of its relationship to construction activity can be found in the White Paper Architecture Billings as a Leading Indicator of Construction: Analysis of the Relationship Between a Billings Index and Construction Spending on the AIA web site.

About The American Institute of Architects

For over 150 years, members of the American Institute of Architects have worked with each other and their communities to create more valuable, healthy, secure, and sustainable buildings and cityscapes. Members adhere to a code of ethics and professional conduct to ensure the highest standards in professional practice. Embracing their responsibility to serve society, AIA members engage civic and government leaders and the public in helping find needed solutions to pressing issues facing our communities, institutions, nation and world. Visit www.aia.org.

Related Stories

Student Housing | Apr 19, 2024

Cal State Long Beach student housing project will add 424 beds

A new $115 million project recently broke ground at California State University, Long Beach (CSULB) that will add housing for 424 students at below-market rates. The 108,000 sf La Playa Residence Hall, funded by the State of California’s Higher Education Student Housing Grant Program, will consist of three five-story structures connected by bridges.

Construction Costs | Apr 18, 2024

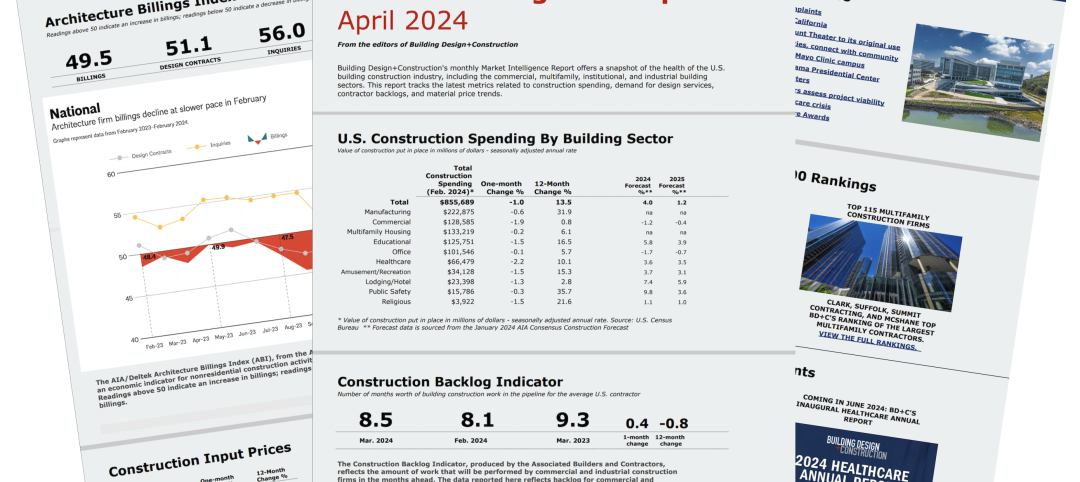

New download: BD+C's April 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

MFPRO+ New Projects | Apr 16, 2024

Marvel-designed Gowanus Green will offer 955 affordable rental units in Brooklyn

The community consists of approximately 955 units of 100% affordable housing, 28,000 sf of neighborhood service retail and community space, a site for a new public school, and a new 1.5-acre public park.

Construction Costs | Apr 16, 2024

How the new prevailing wage calculation will impact construction labor costs

Looking ahead to 2024 and beyond, two pivotal changes in federal construction labor dynamics are likely to exacerbate increasing construction labor costs, according to Gordian's Samuel Giffin.

Healthcare Facilities | Apr 16, 2024

Mexico’s ‘premier private academic health center’ under design

The design and construction contract for what is envisioned to be “the premier private academic health center in Mexico and Latin America” was recently awarded to The Beck Group. The TecSalud Health Sciences Campus will be located at Tec De Monterrey’s flagship healthcare facility, Zambrano Hellion Hospital, in Monterrey, Mexico.

Market Data | Apr 16, 2024

The average U.S. contractor has 8.2 months worth of construction work in the pipeline, as of March 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator increased to 8.2 months in March from 8.1 months in February, according to an ABC member survey conducted March 20 to April 3. The reading is down 0.5 months from March 2023.

Laboratories | Apr 15, 2024

HGA unveils plans to transform an abandoned rock quarry into a new research and innovation campus

In the coastal town of Manchester-by-the-Sea, Mass., an abandoned rock quarry will be transformed into a new research and innovation campus designed by HGA. The campus will reuse and upcycle the granite left onsite. The project for Cell Signaling Technology (CST), a life sciences technology company, will turn an environmentally depleted site into a net-zero laboratory campus, with building electrification and onsite renewables.

Codes and Standards | Apr 12, 2024

ICC eliminates building electrification provisions from 2024 update

The International Code Council stripped out provisions from the 2024 update to the International Energy Conservation Code (IECC) that would have included beefed up circuitry for hooking up electric appliances and car chargers.

Urban Planning | Apr 12, 2024

Popular Denver e-bike voucher program aids carbon reduction goals

Denver’s e-bike voucher program that helps citizens pay for e-bikes, a component of the city’s carbon reduction plan, has proven extremely popular with residents. Earlier this year, Denver’s effort to get residents to swap some motor vehicle trips for bike trips ran out of vouchers in less than 10 minutes after the program opened to online applications.

Laboratories | Apr 12, 2024

Life science construction completions will peak this year, then drop off substantially

There will be a record amount of construction completions in the U.S. life science market in 2024, followed by a dramatic drop in 2025, according to CBRE. In 2024, 21.3 million sf of life science space will be completed in the 13 largest U.S. markets. That’s up from 13.9 million sf last year and 5.6 million sf in 2022.